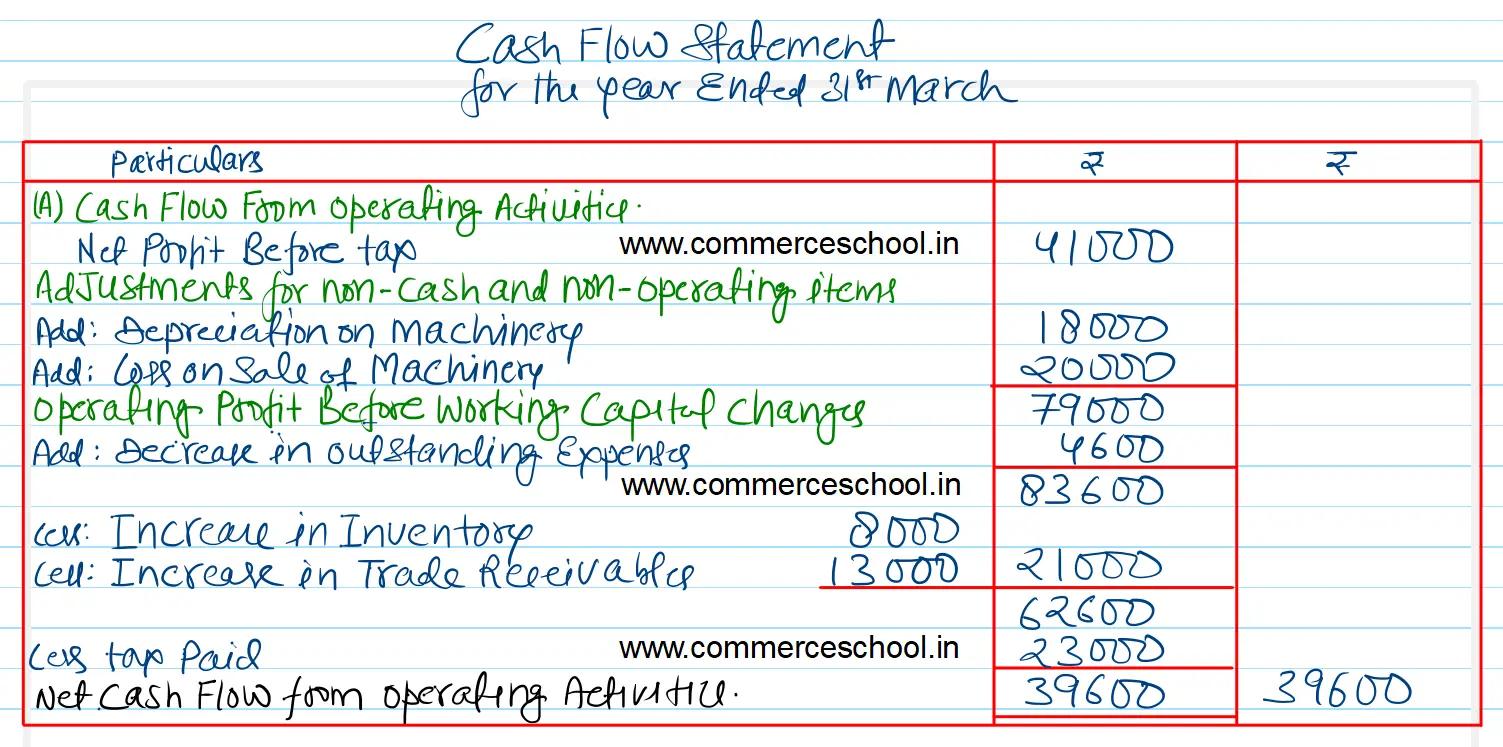

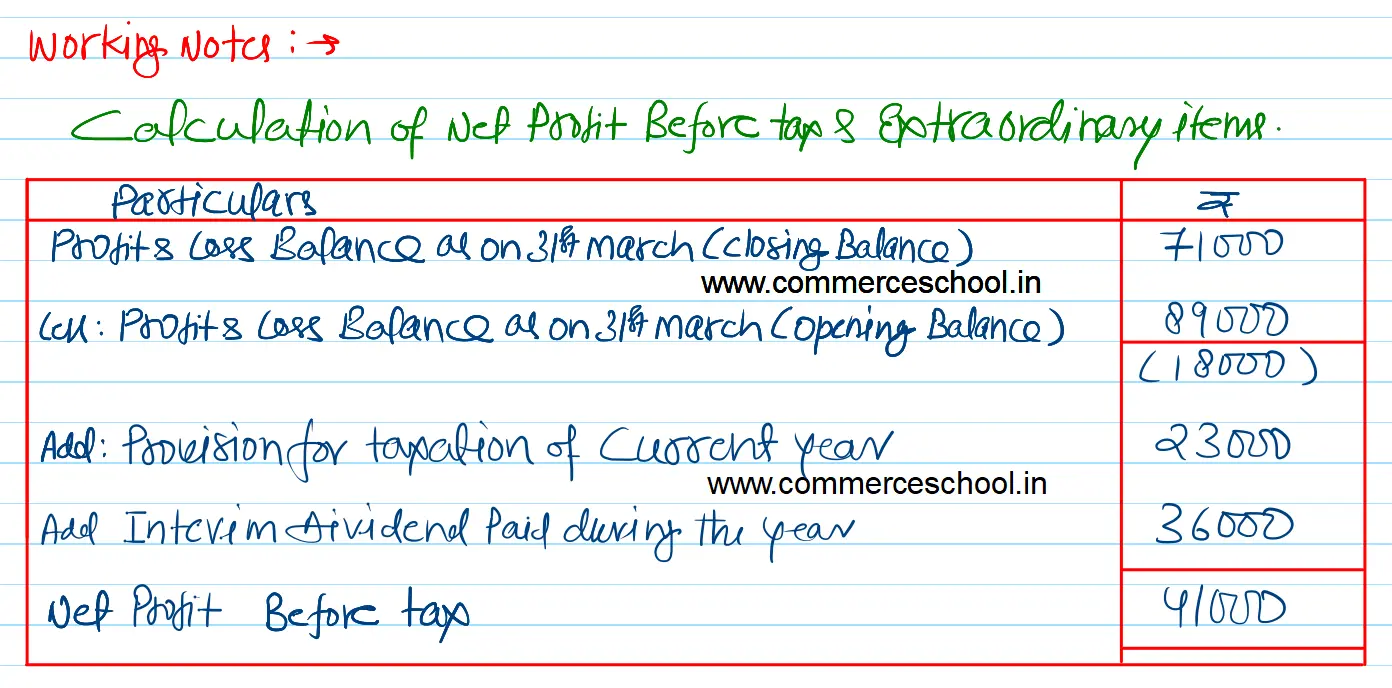

From the following information, calculate Cash Flow from Operating Activities Surplus (i.e., Balance in the Statement for Profit and Loss) ₹ 71,000

From the following information, calculate Cash Flow from Operating Activities:

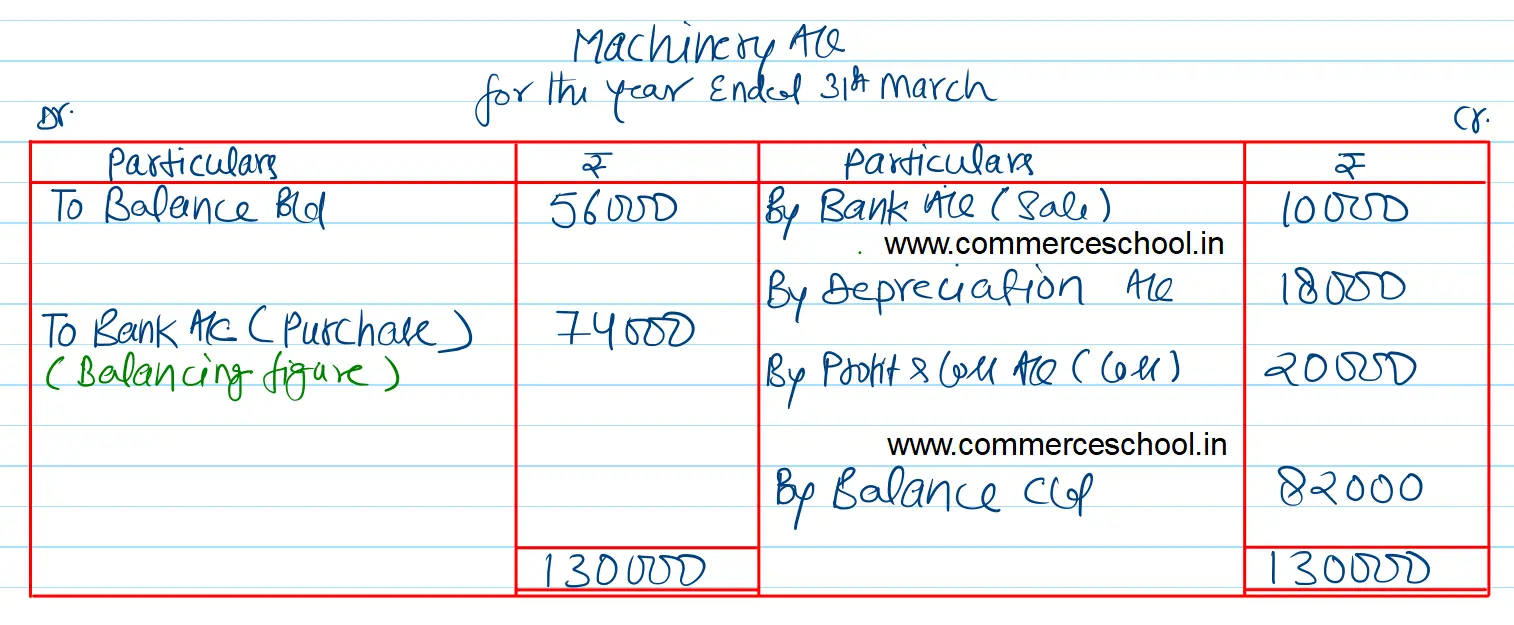

(i) A piece of machinery costing ₹ 50,000 on which depreciation of ₹ 20,000 had been charged was sold for ₹ 10,000. Depreciation charged during the year was ₹ 18,000.

(ii) Income Tax 23,000 was paid during the year.

(iii) Interim Dividend paid during the year was ₹ 36,000.

[Ans. Cash Flow from Operating Activities ₹ 39,000.]

| Particulars | 31st March, 2022 | 31st March, 2021 |

| Surplus (i.e., Balance in the Statement for Profit and Loss) | 71,000 | 89,000 |

| Inventory | 12,000 | 4,000 |

| Trade Receivables | 58,000 | 45,000 |

| Outstanding Expenses | 14,600 | 10,000 |

| Goodwill | 57,000 | 27,000 |

| Cash in Hand | 9,000 | 12,000 |

| Machinery | 82,000 | 56,000 |

Anurag Pathak Answered question