Lisa, Monika and Nisha were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On 31st March, 2019, their Balance Sheet was as follows:

Lisa, Monika and Nisha were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On 31st March, 2019, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Trade Creditors

Bills Payable Employee’s Provident Fund Capitals: Lisa Monika Nisha |

1,60,000

2,44,000 76,000 14,00,000 14,00,000 3,60,000 |

Land and Building

Machinery Stock Sundry Debtors Bank |

10,00,000

12,00,000 10,00,000 4,00,000 40,000 |

| 36,40,000 | 36,40,000 |

On 31st March, 2019, Monika retired from the firm and the remaining partners decided to carry on the business. It was agreed that:

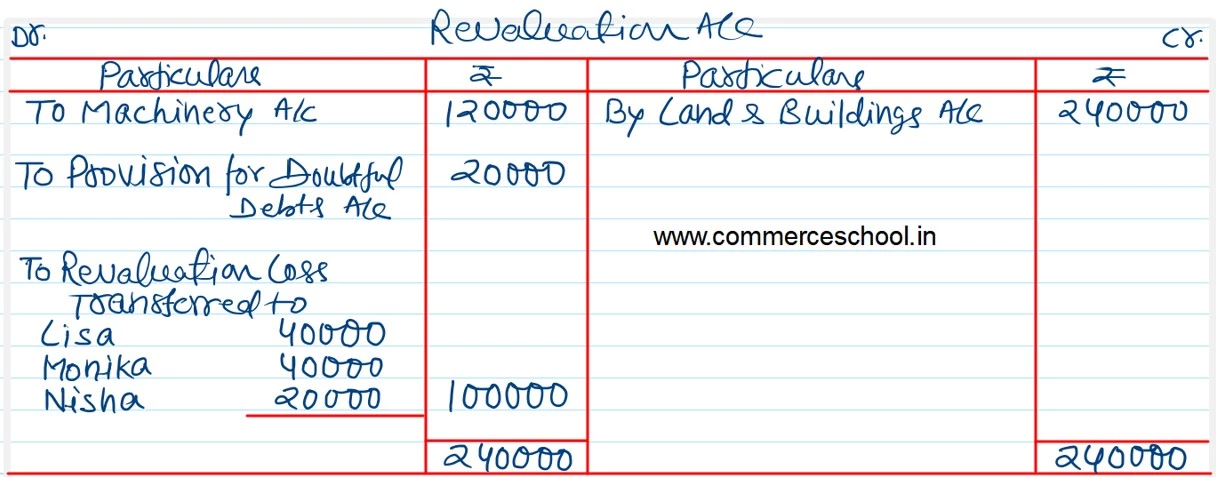

i) Land and building be appreciated by ₹ 2,40,000 and machinery be depreciated by 10%.

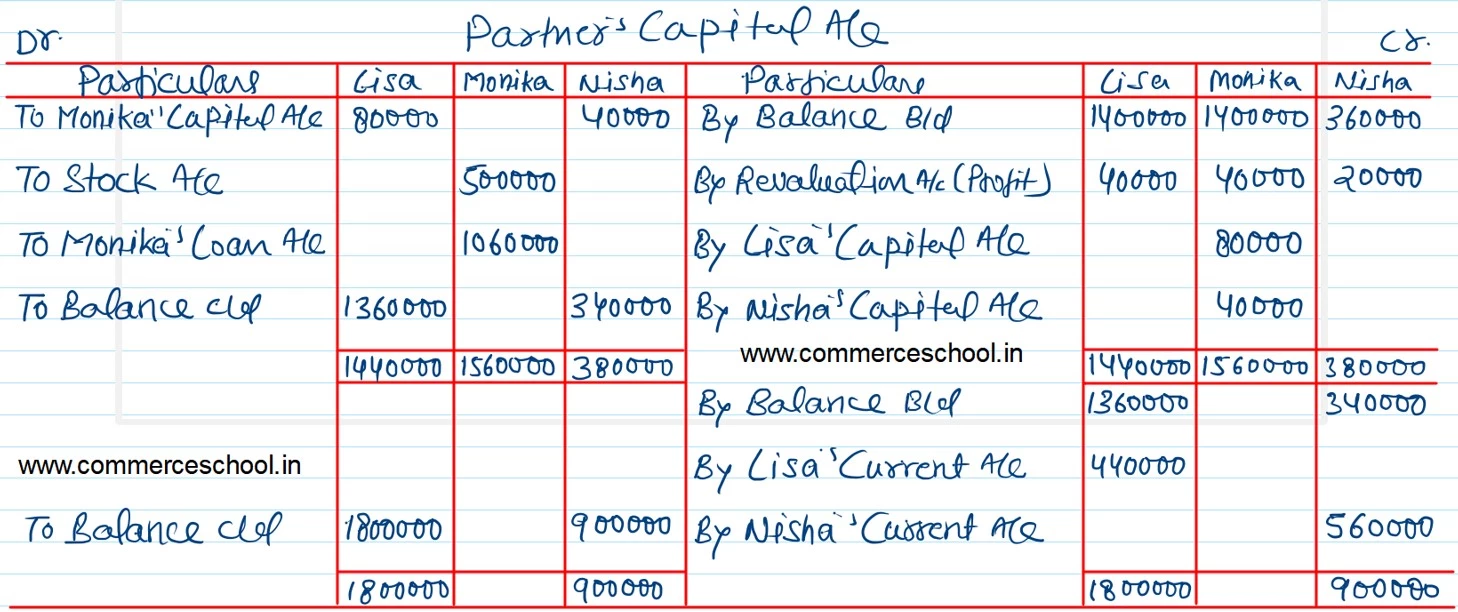

ii) 50% of the stock was taken over by the retiring partner at book value.

iii) Provision for doubtful debts was to be made at 5% on debtors.

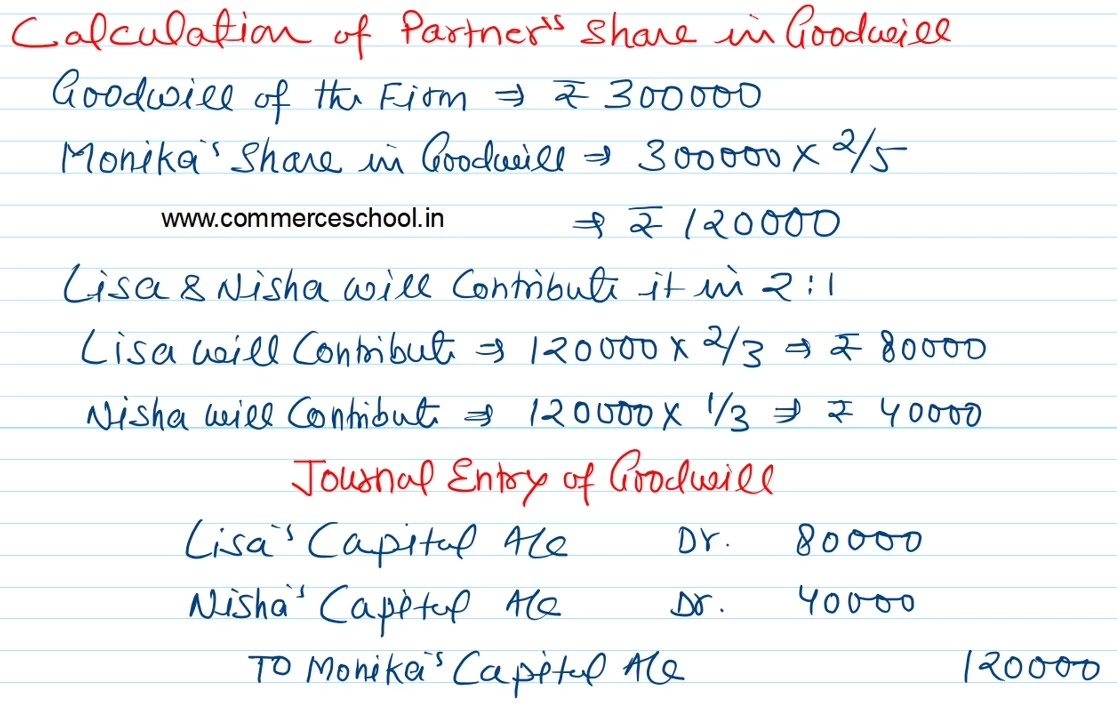

iv) Goodwill of the firm valued at ₹ 3,00,000 and Monika’s share of goodwill be adjusted in the accounts of Lisa and Nisha.

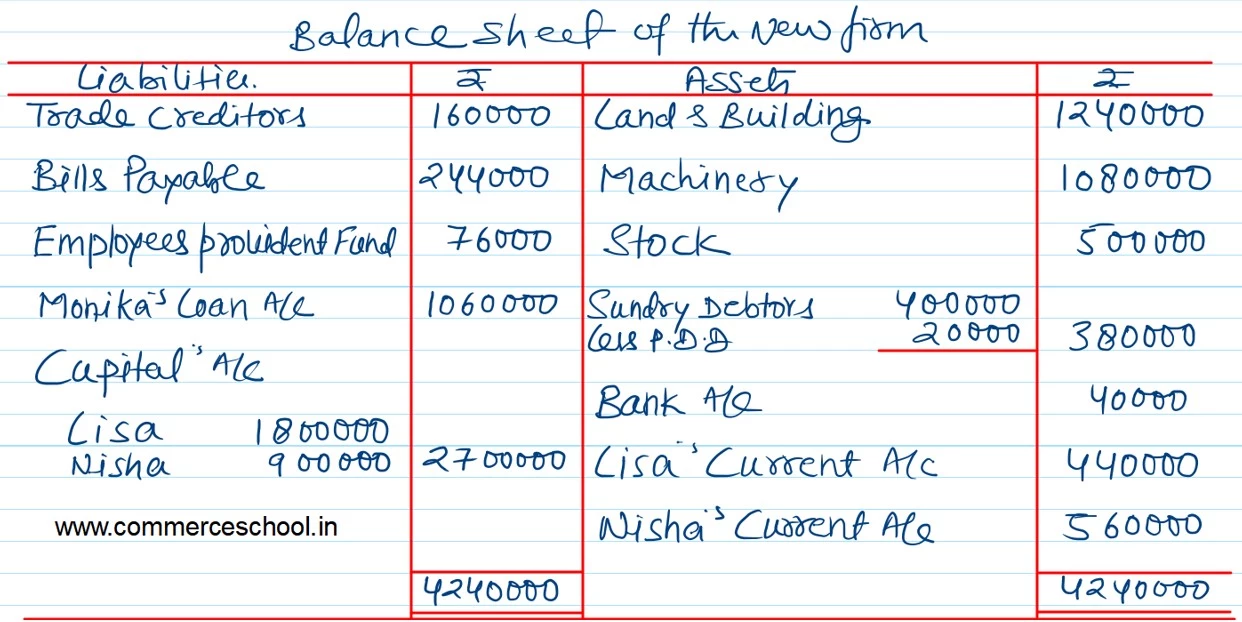

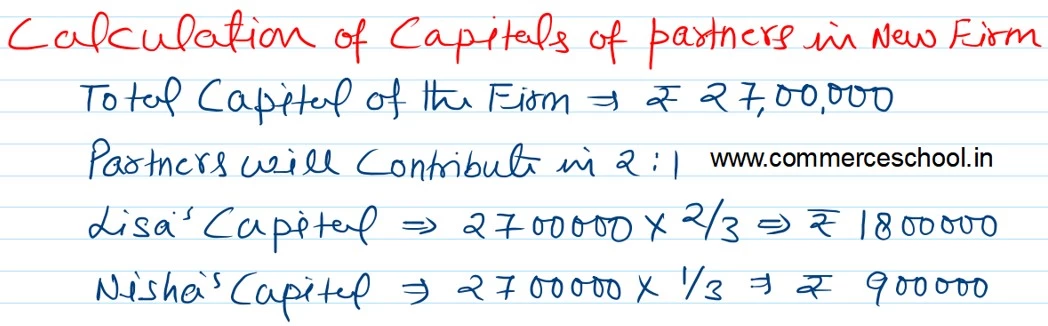

v) The total capital of the new firm be fixed at ₹ 27,00,000 which will be in the proportion of the new profit sharing ratio of Lisa and Nisha. For this purpose, Current Accounts of the partners were to be opened.

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the reconstituted firm on Monika’s retirement.

[Ans.: Gain (Profi)t on Revaluation – ₹ 1,00,000; Monika’s Loan Account – ₹ 10,60,000; Partner’s Capital Account: Lisa – ₹ 18,00,000; Nisha – ₹ 9,00,000; Partner’s Current Accounts: Lisa – ₹ 4,40,000 (Dr.); Nisha – ₹ 5,60,000 (Dr.); Balance Sheet Total – ₹ 42,40,000.]