From the following information, Calculate the value of goodwill of the firm:

From the following information, Calculate the value of goodwill of the firm:

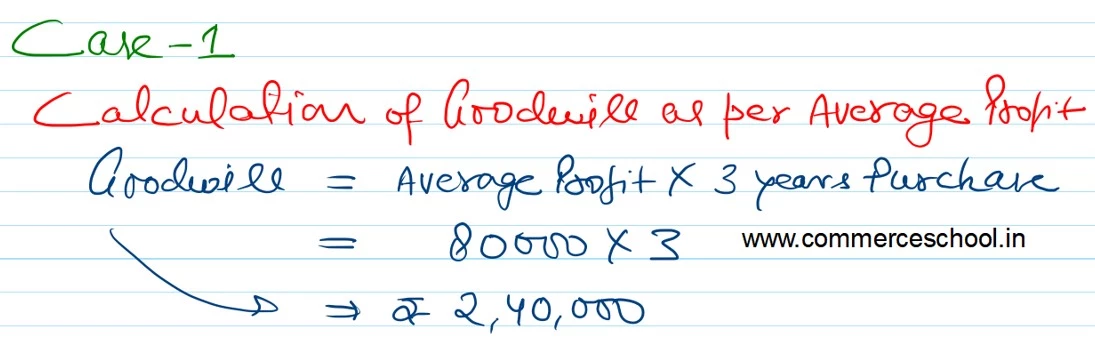

(i) At three years’ purchase of Average profit.

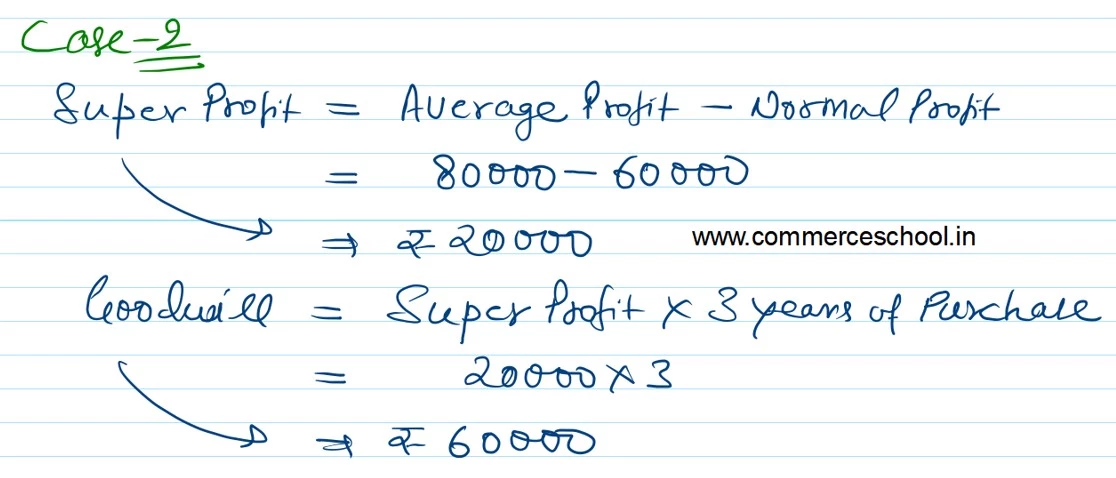

(ii) At three years’ purchase of Super Profit.

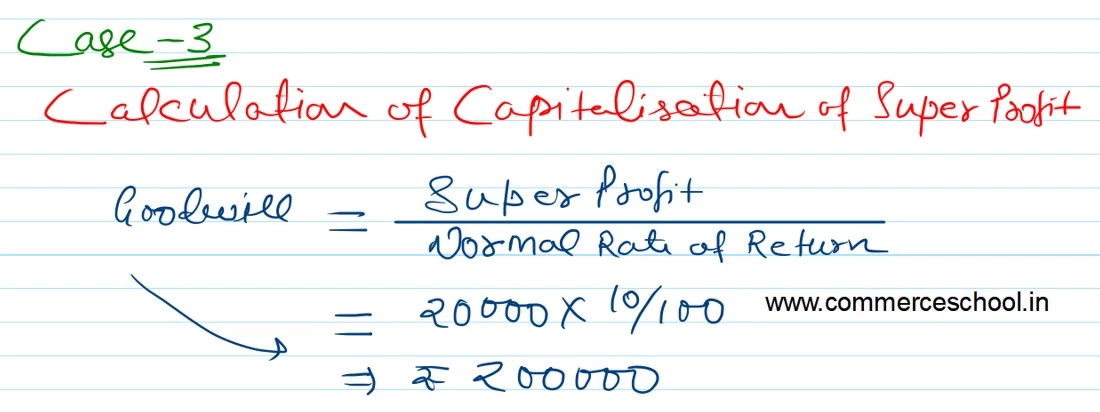

(iii) On the basis of Capitalisation of Super Profit.

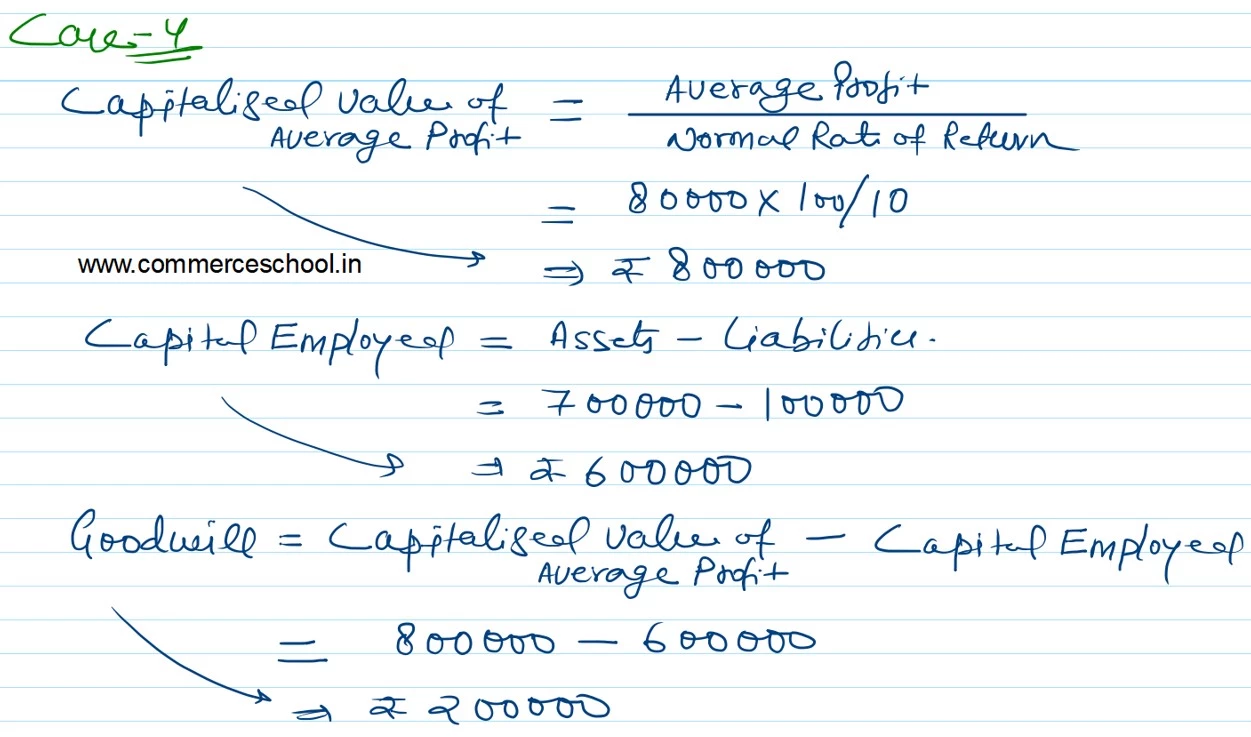

(iv) On the basis of Capitalisation of Average Profit.

Information:

(a) Average Capital Employed is ₹ 6,00,000.

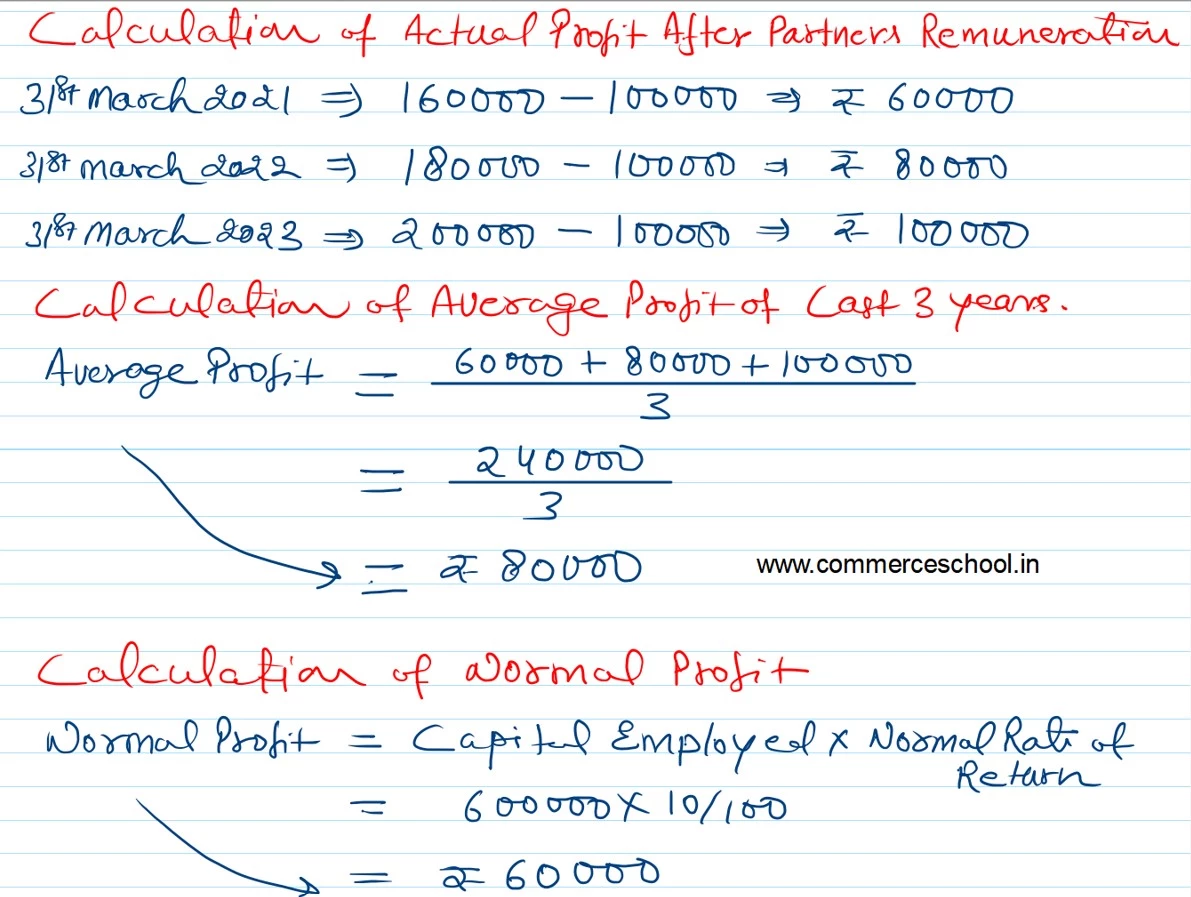

(b) Net profit/Loss of the firm for the last three years ended are 31st March 2023 – ₹ 2,00,000, 31st March 2022 – ₹ 1,80,000, and 31st March 2021 – ₹ 1,60,000.

(c) Normal Rate of Return in similar business is 10%.

(d) Remuneration of ₹ 1,00,000 to partners is to be taken as a charge against profit.

(e) Assets of the firm (excluding goodwill, fictitious assets, and non-trade investments is ₹ 7,00,000 whereas Partner’s Capital is ₹ 6,00,000 and Outside Liabilities ₹ 1,00,000.

[Ans.: Goodwill – (i) ₹ 2,40,000; (ii) ₹ 60,000; (iii) ₹ 2,00,000; (iv) ₹ 2,00,000.]