Give Journal Entries for the following adjustments in final accounts: Extract of Trial Balance as on 31st March, 2023

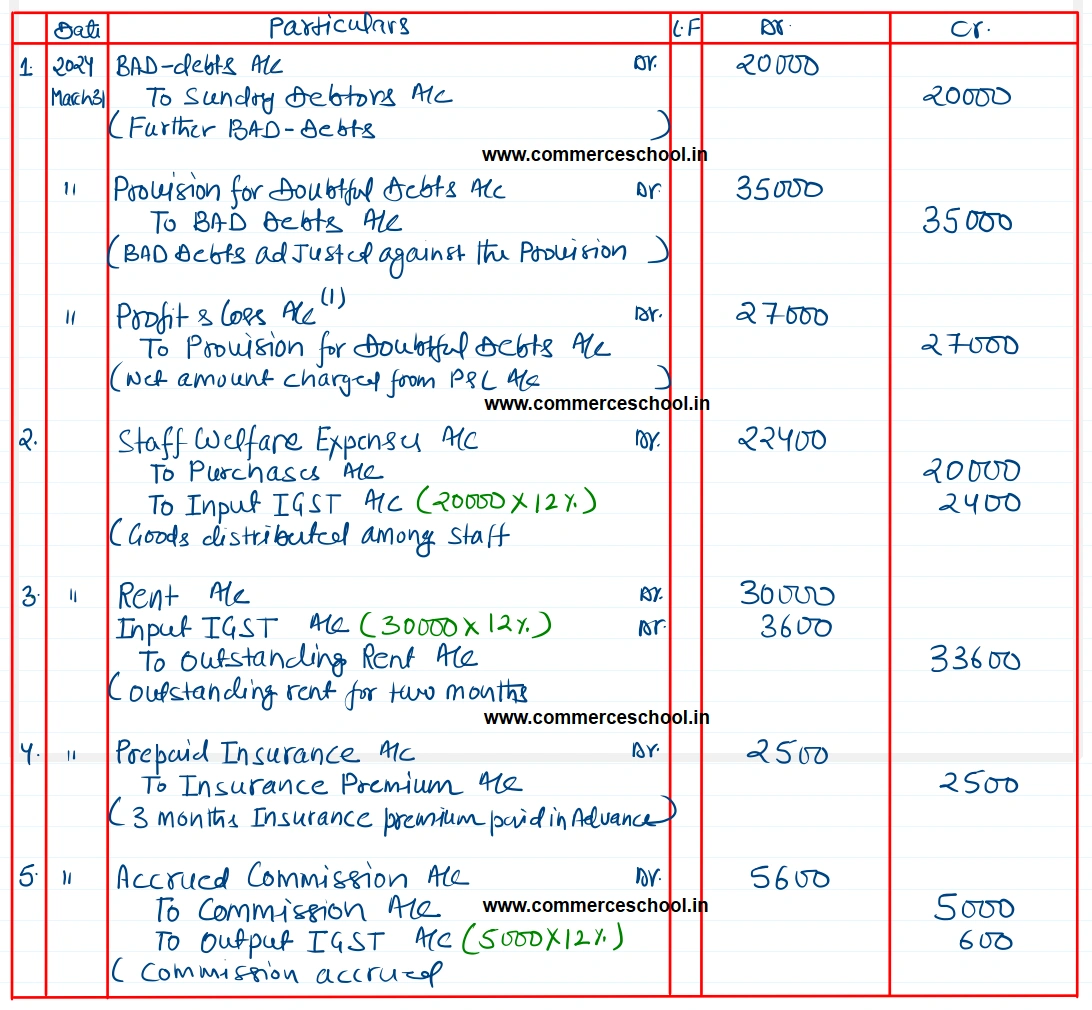

Give Journal Entries for the following adjustments in final accounts:

1. Extract of Trial Balance as on 31st March, 2023

Additional Information:

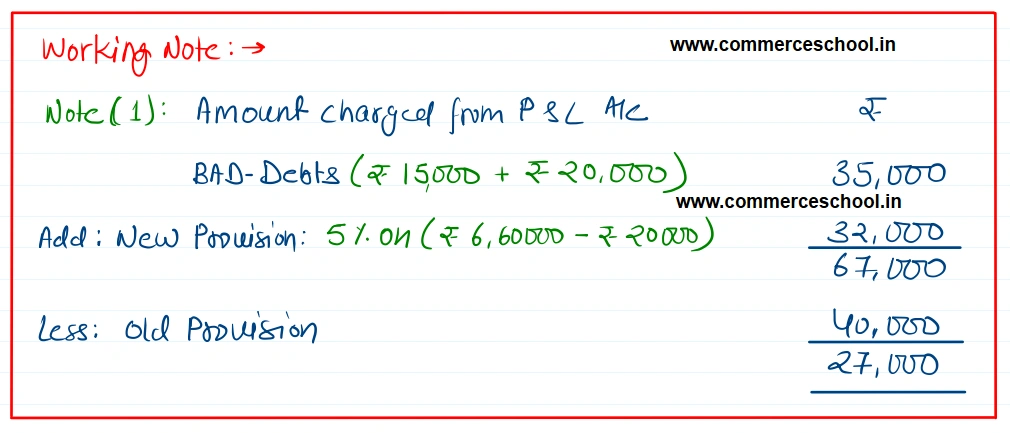

(a) Additional Bad Debts ₹ 20,000.

(b) Maintain the provision for doubtful debts @ 5% on debtors.

2. Goods costing ₹ 20,000 were distributed among staff members as free of cost. These goods were purchased paying IGST @ 12%.

3. Two month’s rent @ ₹ 15,000 per month is outstanding. Rent is subject to levy of 12% IGST.

4. Included in general expenses is annual Insurance Premium of ₹ 10,000 paid for the year ending 30th June, 2023. IGST is levied @ 12%.

5. Accrued commission ₹ 5,000. IGST is levied @ 12%.

| Particulars | Debit (₹) | Credit (₹) |

| Sundry Debtors | 6,60,000 | |

| Bad-debts | 15,000 | |

| Provision for doubtful debts | 40,000 |

Anurag Pathak Answered question