From the following Trial Balance of Shradha as on 31st March, 2023, prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date:

From the following Trial Balance of Shradha as on 31st March, 2023, prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date:

| Heads of Accounts | L.F. | Debit Balances ₹ | Credit Balances ₹ |

|

Capital Drawings Sales Purchases Stock (1st April, 2022) Returns Outward Carriage Inwards Wages Power Machinery Furniture Rent Salary Insurance Bank Loan Debtors Creditors Cash In Hand |

– 18,000 – 82,600 42,000 – 1,200 4,000 6,000 50,000 14,000 22,000 15,000 3,600 – 20,600 – 1,500 |

80,000 – 1,55,000 – – 1,600 – – – – – – – – 25,000 – 18,900 – |

|

| Total | 2,80,500 | 2,80,500 |

Adjustments:

(i) Closing Stock ₹ 64,000.

(ii) Wages Outstanding ₹ 2,400.

(iii) Interest rate of Bank Loan is 8% p.a.

(iv) Bad Debts ₹ 600.

(v) Provision for Doubtful Debts to be 5%.

(vi) Rent is paid for 11 months.

(vii) Insurance premium is paid per annum, ended 31st May, 2023.

(viii) Loan from the Bank was taken on 1st October, 2022.

(ix) Provide depreciation on machinery @ 10% and on Furniture @ 5%.

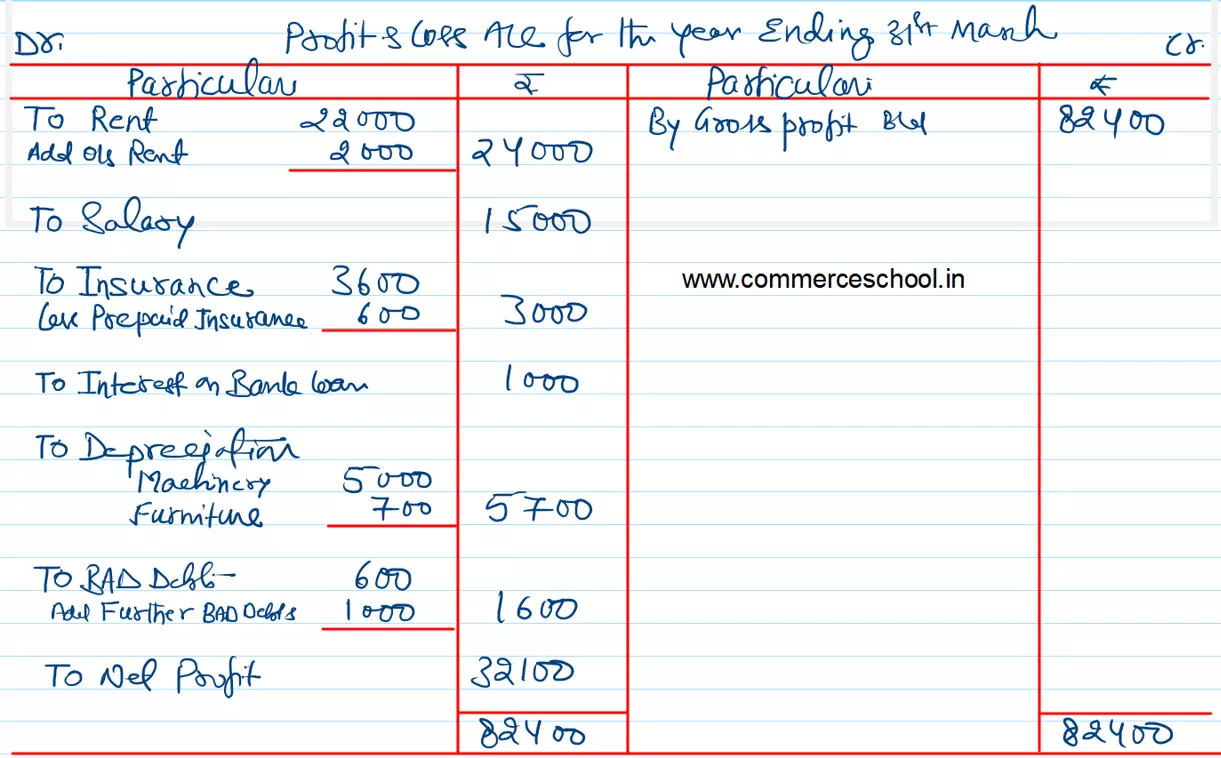

[Gross Profit – ₹ 82,400; Net Profit – ₹ 32,100; Balance Sheet Total – ₹ 1,43,400.]