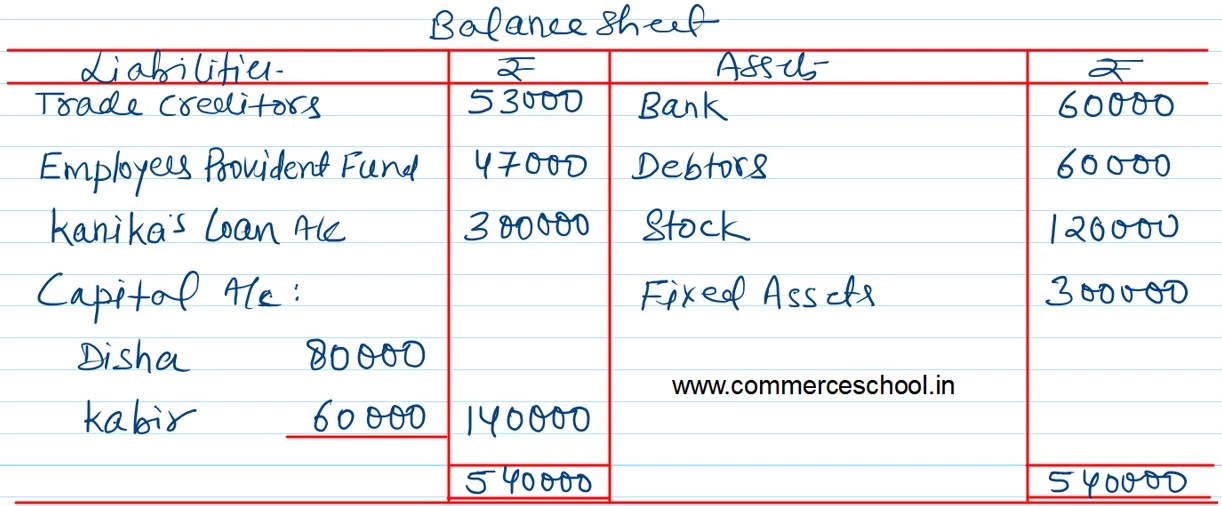

Kanika, Disha and Kabir were partners sharing profits in the ratio of 2 : 1 : 1. On 31st March, 2016, their Balance Sheet was as under:

Kanika, Disha and Kabir were partners sharing profits in the ratio of 2 : 1 : 1. On 31st March, 2016, their Balance Sheet was as under:

| Liabilities | ₹ | Assets | ₹ |

| Trade Creditors

Employee’s Provident Fund Kanika’s Capital Disha’s Capital Kabir’s Capital |

53,000 47,000 2,00,000 1,00,000 80,000 |

Bank

Debtors Stock Fixed Assets Profit & Loss A/c |

60,000 60,000 1,00,000 2,40,000 20,000 |

| 4,80,000 | 4,80,000 |

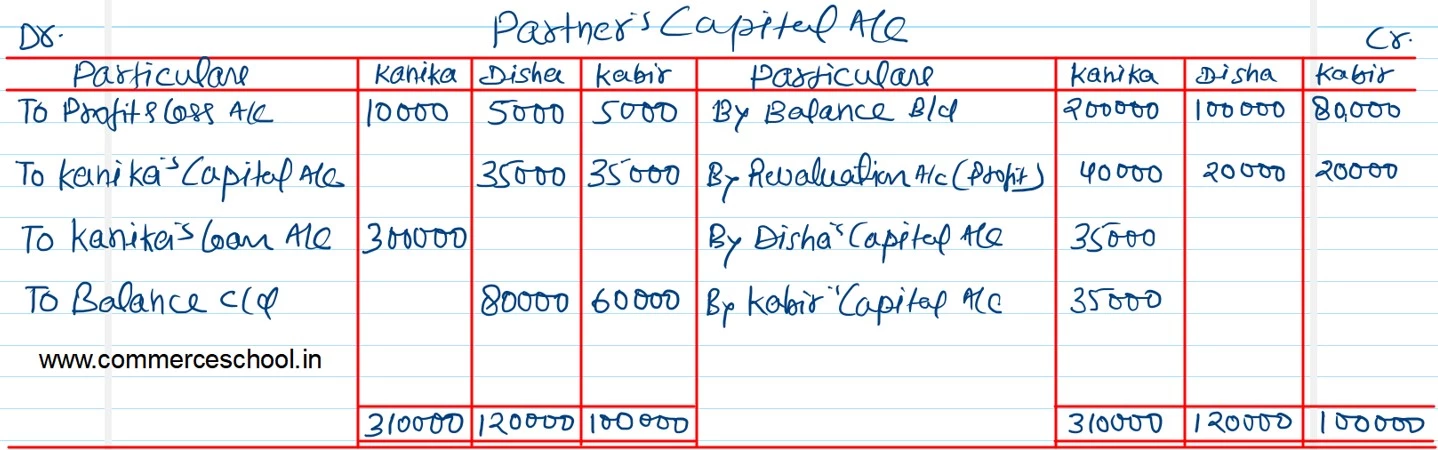

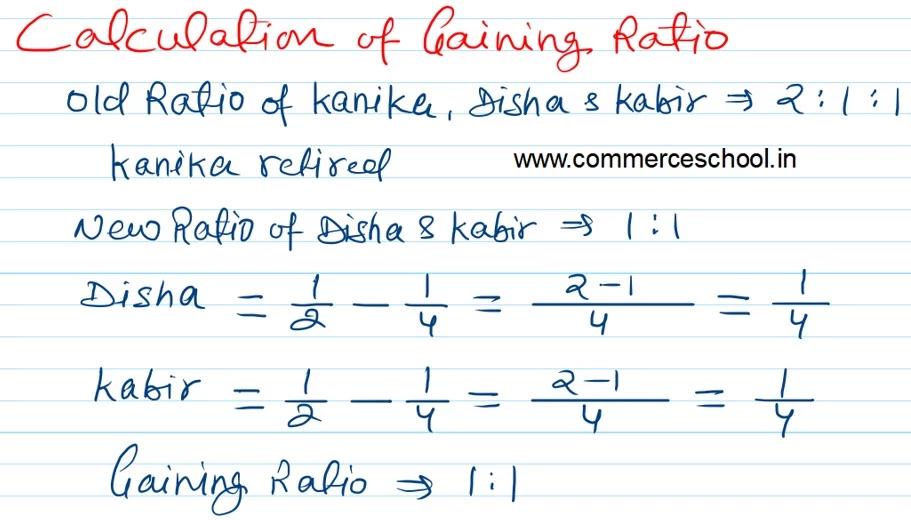

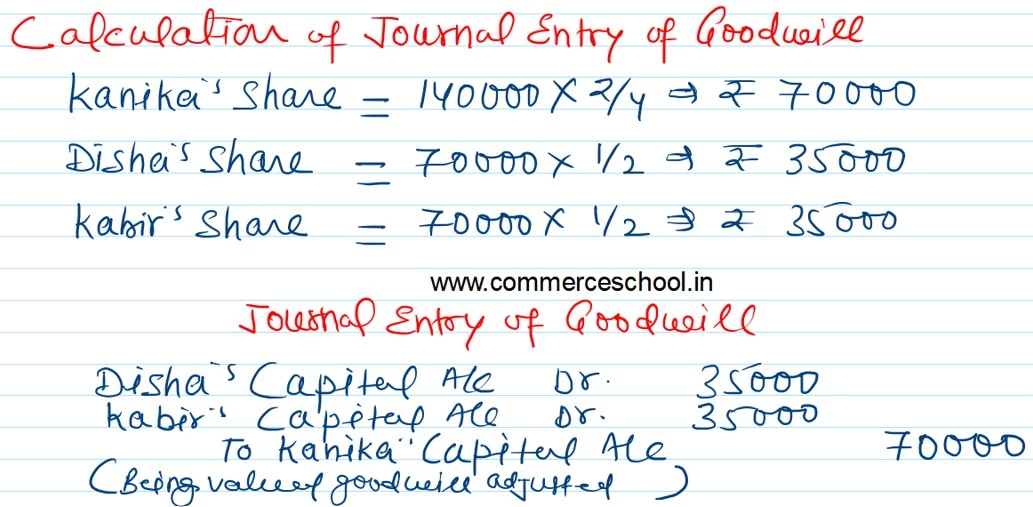

Kanika retired on 1st April, 2016. For this purpose, the following adjustments were agreed upon:

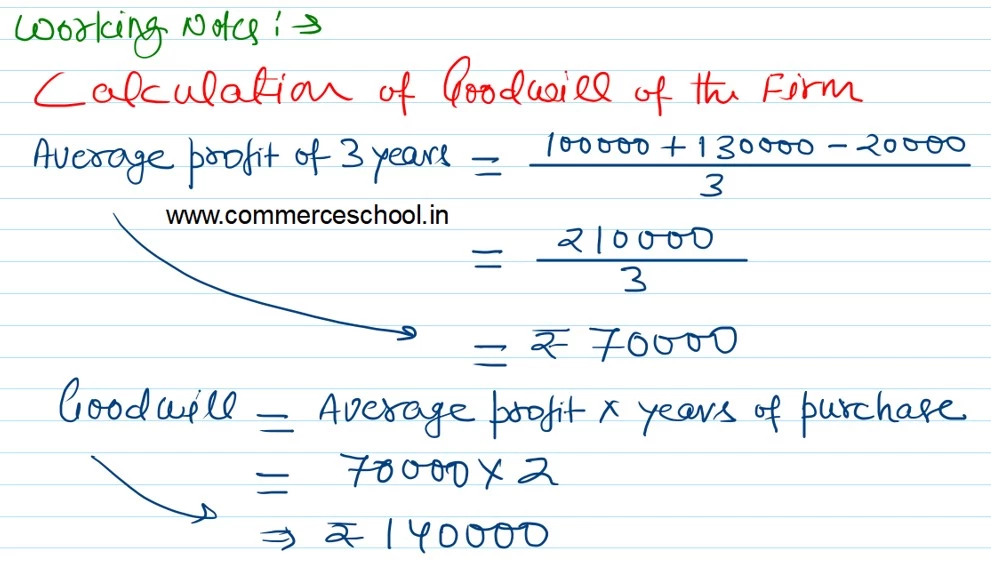

a) Goodwill of the firm was valued at 2 year’s purchase of average profits of three completed years preceding the date of retirement. The profits for the year: 2013 – 14 were ₹ 1,00,000 and for 2014 – 15 were ₹ 1,30,000.

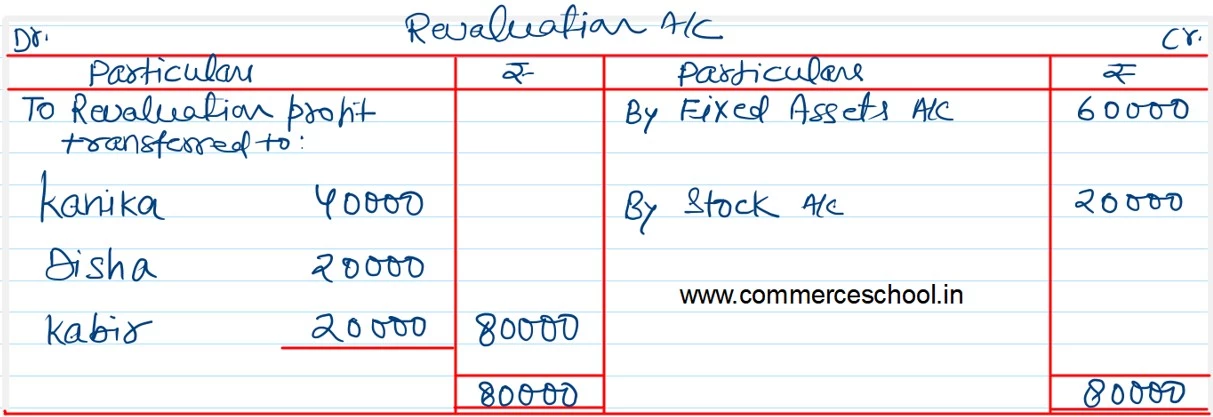

b) Fixed Assets were to be increased to ₹ 3,00,000.

c) Stock was to be valued at 120%.

d) The amount payable to Kanika was transferred to her Loan Account.

Prepare Revaluation Account, Capital Accounts of the partners and the Balance Sheet of the reconstituted firm.