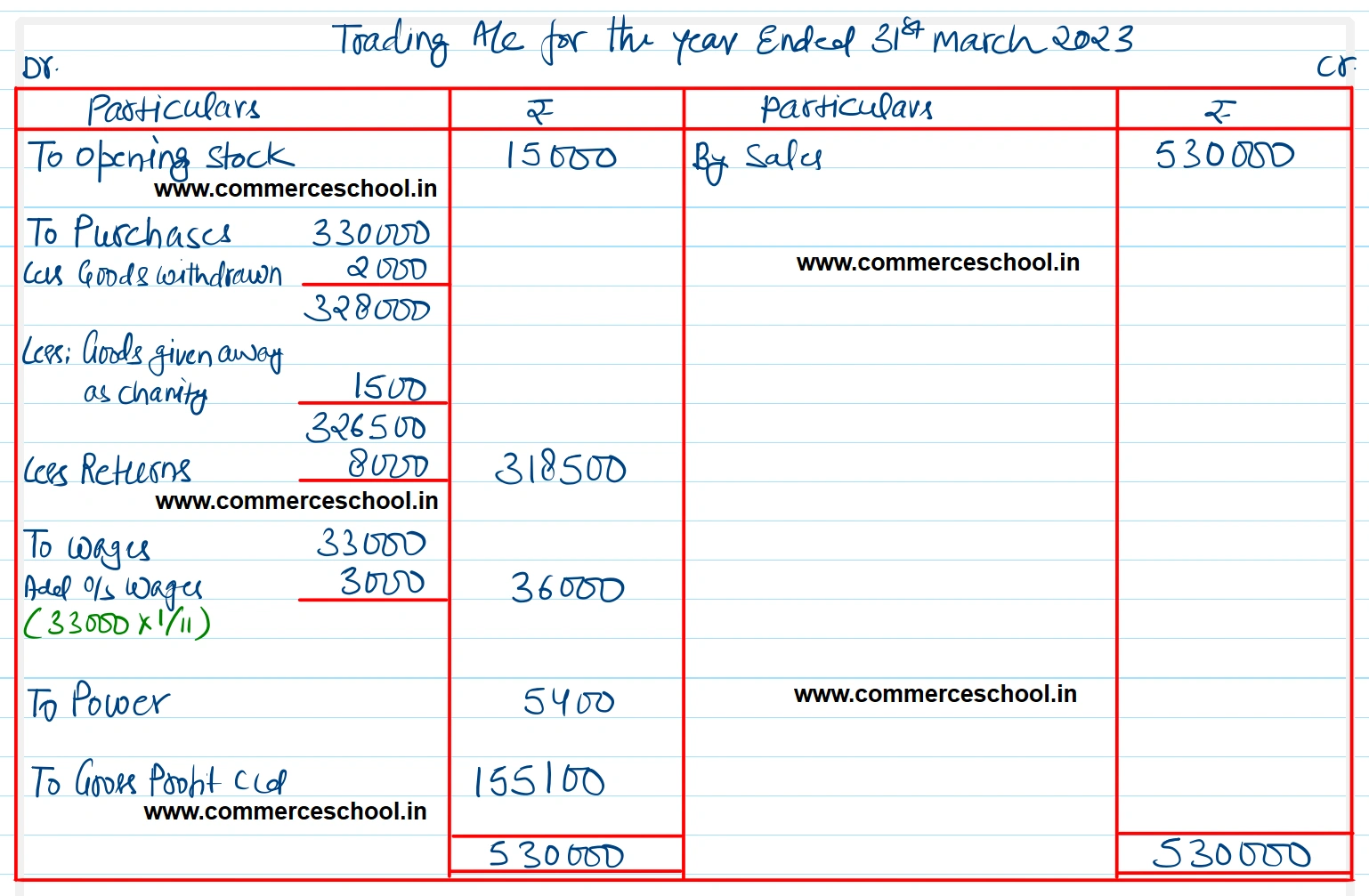

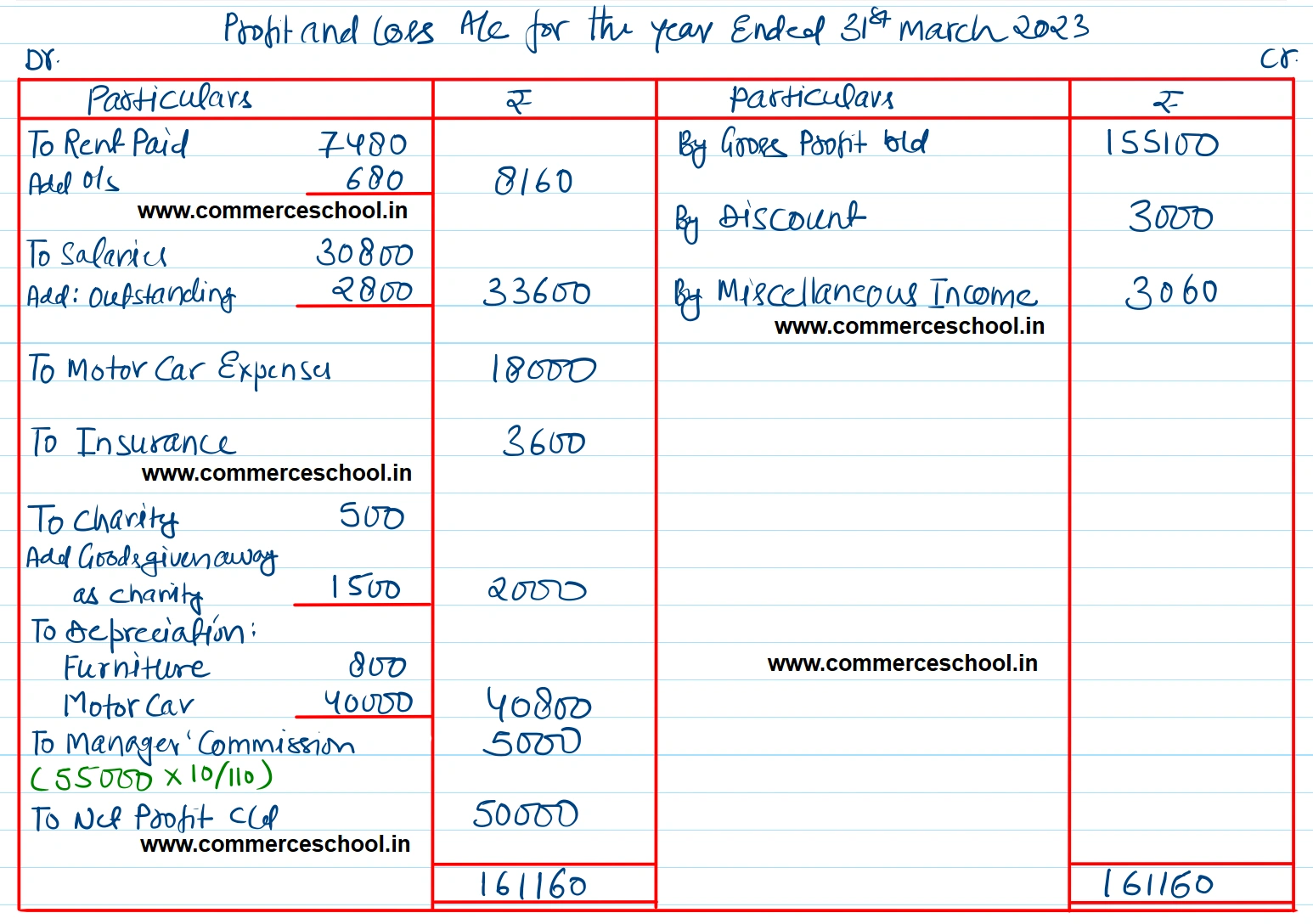

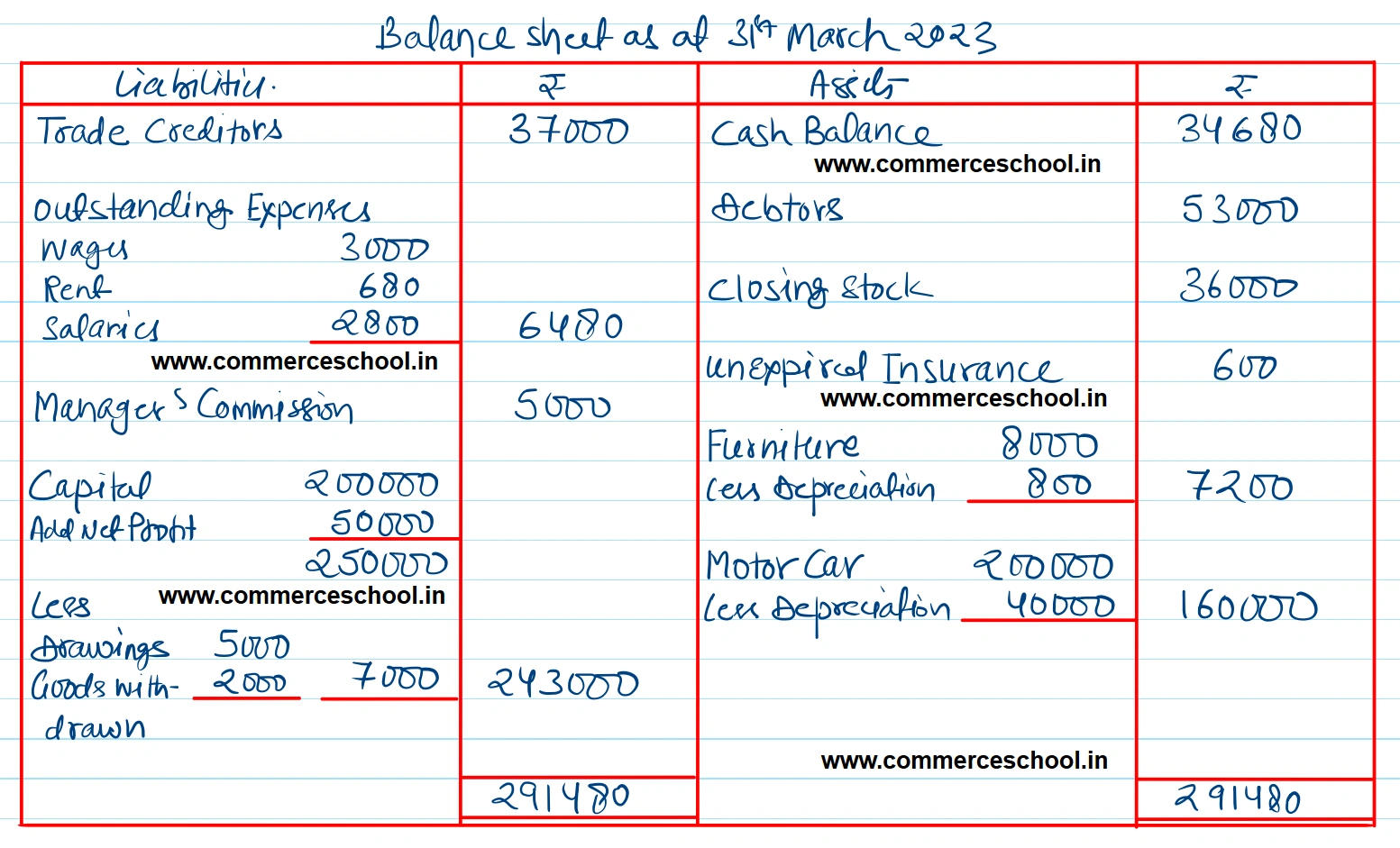

From the following Trial Balance extracted from the books of Mr. Karuna Sagar, prepare a Trading and Profit & Loss A/c For for the year ended 31st March, 2023 and a Balance Sheet as at that date:

From the following Trial Balance extracted from the books of Mr. Karuna Sagar, prepare a Trading and Profit & Loss A/c For for the year ended 31st March, 2023 and a Balance Sheet as at that date:

| Dr. Balances | ₹ | Cr. Balances | ₹ |

| Purchases | 3,30,000 | Sales | 5,30,000 |

| Rent paid | 7,480 | Returns | 8,000 |

| Wages | 33,000 | Trade Creditors | 37,000 |

| Salaries | 30,800 | Discount | 3,000 |

| Power | 5,400 | Capital | 2,00,000 |

| Stock on 1-4-2022 | 15,000 | Miscellaneous Income | 3,060 |

| Stock on 31-3-2023 | 36,000 | ||

| Charity | 500 | ||

| Debtors | 53,000 | ||

| Furniture | 8,000 | ||

| Motor Car | 2,00,000 | ||

| Motor Car Expenses | 18,000 | ||

| Insurance | 3,600 | ||

| Unexpired Insurance | 600 | ||

| Drawings | 5,000 | ||

| Cash Balance | 34,680 | ||

| 7,81,060 | 7,81,060 |

Informations:-

(i) Goods costing ₹ 2,000 were taken away by the proprietor for his personal use and goods costing ₹ 1,500 were given away as charity.

(ii) Expenses for wages, rent and salaries are uniform throughoght the year and those for March have not been paid.

(iii) Provide 10% depreciation on Furniture and 20% on Motor Car.

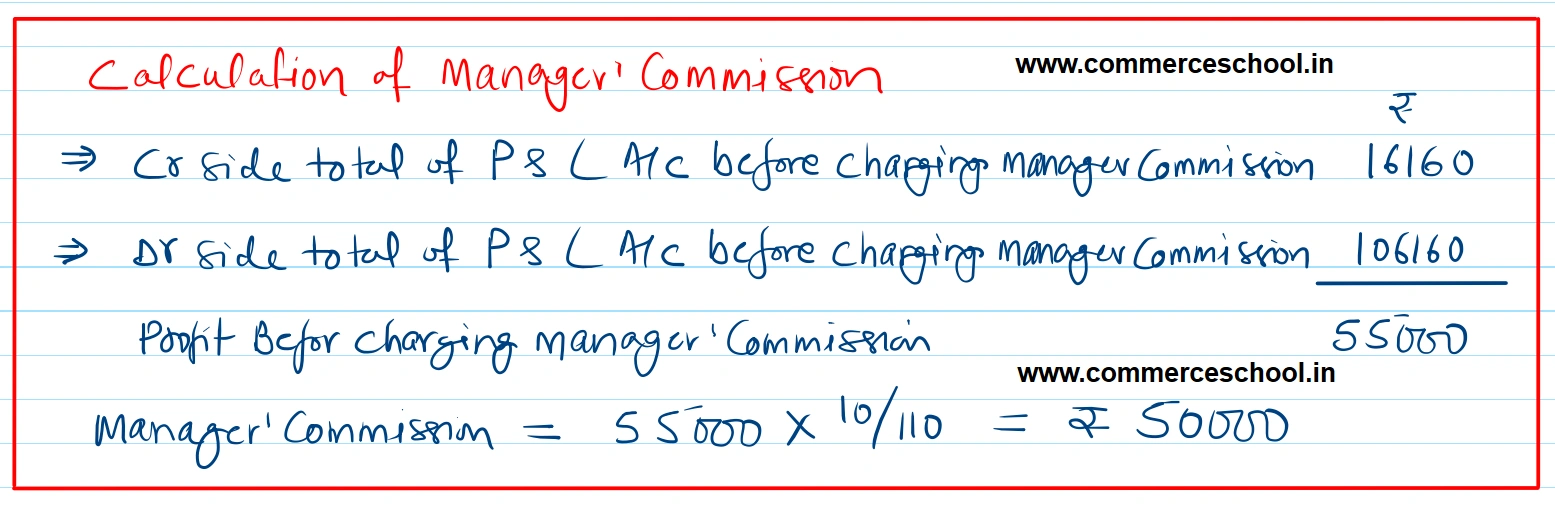

(iv) Provide for Manager’s Commission at 10% on Net Profit after charging such Commission.

[Ans. G.P ₹ 1,55,100; N.P. ₹ 50,000; Balance Sheet Total ₹ 2,91,480.]

Anurag Pathak Changed status to publish