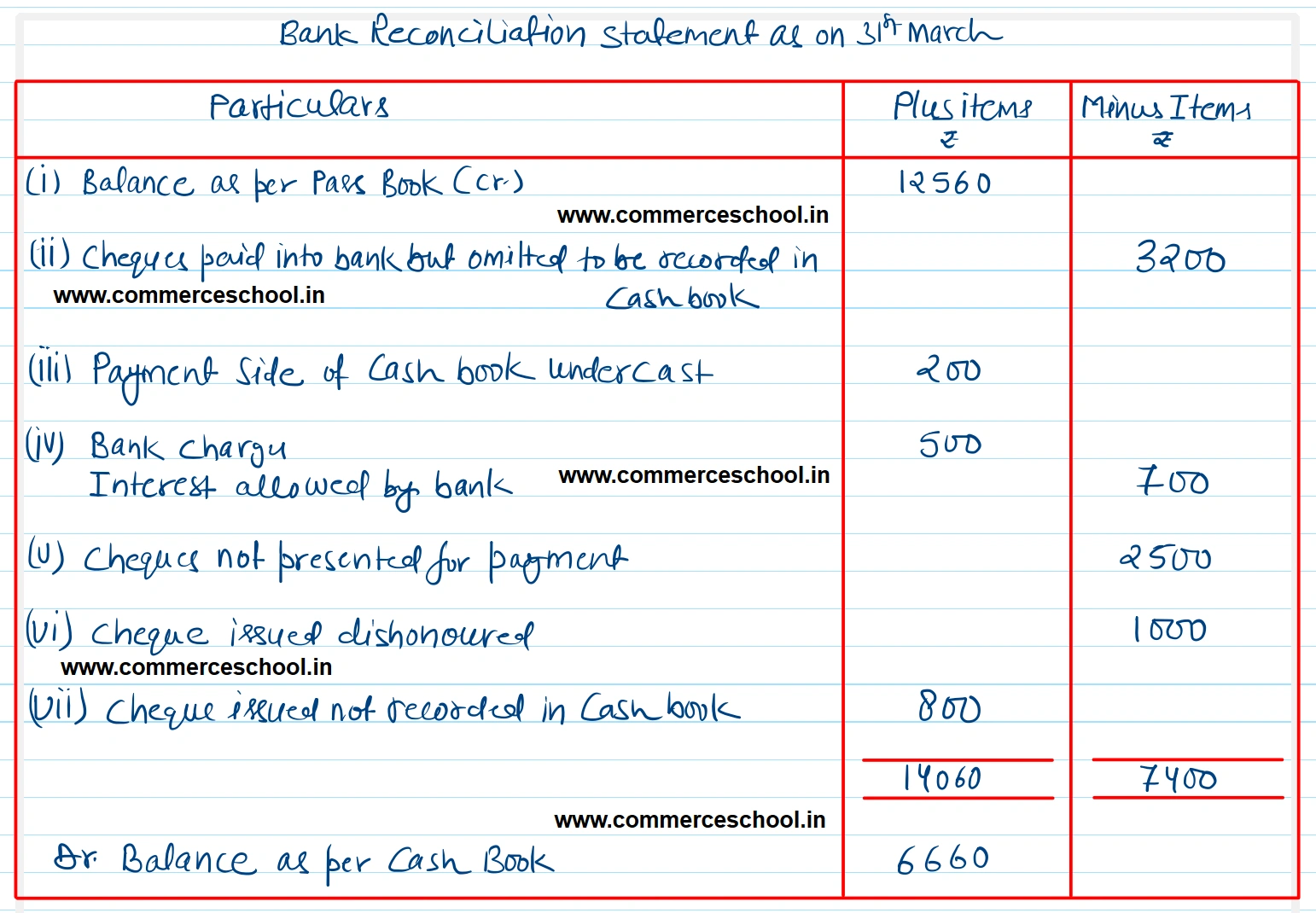

From the following Particulars, prepare Bank Reconciliation Statement as on 31st March, 2019. Pass book showed a credit balance of ₹ 12,560.

From the following Particulars, prepare Bank Reconciliation Statement as on 31st March, 2019.

(i) Pass book showed a credit balance of ₹ 12,560.

(ii) Cheque paid into bank but omitted to be recorded in cash book ₹ 3,200.

(iii) The payment side of bank column of cash book was undercast by ₹ 200.

(iv) There was a debit of ₹ 500 for bank charges and a credit of ₹ 700 for Interest allowed by bank.

(v) Cheques amounting to ₹ 8,500 were issued out of which cheques amounting to ₹ 2,500 were presented for payment in April.

(vi) Cheque issued to a creditor returned dishonoured on technical grounds ₹ 1,000.

(vii) Two cheques for ₹ 800 each were issued to seller of goods but only one cheque was recorded in cash book.

[Ans. Dr. Balance as per Cash Book ₹ 6,600.]