From the following information, calculate cash inflows from operating activities Profit & Loss Balance 1-4-2023 (Credit) ₹ 5,50,000

From the following information, calculate ‘cash inflows from operating activities’:-

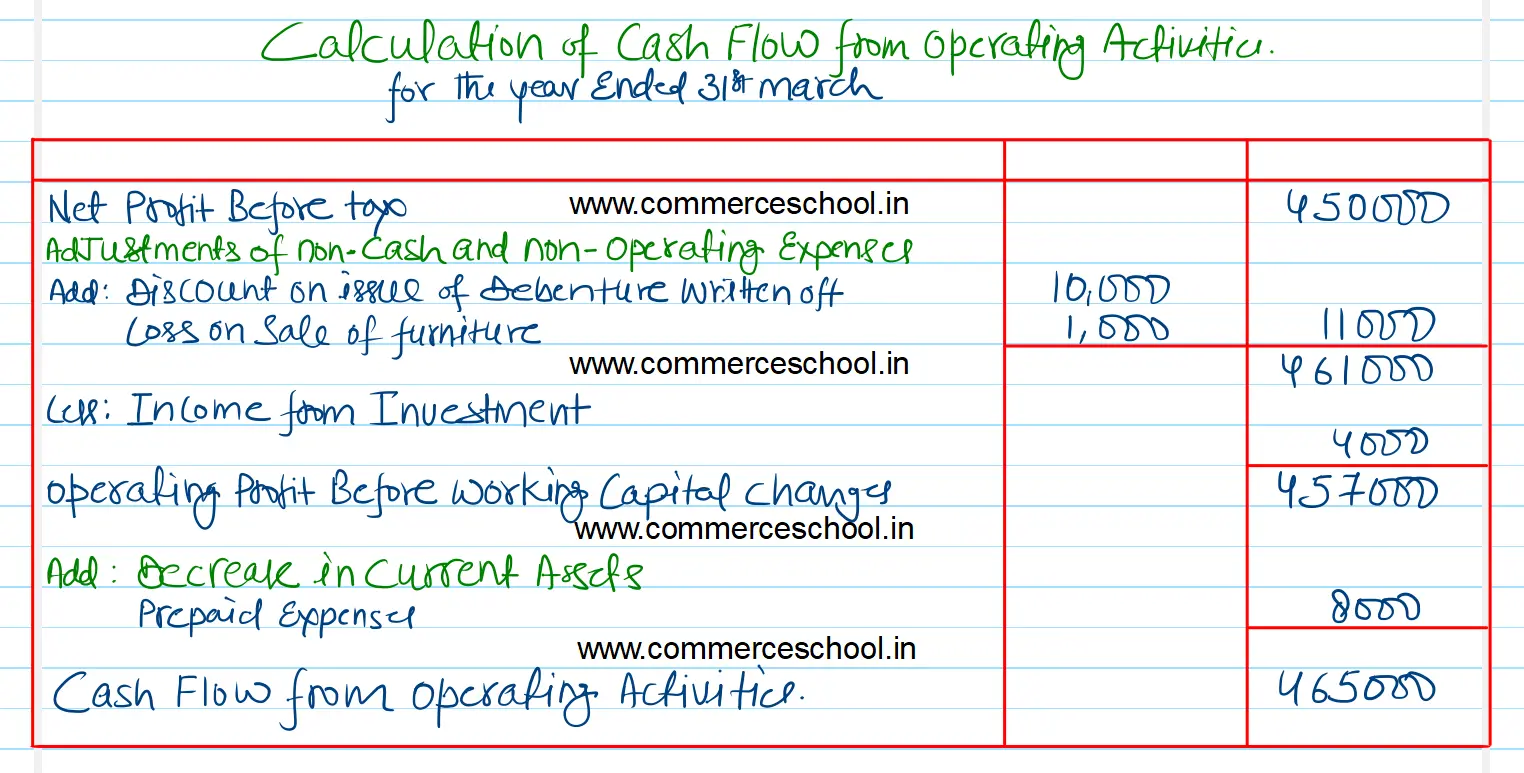

[Ans. Cash from operating activities before payment of tax ₹ 4,65,000.]

| ₹ | |

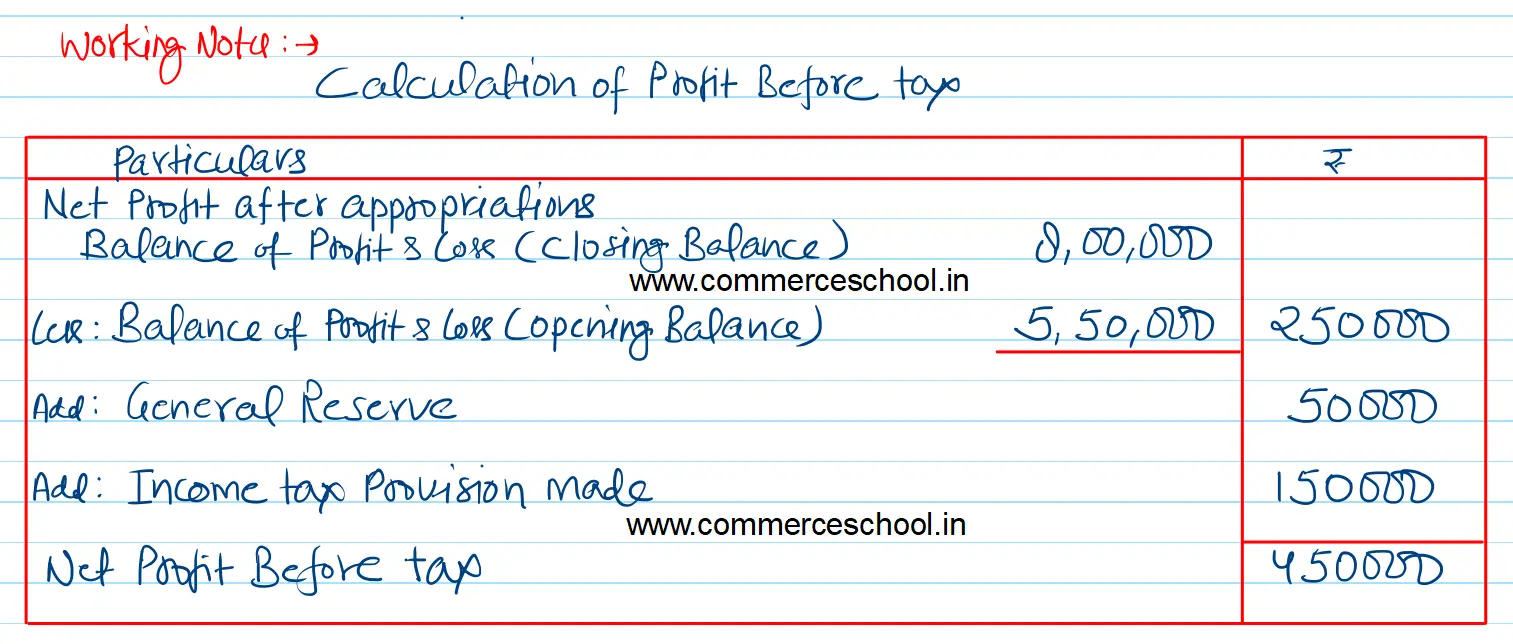

| Profit & Loss Balance 1-4-2023 (Credit) | 5,50,000 |

| Profit & Loss Balance 31-3-2024 (Credit) | 8,00,000 |

| Amount transferred to General Reserve | 50,000 |

| Income Tax Provision made | 1,50,000 |

| Discount on Issue of Debentures written off | 10,000 |

| Prepaid Expenses on 1-4-2023 | 8,000 |

| Loss on Sale of Furniture | 1,000 |

| Income from Investment | 4,000 |

Anurag Pathak Answered question