From the following balances extracted from the books of Karan and the additional information, prepare the trading and profit and loss account for the year ended 31st March, 2023 and also show the balance sheet as at that date:

From the following balances extracted from the books of Karan and the additional information, prepare the trading and profit and loss account for the year ended 31st March, 2023 and also show the balance sheet as at that date:

Additional Information:

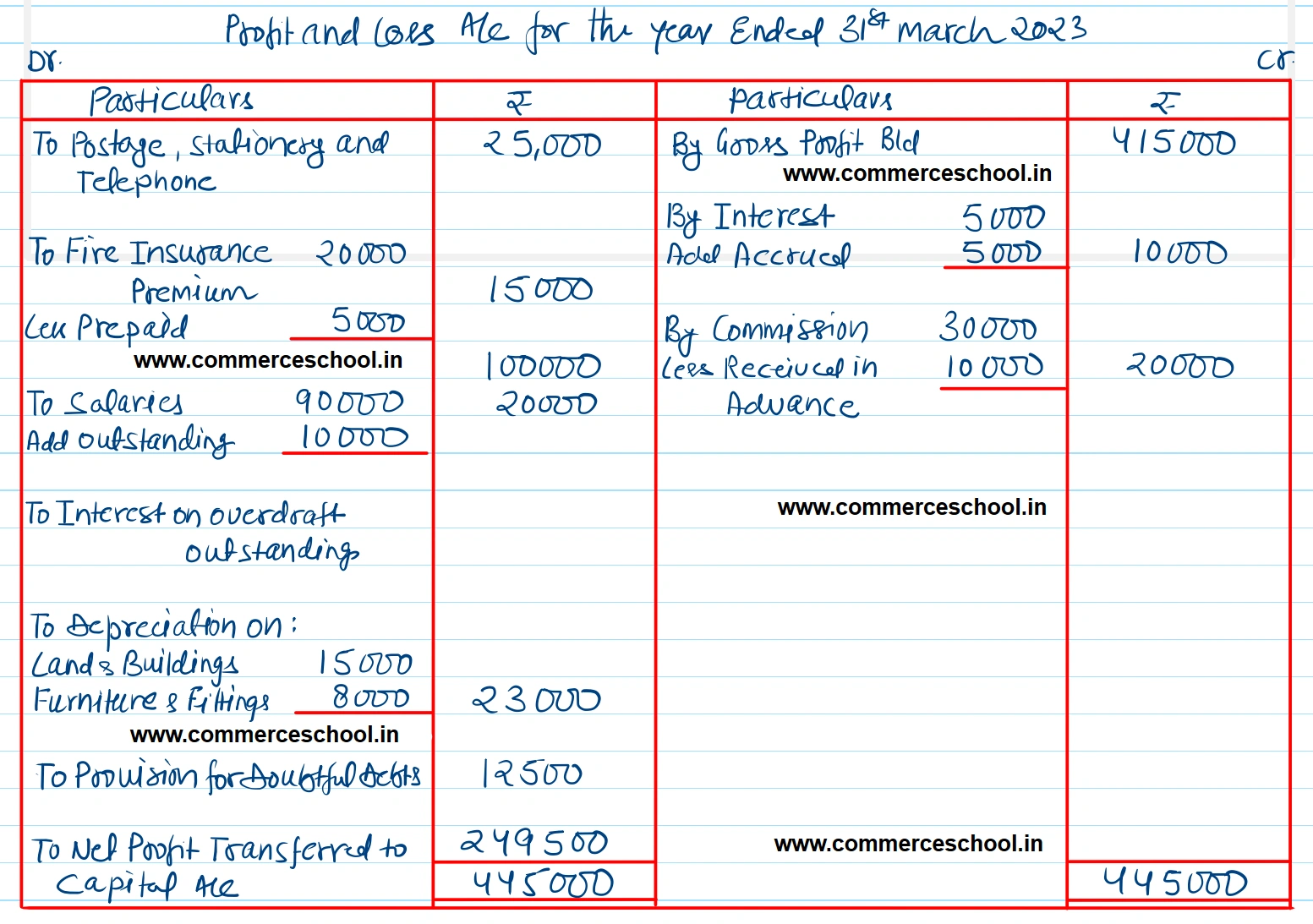

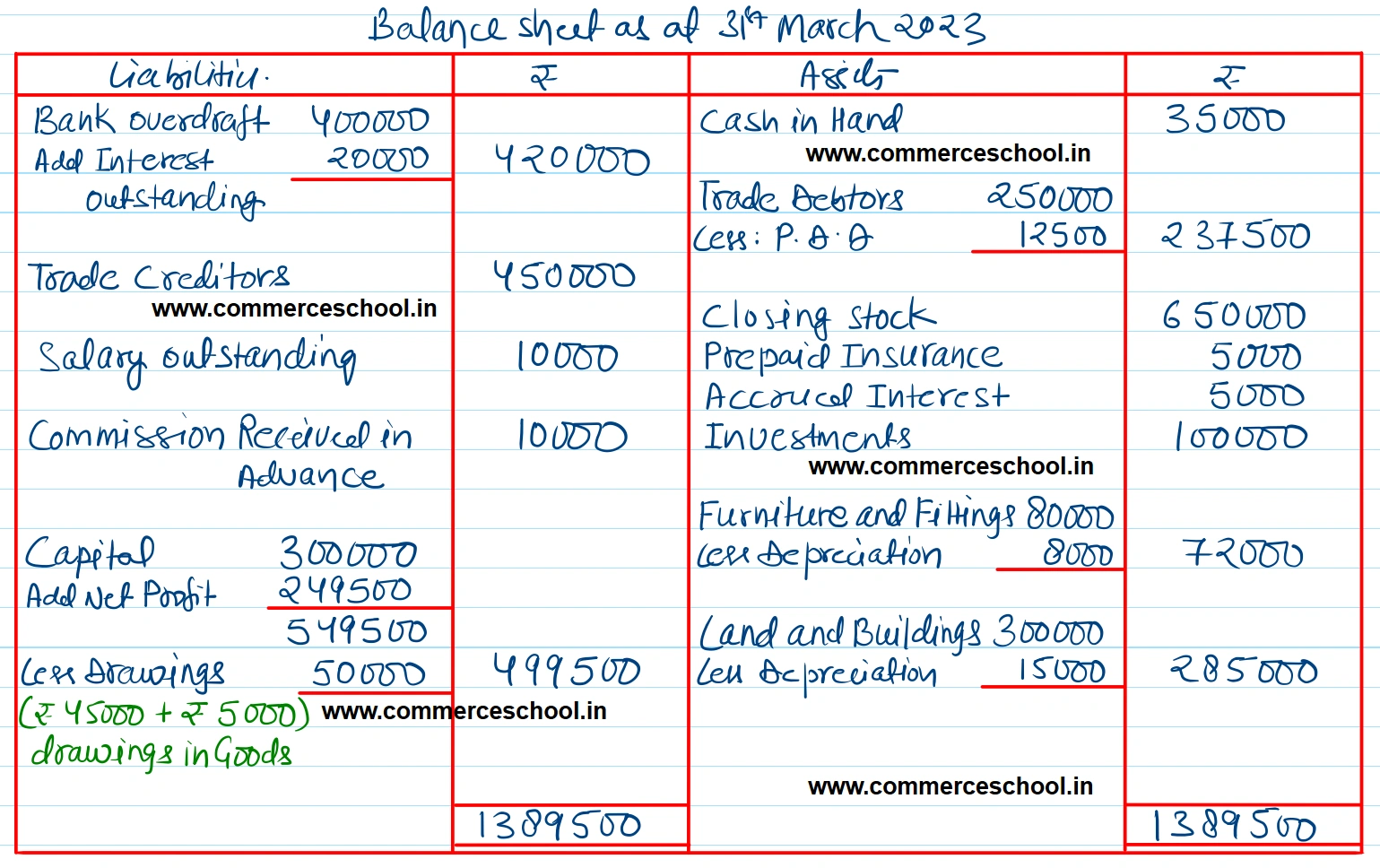

(i) Closing stock on 31st March, 2023 is valued at ₹ 6,50,000. Goods worth ₹ 5,000 are reported to have been taken away by the proprietor for his personal use at home during the year.

(ii) Interest on investments ₹ 5,000 is yet to be received while ₹ 10,000 of the commission received is yet to be earned.

(iii) ₹ 5,000 of the fire insurance premium paid is in respect of the quarter ending 30th June, 2023.

(iv) Salaries ₹ 10,000 for March, 2023 and bank overdraft interest estimated at ₹ 20,000 are yet to be recorded as oustanding charges.

(v) Depreciation is to be provided on land and buildings @ 5% per annum and on furniture and fitting @ 10% per annum.

(vi) Make a provision for doubtful debts @ 5% of trade debtors.

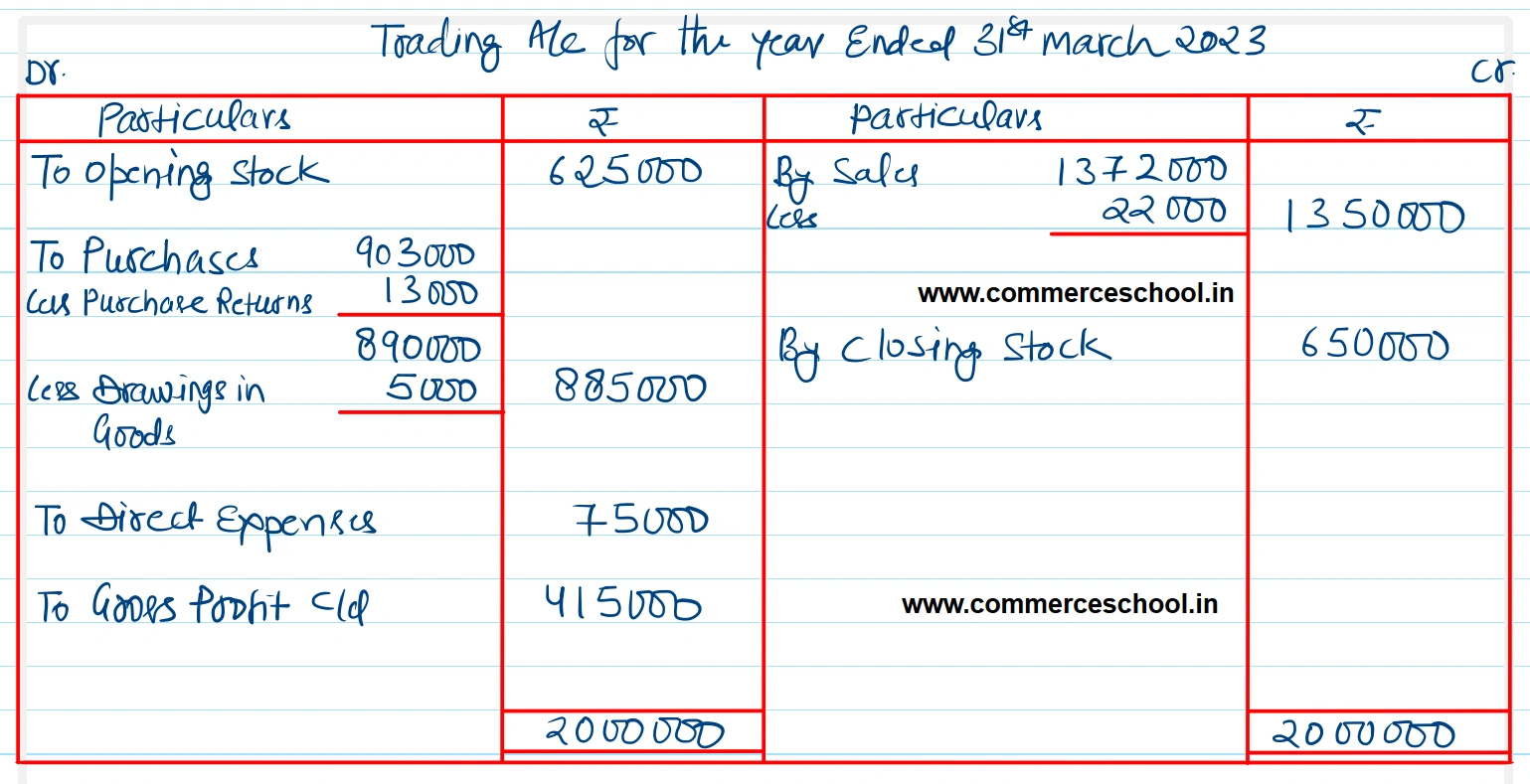

[Ans. Gross Profit ₹ 4,15,000; Net Profit ₹ 2,49,500; Balance Sheet Total ₹ 13,89,500.]

Solution:-

| Debit Balance (₹ ‘000) | Credit Balance (₹ ‘000) | |

| Stock on 1st April, 2022 | 625 | |

| Purchases and Sales | 903 | 1,372 |

| Returns | 22 | 13 |

| Capital Account | 300 | |

| Drawings | 45 | |

| Land and Buildings | 300 | |

| Furniture and Fittings | 80 | |

| Trade Debtors and Trade Creditors | 250 | |

| Cash in Hand | 35 | |

| Investments | 100 | |

| Interest | 5 | |

| Commission | 30 | |

| Direct Expenses | 75 | |

| Postage, Stationery and Telephone | 25 | |

| Fire Insurance Premium | 20 | |

| Salaries | 90 | |

| Bank Overdraft | 400 | |

| 2,570 | 2,570 |

Anurag Pathak Answered question