Mahesh and Rajesh are partners sharing profits in the ratio of 2 : 1. Their Balance sheet as at 31st March, 2023 was as under:

Mahesh and Rajesh are partners sharing profits in the ratio of 2 : 1. Their Balance sheet as at 31st March, 2023 was as under:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors

Employees Provident Fund Capital A/cs: Mahesh Rajesh |

4,00,000 40,000 3,00,000 2,00,000 |

Cash at Bank

Sundry Debtors Bill Receivable Stock Furniture and Fixtures Land and Building |

1,70,000 1,50,000 40,000 2,50,000 30,000 3,00,000 |

| 9,40,000 | 9,40,000 |

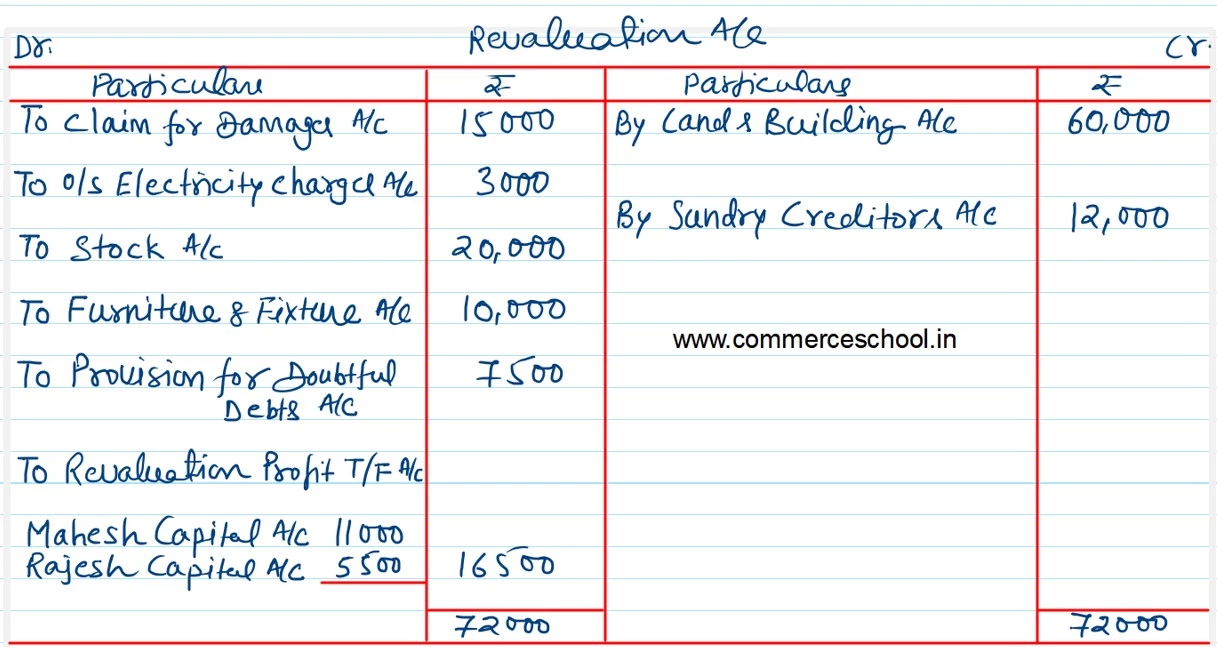

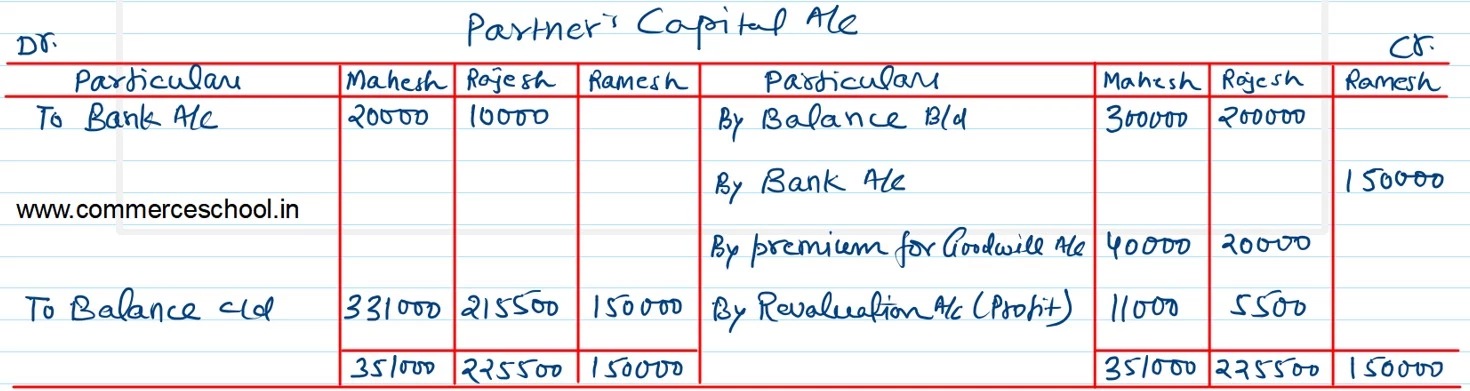

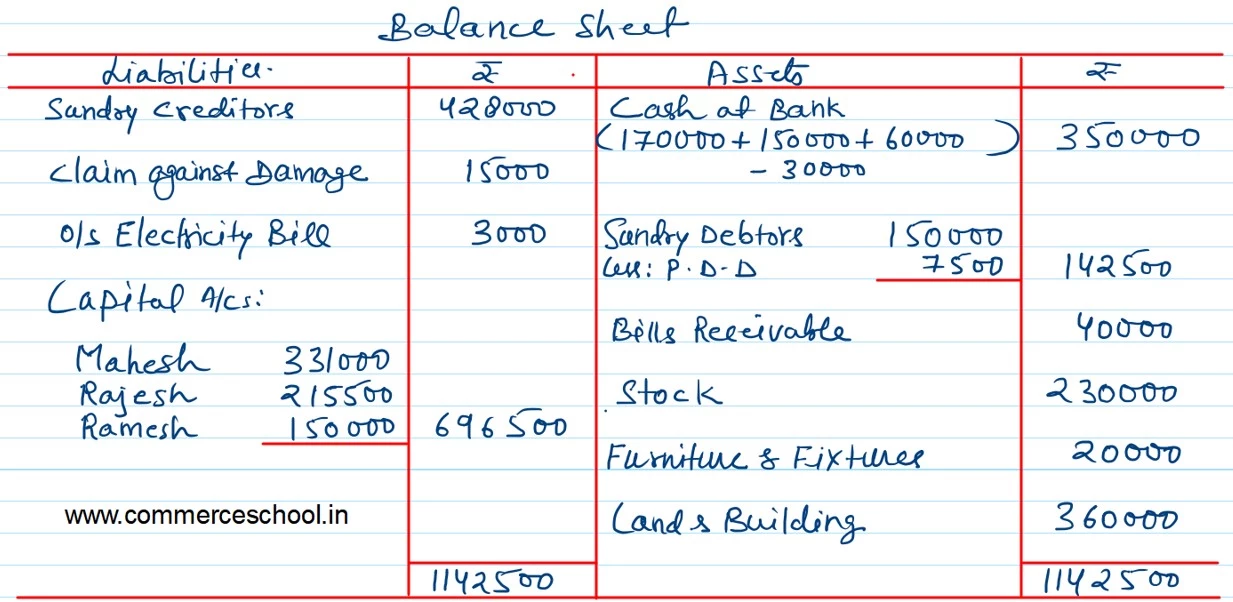

Ramesh is admitted to partnership with effect from 1st April, 2023 on the following terms:

(i) He brings ₹ 1,50,000 as his capital for 1/4th share and pays ₹ 60,000 for Goodwill, half of which is to be withdrawn by Mahesh and Rajesh.

(ii) That there is likely to be a claim against the firm for damages for which a provision of ₹ 15,000 is to be made.

(iii) A bill for ₹ 3,000 for electricity charges has been omitted to be accounted. it is to be provided for.

(iv) Value of stock is to be reduced to ₹ 2,30,000 and Furniture and Fixtures by ₹ 10,000.

(v) Provision for Doubtful Debts is to be created on sundry Debtors @ 5%.

(vi) Value of Land and Building is to be appreciated by 20%.

(vii) Sundry Creditors includes an item of ₹ 12,000 which is not to be paid.

(viii) That the profit sharing ratio of the old partners will not change.

Prepare the necessary ledger accounts and the Balance Sheet of hte new firm.