Kavita and Leela are partners with capitals of ₹ 6,00,000 and ₹ 4,00,000 and sharing profits & Loss in the ratio of 2 : 1. Their partnership deed provides that interest on capitals shall be provided @ 8% p.a

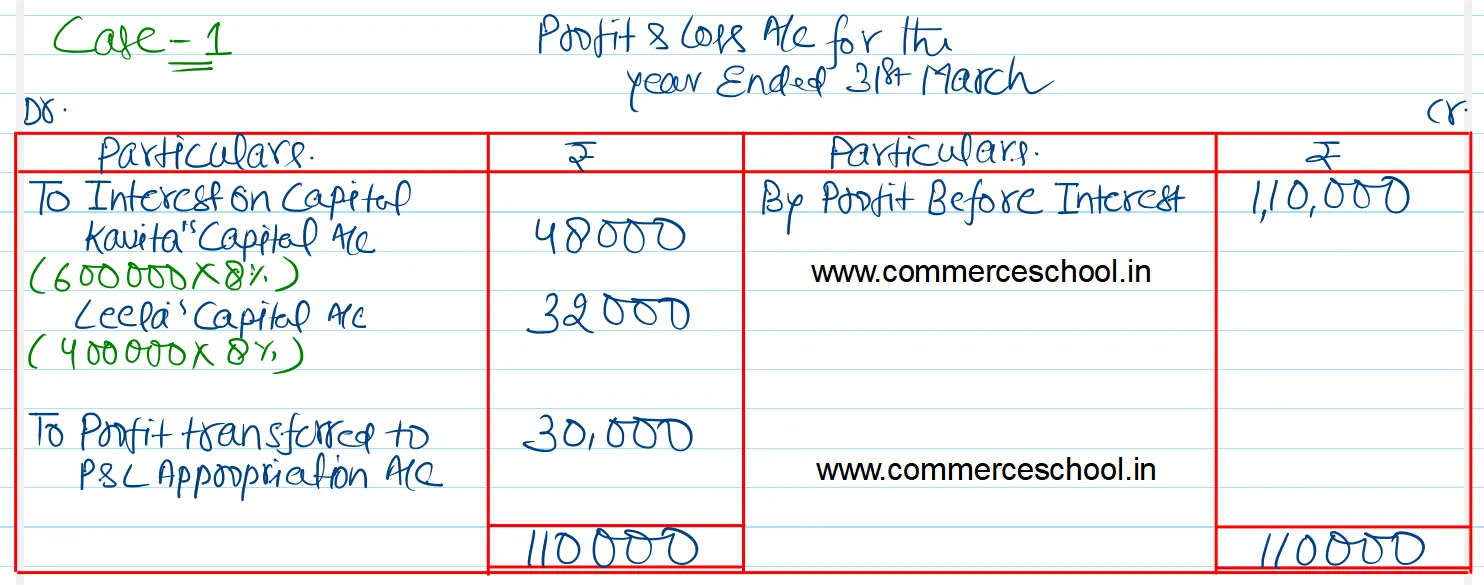

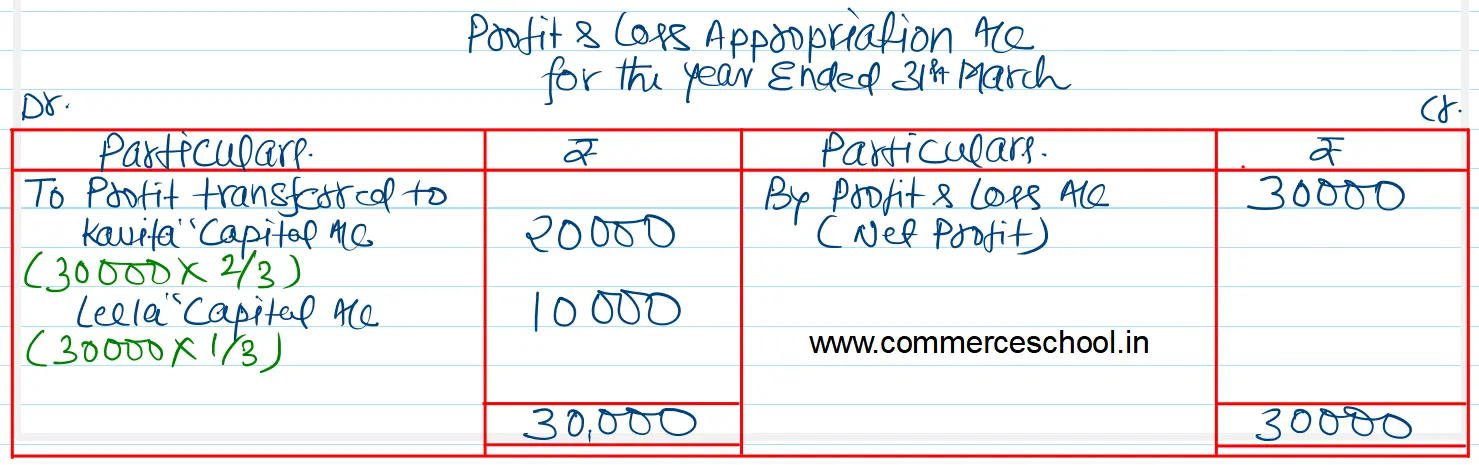

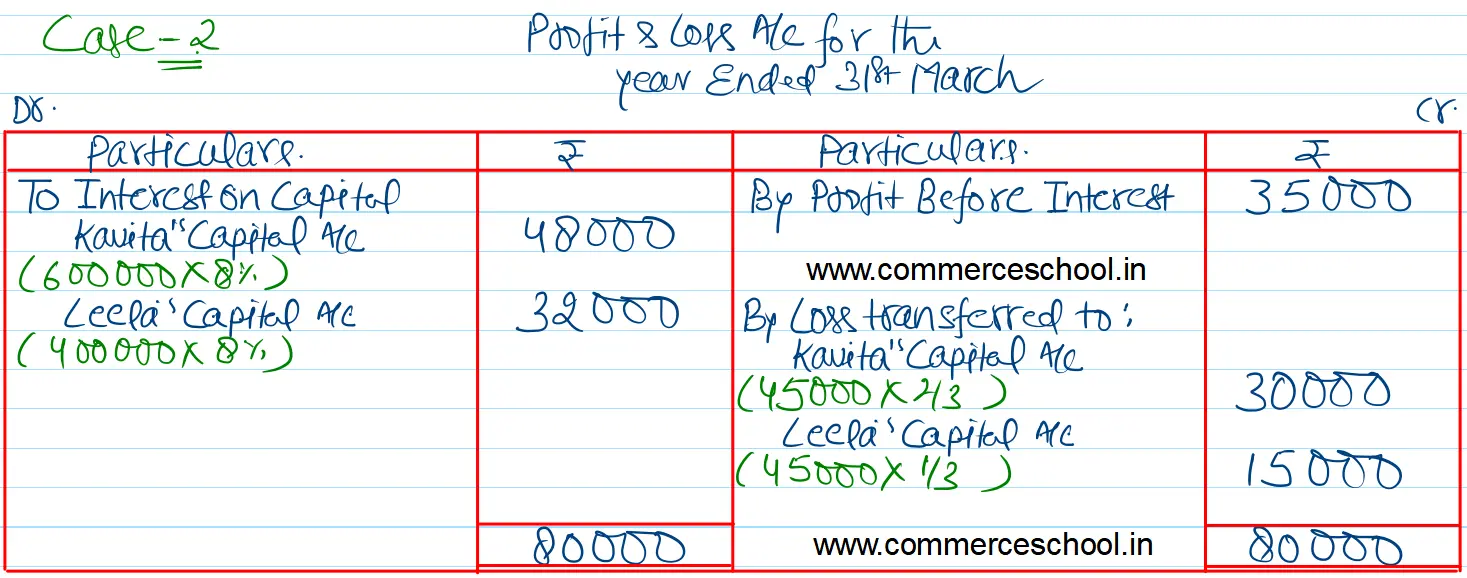

Kavita and Leela are partners with capitals of ₹ 6,00,000 and ₹ 4,00,000 and sharing profits & Loss in the ratio of 2 : 1. Their partnership deed provides that interest on capitals shall be provided @ 8% p.a. and it is to be treated as a charge against profits. Prepare relevant account to allocate the profit in the following alternative cases:

(i) If profit for the year is ₹ 1,10,000

(ii) If profit for the year is ₹ 35,000

(iii) If loss for the year is ₹ 10,000.

[Ans. Case (i) Share of Profit : kavital ₹ 20,000; Leela ₹ 10,000 Case (ii) Share of Loss : Kavita ₹ 30,000; Leela ₹ 15,000 Case (iii) Share of Loss : Kavita ₹ 60,000; Leela ₹ 30,000]

Hint: Interest on Capital will be recorded in Profit & Los Account since it is a charge against profits.