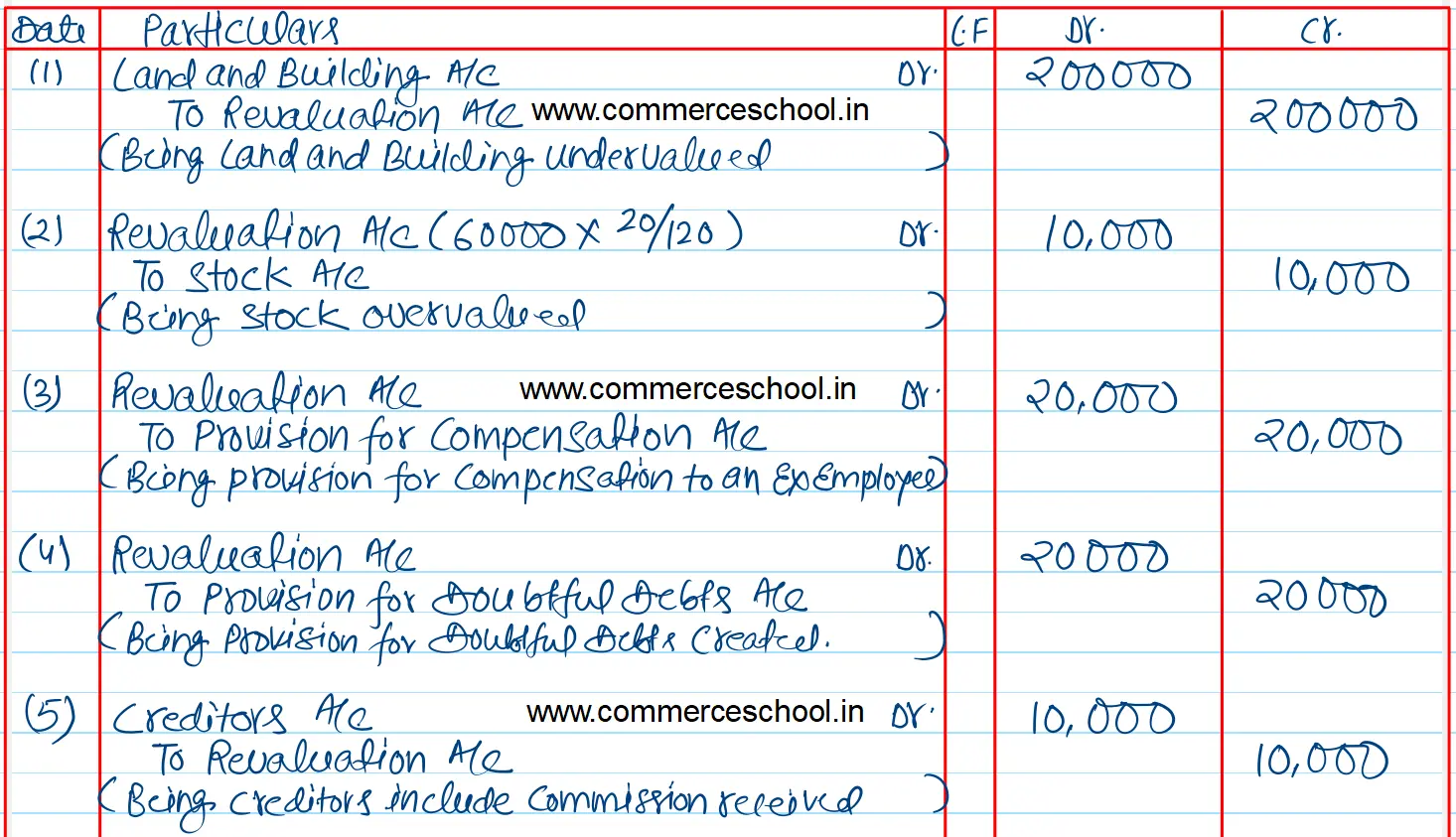

Pass journal entries to record the following transactions on the admission of a new partner: Land and Building is undervalued by ₹ 2,00,000

Pass journal entries to record the following transactions on the admission of a new partner:

(i) Land and Building is undervalued by ₹ 2,00,000.

(ii) Stock is overvalued by 20% (Book Value of Stock ₹ 60,000)

(iii) Provision to be made for compensation of ₹ 20,000 to an ex-employee.

(iv) Sundry Debtors appeared in the books at ₹ 1,50,000. They are estimated to produce not more than ₹ 1,30,000.

(v) Creditors include an amount of ₹ 10,000 received as commission.

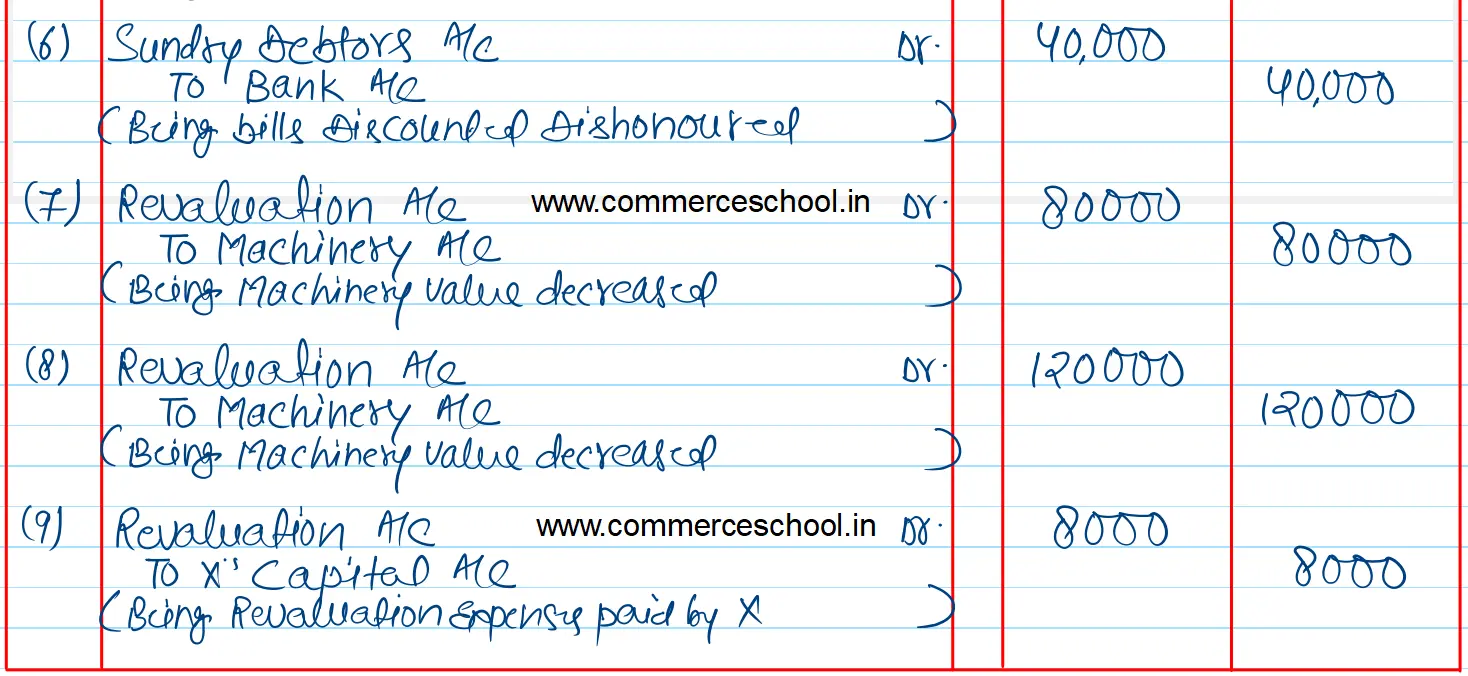

(vi) A bill of exchange of ₹ 40,000 which was previously discounted with the banker, was dishonoured on 31st March, 2024 but no entry has been passed for it.

(vii) Value of Machinery is to be decreased to ₹ 1,20,000 (Book Value ₹ 2,00,000)

(viii) Value of Machinery is to be decreased by ₹ 1,20,000 (Book Value ₹ 2,00,000)

(ix) Expenses on revaluation amount to ₹ 8,000 have been paid by partner X.