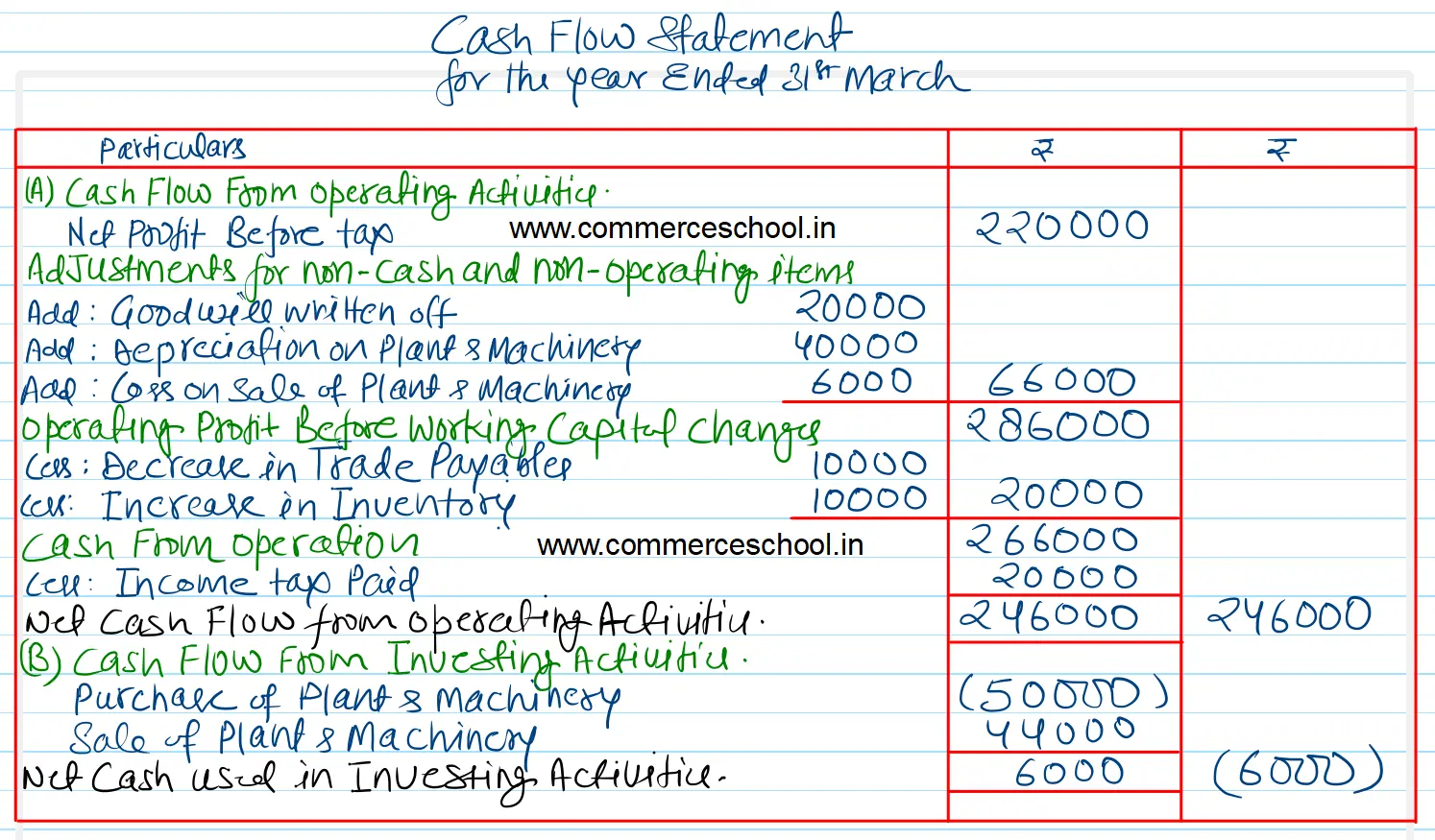

From the following particulars of Phantom Ltd., you are required to calculate Cash from Operating Activities, and Cash from Investing Activities

From the following particulars of Phantom Ltd., you are required to calculate: Cash from Operating Activities, and Cash from Investing Activities.

| 31.3.2021 | 31.3.2020 | |

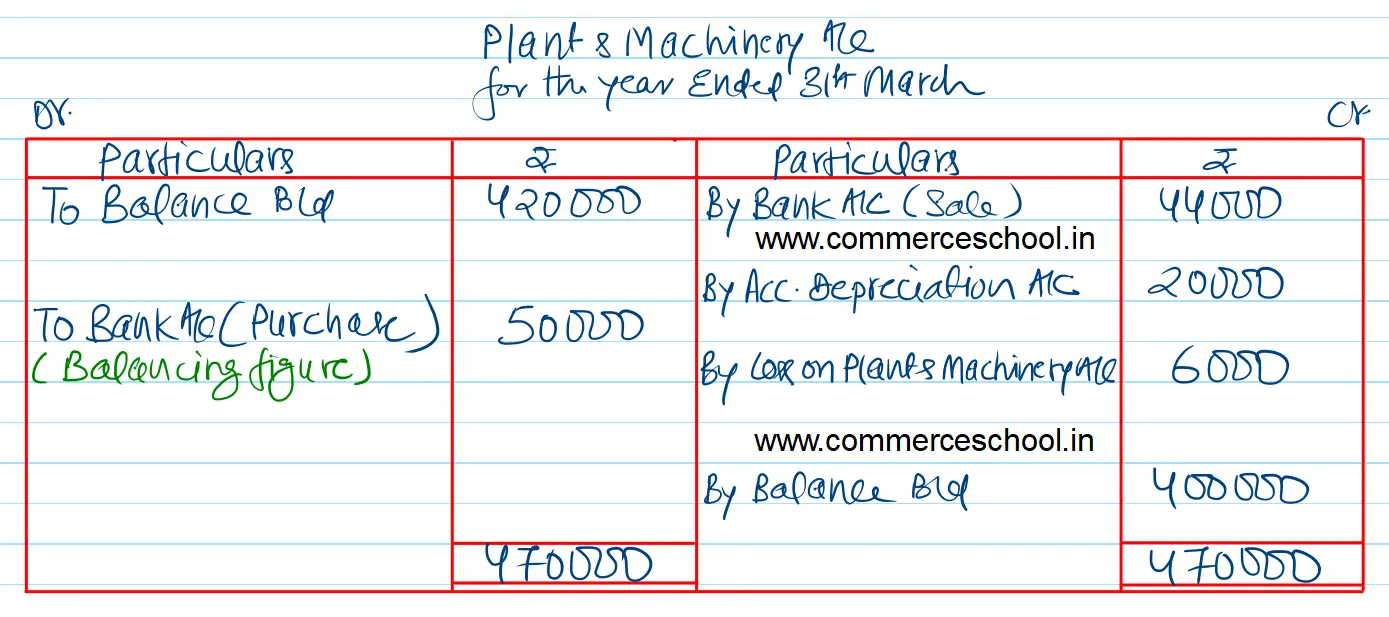

| Plant & Machinery (at cost) | 4,00,000 | 4,20,000 |

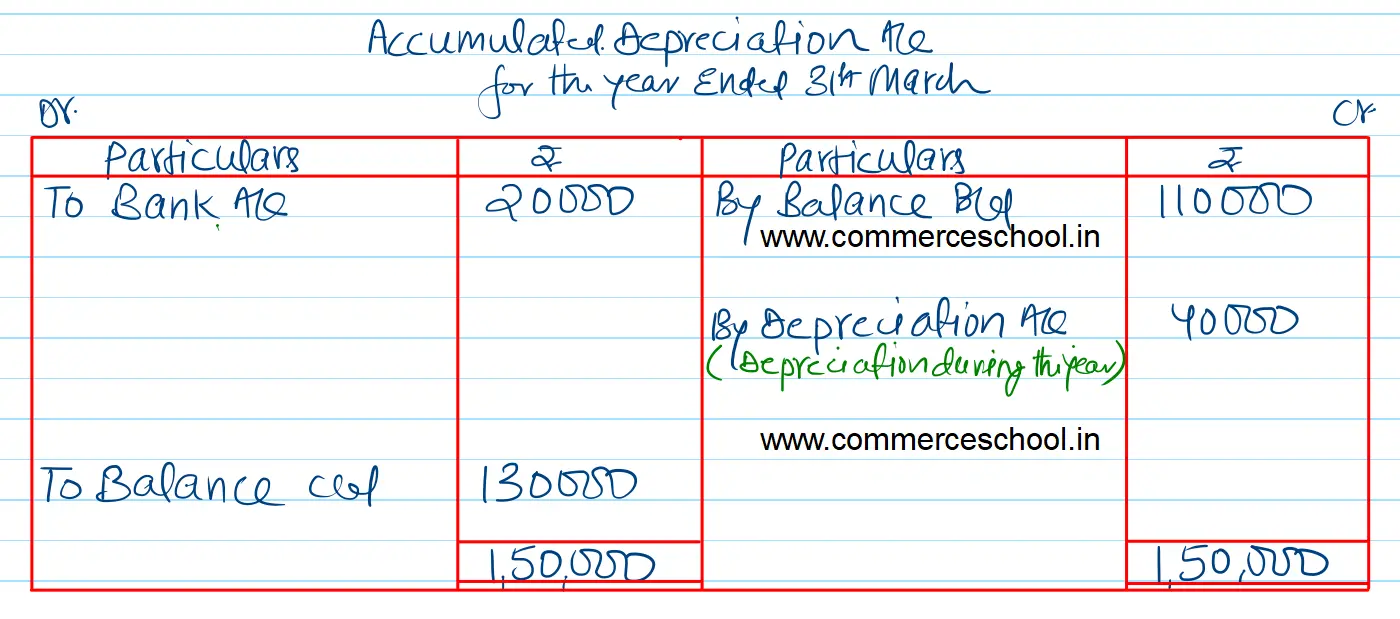

| Accumulated Depreciation | 1,30,000 | 1,10,000 |

| Goodwill | 70,000 | 90,000 |

| Inventory | 20,000 | 10,000 |

| Trade Payables | 15,000 | 25,000 |

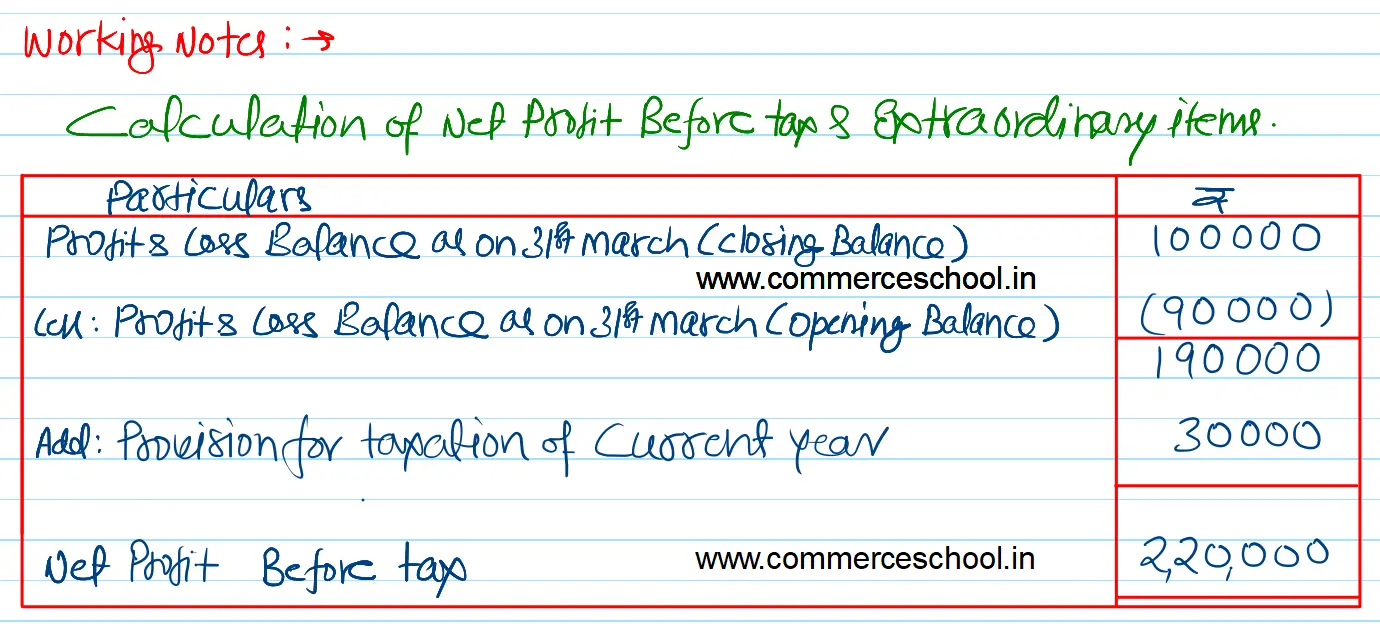

| Provision for Tax | 30,000 | 20,000 |

| Balance of Statement of Profit & Loss | 1,00,000 | (90,000) |

Additional Information:

During the year 2020-21, a machine with a book value of ₹ 50,000 (accumulated depreciation ₹ 20,000) was sold at a loss of ₹ 6,000.

[Ans. Cash from Operating Activities ₹ 2,46,000; Cash used in Investing Activities ₹ 6,000; Net Profit before Tax ₹ 2,20,000.]

Anurag Pathak Changed status to publish