Gaurav and Dinesh were carrying on business in partnership sharing profits and losses in the ratio of 3 : 2. On 31st March, 2023, their Balance Sheet stood as follows:

Gaurav and Dinesh were carrying on business in partnership sharing profits and losses in the ratio of 3 : 2. On 31st March 2023, their Balance Sheet stood as follows:

| Liabilities | ₹ | Assets | ₹ |

| Gaurav’s Capital

Dinesh’s Capital Bank Loan Sundry Creditors Bills Payable |

30,200 35,400 20,000 20,800 10,000 |

Land and Building

Furniture Stock Sundry Debtors Cash |

40,000 10,600 38,500 19,000 8,300 |

| 1,16,400 | 1,16,400 |

Umesh was admitted to the partnership on the following conditions:

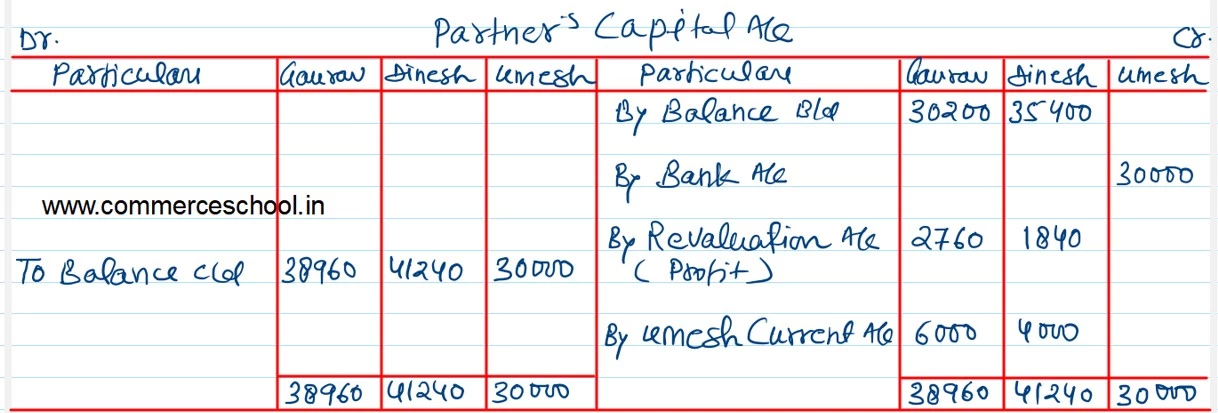

(i) Umesh will get 1/3rd share in profits.

(ii) Umesh would bring ₹ 30,000 as Capital and ₹ 10,000 as Goodwill. However, he is able to bring capital but not his share of Goodwill.

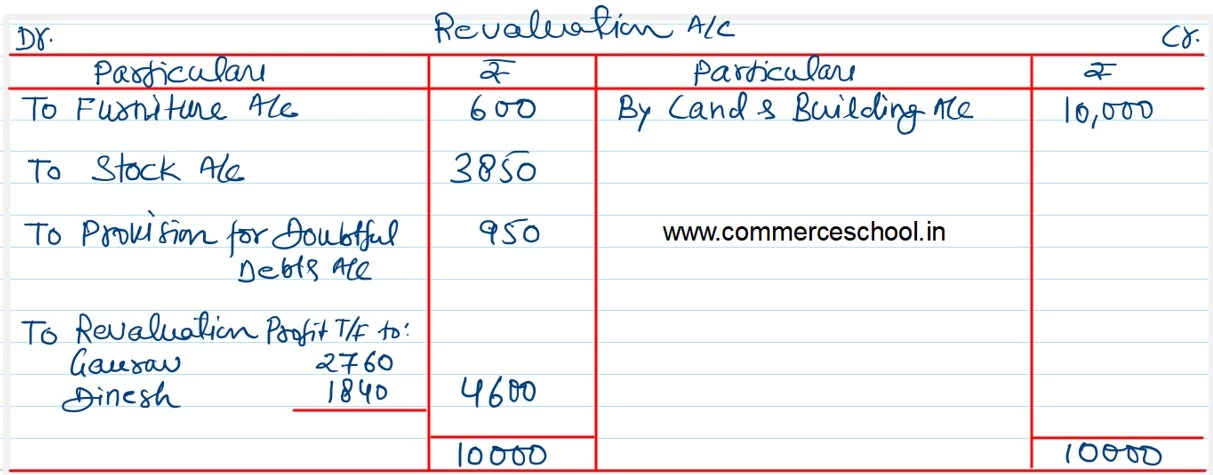

(iii) Value of Land and Building will be increased by ₹ 10,000, that of Furniture will be reduced to ₹ 10,000 and Stock by 10%.

(iv) Provision for Doubtful Debts @ 5% of Sundry Debtors would be created.

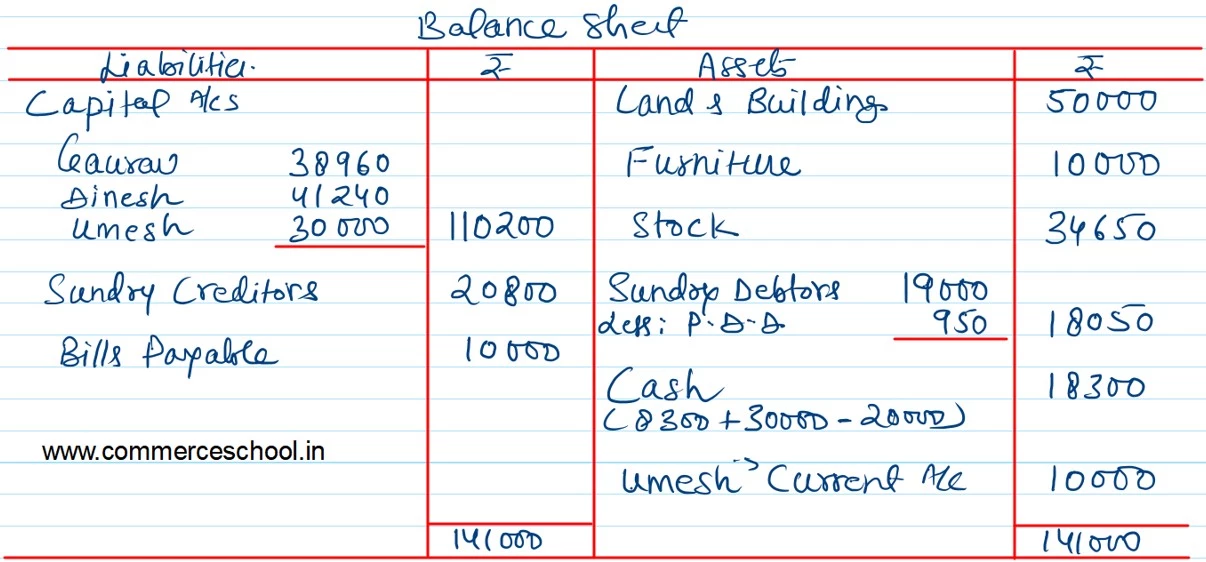

(v) Bank Loan will be paid.

You are required to:

a) Prepare Revaluation Account, Cash Account, and Partner’s Capital Accounts

b) Show Balance Sheet of the new firm.