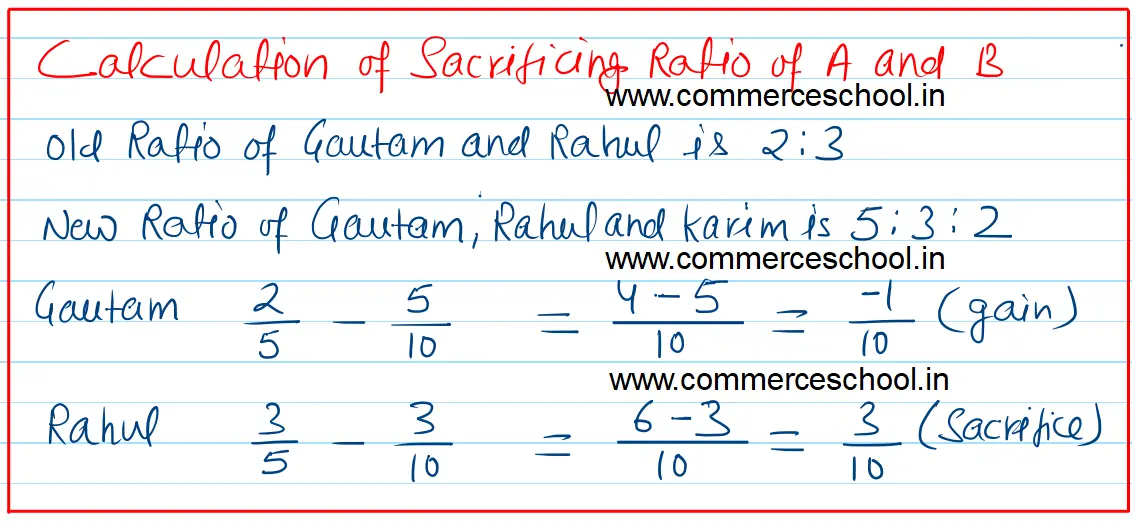

Gautam and Rahul are partners in a firm, sharing profits and losses in the ratio of 2 : 3. Their Balance Sheet as at 31st March, 2023, was as follows:

Gautam and Rahul are partners in a firm, sharing profits and losses in the ratio of 2 : 3. Their Balance Sheet as at 31st March, 2023, was as follows:

Karim was to be taken as a partner with effect from 1st April, 2023, on the following terms:

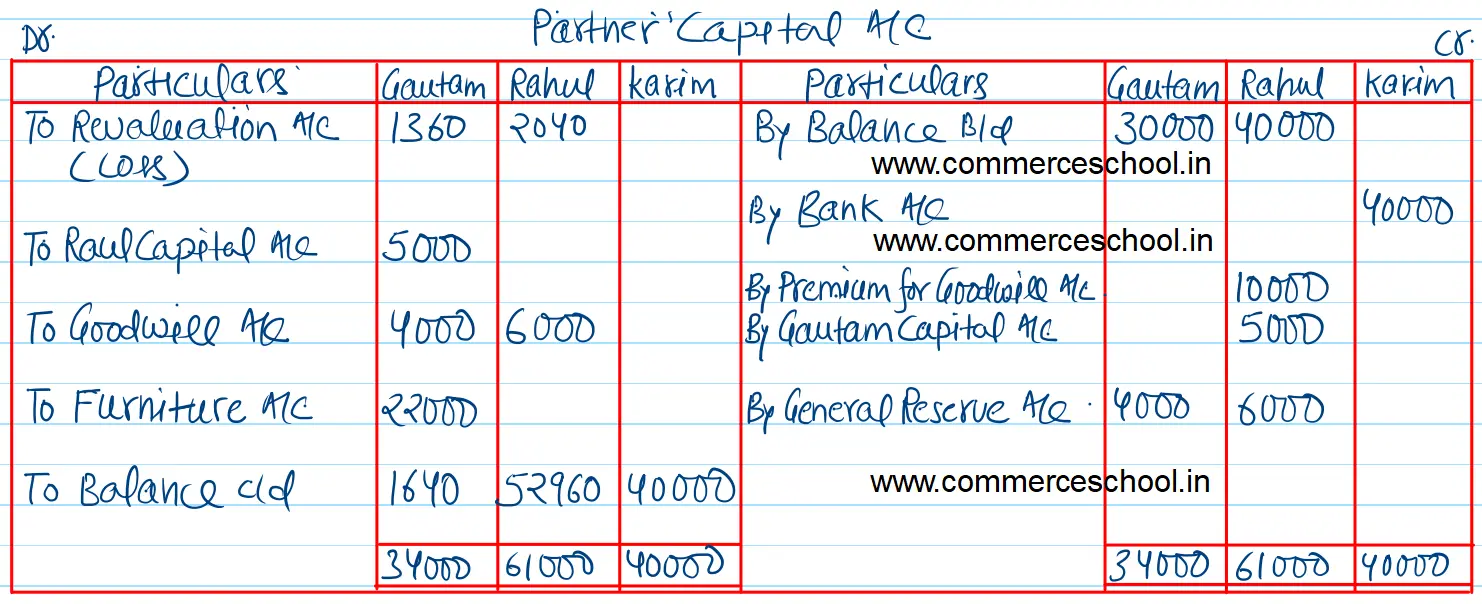

(a) The new profit sharing ratio of Gautam, Rahul and Karim would be 5 : 3 : 2.

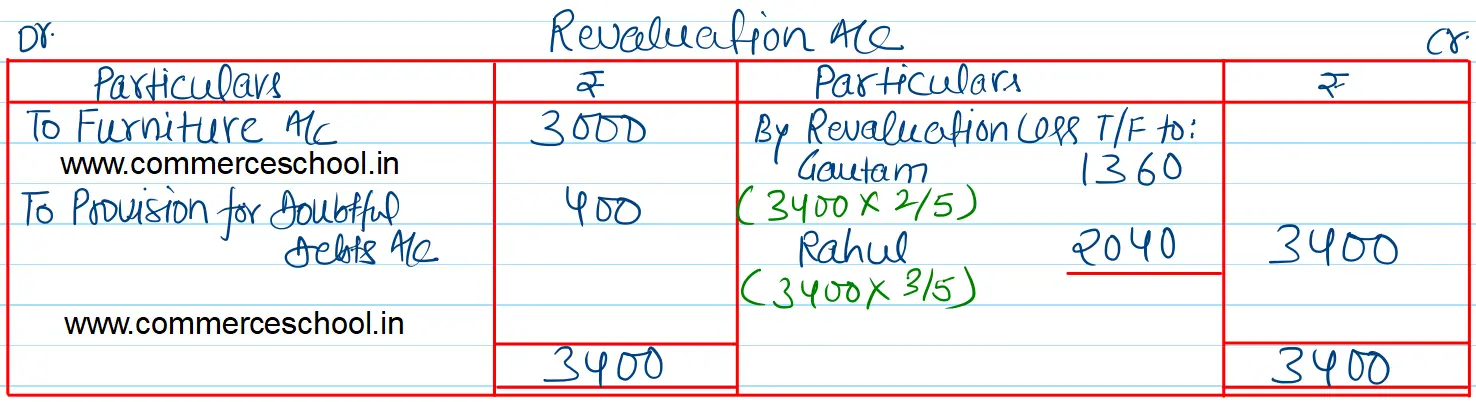

(b) Provision for Doubtful Debts would be raised to 20% of debtors.

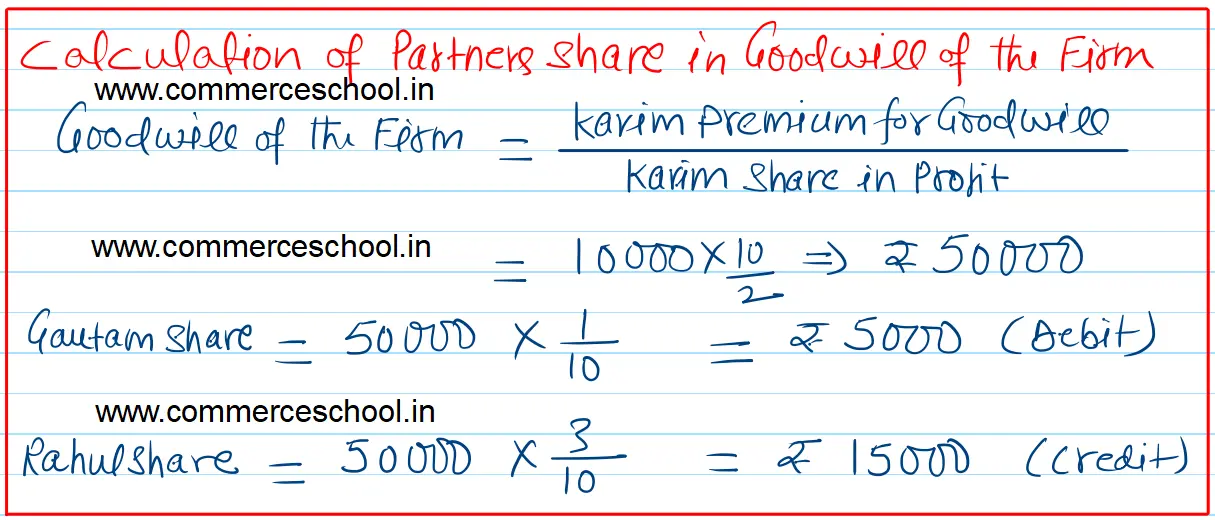

(c) Karim would bring in cash, his share of capital of ₹ 40,000 and his share of goodwill valued at ₹ 10,000.

(d) Gautam would take over the furniture at ₹ 22,000.

You are required to:

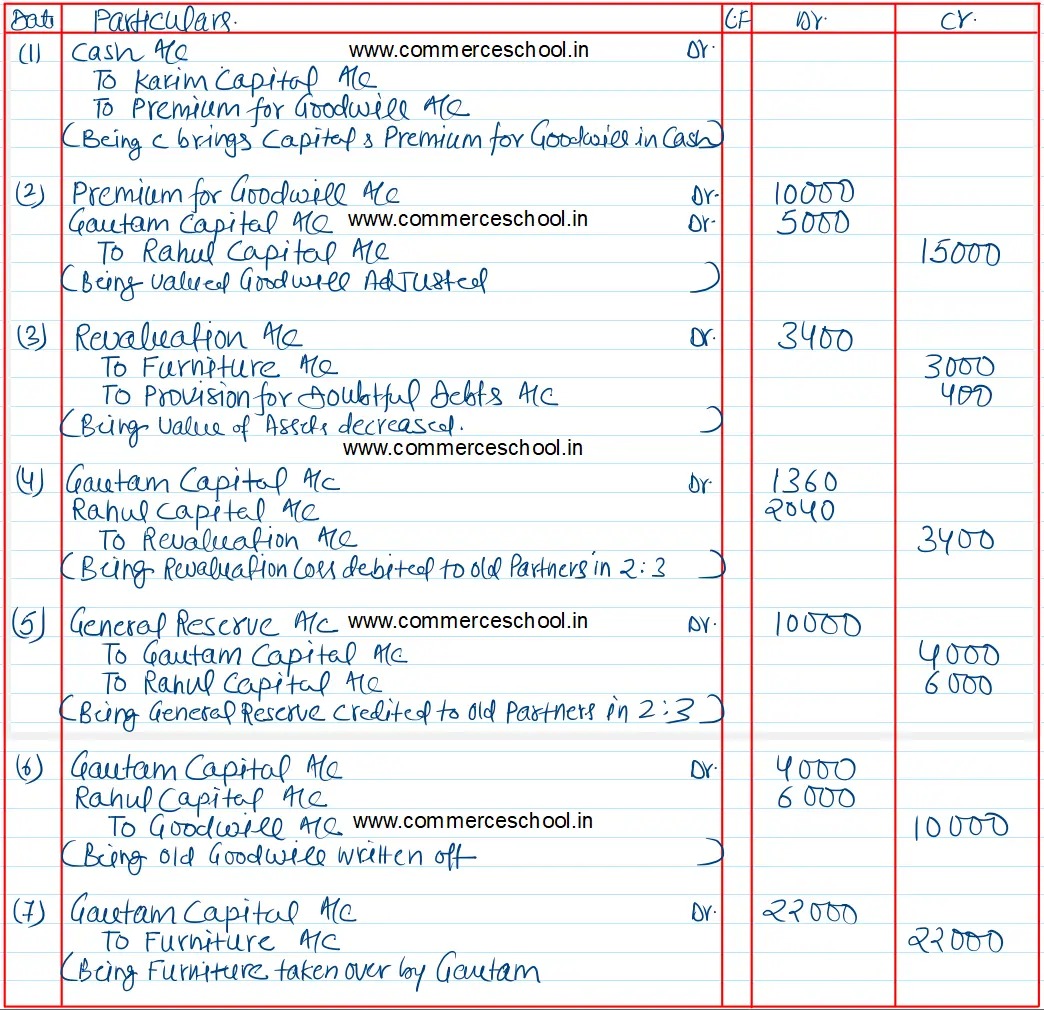

(I) Pass journal entries at the time of Karim’s admission.

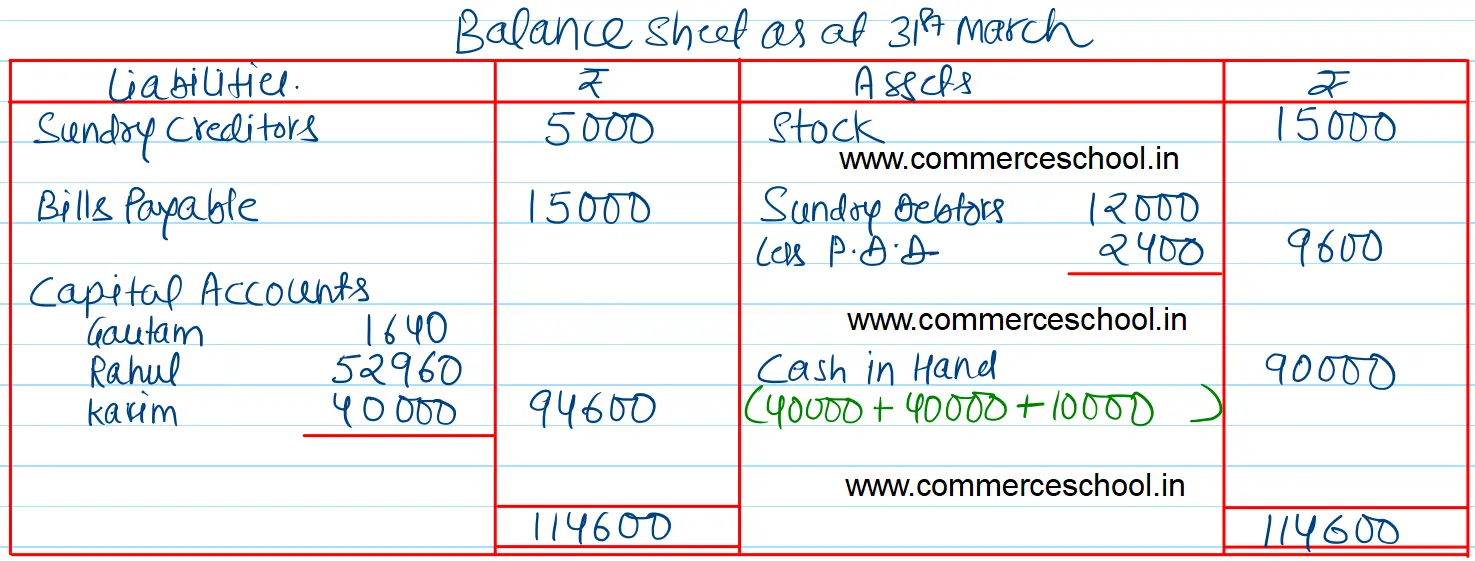

(ii) Prepare the Balance Sheet of the reconstituted firm.

[Ans. Loss on Revaluation ₹ 3,400; Capital A/cs: Gautam ₹ 1,640; Rahul ₹ 52,960 and Karim ₹ 40,000; B/S Total ₹ 1,14,600.]

Balance Sheet as at 31st March, 2023

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 5,000 | Goodwill | 10,000 |

| Bills Payable | 15,000 | Furniture | 25,000 |

| General Reserve | 10,000 | Stock | 15,000 |

| Capital A/cs: Gautam Rahul | 30,000 40,000 | Sundry Debtors 12,000 Less: Provision for Doubtful Debts 2,000 | 10,000 |

| Cash in Hand | 40,000 | ||

| 1,00,000 | 1,00,000 |

Anurag Pathak Answered question