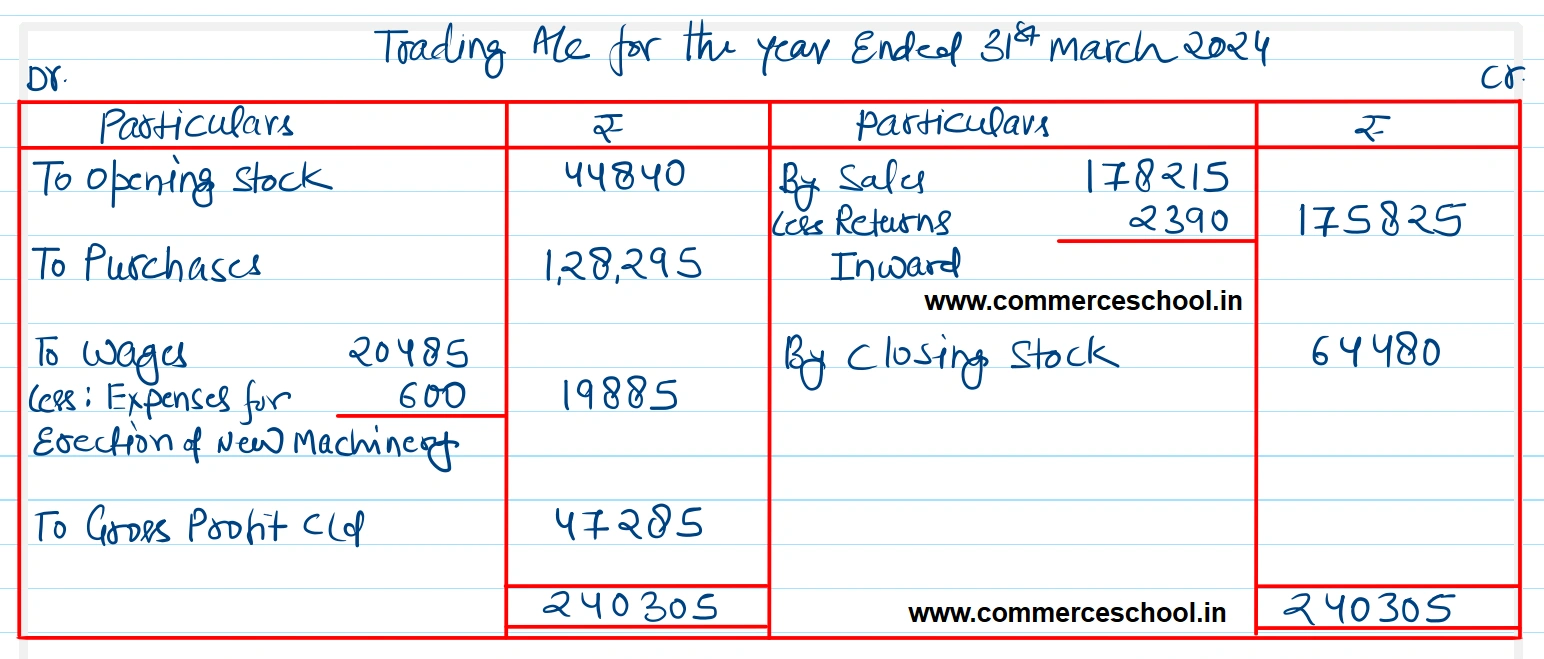

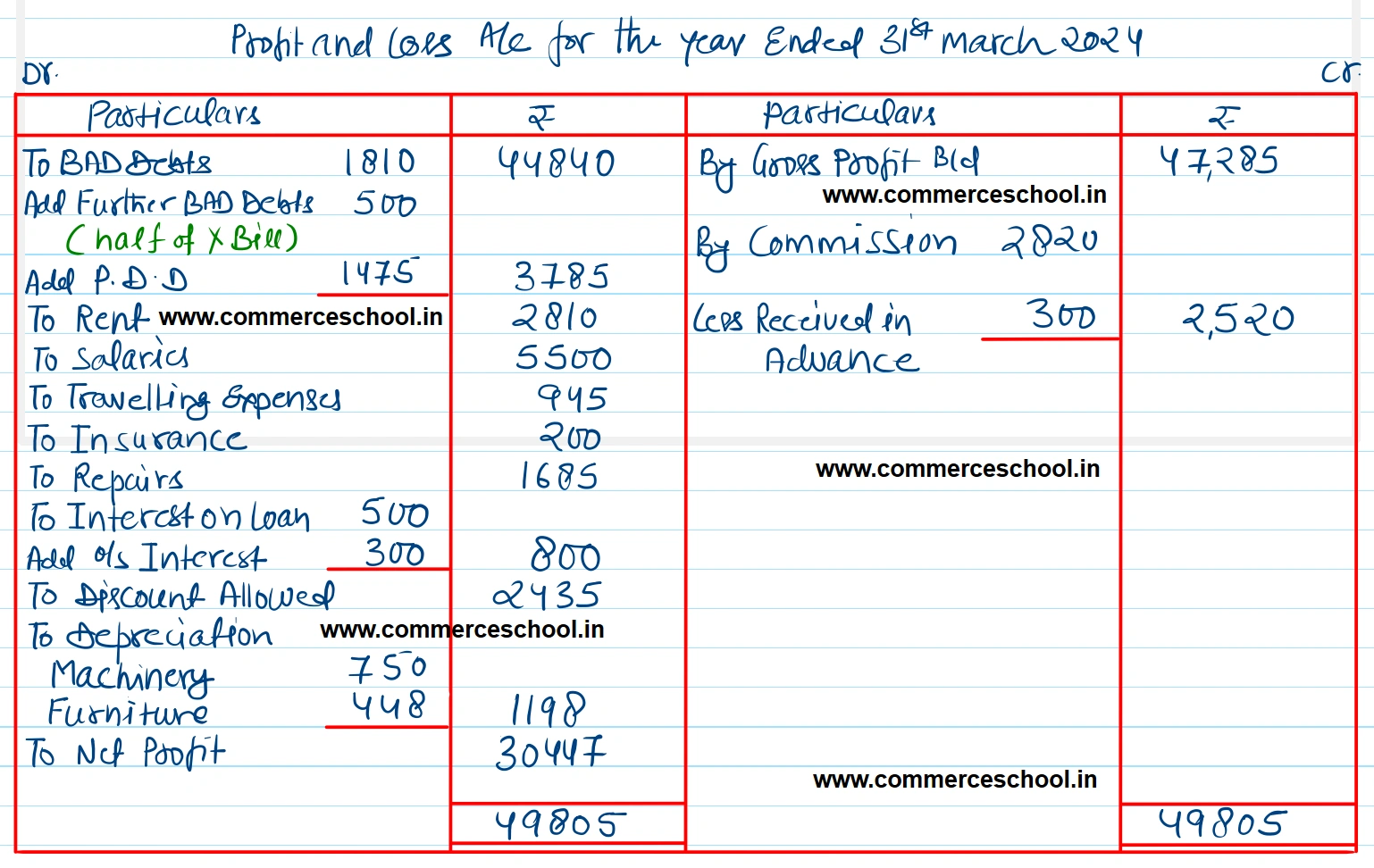

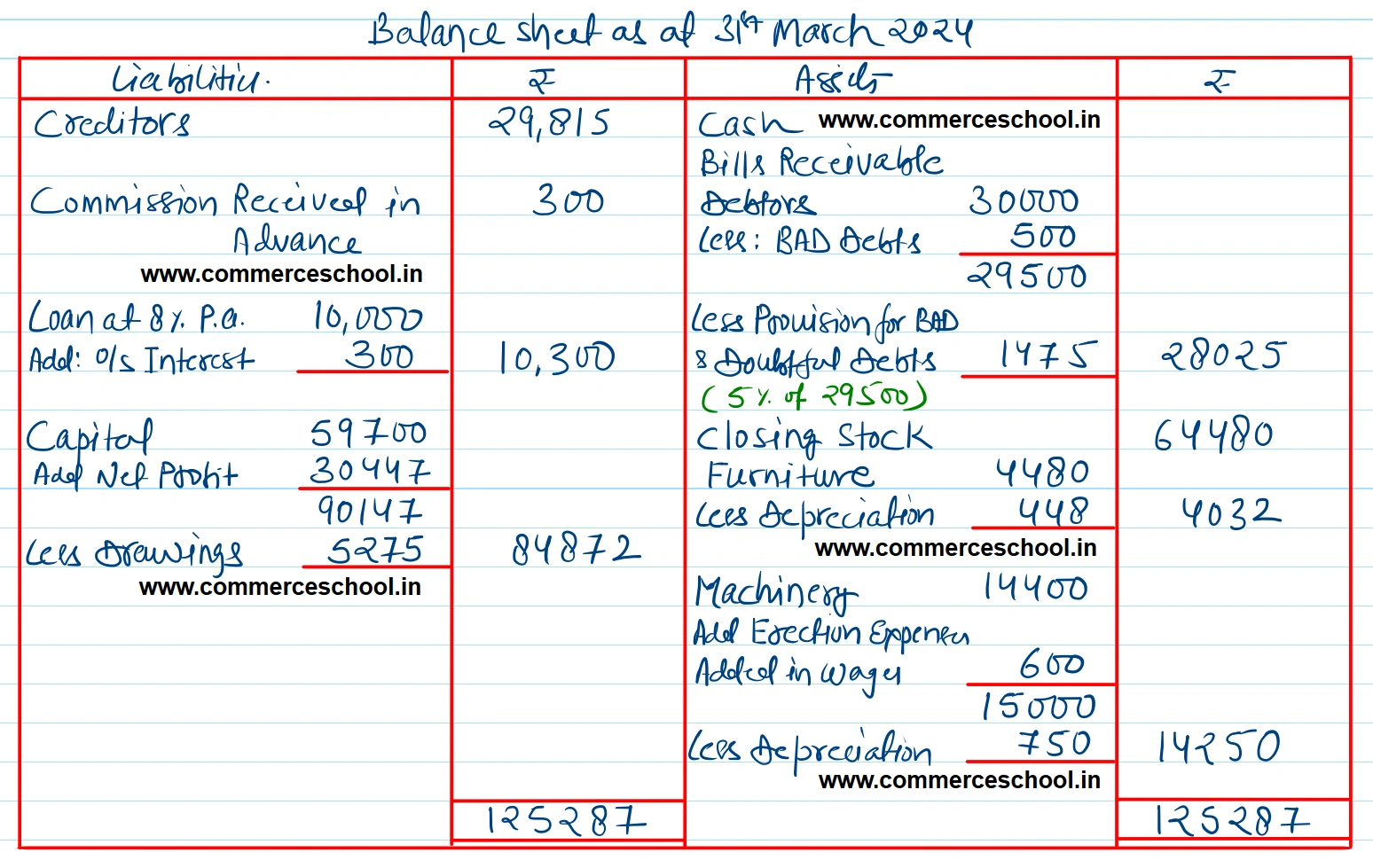

From the following Trial Balance of Mr. Alok, prepare Trading and Profit & Loss Account for the year ending 31st March, 2024, and a Balance Sheet as at that date:

From the following Trial Balance of Mr. Alok, prepare Trading and Profit & Loss Account for the year ending 31st March, 2024, and a Balance Sheet as at that date:

The following adjustments are to be made:

(i) Stock in the shop on 31st March, 2024 was ₹ 64,480.

(ii) Write off ₹ 500 as further bad debts.

(iii) Create a provision of 5% on other debtors.

(iv) Wages include ₹ 600 for erection of new machinery.

(v) Depreciate Machinery by 5% and Furniture by 10%.

(vi) Commission includes ₹ 300 being Commission received in advance.

| Dr. Balances | ₹ | Cr. Balances | ₹ |

| Drawings | 5,275 | Capital | 59,700 |

| Bills Receivable | 4,750 | Loan at 8% p.a. (On 1.4.2023) | 10,000 |

| Machinery | 14,400 | Commission Received | 2,820 |

| Debtors | 30,000 | Creditors | 29,815 |

| Wages | 20,485 | Sales | 1,78,215 |

| Returns Inward | 2,390 | ||

| Purchases | 1,28,295 | ||

| Rent | 2,810 | ||

| Stock (1.4.2023) | 44,840 | ||

| Salaries | 5,500 | ||

| Travelling Expenses | 945 | ||

| Insurance | 200 | ||

| Cash | 9,750 | ||

| Repairs | 1,685 | ||

| Interest on Loan | 500 | ||

| Discount Allowed | 2,435 | ||

| Bad-Debts | 1,810 | ||

| Furniture | 4,480 | ||

| 2,80,550 | 2,80,550 |

Anurag Pathak Answered question