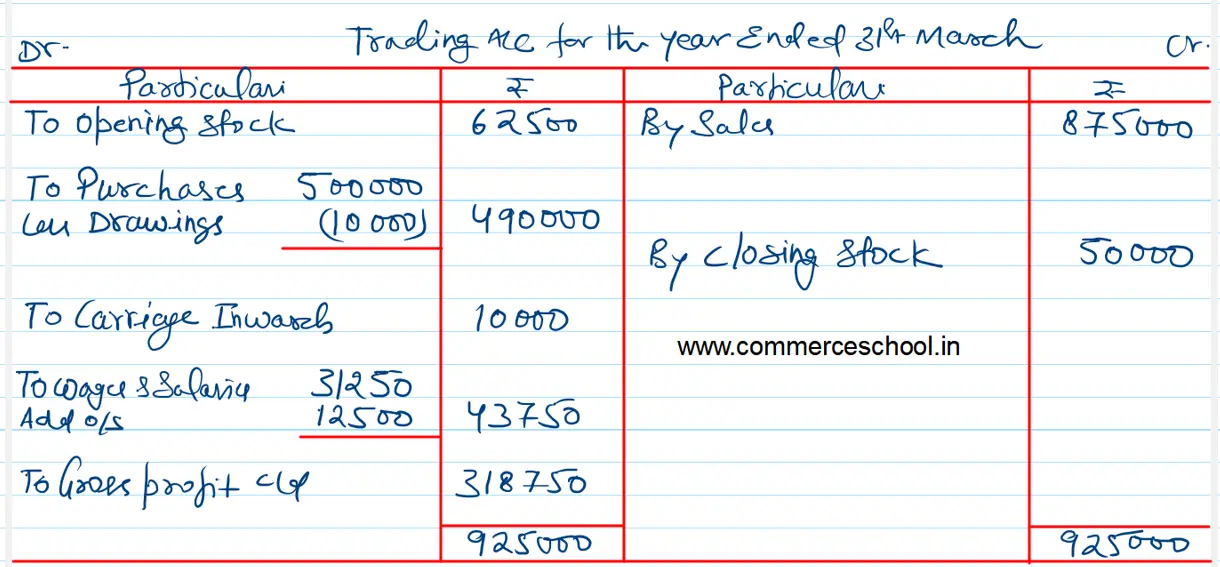

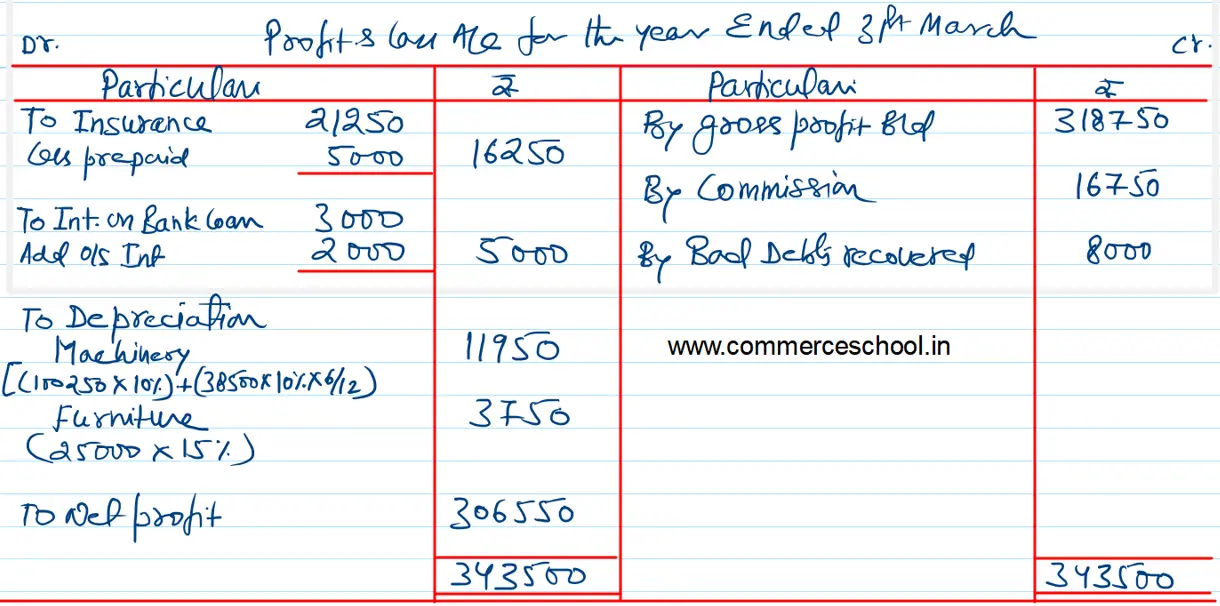

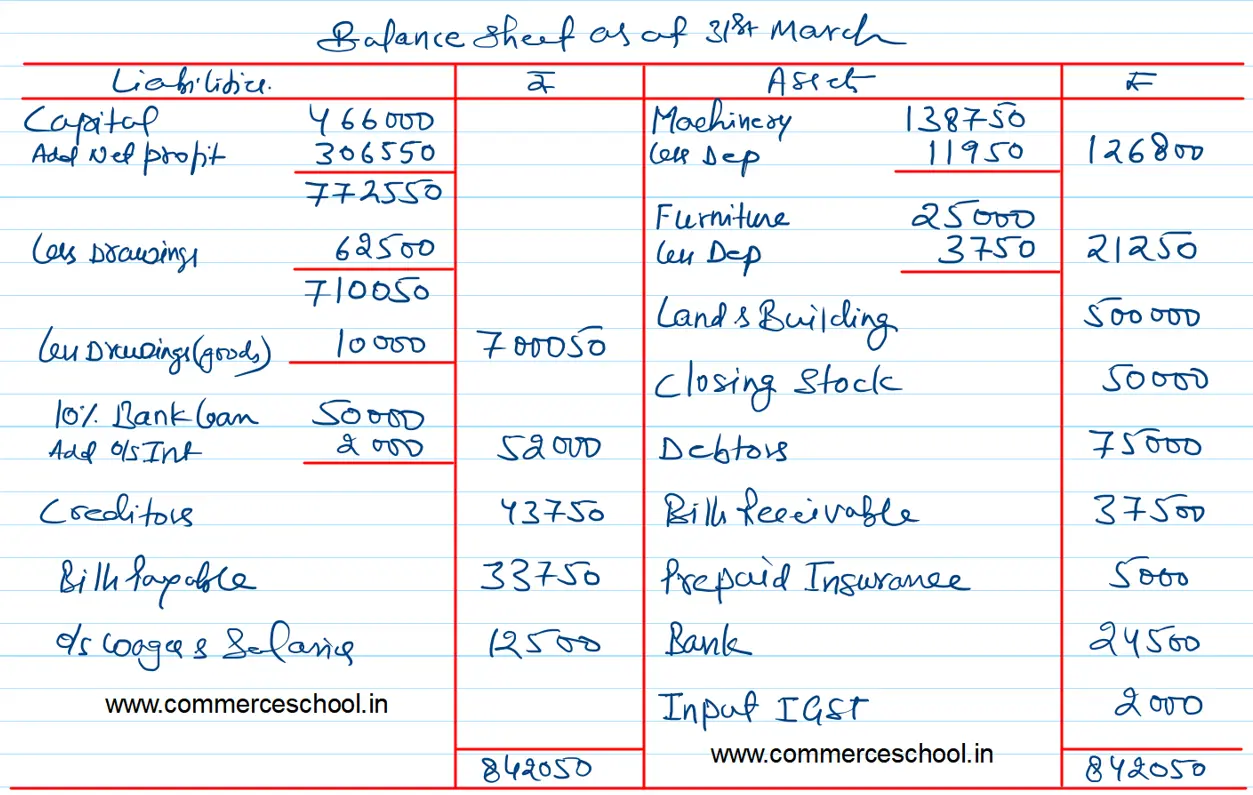

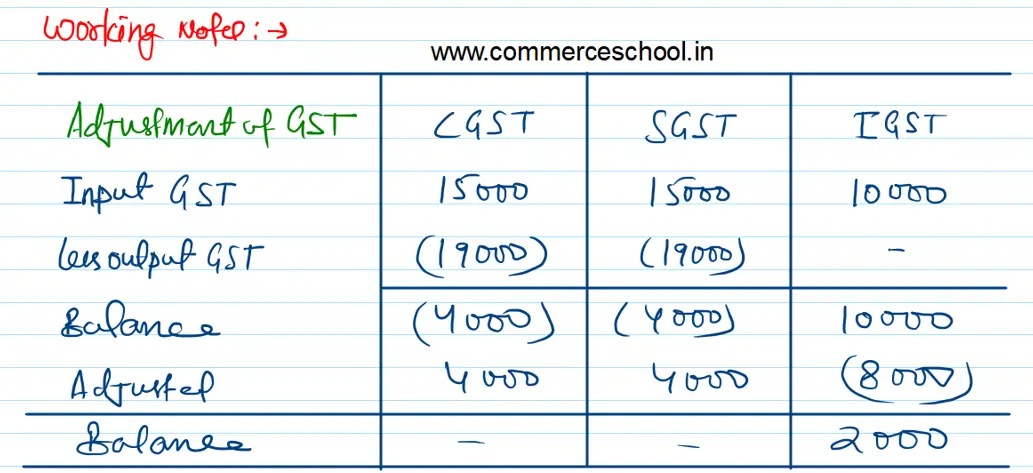

From the following Trial Balance of Gaurav and additional information given, prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date:

From the following Trial Balance of Gaurav and additional information given, prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date:

| Particulars | Dr. | Cr. |

|

Opening Stock Capital Debtors Creditors Purchases Sales Carriage Inwards Wages and Salaries Commission Machinery Furniture Bad Debts Recovered Bills Receivable Bills Payable Land and Building Insurance 10% Bank Loan Interest on Bank Loan Bank Drawings Input CGST Input SGST Input IGST Output CGST Output SGST |

62,500 – 75,000 – 5,00,000 – 10,000 31,250 – 1,38,750 25,000 – 37,500 – 5,00,000 21,250 – 3,000 24,500 62,500 15,000 15,000 10,000 – – |

– 4,66,000 – 43,750 – 8,75,000 – – 16,750 – – 8,000 – 33,750 – – 50,000 – – – – – – 19,000 19,000 |

| Total | 15,31,250 | 15,31,250 |

Adjustments:

(i) Value of the Closing Stock as on 31st March, 2023 is ₹ 50,000.

(ii) Wages and Salaries outstanding are ₹ 12,500 and Insurance prepaid is ₹ 5,000.

(iii) Depreciate Machinery and Furniture @ 10% and 15% p.a. respectively. Machinery included a machine which was purchased for ₹ 38,500 on 30th September, 2023.

(iv) Goods costing ₹ 10,000 were taken by the proprietor for his personal use but no entry has been made in the books of account.