Lal and Pal were partners in a firm sharing profits in the ratio of 3 : 7. On 1st April, 2015, their firm was dissolved. After transferring assets (other than cash) and outsider’s liabilities to Realisation Account, you are given the following information:

Lal and Pal were partners in a firm sharing profits in the ratio of 3 : 7. On 1st April, 2015, their firm was dissolved. After transferring assets (other than cash) and outsider’s liabilities to Realisation Account, you are given the following information:

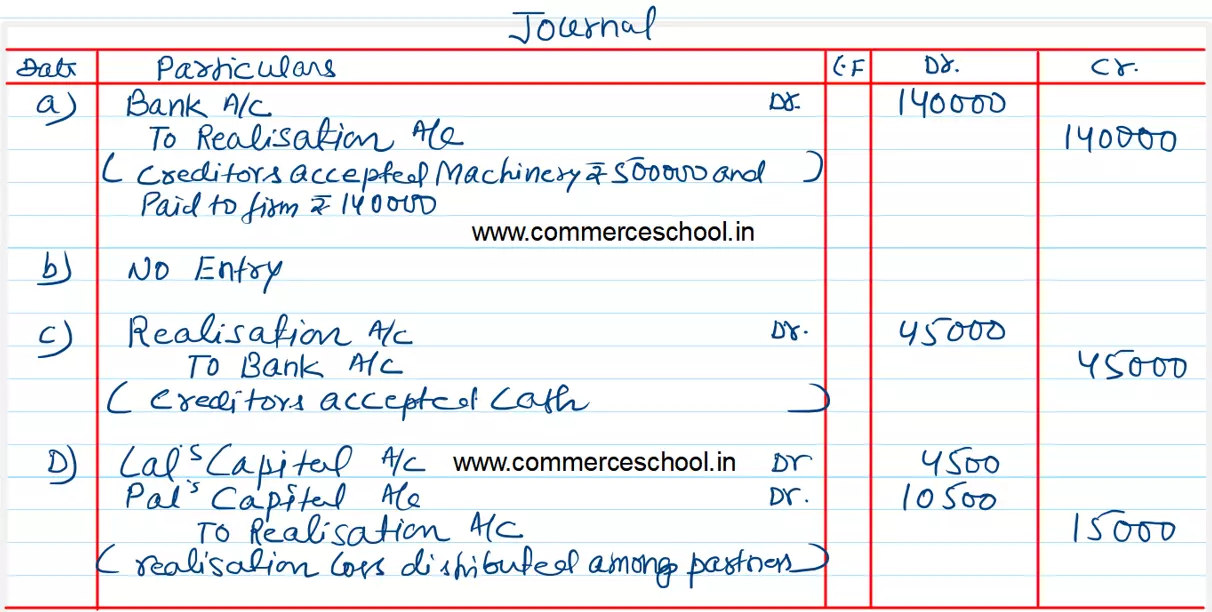

(a) A creditor of ₹ 3,60,000 accepted machinery valued at ₹ 5,00,000 and paid to the firm ₹ 1,40,000.

(b) A second creditor for ₹ 50,000 accepted stock at ₹ 45,000 in full settlement of his claim.

(c) A third creditor amounting to ₹ 90,000 accepted ₹ 45,000 in cash and investments worth ₹ 43,000 in full settlement of his claim.

(d) Loss on dissolution was ₹ 15,000.

Pass necessary Journal entries for the above transactions in the books of firm assuming that all payments were made by cheque.