From the following information, Calculate Cash Flow from Operating Activities and Investing Activities:

From the following information, Calculate Cash Flow from Operating Activities and Investing Activities:

| Particulars | 31st March, 2022 (₹) |

31st March, 2023 (₹) |

| Surplus, i.e., Balance in Statement of Profit & Loss Provision for Tax Trade Payables Current Assets (Trade Receivables and Inventories) Property, Plant and Equipment and Intangible Assets: Property, Plant and Equipment Accumulated Depreciation |

2,50,000 75,000 1,00,000 11,50,000 21,25,000 10,62,500 |

10,00,000 75,000 3,75,000 13,00,000 23,30,000 |

Additional Information:-

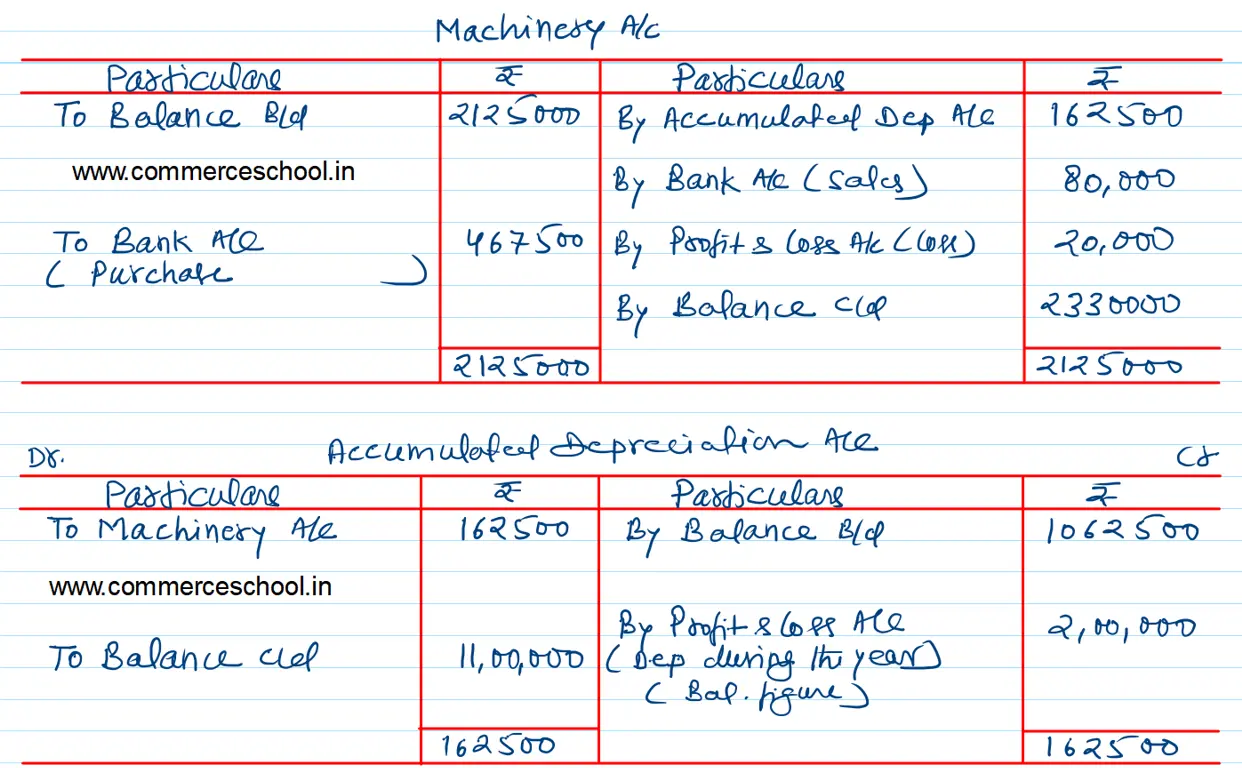

A Machine having book value of ₹ 1,00,000 (Depreciation provided thereon ₹ 1,62,500) was sold at a loss of ₹ 20,000.

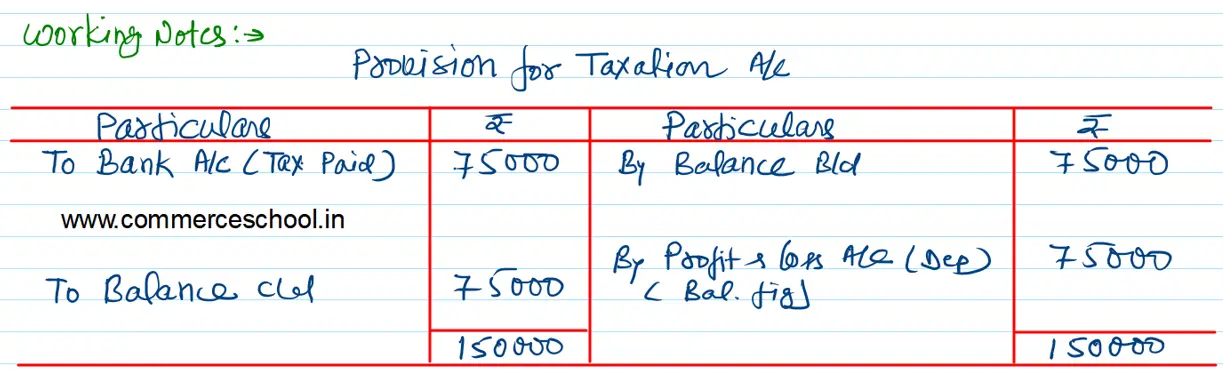

Tas Paid during the year ₹ 75,000.

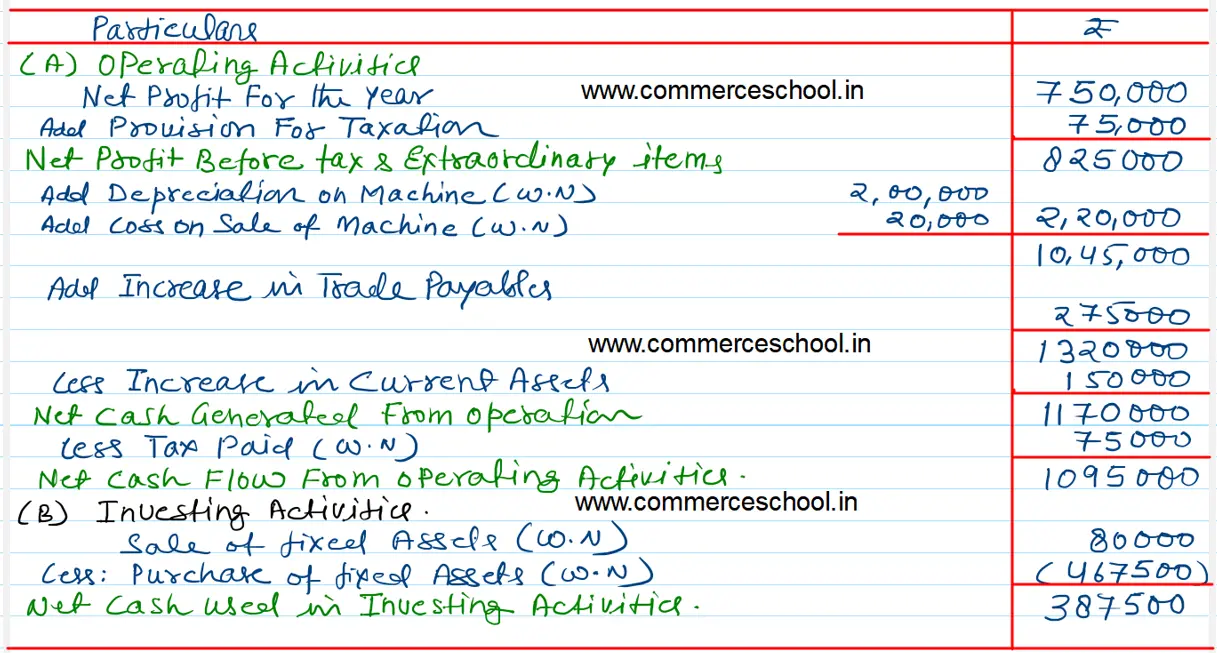

[Ans.: Cash Flow from Operating Activities = ₹ 10,95,000; Cash Used in Investing Activities = ₹ 3,87,500.]

Anurag Pathak Changed status to publish