Given below is the Balance Sheet of A and B on 31st March, 2023, who are carrying on partnership business. A and B share profits and losses in the ratio of 2 : 1.

Given below is the Balance Sheet of A and B on 31st March, 2023, who are carrying on partnership business. A and B share profits and losses in the ratio of 2 : 1.

| Liabilities | ₹ | Assets | ₹ |

| Bills Payable

Creditors Outstanding Expenses Capital A/cs: A B |

10,000 58,000 2,000 1,80,000 1,50,000 |

Cash in Hand

Cash at Bank Sundry Debtors Stock Plant Building |

10,000 40,000 60,000 40,000 1,00,000 1,50,000 |

| 4,00,000 | 4,00,000 |

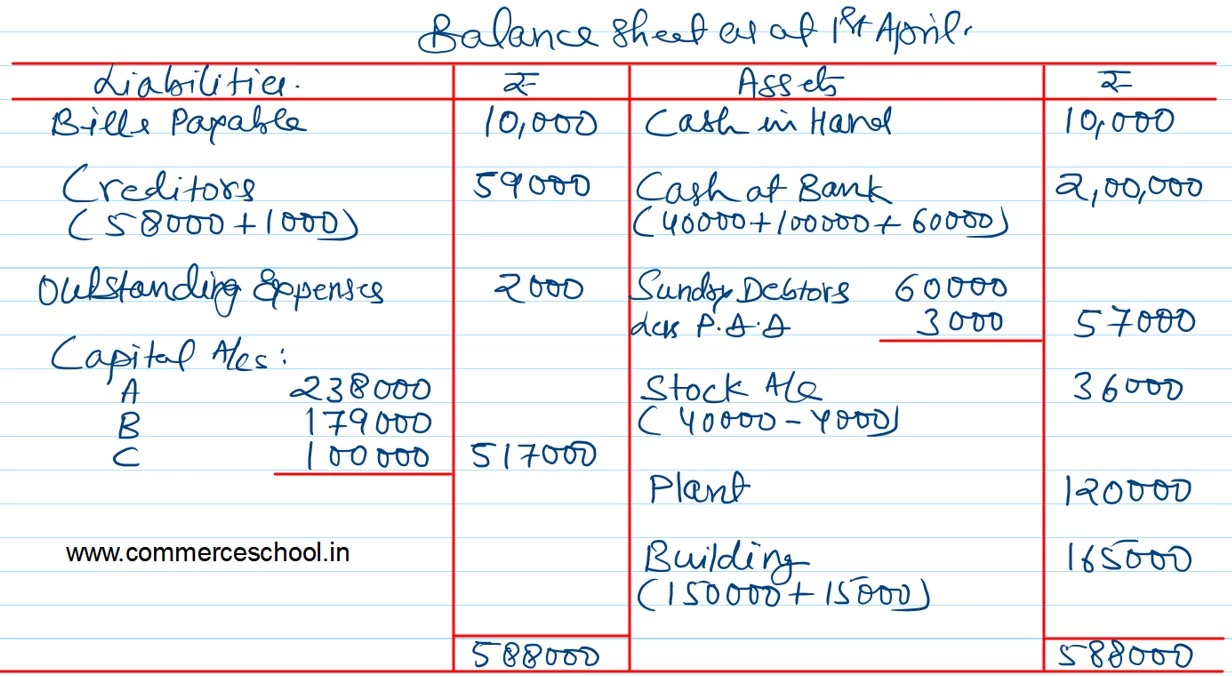

C is admitted as a partner on 1st April, 2023 on the following terms:

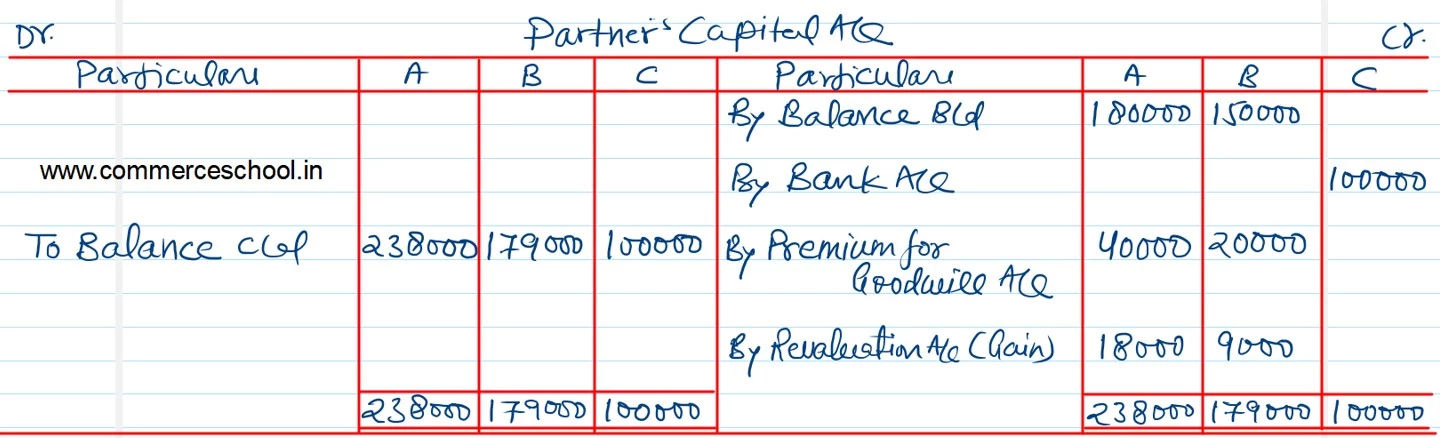

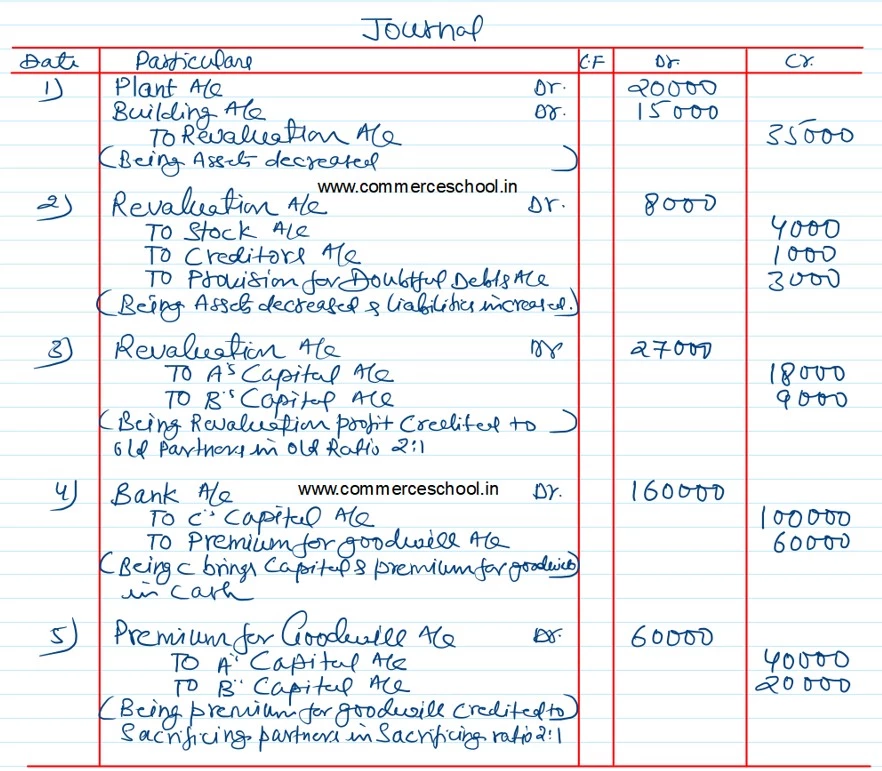

a) C will being ₹ 1,00,000 as his capital and ₹ 60,000 as his share of goodwill for 1/4th share in the profits.

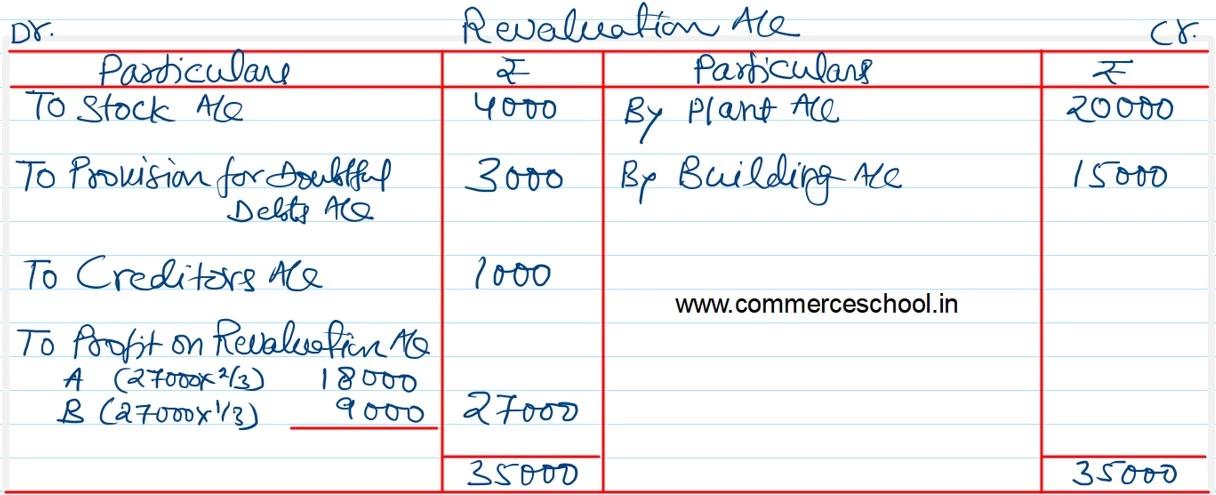

b) Plant is to be appreciated to ₹ 1,20,000 and the value of building is to be appreciated by 10%.

c) Stock is found overvalued by ₹ 4,000.

d) A provision for doubtful debts is to be created at 5% of sundry debtors.

e) Creditors were unrecorded to the extent of ₹ 1,000.

Pass the necessary Journal entries, prepare the Revaluation Account and Partner’s Capital Accounts and show the Balance Sheet after the admission of C.