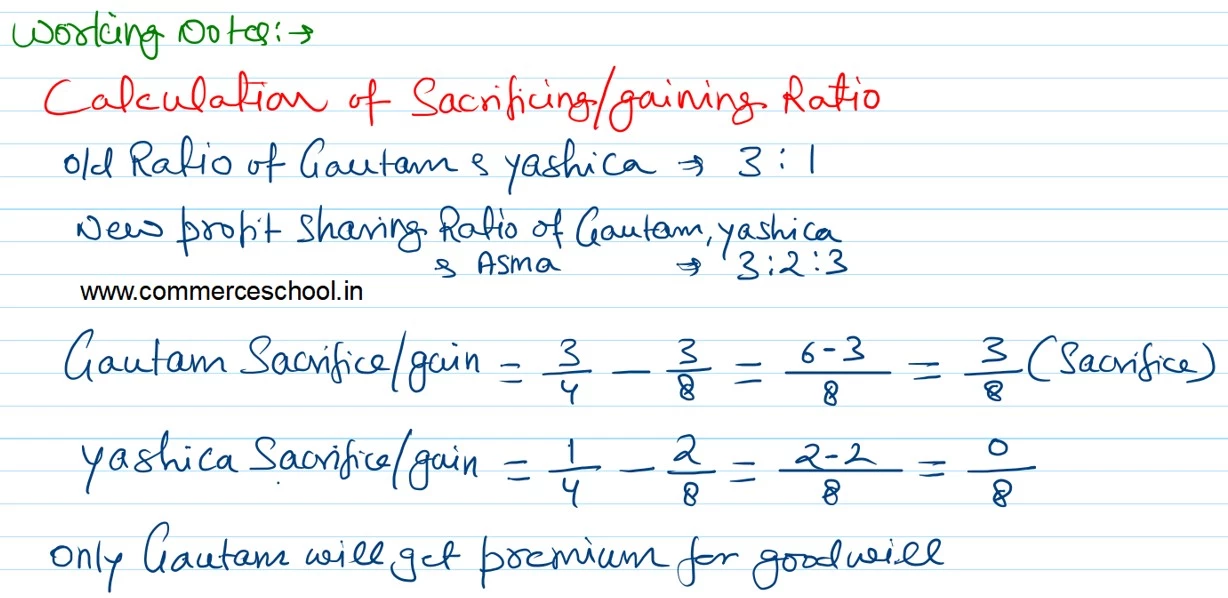

Gautam and Yashica are partners in a firm, sharing profits and losses in 3 : 1 respectively. The Balance Sheet of the firm as on 31st March, 2018 was as follows:

Gautam and Yashica are partners in a firm, sharing profits and losses in 3 : 1 respectively. The Balance Sheet of the firm as on 31st March, 2018 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors

Bills Payable Capitals A/cs: Gautam Yashica |

50,000 30,000 4,00,000 1,00,000 |

Furniture

Stock Debtors Cash in Hand Machinery |

60,000 1,40,000 80,000 90,000 2,10,000 |

| 5,80,000 | 5,80,000 |

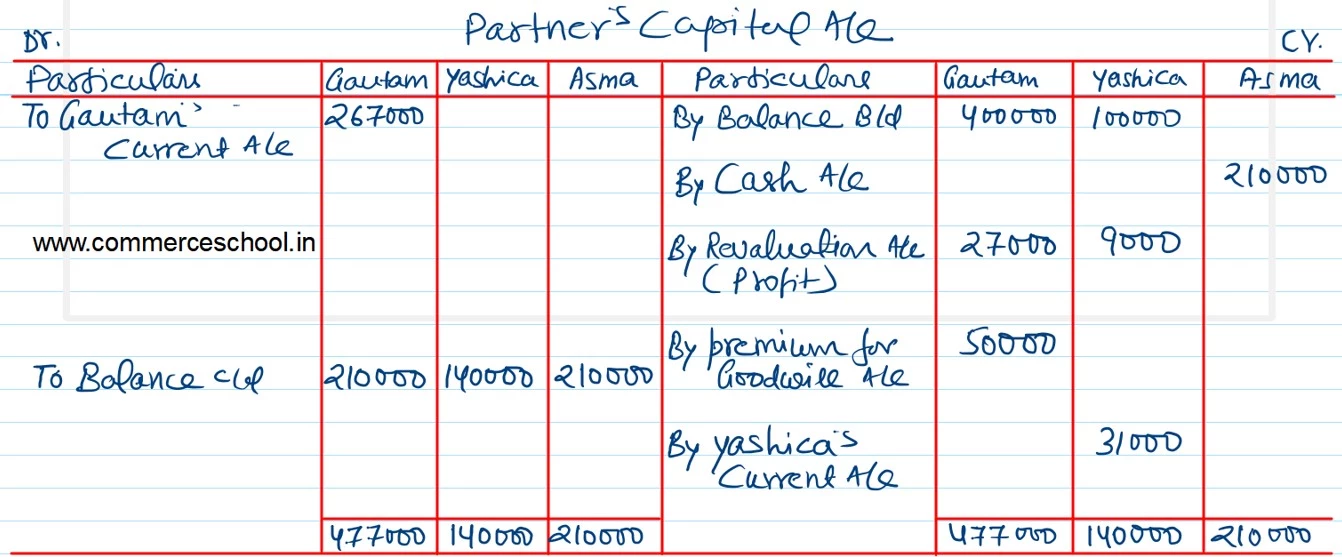

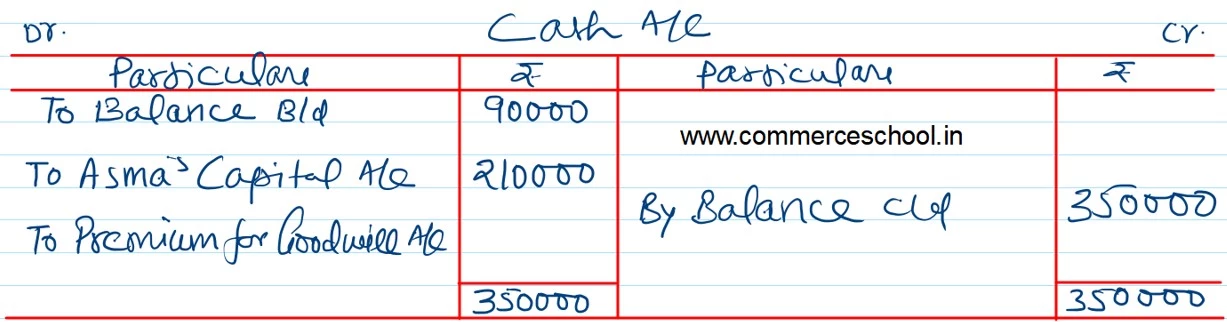

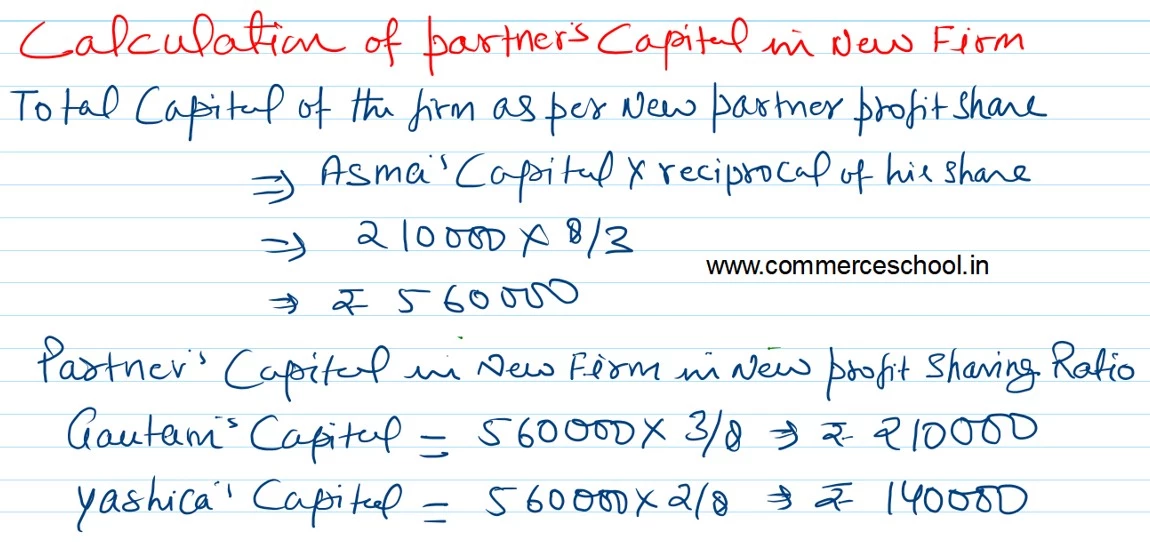

Asma is admitted as a partner for 3/8th share in the profits with a capital of ₹ 2,10,000 and ₹ 50,000 for her share of goodwill. It was decided that:

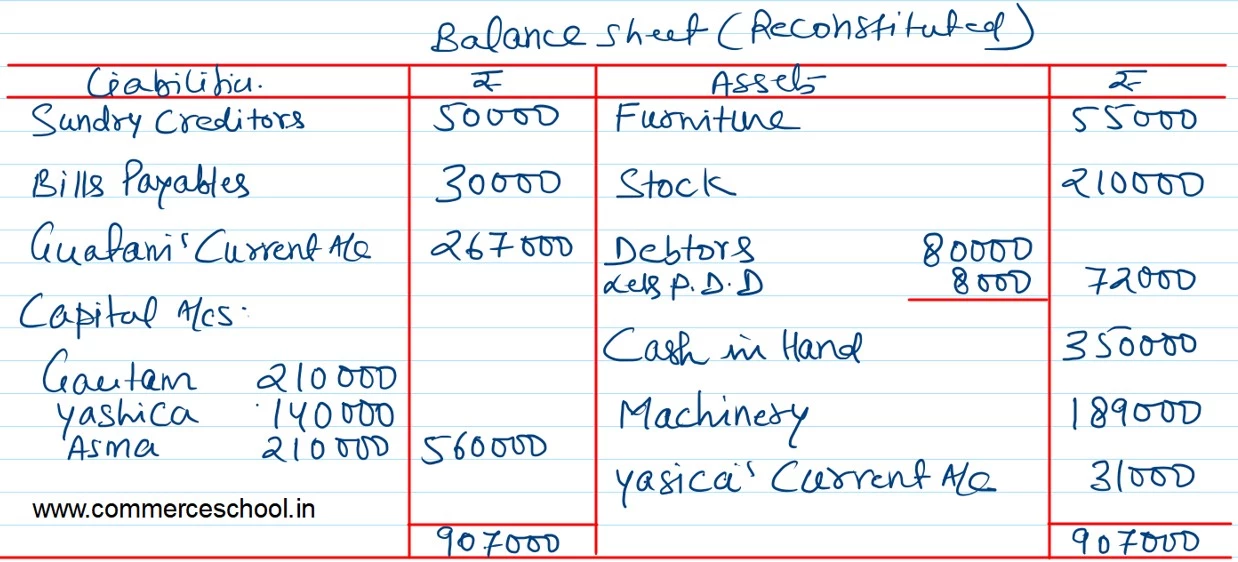

i) New profit sharing ratio will be 3 : 2 : 2.

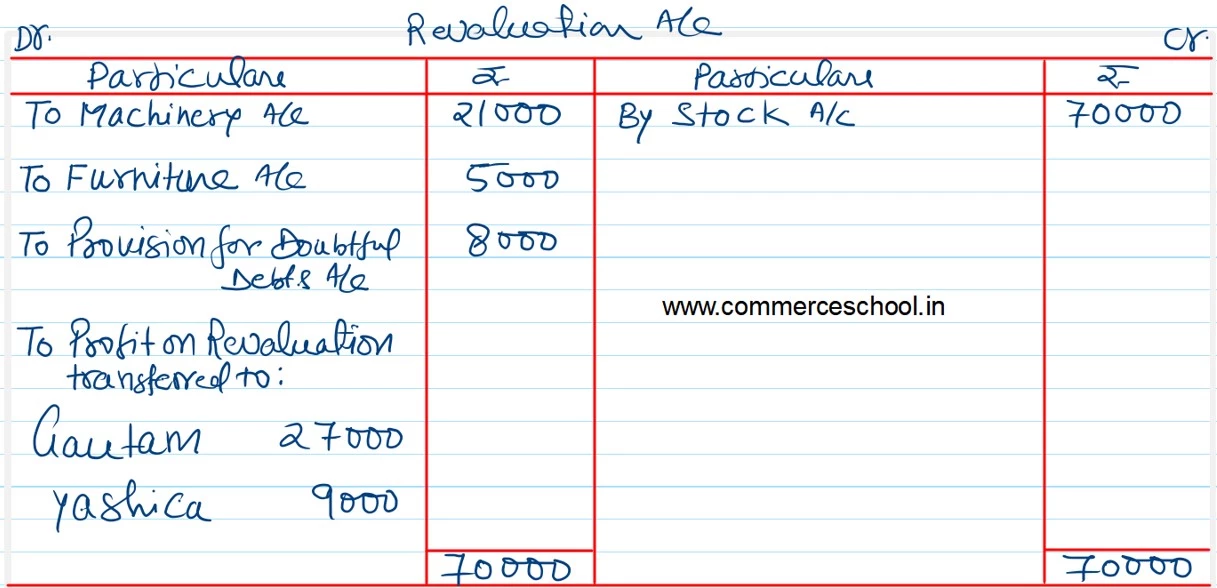

ii) Machinery will be depreciated by 10% and Furniture by ₹ 5,000.

iii) Stock was revalued at ₹ 2,10,000.

iv) Provision for doubtful debts is to be created at 10% of debtors.

v) The capitals of all the partners were to be in the new profit sharing ratio on basis of capital of new partner. Any adjustment to be done through current accounts.

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the new firm.

[Ans: Gain (profit) on Revaluation = ₹ 36,000, partner’s capital accounts: Gautam – ₹ 2,10,000; Yashica – ₹ 1,40,000; Asma – ₹ 2,10,000; Balance Sheet Total – ₹ 9,07,000.]