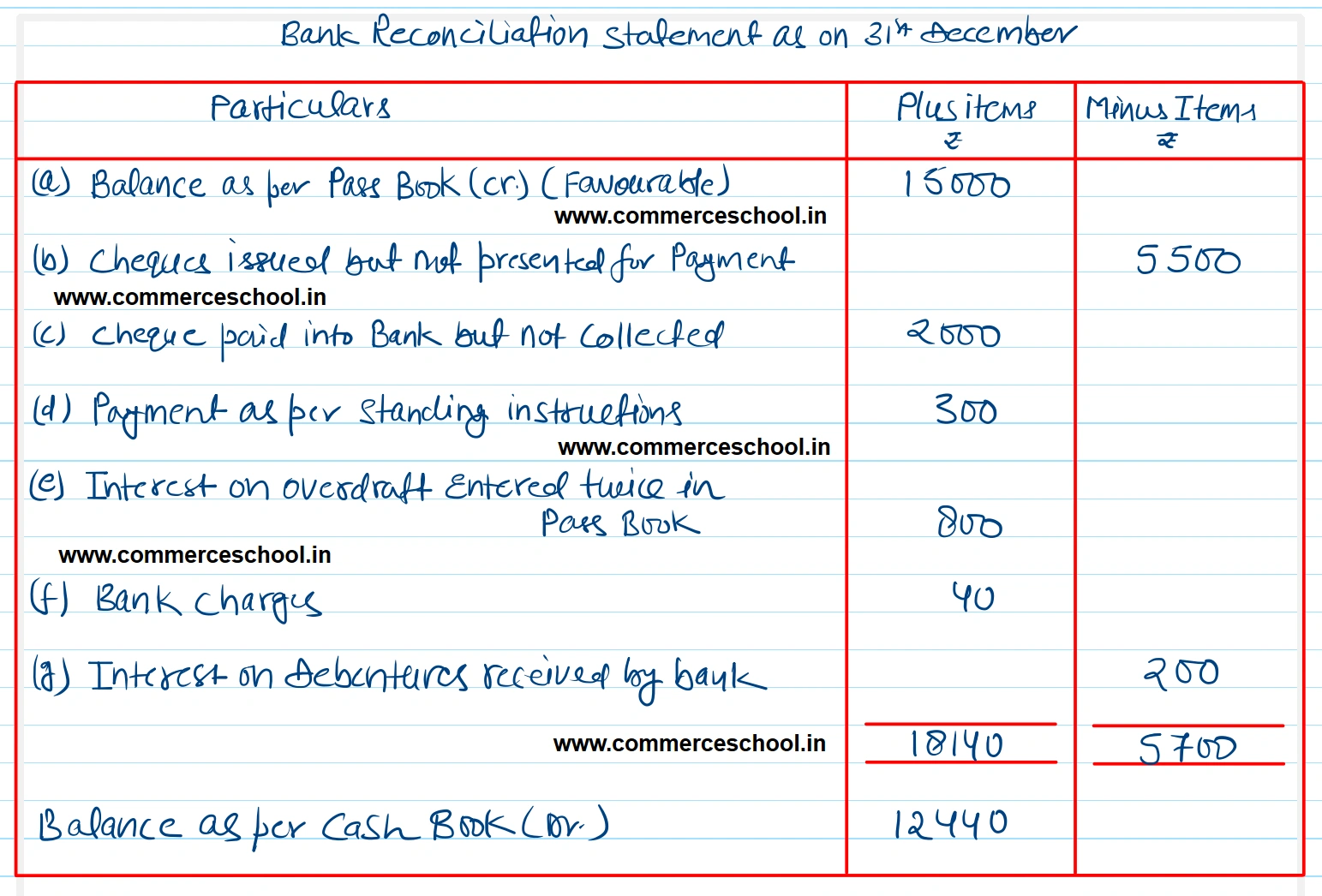

From the following particulars make out the Bank Reconciliation Statement as on 31st December 2024. Pass book showed a credit balance of ₹ 15,000 on 31st December 2024.

From the following particulars make out the Bank Reconciliation Statement as on 31st December 2024.

(a) Pass book showed a credit balance of ₹ 15,000 on 31st December 2024.

(b) Cheques of ₹ 17,500 were issued but cheques of ₹ 12,000 only presented for payment till 31st December.

(c) Cheques of ₹ 10,000 were sent to the bank for collection. Out of which cheques of ₹ 2,000 were credited in the month of January 2025.

(d) Bank paid ₹ 300 as per standing instructions but no record made in the cash book.

(e) Bank charged interest on overdraft ₹ 800 and it was entered twice in pass book by bank.

(f) ₹ 40 as bank charges not recorded in the cash book.

(g) Bank receives ₹ 200 as interest on debentures, but no information being sent to the customer.

[Ans. Balance as per Cash Book ₹ 12,440.]