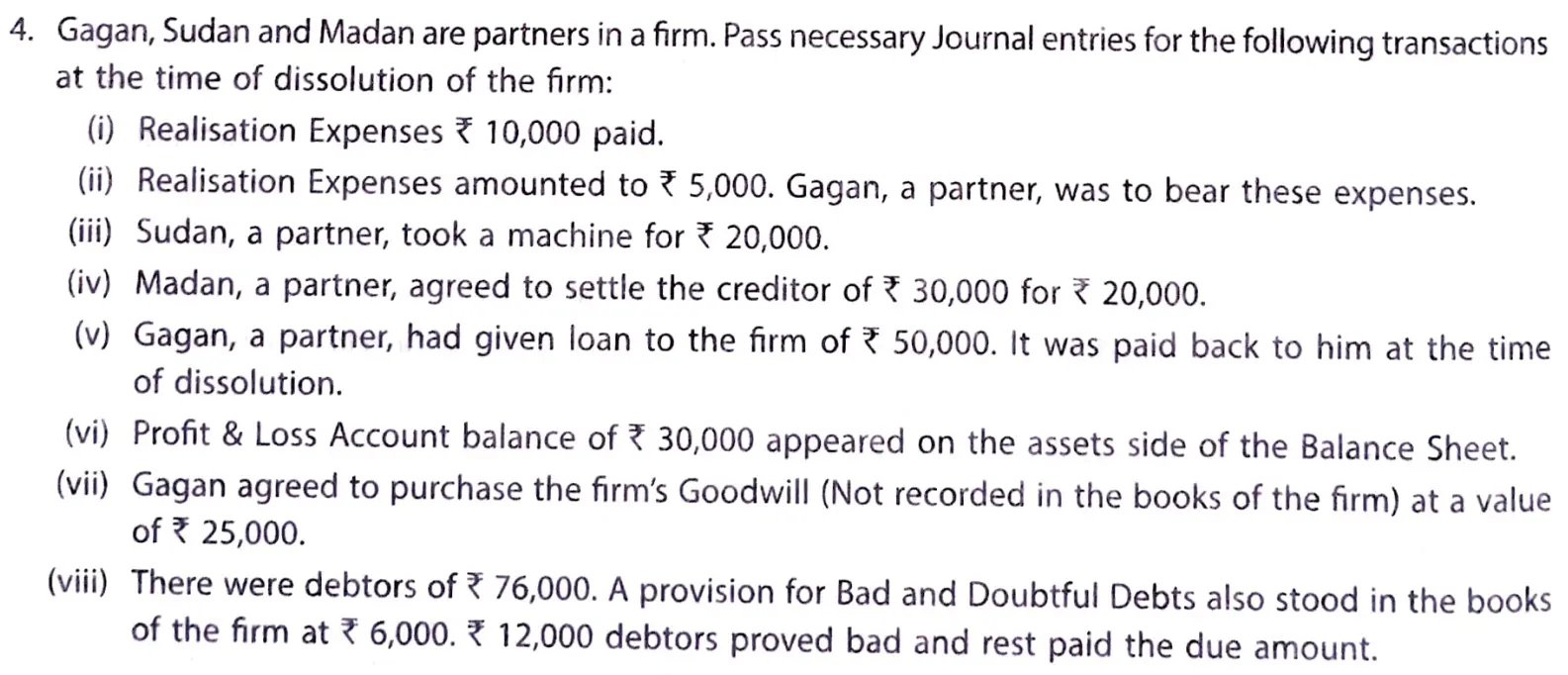

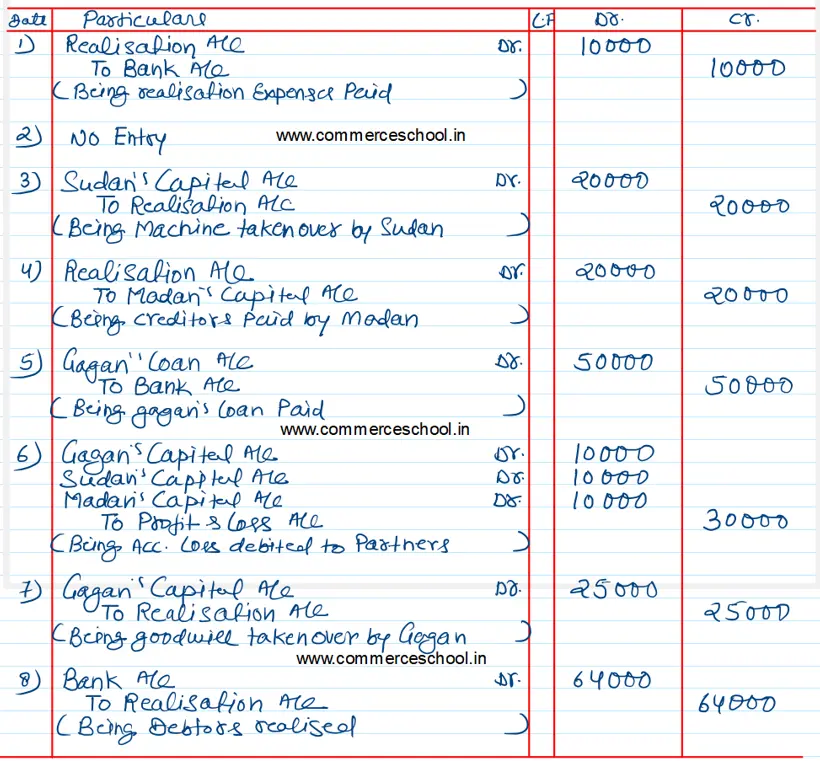

Gagan, Sudan and Madan are partners in a firm. Pass necessary Journal entries for the following transactions at the time of dissolution of the firm:

Gagan, Sudan and Madan are partners in a firm. Pass necessary Journal entries for the following transactions at the time of dissolution of the firm:

(i) Realisation Expenses ₹ 10,000 paid.

(ii) Realisation Expenses amounted to ₹ 5,000. Gagan, a partner, was to bear these expenses.

(iii) Sudan, a partner, took a machine for ₹ 20,000.

(iv) Madan, a partner, agreed to settle the creditor of ₹ 30,000 for ₹ 20,000.

(v) Gagan, a partner, had given loan to the firm of ₹ 50,000. It was paid back to him at the time of dissolution.

(vi) Profit and Loss Account balance of ₹ 30,000 appeared on the assets side of the Balance Sheet.

(vii) Gagan agreed to purchase the firm’s Goodwill (Not recorded in the books of the firm) at a value of ₹ 25,000.

(viii) There were debtors of ₹ 76,000. A provision for Bad and Doubtful Debts also stood in the books of the firm at ₹ 6,000. ₹ 12,000 debtors proved bad and rest paid the due amount.