Pass the Journal entries for the following transactions on the dissolution of the firm of P and Q after assets (other than cash) and outside liabilities have been transferred to Realisation Account:

Pass the Journal entries for the following transactions on the dissolution of the firm of P and Q after assets (other than cash) and outside liabilities have been transferred to Realisation Account:

(a) Stock ₹ 2,00,000, ‘P’ took 50% of stock at a discount of 10%. Balance stock was sold at a profit of 25% on cost.

(b) Debtors ₹ 2,25,000. Provision for Doubtful Debts ₹ 25,000; ₹ 20,000 of the book debts proved bad.

(c) Land and Building (Book Value ₹ 12,50,000) sold for ₹ 15,00,000 through a broker who charged 2% commission.

(d) Machinery (Book Value ₹ 6,00,000) was handed over to a creditor at a discount of 10%.

(e) Investment (Book value ₹ 60,000) realised at 125%.

(f) Goodwill of ₹ 75,000 and prepaid fire insurance of ₹ 10,000.

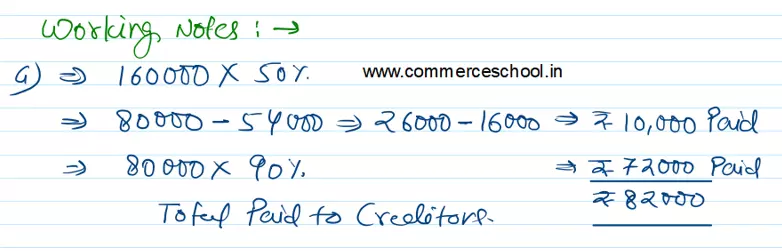

(g) Trade creditors ₹ 1,60,000. Half of the trade creditors accepted Plan and Machinery at an agreed valuation of ₹ 54,000 and cash in full settlement of their claims after allowing a discount of ₹ 16,000. Remaining trade creditors were paid 90% in final settlement.