Gautam and Yashica were partners in a firm sharing profits in the ratio of 7 : 3. Their Balance Sheet as at 31st March, 2023 was as follows:

Gautam and Yashica were partners in a firm sharing profits in the ratio of 7 : 3. Their Balance Sheet as at 31st March, 2023 was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

Bills Payable Workmen Compensation Reserve Parul’s Loan Capital A/cs: Gautam Yashica |

10,000 15,000 10,000 10,000 80,000 |

Cash

Debtors Bills Receivable Stock Building Land Goodwill |

20,000

|

15,500 19,500 50,000 30,000 1,00,000 1,00,000 10,000 |

| 3,25,000 | 3,25,000 |

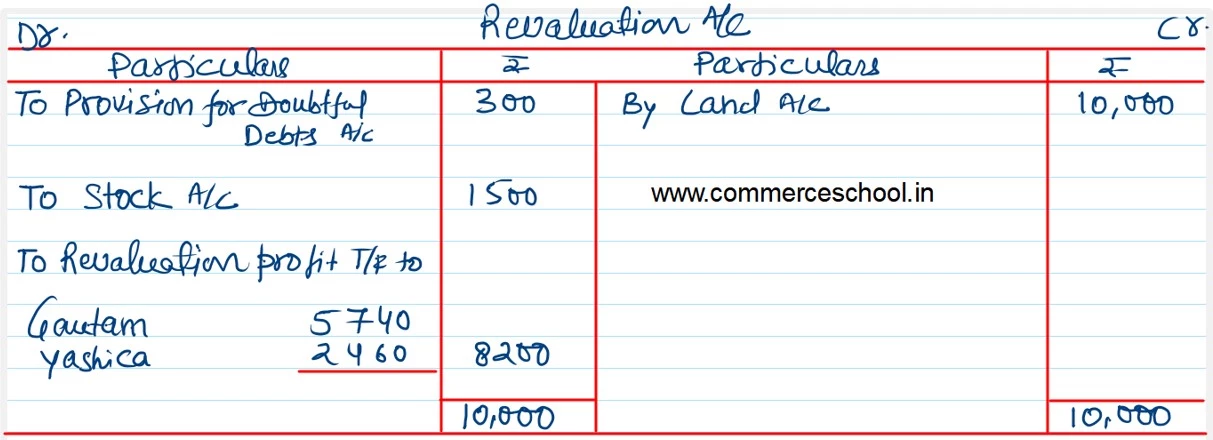

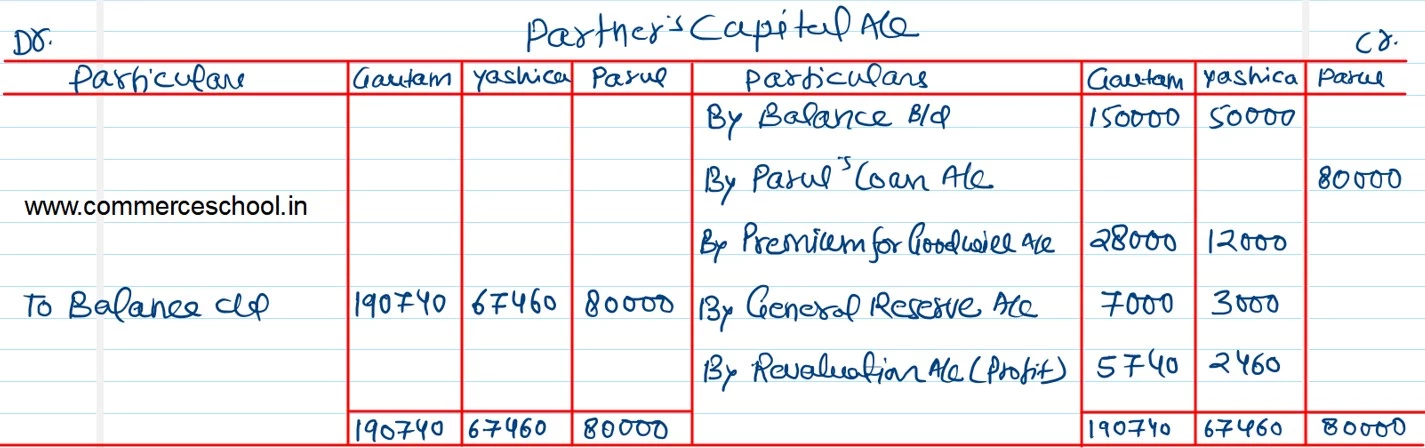

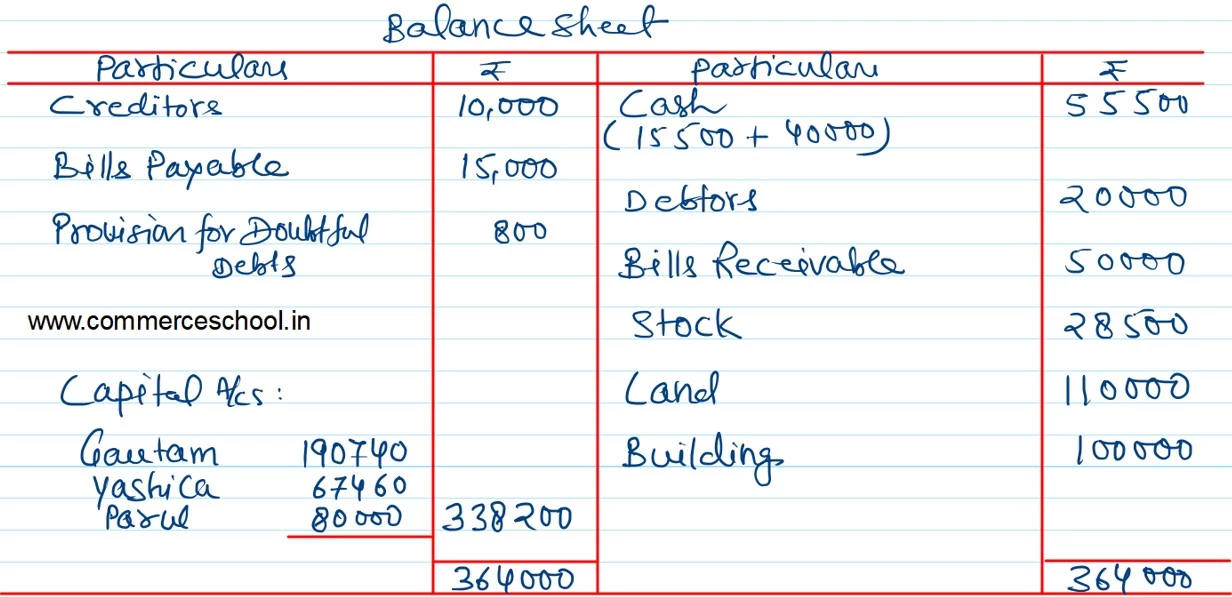

On 1st April, 2023, they admitted Parul as a partner on the following terms:

(i) Parul will get 1/5th share in the profits of the firm.

(ii) Parul’s Loan will be transferred to Capital

(iii) Goodwill of the firm was valued at ₹ 2,00,000 and Parul brought her share of goodwill premium in cash.

(iv) Provision for Doubtful Debts was to be made equal to 4% of Debtors.

(v) Stock was to be reduced by 5%.

(vi) Land was to be appreciated by 10%.

Prepare Revaluation Account, Capital Accounts of Gautam, Yashica and Parul and Balance Sheet of the new firm as at 1st April, 2023.