Mike and Ajay are partners sharing profits and losses in ratio of the capitals. They decided to dissolve their firm on 31st March, 2022, the date on which the Balance Sheet stood as under:

Mike and Ajay are partners sharing profits and losses in ratio of the capitals. They decided to dissolve their firm on 31st March, 2022, the date on which the Balance Sheet stood as under:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

Mike Ajay Workmen Compensation Reserve Creditors Bills Payable Others |

6,00,000 4,00,000 1,00,000 2,00,000 60,000 3,40,000 |

Sundry Assets

Cash |

16,30,000 70,000 |

| 17,00,000 | 17,00,000 |

Following additional information is given:

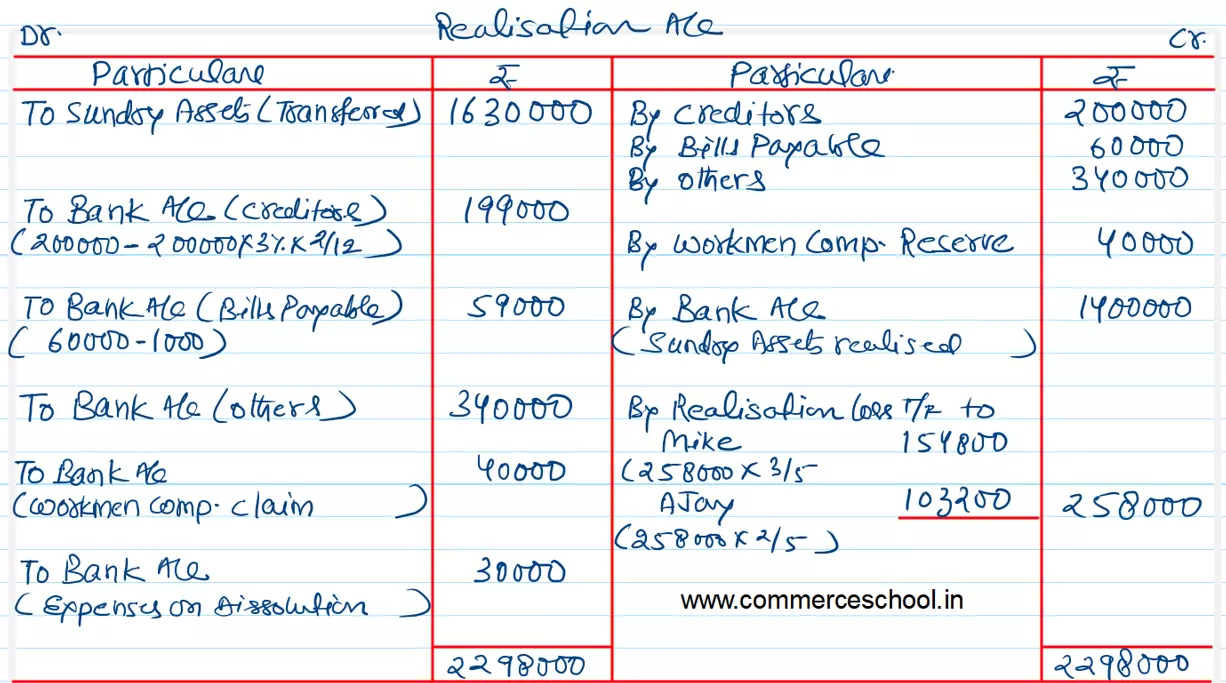

Sundry assets realised ₹ 14,00,000 and the liabilities were dischared as follows:

(i) Creditors due on 31st May, 2022, were paid at a discount of 3% per annum.

(ii) Bills Payable were dischared at a rebate of ₹ 1,000.

(iii) Workmen Compensation Claim of ₹ 40,000 was met.

(iv) Expenses of Dissolution amounting to ₹ 30,000 were paid.

You are required to prepare:

(a) Realisation Account.

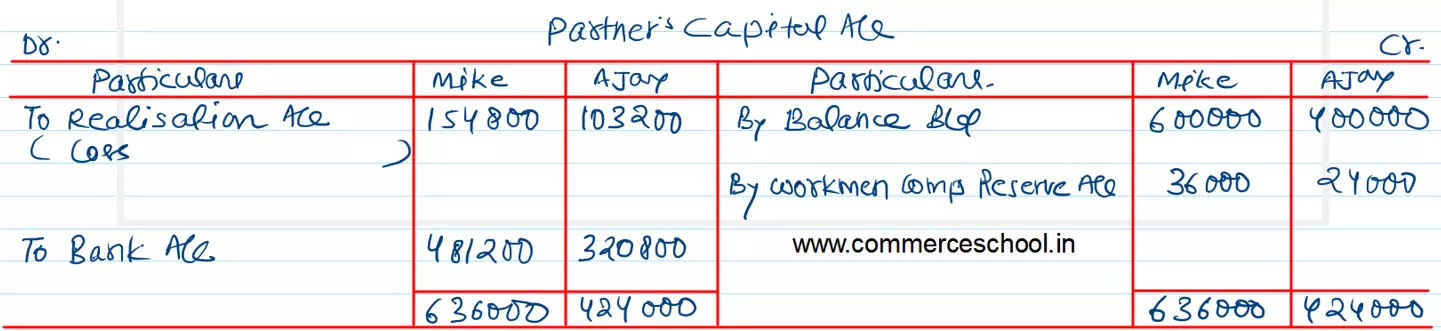

(b) Partner’s Capital Accounts.

[Ans.: Loss on Realisation – ₹ 2,58,000; Final Payment; Mike – ₹ 4,81,200 and Ajay – ₹ 3,20,800.]