From the following information, Calculate (a) Cash Flow from Investing Activities; and (b) Cash Flow from Financing Activities:

From the following information, Calculate (a) Cash Flow from Investing Activities; and (b) Cash Flow from Financing Activities:

| Particulars | 31st March, 2022 (₹) |

31st March, 2023 (₹) |

| Plant and Machinery Non-Current Investments Land (at Cost) Equity Share Capital 10% Preference Share Capital Securities Premium 10% Debentures |

8,50,000 40,000 2,00,000 20,00,000 2,00,000 – 10,00,000 |

10,00,000 1,00,000 1,00,000 30,00,000 1,00,000 1,00,000 10,00,000 |

Additional Information:

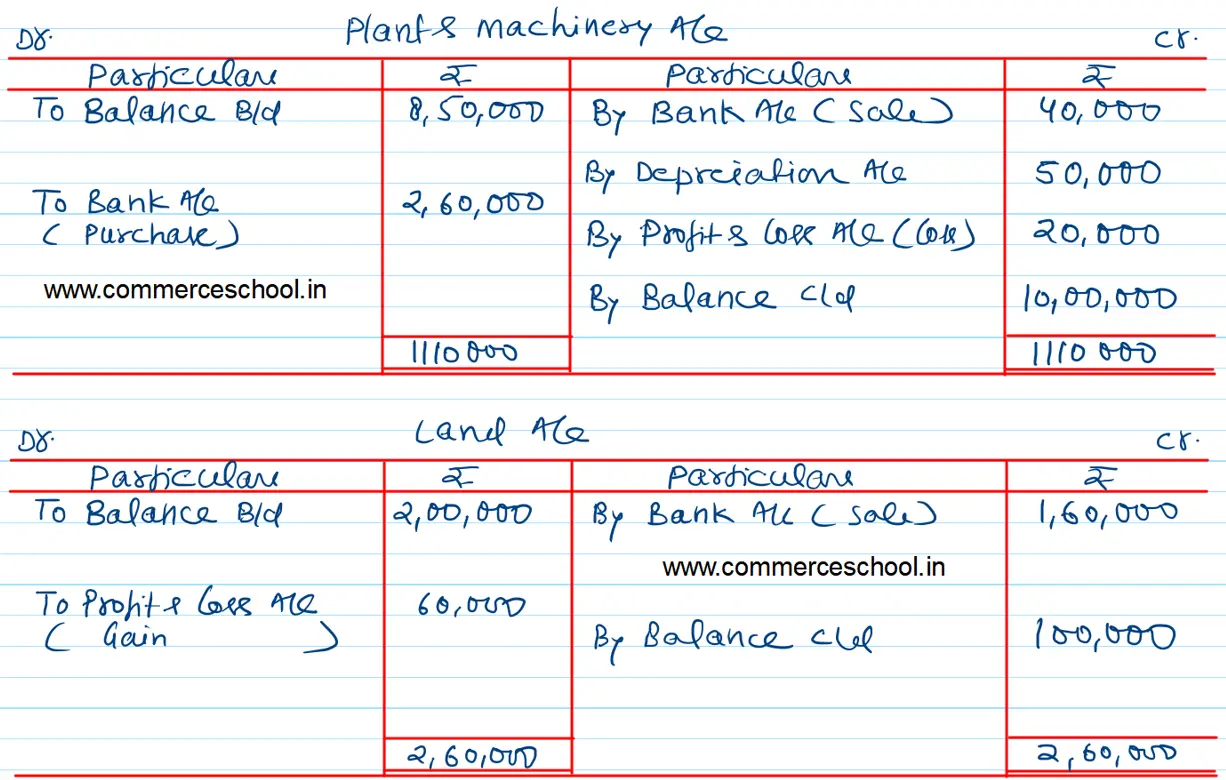

Depreciation charged on Plant and Machinery was ₹ 50,000.

Plant and Machinery of book value ₹ 60,000 was sold for ₹ 40,000.

Land was sold at a gain of ₹ 60,000.

Preference Shares were redeemed on 31st March, 2023 at a premium of 5%.

Dividend on Equity Shares and Preference Shares for the year ended 31st March, 2022 was Nil and for the year ended 31st March, 2023 Proposed Dividend on Equity Shares was 10%.

Fresh issue of Equity Shares was on 1st April, 2022.

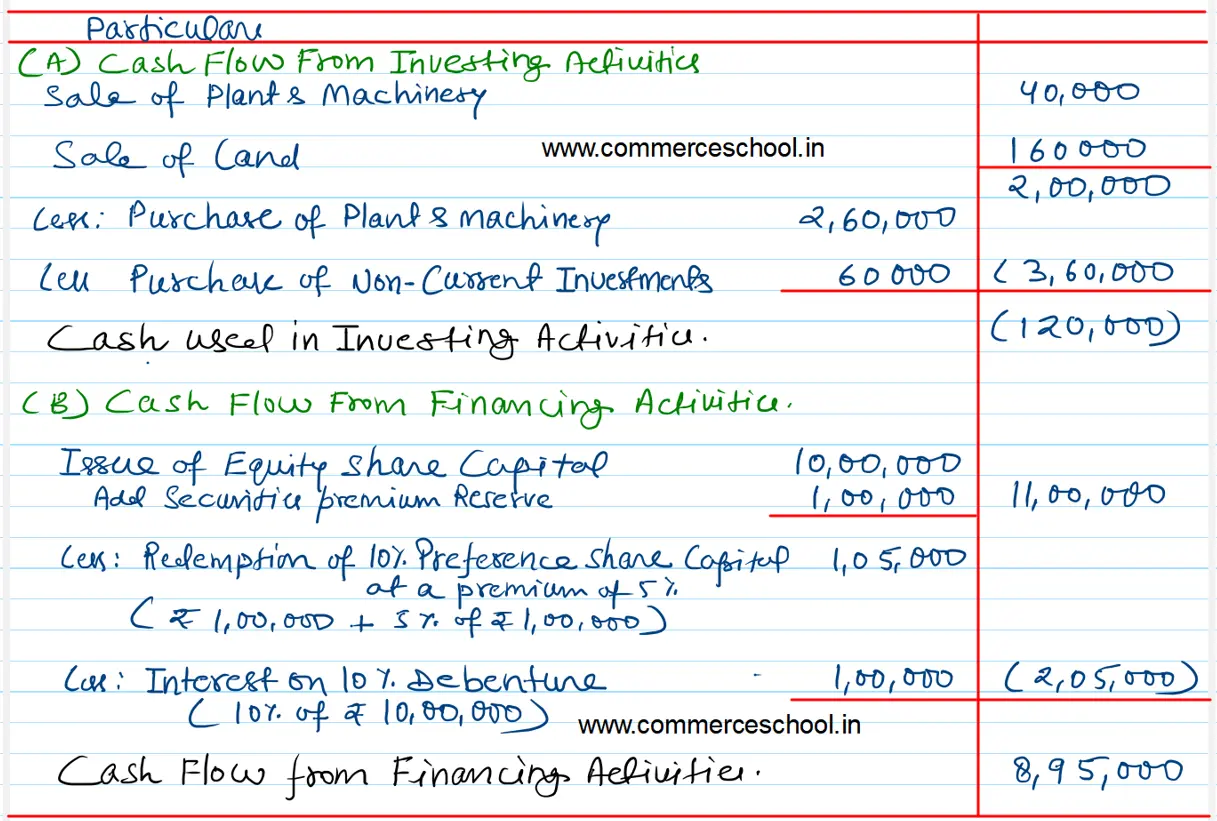

[Ans.: Cash used in Investing Activities – ₹ 1,20,000; Cash Flow from Financing Activities – ₹ 8,95,000,]

Anurag Pathak Changed status to publish