From the following Balance Sheets of XY Ltd. Prepare a Cash Flow Statement for the year ended 31st March, 2023 Share Capital ₹ 10,00,000

From the following Balance Sheets of XY Ltd. Prepare a Cash Flow Statement for the year ended 31st March, 2023:

| Particulars | Note. No. | 31st March, 2023 | 31st March, 2022 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserve and Surplus |

10,00,000 6,40,000 |

8,00,000 5,59,000 |

|

|

(2) Non-Current Liabilities: Long-term Borrowings |

1,50,000 | 1,00,000 | |

|

(3) Current Liabilities (a) Trade Payables |

60,000 | 40,000 | |

| Total | 18,50,000 | 14,99,000 | |

| II. ASSETS: | |||

|

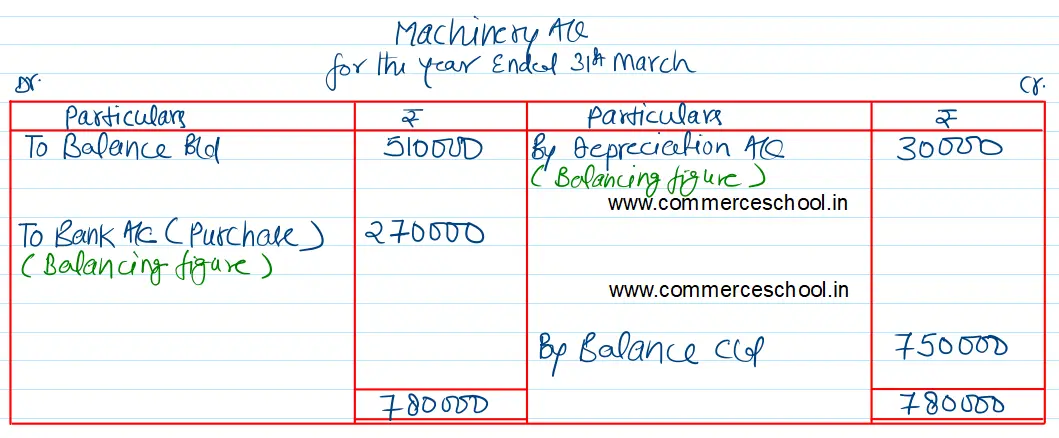

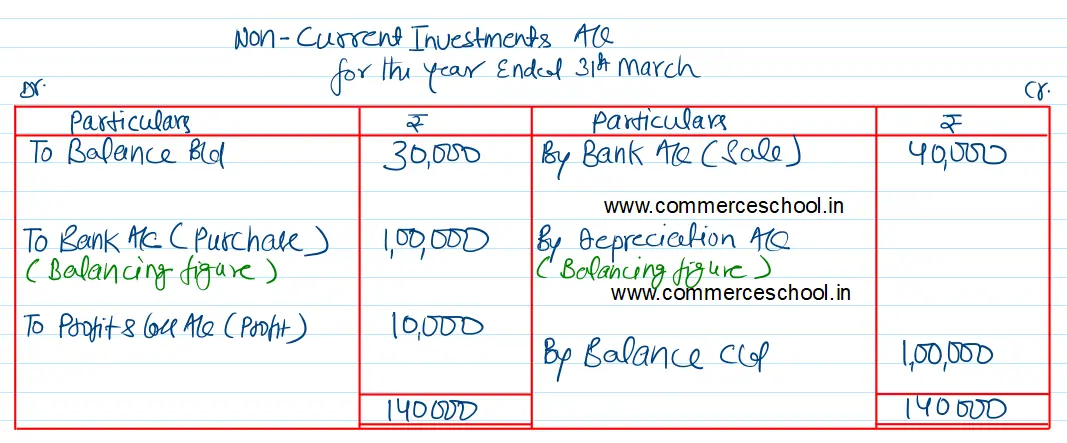

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment (Machinery) (ii) Intangible Assets (b) Non-Current Investments |

7,50,000 15,000 1,00,000 |

5,10,000 20,000 30,000 |

|

|

(2) Current Assets: (a) Inventories (b) Trade Receivables (c) Cash & Cash Equivalents (d) Other Current Assets |

6,30,000 3,20,000 28,000 7,000 |

4,20,000 4,94,000 20,000 5,000 |

|

| Total | 18,50,000 | 14,99,000 |

Notes to Accounts:-

| 31.3.2023 | 31.3.2022 | |

|

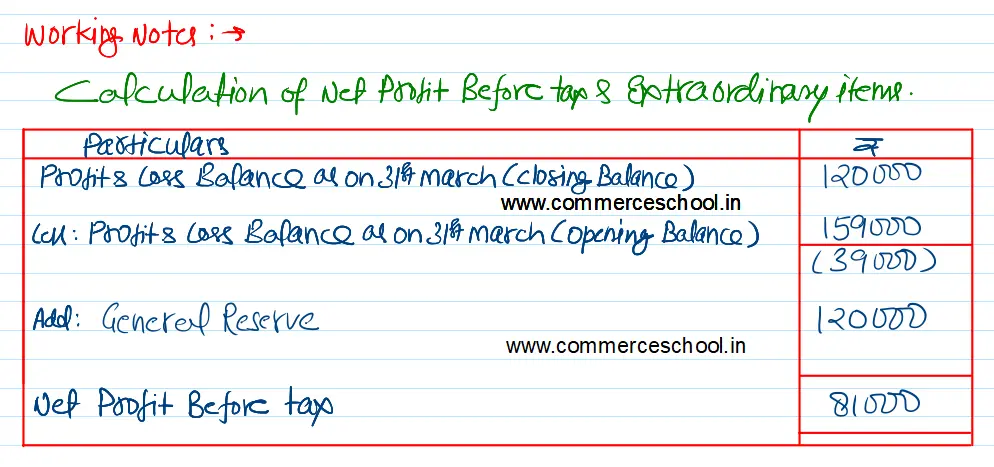

(1) Reserve & Surplus: General Reserve Profit & Loss Balance |

5,20,000 1,20,000 |

4,00,000 1,59,000 |

| 6,40,000 | 5,59,000 | |

|

(2) Long-term Borrowings: 8% Debentures |

1,50,000 | 1,00,000 |

| (3) Rate of Interest on Non-Current Investment is 10% p.a. | ||

|

(4) Other Current Assets: Prepaid Expenses Accrued Income |

4,000 3,000 |

— 5,000 |

| 7,000 | 5,000 |

Additional Information:-

(i) Depreciation of ₹ 30,000 has been charged on machinery.

(ii) Non-Current Investments costing ₹ 30,000 were sold for ₹ 40,000 at the end of the year.

(iii) New Debentures were issued on 1st October, 2022.

(iv) During the year share issue expenses amounted to ₹ 10,000 and these were written off from statement of Profit & Loss.

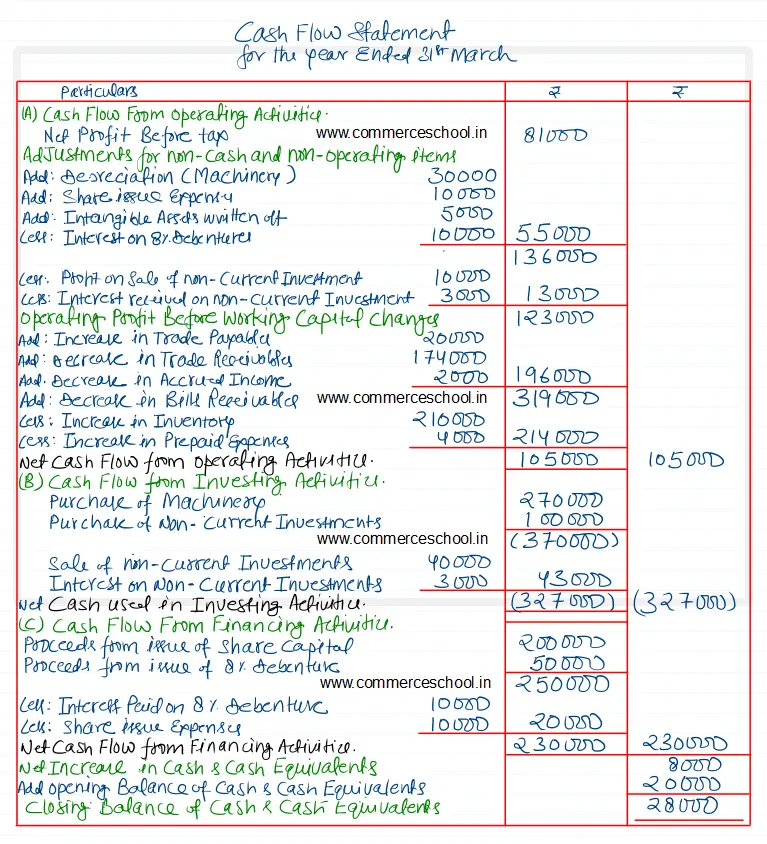

[Ans. Cash from Operating activities ₹ 1,05,000; Cash used in Investing Activities ₹ 3,27,000; and Cash from Financing Activities ₹ 2,30,000]

Note:- It has been assumed that Non-Current Investments have been purchased at the end of the accounting year, i.e., on 31st March, 2023.