From the following Trial Balance and other information, prepare Trading and profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date:

From the following Trial Balance and other information, prepare Trading and profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date:

| Heads of Accounts | L.F. | Dr. (₹) | Cr. (₹) |

|

Sundry Debtors Stock on 1st April, 2022 Cash in Hand Cast at Bank Plant and Machinery Sundry Creditors General Expenses Sales Salaries Carriage Outwards Rent Purchases Discount Premises Capital on 1st April, 2022 |

3,20,000 2,20,000 350 15,450 1,75,000 – 10,750 – 22,250 4,000 9,000 – 11,88,700 11,000 3,45,000 |

– – – – – 1,81,500 – 13,45,000 – – – – – – 7,95,000 |

|

| 23,21,500 | 23, 21,500 |

Additional Information:

(i) Stock on 31st March, 2023 was ₹ 1,24,500.

(ii) Rent was unpaid to the extent of ₹ 850 and ₹ 1,500 were outstanding for General Expenses.

(iii) ₹ 4,000 are to be written off as bad debts out of the above debtors and 5% is to be provided for doubtful debts.

(iv) Depreciate Plant and Machinery by 10% and Premises by 2%.

(v) Manager is entitled to a commission of 5% on profit after charging his commission.

(vi) A fire broke out on 1st April, 2023 destroying goods costing ₹ 20,000.

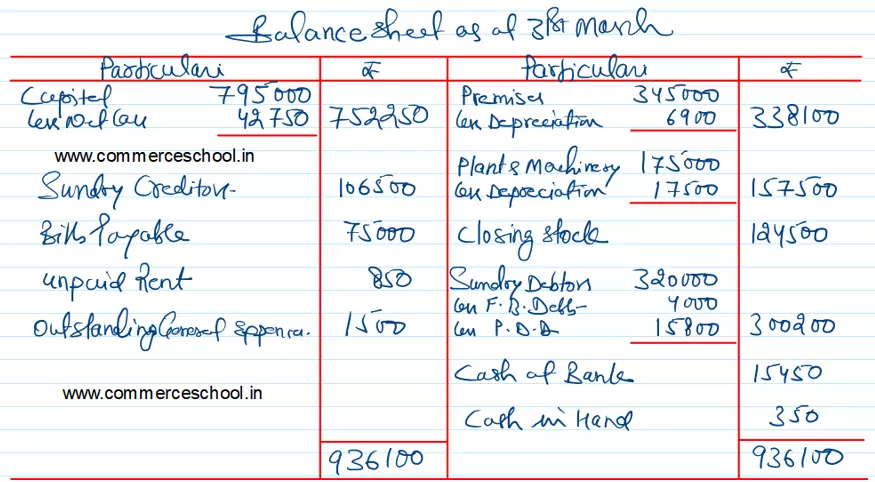

[Gross Profit – ₹ 60,800; Net Loss – ₹ 42,750; Balance Sheet Total – ₹ 9,36,100.]

[Hints:

- As there is net loss, the manager will not get commission.

- An event occurring after the date of Balance Sheet (i.e., fire broke out on 1st April, 2023 does not effect the Balance Sheet as on 31st March, 2023.]