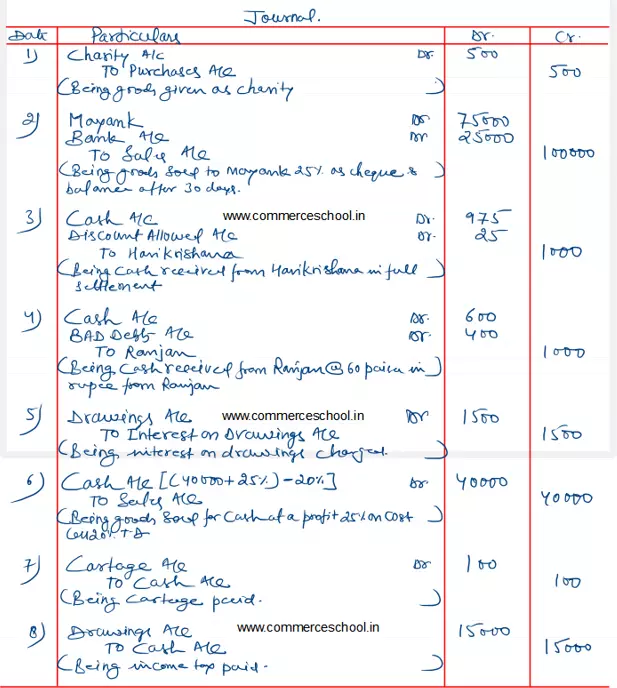

Journalise the following entries: Goods costing ₹ 500 given as charity Sold goods to Mayank of ₹ 1,00,000, payable 25% by cheque at the time of sale and balance after 30 days of sale

Journalise the following entries:

(i) Goods costing ₹ 500 given as charity.

(ii) Sold goods to Mayank of ₹ 1,00,000, payable 25% by cheque at the time of sale and balance after 30 days of sale.

(iii) Received ₹ 975 from Harikrishna in settlement of his account of ₹ 1,000.

(iv) Received dividend of 60 paise in a rupee from the Official Receiver of Rajan, who owed us ₹ 1,000.

(v) Charge interest on Drawings ₹ 1,500.

(vi) Sold goods to Anil costing ₹ 40,000 for cash at a profit of 25% on cost less 20% trade discount.

(viii) Paid cartage of ₹ 100 for delivery of goods.

(viii) Paid income tax ₹ 15,000.

Anurag Pathak Changed status to publish