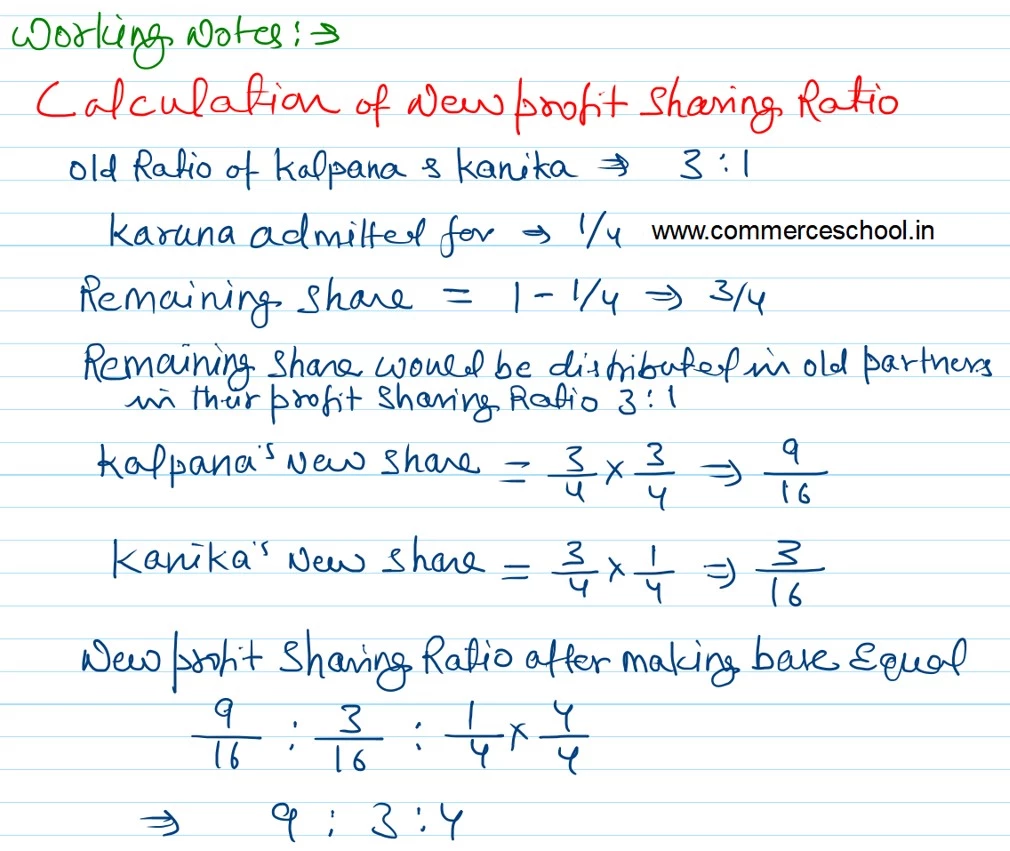

Kalpana and Kanika were partners in a firm sharing profits in 3 : 1 ratio. They admitted Karuna as a partner for 1/4th share in future profits. Karuna was to bring ₹ 60,000 for his capital. The Balance Sheet of Kalpana and Kanika as at 1st April, 2023, the date on which C was admitted, was:

Kalpana and Kanika were partners in a firm sharing profits in 3 : 1 ratio. They admitted Karuna as a partner for 1/4th share in future profits. Karuna was to bring ₹ 60,000 for his capital. The Balance Sheet of Kalpana and Kanika as at 1st April, 2023, the date on which C was admitted, was:

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/cs:

Kalpana Kanika General Reserve Creditors |

50,000 80,000 10,000 70,000 |

Land and Building

Plant and Machinery Stock Debtors Investments Cash |

35,000

|

40,000

70,000 30,000 34,000 26,000 10,000 |

| 2,10,000 | 2,10,000 |

The other terms agreed upon were:

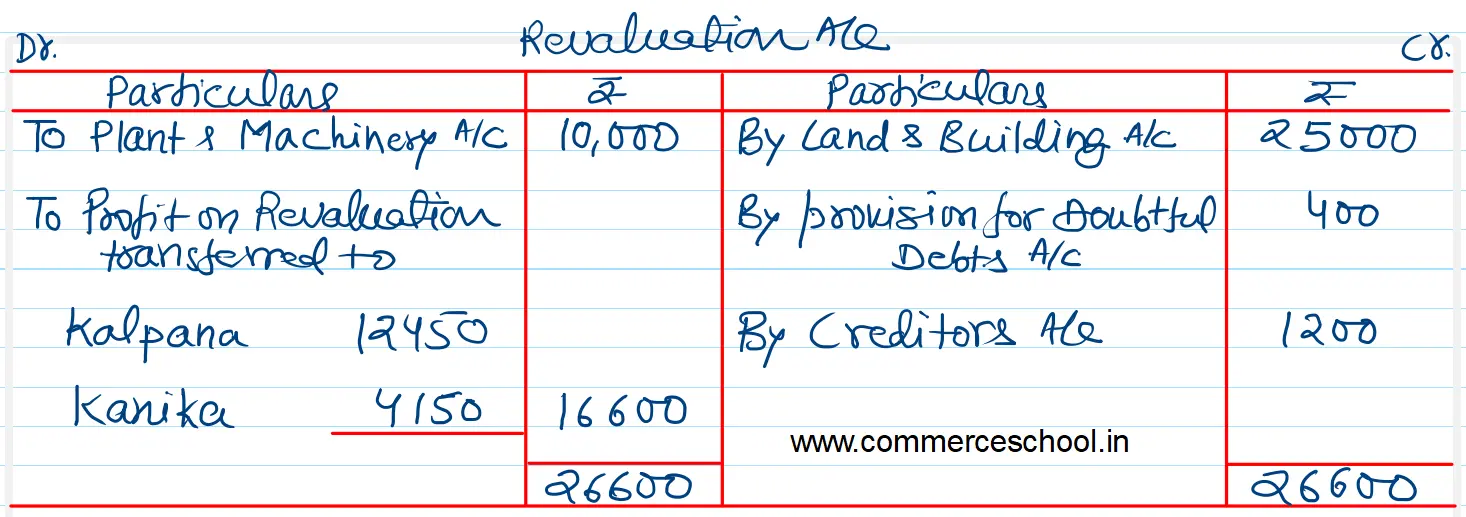

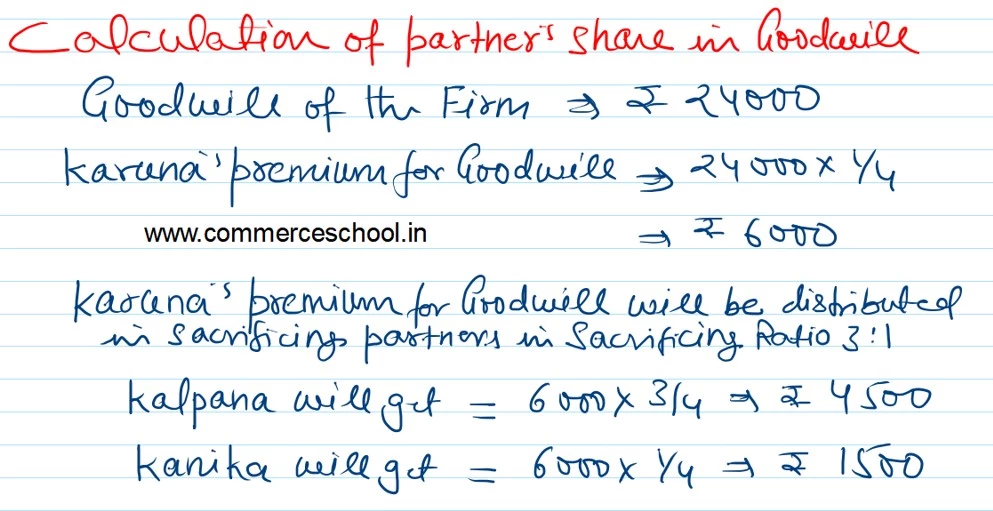

a) Goodwill of the firm was valued at ₹ 24,000.

b) Land and Building were valued at ₹ 65,000 and Plant and Machinery at ₹ 60,000.

c) Provision for Doubtful Debts was found in excess by ₹ 400.

d) A liability of ₹ 1,200 included in Sundry Creditors was not payable.

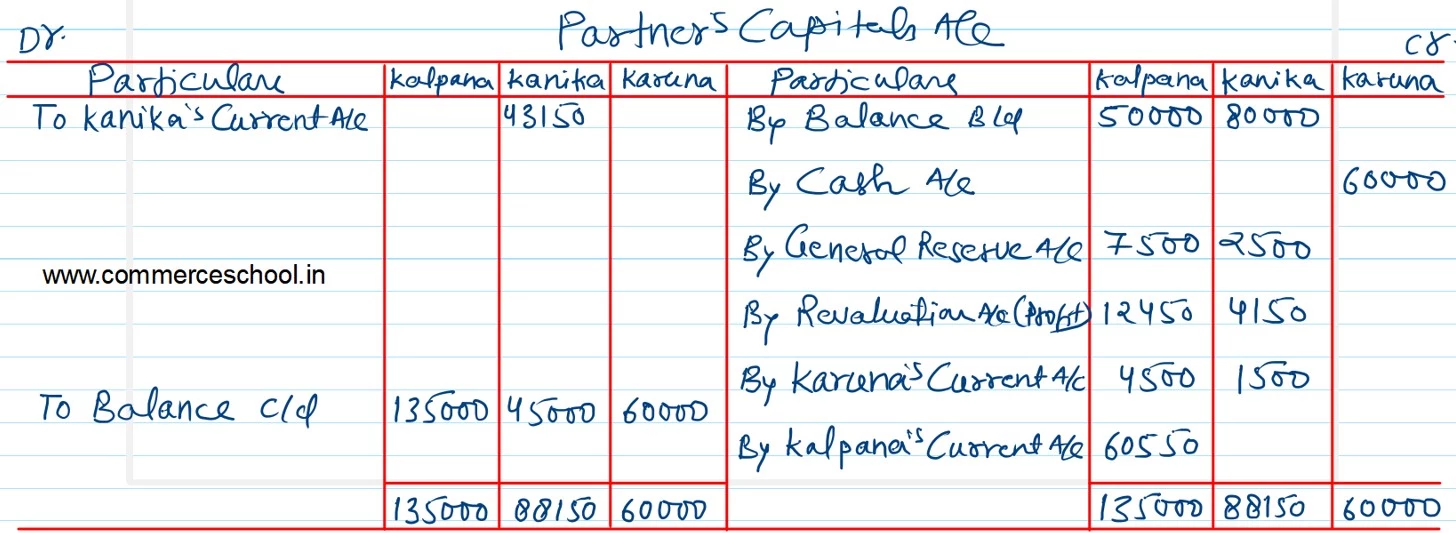

e) The capitals of the partners be adjusted on the basis of Karuna’s contribution of capital of the firm.

f) Excess of Shortfall, if any, be transferred to Current Accounts.

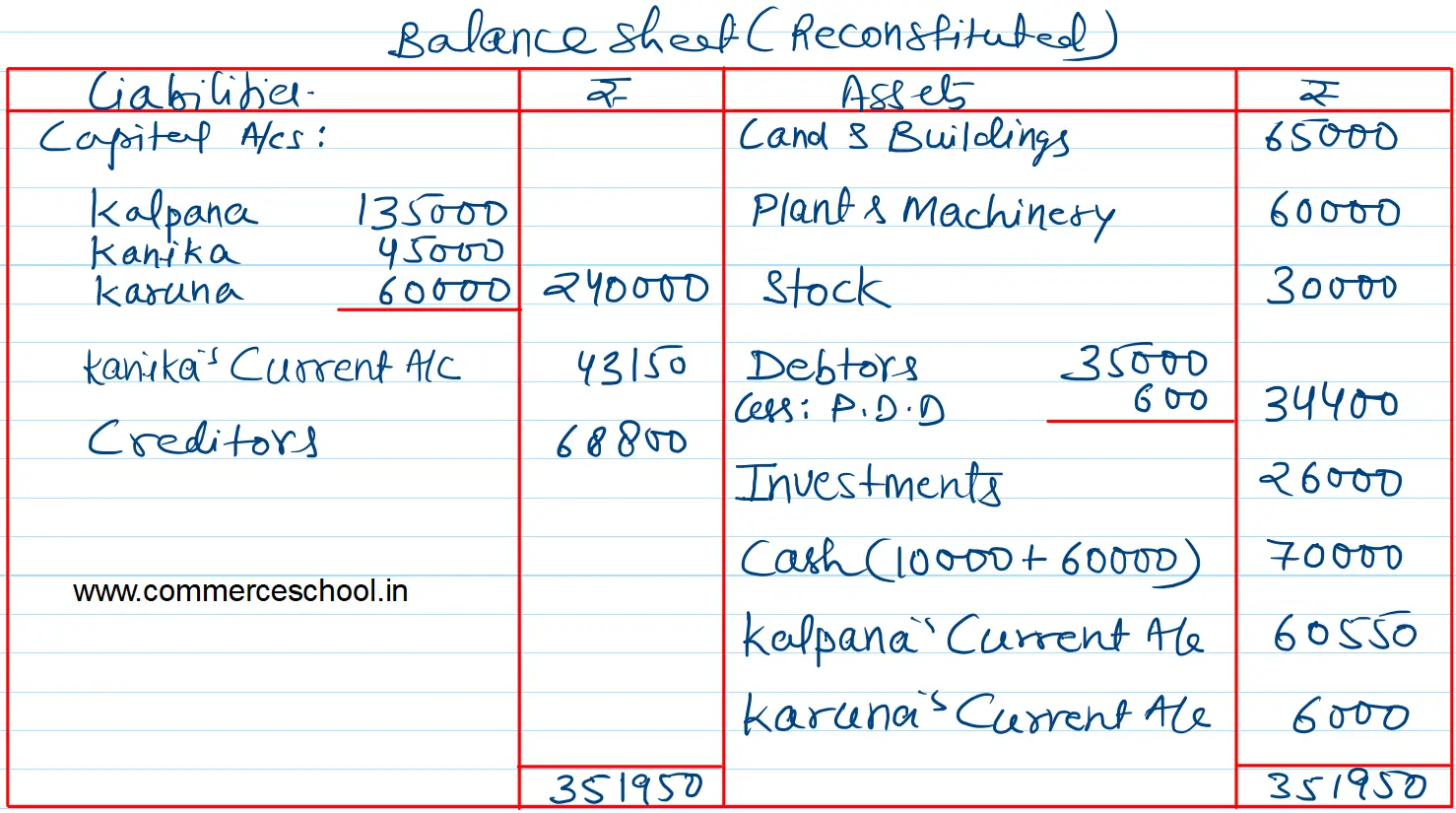

Prepare Revaluation Account, partner’s Capital Accounts and Balance Sheet of the new firm.

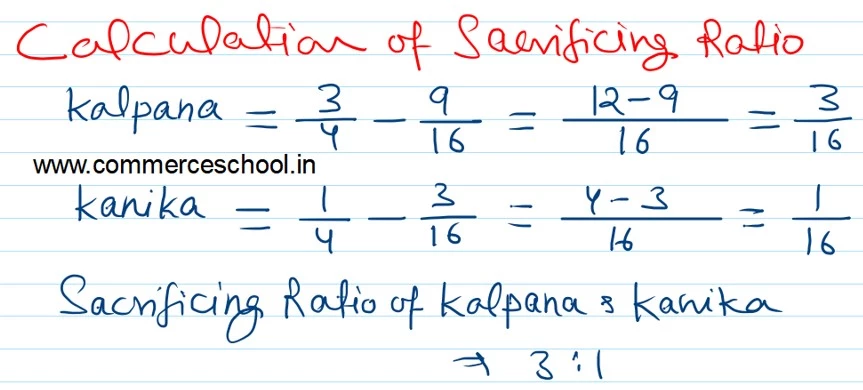

[Ans: Gain (profit) on Revaluation – ₹ 16,600; New Ratio of Kalpana, Kanika and Karuna – 9 : 3 : 4; Capital A/cs: Kalpana – ₹ 1,35,000; Kanika – ₹ 45,000 and Karuna – ₹ 60,000; Balance Sheet Total – ₹ 3,51,950.]