From the following figures, prepare the Trading and Profit and Loss Account for the year ended 31st March, 2023 and the Balance Sheet as at that date

From the following figures, prepare the Trading and Profit and Loss Account for the year ended 31st March, 2023 and the Balance Sheet as at that date:-

Adjustments:

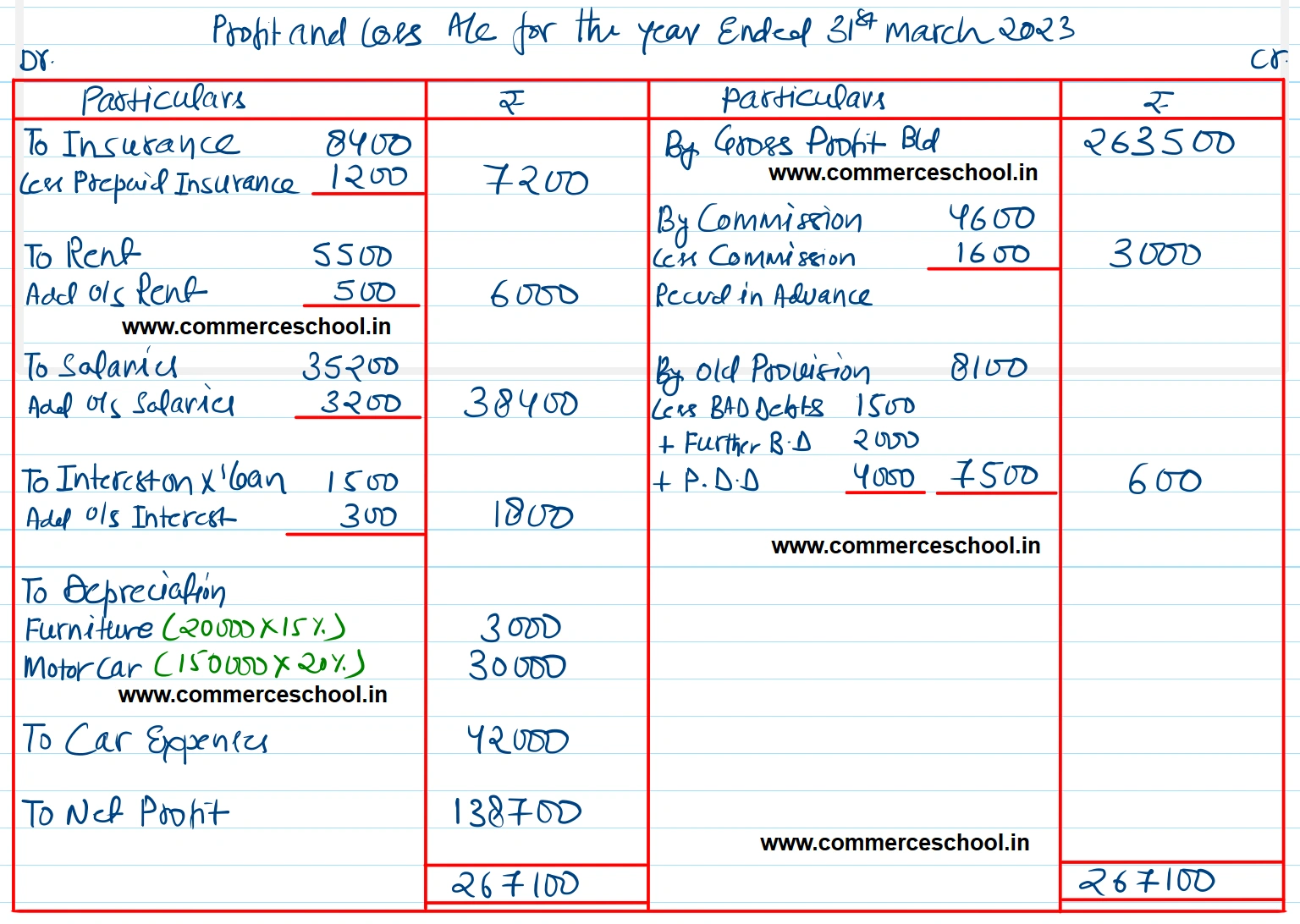

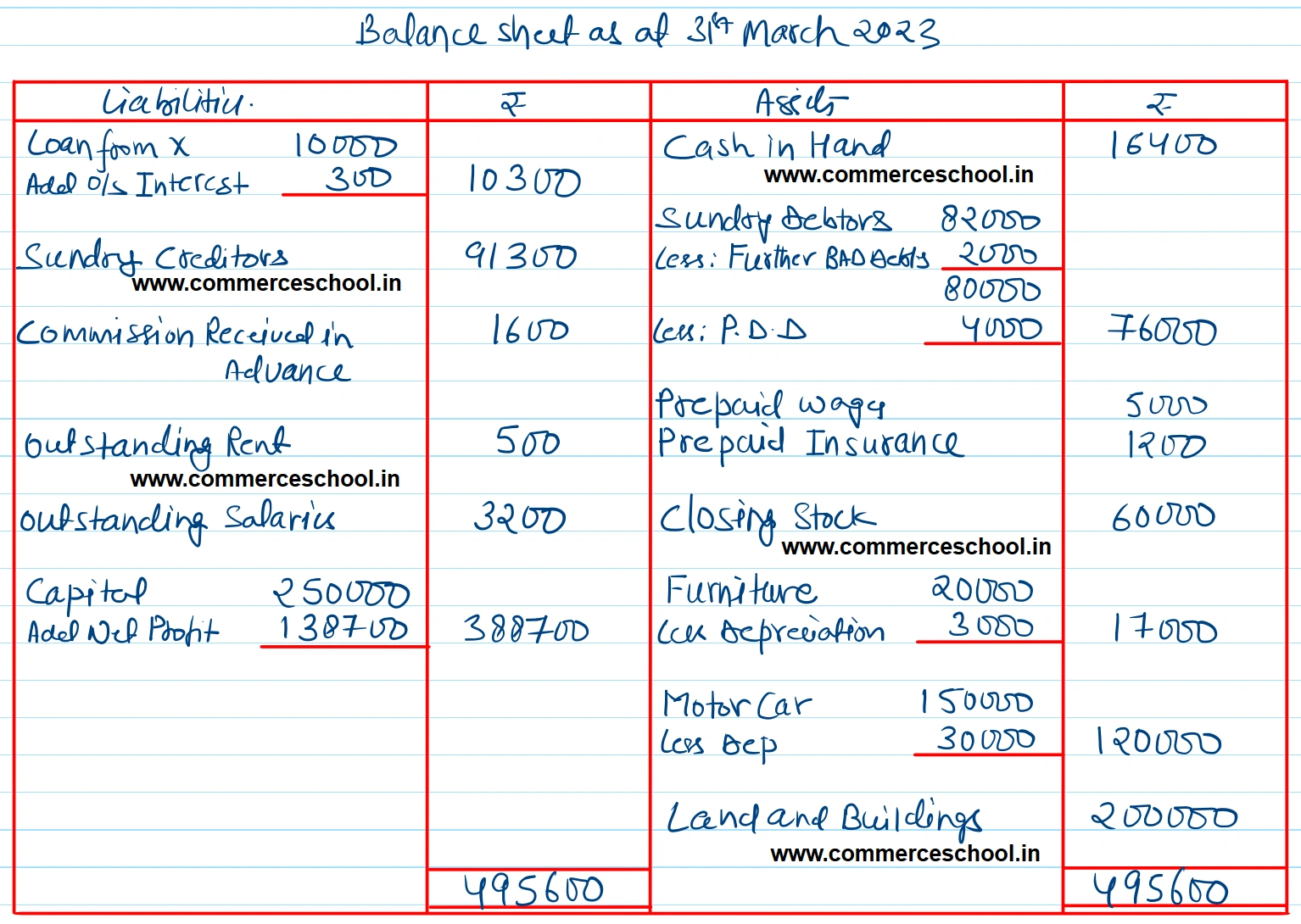

(i) Commission include ₹ 1,600 being commission received in advance.

(ii) Write off ₹ 2,000 as further Bad-debts and maintain Bad-debts provision at 5% on debtors.

(iii) Expenses paid in advance are : Wages ₹ 5,000 and Insurance ₹ 1,200.

(iv) Rent and Salaries have bee paid for 11 months.

(v) Loan from X has been taken at 18% p.a. interest.

(vi) Depreciate furniture by 15% p.a. and Motor Car by 20% p.a.

(vii) Closing Stock was valued at ₹ 60,000.

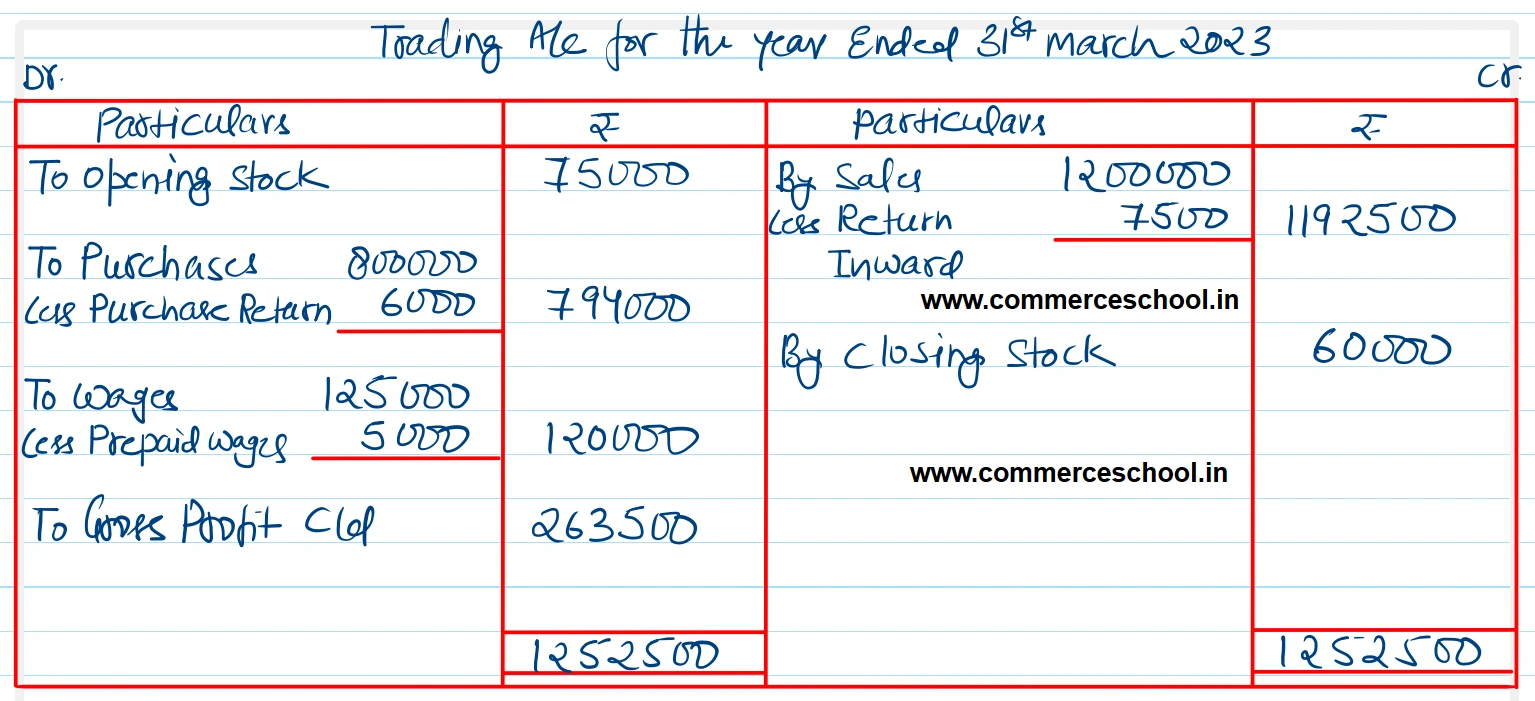

[Ans. G.P. ₹ 2,63,500; N.P. ₹ 1,38,700 and B/S Total ₹ 4,95,600.]

Hint: Net amount shown on the Cr. side of P & L A/c will be ₹ 600 calculated as follows: Old Provision ₹ 8,100 – Bad-debts ₹ 3,500 – New Provision ₹ 4,000.

| Particulars | ₹ | Particulars | ₹ |

| Stock (1st April, 2022) | 75,000 | Sundry Debtors | 82,000 |

| Purchases | 8,00,000 | Loan from X | 10,000 |

| Sales | 12,00,000 | Interest on X Loan | 1,500 |

| Motor Car | 1,50,000 | Furniture | 20,000 |

| Car Expenses | 42,000 | Land and Building | 2,00,000 |

| Rent | 5,500 | Capital | 2,50,000 |

| Salaries | 35,200 | Sundry Creditors | 91,300 |

| Bad Debts | 1,500 | Returns Inward | 7,500 |

| Provision for bad debts | 8,100 | Returns Outward | 6,000 |

| Commission (Cr.) | 4,600 | Cash in Hand | 16,400 |

| Wages | 1,25,000 | ||

| Insurance | 8,400 |

Anurag Pathak Answered question