From the following Trial Balance of Shubho, prepare Trading and Profit & Loss Accounts for the year ended 31st March, 2023 and Balance Sheet as at that date:

From the following Trial Balance of Shubho, prepare Trading and Profit & Loss Accounts for the year ended 31st March, 2023 and Balance Sheet as at that date:

| Heads of Accounts | L.F. | Dr. (₹) | Cr. (₹) |

|

Land and Building Purchases (Adjusted) Stock (31st March, 2023) Wages Salaries Office Expenses Carriage Inwards Carriage Outwards Discount Allowed Discount Received Bad Debts Sales Capital Account Chatterji’s Loan A/c (Taken on 1st Oct., 2022 @ 18% p.a.) Insurance Commission Plant and Machinery Furniture and Fixtures Drawings Sundry Debtors Sundry Creditors Cash at Bank Office Equipments Expenses Payable |

50,000 2,07,500 45,000 45,300 39,000 15,400 1,200 2,000 750 – 1,200 – – – 1,500 – 50,000 20,000 20,000 40,000 – 16,000 12,000 – – |

– – – – – – – – – 1,200 – 3,83,500 1,15,000 25,000 – 1,500 – – – – 37,350 – – 3,300 |

|

| 5,66,850 | 5,66,850 |

The following adjustments be made:

(i) Depreciate Land and Building @ 6%, Plant and Machinery @ 10%, Office equipments @ 2% and Furniture and Fixtures @ 15%.

(ii) Create Provision for Doubtful Debts at 2% on Sundry Debtors.

(iii) Insurance includes ₹ 250 Insurance Premium paid in advance.

(iv) Provide salary to Shubho ₹ 15,000 p.a.

(v) Outstanding Salaries ₹ 11,500.

(vi) 10% of the net profit is to be transferred to General Reserve.

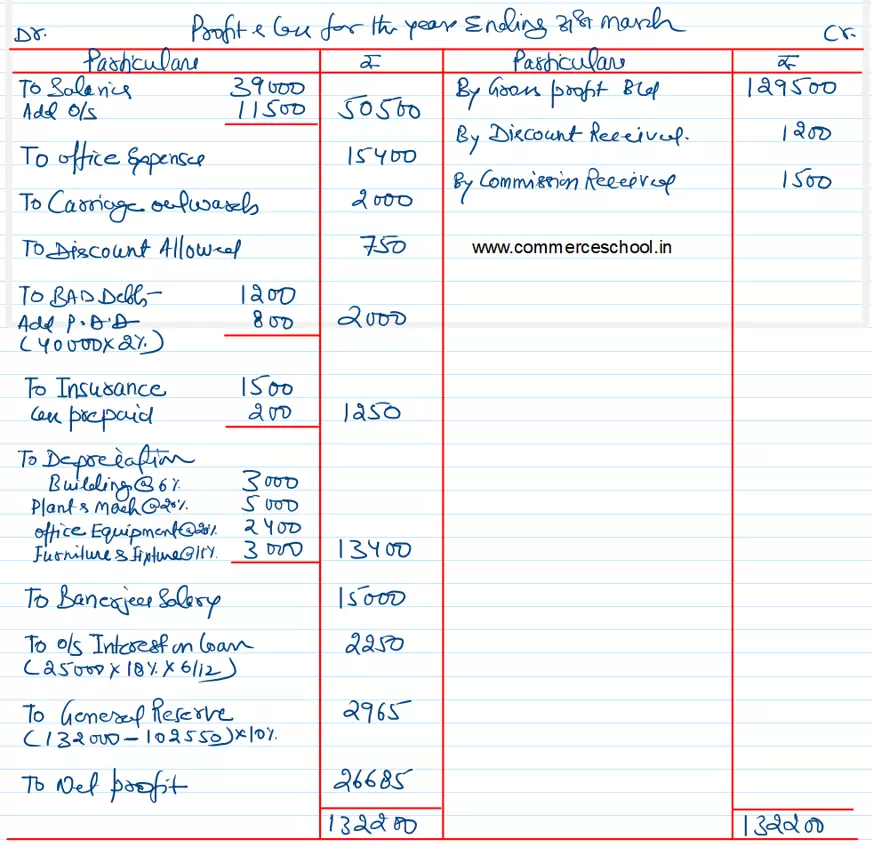

[Gross Profit – ₹ 1,29,500; Net Profit – ₹ 26,685; Balance Sheet Total – ₹ 2,19,050.]

[Hints:]

- Closing stock is given in the Trial Balance. Thus, it will be shown in the Balance Sheet.

- Adjusted Purchases is given. It means Opening Stock, Purchases Return and Closing stock are already adjusted.

- Net Profit, i.e., Profit before transfer to General Reserve is ₹ 29,650. Transfer to General Reserve is 10% of ₹ 29,650, i.e., ₹ 2,965.]