From the following Trial Balance extracted from the books of Sh. Pawan Kumar, prepare a Trading Account, Profit & Loss Account for the year ended 31st March, 2024 and a Balance Sheet a at that date:

From the following Trial Balance extracted from the books of Sh. Pawan Kumar, prepare a Trading Account, Profit & Loss Account for the year ended 31st March, 2024 and a Balance Sheet a at that date:

Adjustments:-

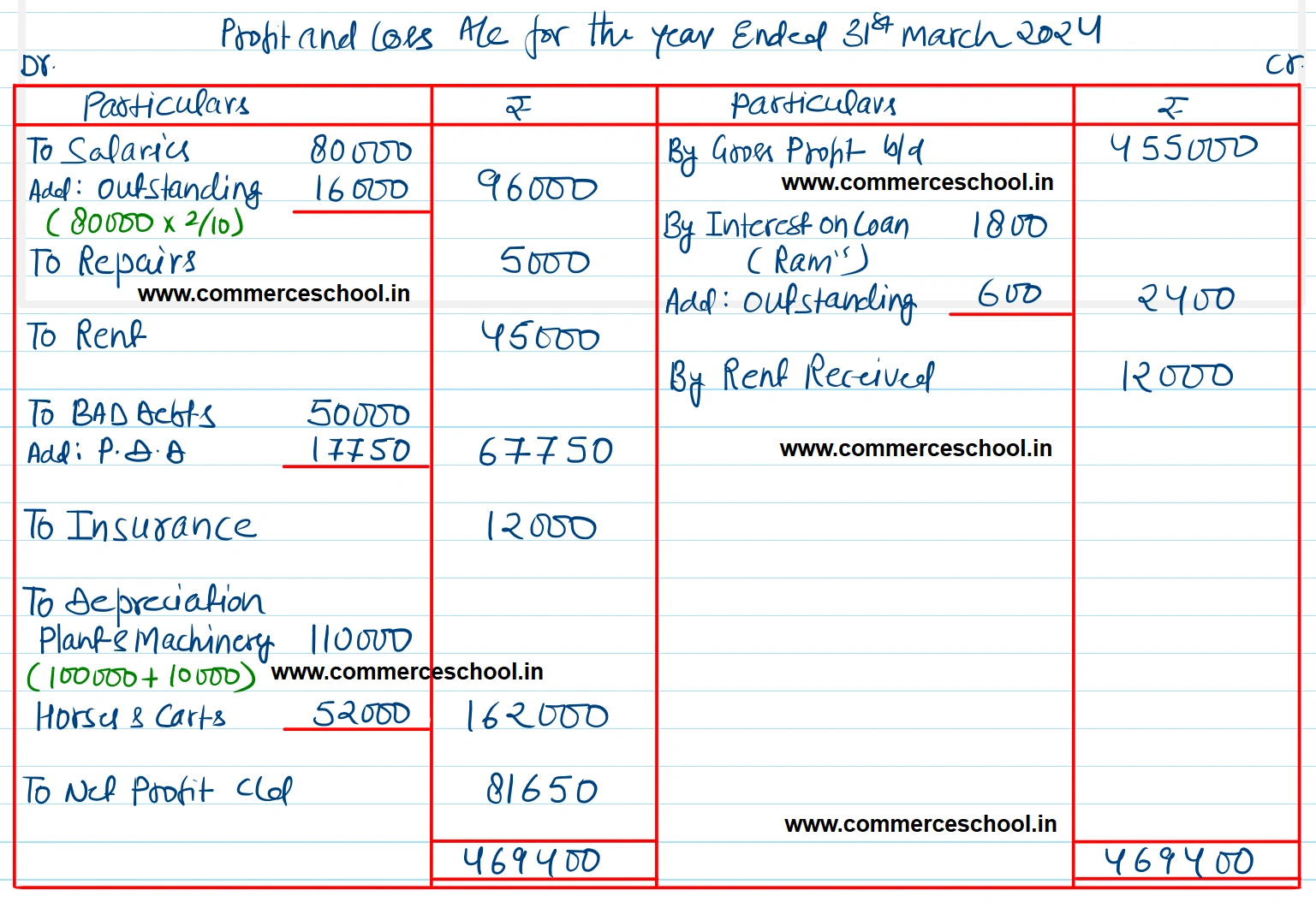

(1) Plant and Machinery includes a new machinery purchased on 1st October, 2023 for ₹ 2,00,000.

(2) Depreciate Plant and Machinery by 10% p.a. and Horses and Carts by 20% p.a.

(3) Salaries for the month of February and March 2024 are outstanding.

(4) Goods worth ₹ 15,000 were sold and depatched on 27th March but no entry was passed to this effect.

(5) Make a provision for Doubtful Debts at 5% on Debtors.

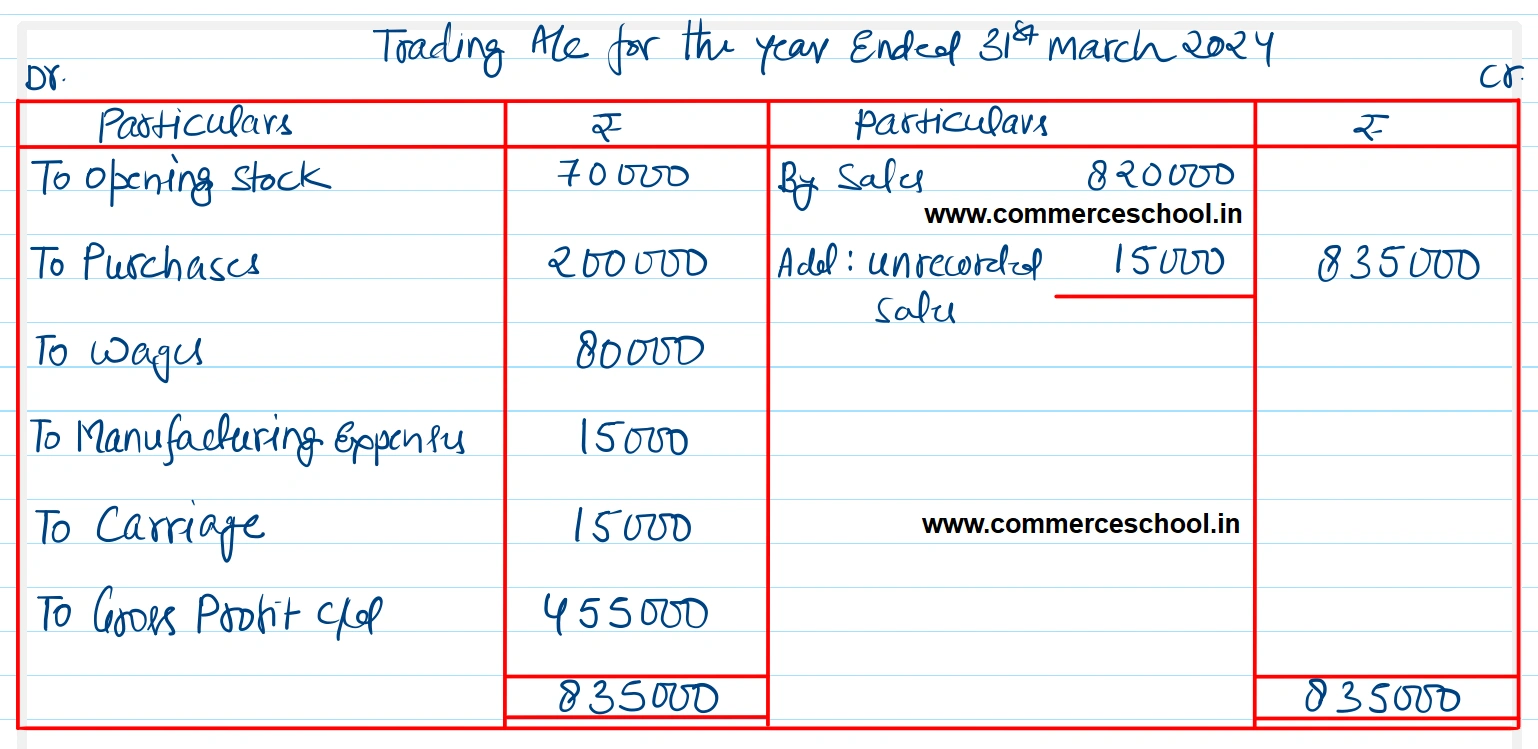

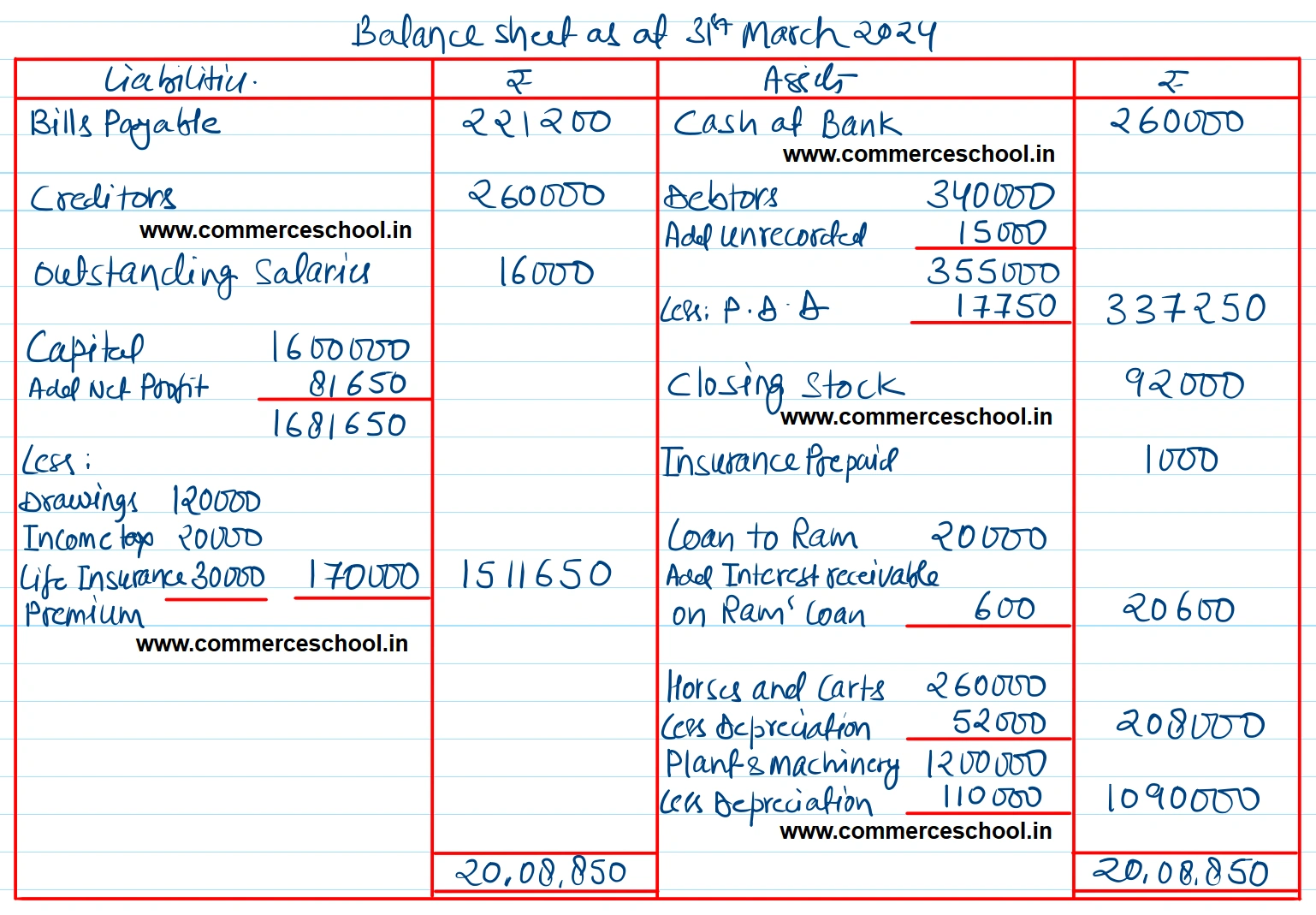

[Ans. G.P. ₹ 4,55,000; Net Profit ₹ 81,650; B/S Total ₹ 20,08,850.]

Solution:-

| Dr. Balances | ₹ | Cr. Balances | ₹ |

| Drawings | 1,20,000 | Capital | 16,00,000 |

| Plant and Machinery | 12,00,000 | Creditors | 2,60,000 |

| Horses and Carts | 2,60,000 | Sales | 8,20,000 |

| Debtors | 3,40,000 | Bills Payable | 2,21,200 |

| Purchases | 2,00,000 | Interest on Ram’s Loan | 1,800 |

| Wages | 80,000 | Rent Received | 12,000 |

| Cash at Bank | 2,60,000 | ||

| Salaries | 80,000 | ||

| Repairs | 5,000 | ||

| Stock (1.4.2023) | 70,000 | ||

| Stock (31.3.2024) | 92,000 | ||

| Rent | 45,000 | ||

| Manufacturing expenses | 15,000 | ||

| Bad-Debts | 50,000 | ||

| Carriage | 15,000 | ||

| Income Tax | 20,000 | ||

| Life Insurance Premium | 30,000 | ||

| Loan to Ram at 12% p.a. | 20,000 | ||

| Insurance | 12,000 | ||

| Insurance Prepaid | 1,000 | ||

| 29,15,000 | 29,15,000 |

Anurag Pathak Answered question