Jannat and Mannat are partners in a firm. They share profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 was as under:

Jannat and Mannat are partners in a firm. They share profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 was as under:

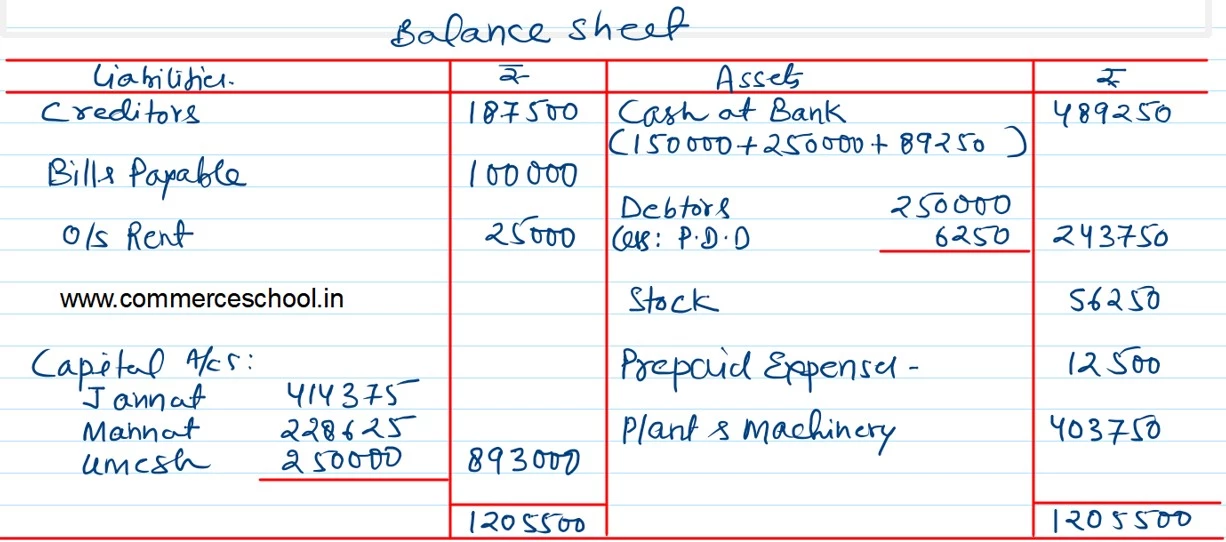

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

Bills Payable Outstanding Rent Contingency Reserve Capital A/cs: Jannat Mannat |

1,87,500 1,00,000 25,000 15,000 3,75,000 1,87,500 |

Cash at Bank

Debtors Stock Prepaid Expenses Plant and Machinery Advertisement Expenditure |

2,50,000

|

1,50,000 2,25,000 62,500 12,500 4,25,000 15,000 |

| 8,90,000 | 8,90,000 |

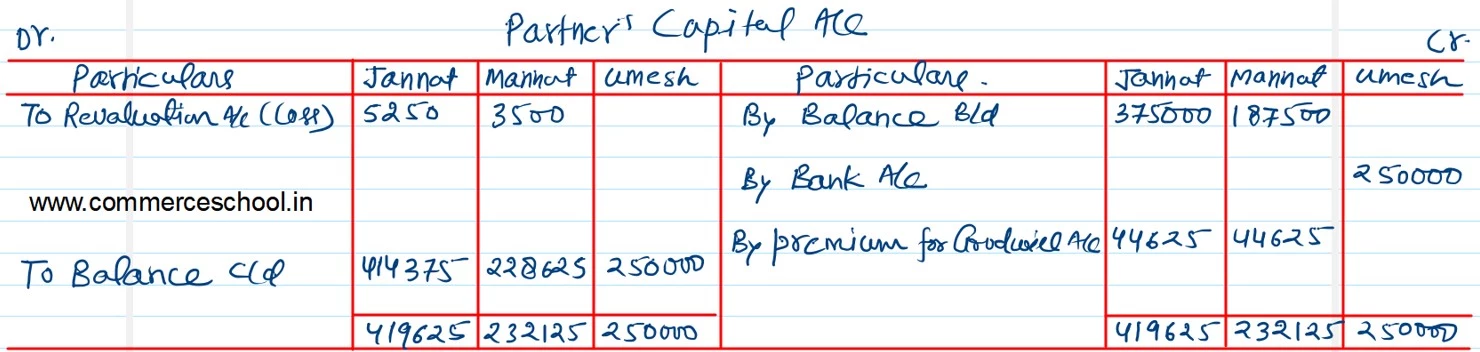

They admitted Umesh as a partner on 1st April, 2023 on the following terms:

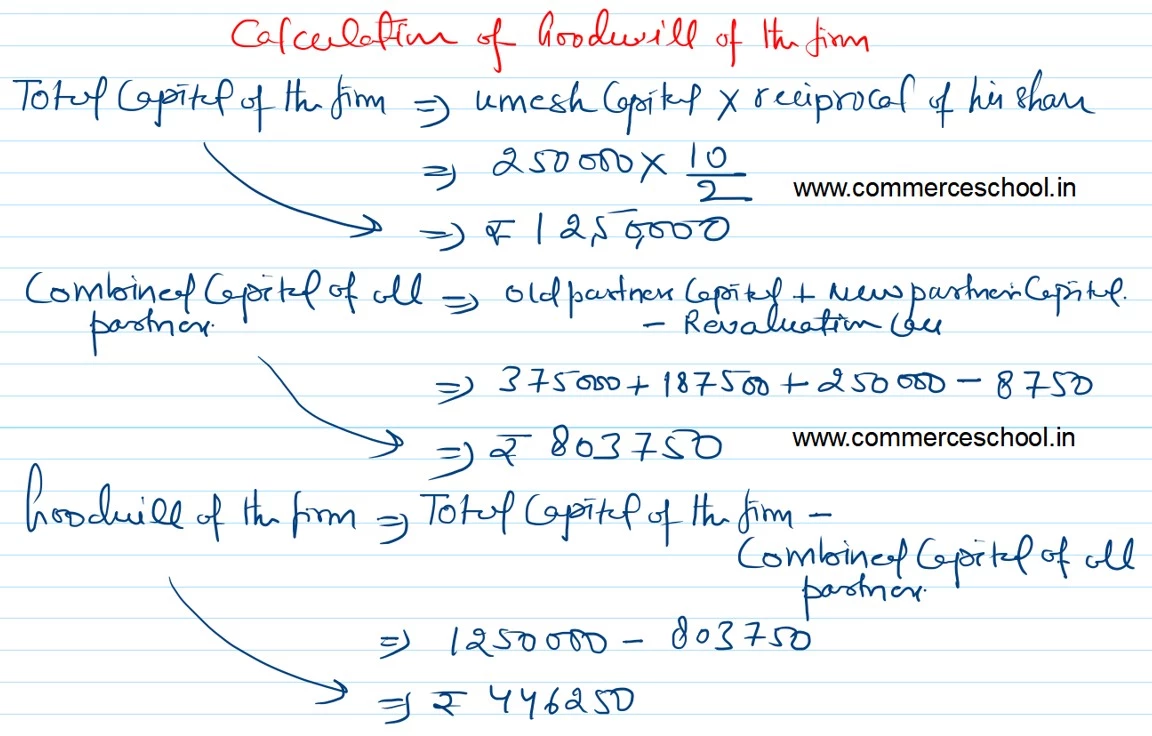

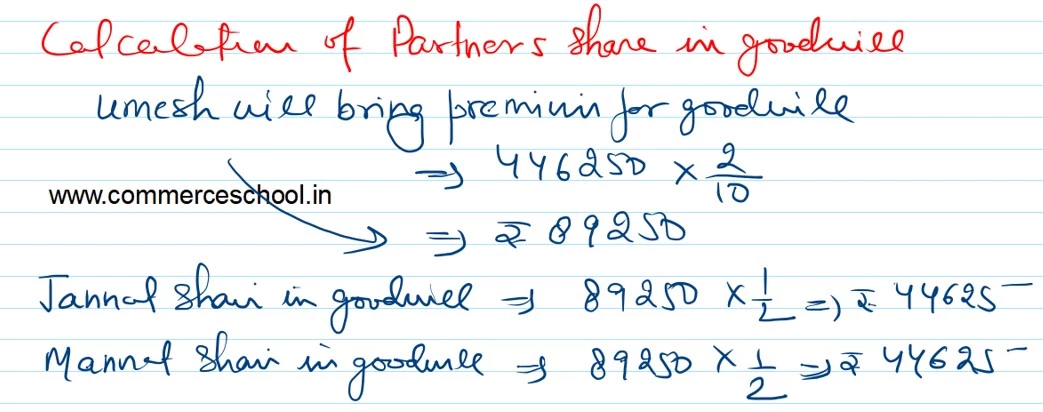

(i) Umesh will bring ₹ 2,50,000 as Capital and necessary amount for Goodwill.

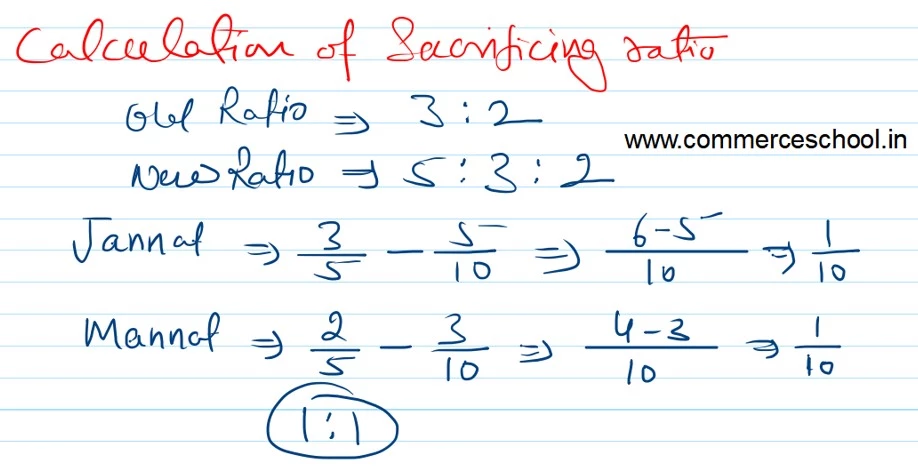

(ii) The new profit sharing ratio among Jannat, Mannat and Umesh will be 5 : 3 : 2.

(iii) The amount of goodwill is to be based on Umesh’s share in profits and capital contributed by him.

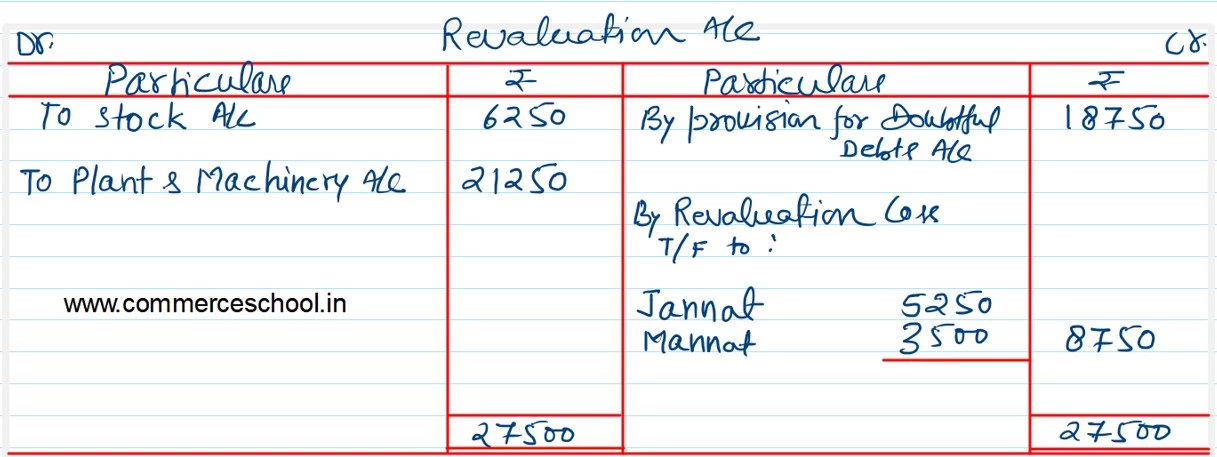

(iv) Stock to be reduced by 10%.

(v) Provision for Doubtful Debts is to be ₹ 6,250.

(vi) Plant and Machinery is to be reduced (depreciated) by 5%.

Prepare Revaluation Account, Bank Account, Partner’s Capital Accounts and Balance Sheet of the new firm.