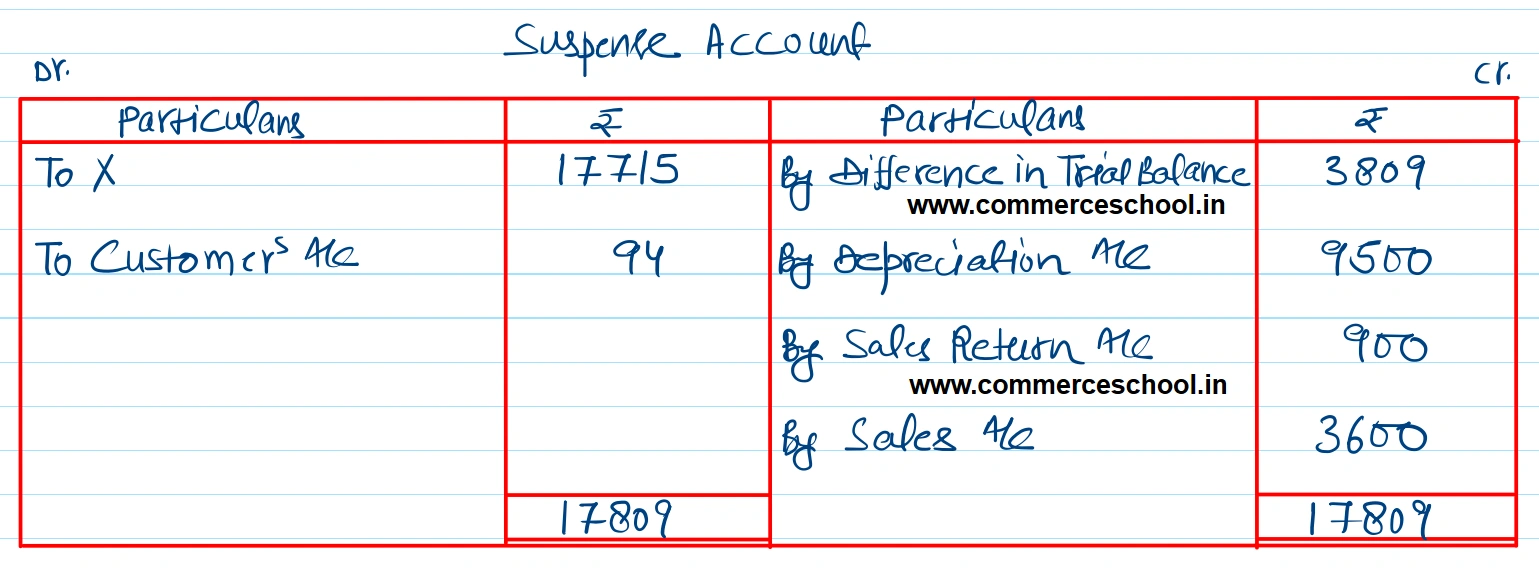

In taking out the Trial Balance, book-keeper finds that he is out ₹ 3,809 excess debit. Being desirous of closing his books he places the difference to a newly opened Suspense A/c which is carried forward. In the next period he discovered that

In taking out the Trial Balance, book-keeper finds that he is out ₹ 3,809 excess debit. Being desirous of closing his books he places the difference to a newly opened Suspense A/c which is carried forward. In the next period he discovered that:-

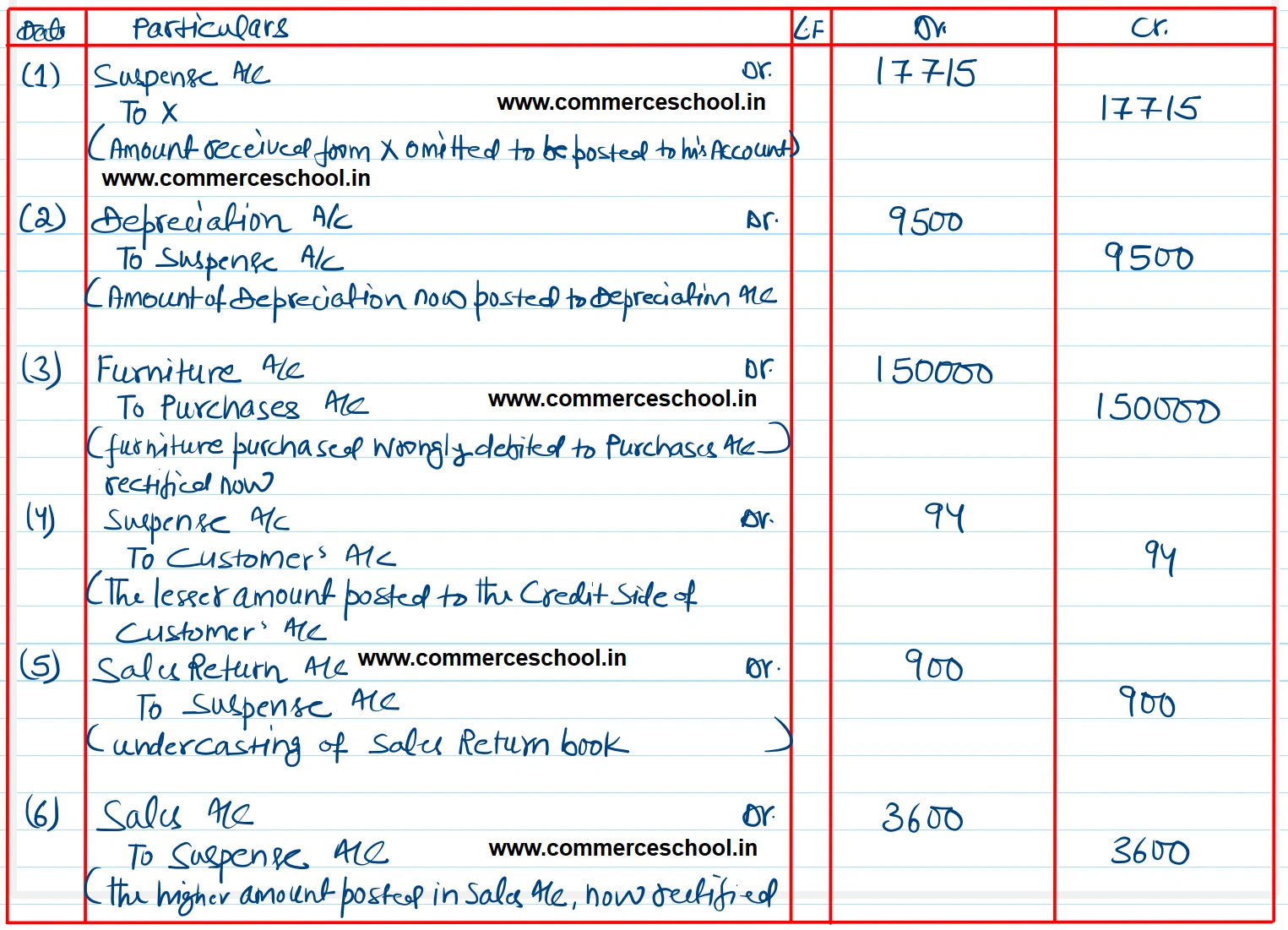

(1) ₹ 17,715 received from X has not been posted to his account.

(2) A sum of ₹ 9,500 written off as depreciation on fixtures has not been posted to the Depreciation A/c.

(3) ₹ 1,50,000 paid for furniture purchased has been charged to Ordinary Purchases A/c.

(4) A discount of ₹ 3,742 allowed to a customer has been credited to him as ₹ 3,648.

(5) The total of the Inwards return has been added ₹ 900 short.

(6) An item of Sale for ₹ 5,900 was posted as ₹ 9,500 in the Sales Account

Give the rectifying entries and prepare the Suspense Account.

[Ans. Total of Suspense A/c ₹ 17,809.]