From the following Trial Balance extracted from the books of Joseph, prepare Trading and Profit & Loss Account for the year ending 31st March, 2025 and a Balance Sheet as at that date:-

From the following Trial Balance extracted from the books of Joseph, prepare Trading and Profit & Loss Account for the year ending 31st March, 2025 and a Balance Sheet as at that date:-

The following adjustments are to be made:

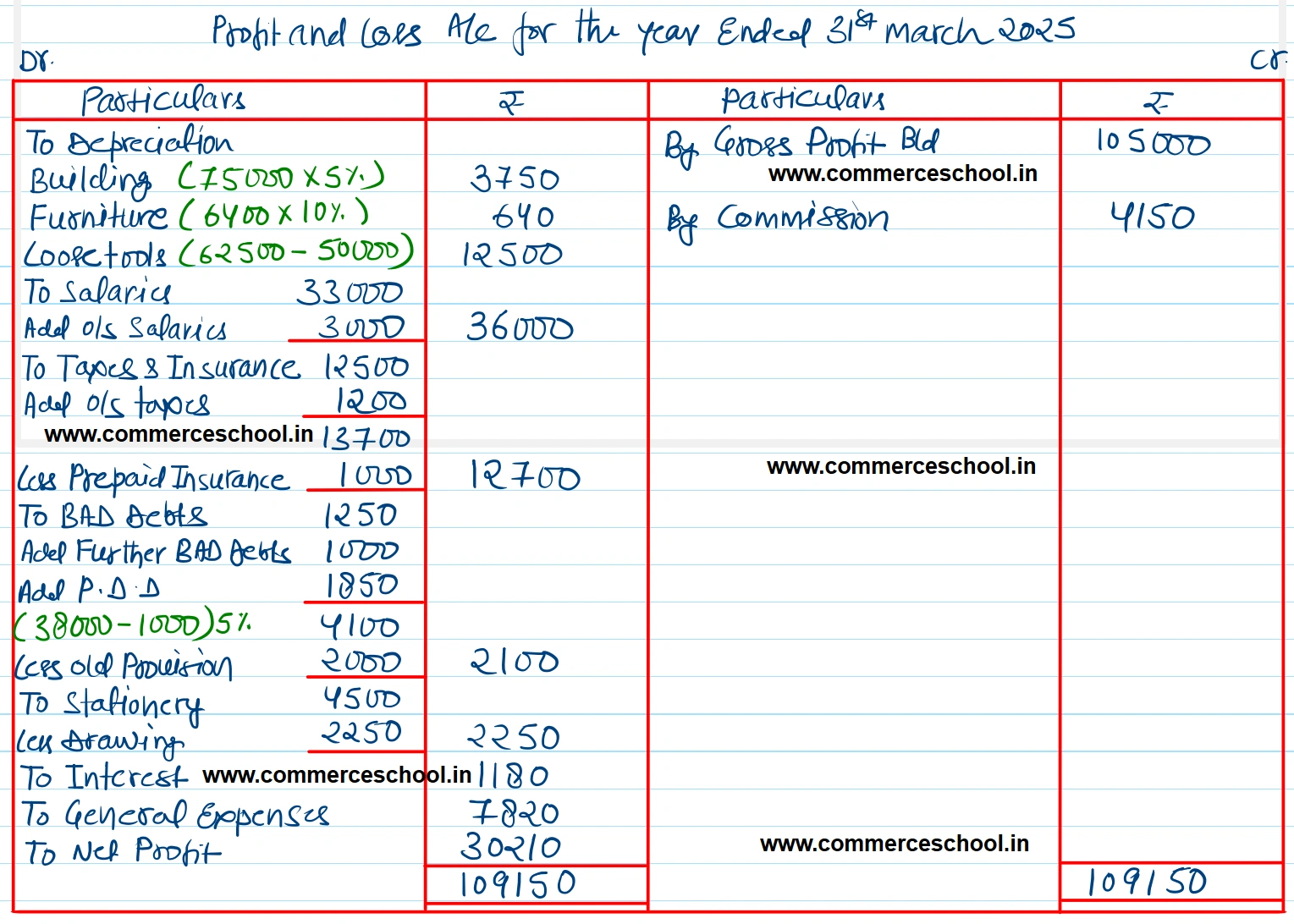

(i) Depreciate Buildings at 5% and Furniture at 10%. Loose Tools are revalued at ₹ 50,000 at the end of the year.

(ii) Salaries ₹ 3,000 and taxes ₹ 1,200 are outstanding.

(iii) Insurance amounting to ₹ 1,000 is prepaid.

(iv) Write off a further ₹ 1,000 as Bad-Debts and provision for Doubtful Debts is to be made equal to 5% on Sundry Debtors.

(v) Half of the stationery was used by the proprietor for his personal purposes.

(vi) Stock in hand on 31st March, 2025 was ₹ 41,000.

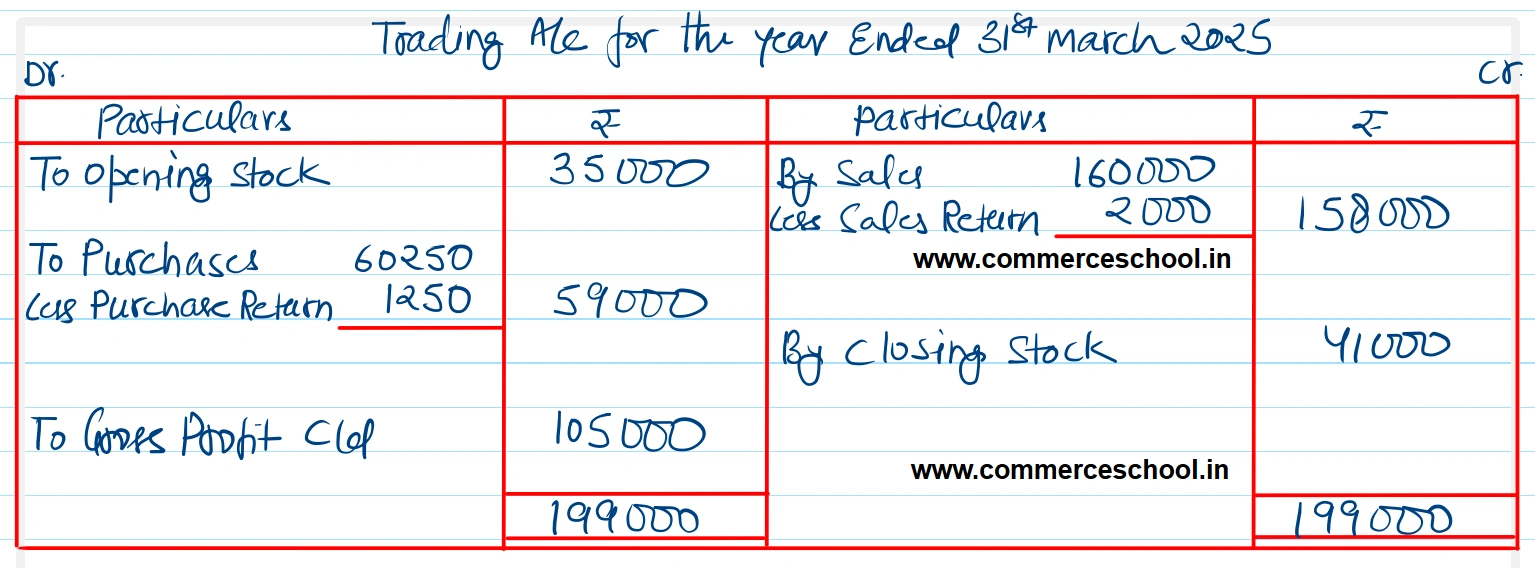

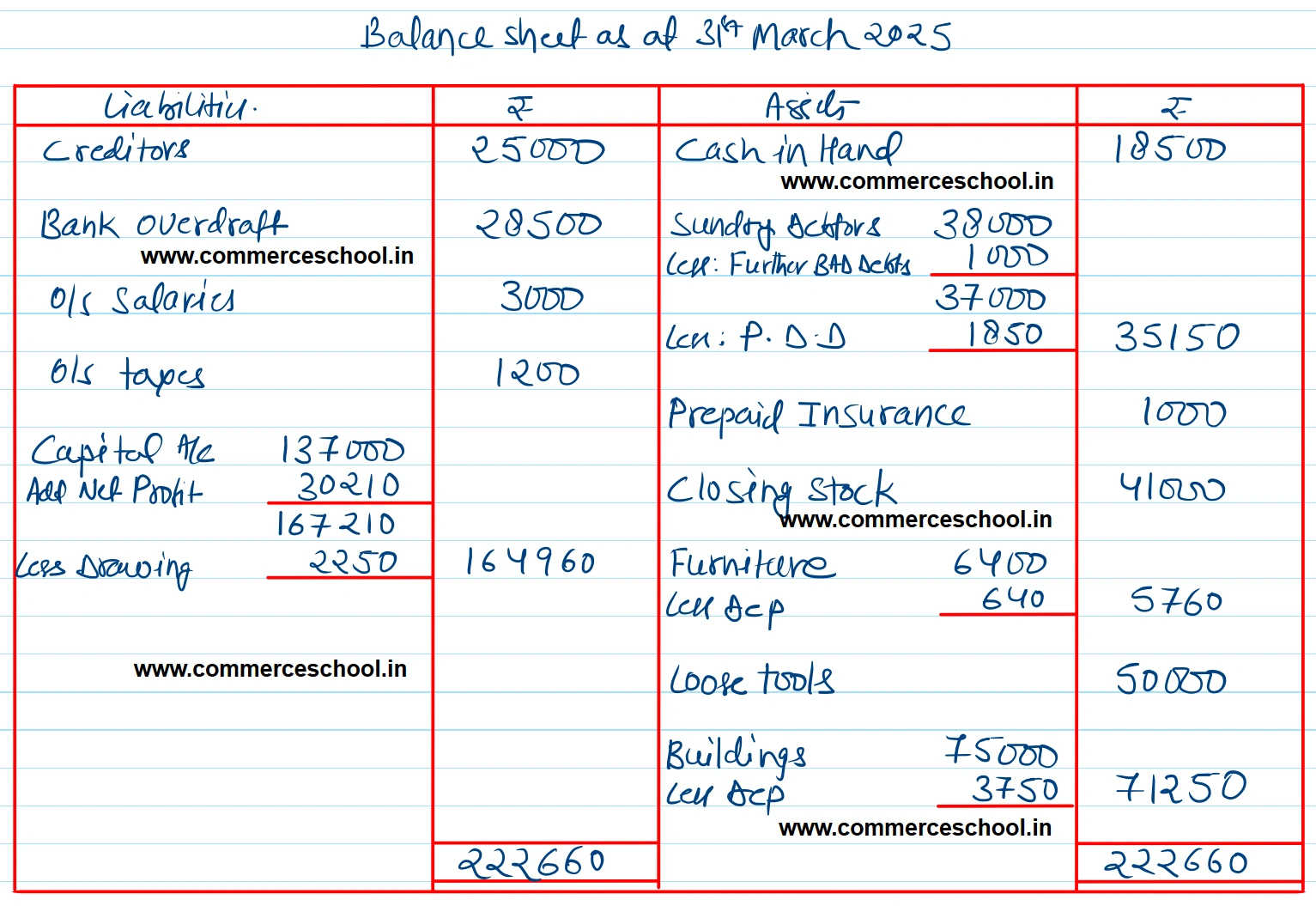

[Ans. G.P. ₹ 1,05,000; N.P. ₹ 30,210 and B/S Total ₹ 2,22,660.]

| Particulars | Dr. (₹) | Cr. (₹) |

| Capital Account | 1,37,000 | |

| Bad-debts | 1,250 | |

| Provision for Bad-debts | 2,000 | |

| Sundry Debtors and Creditors | 38,000 | 25,000 |

| Stock on 1st April, 2022 | 35,000 | |

| Purchases and Sales | 60,250 | 1,60,000 |

| Bank Overdraft | 28,500 | |

| Sales Return and Purchases Return | 2,000 | 1,250 |

| Stationery | 4,500 | |

| Interest Account | 1,180 | |

| Commission | 4,150 | |

| Cash in Hand | 18,500 | |

| Taxes and Insurance | 12,500 | |

| General Expenses | 7,820 | |

| Salaries | 33,000 | |

| Furniture | 6,400 | |

| Loose Tools | 62,500 | |

| Buildings | 75,000 | |

| 3,57,900 | 3,57,900 |

Anurag Pathak Answered question