Mohan and Mahesh were partners in a firm sharing profits in the ratio of 3 : 2. On 1st April, 2024 they admitted Nusrat as a partner in the firm. The Balance Sheet of Mohan and Mahesh on that date was as under:

Mohan and Mahesh were partners in a firm sharing profits in the ratio of 3 : 2. On 1st April, 2024 they admitted Nusrat as a partner in the firm. The Balance Sheet of Mohan and Mahesh on that date was as under:

It was agreed that:

(i) The value of Building is to be appreciated to ₹ 3,80,000.

(ii) Stock is undervalued by 25%.

(iii) The liability of workmen’s compensation fund was determined at ₹ 2,30,000.

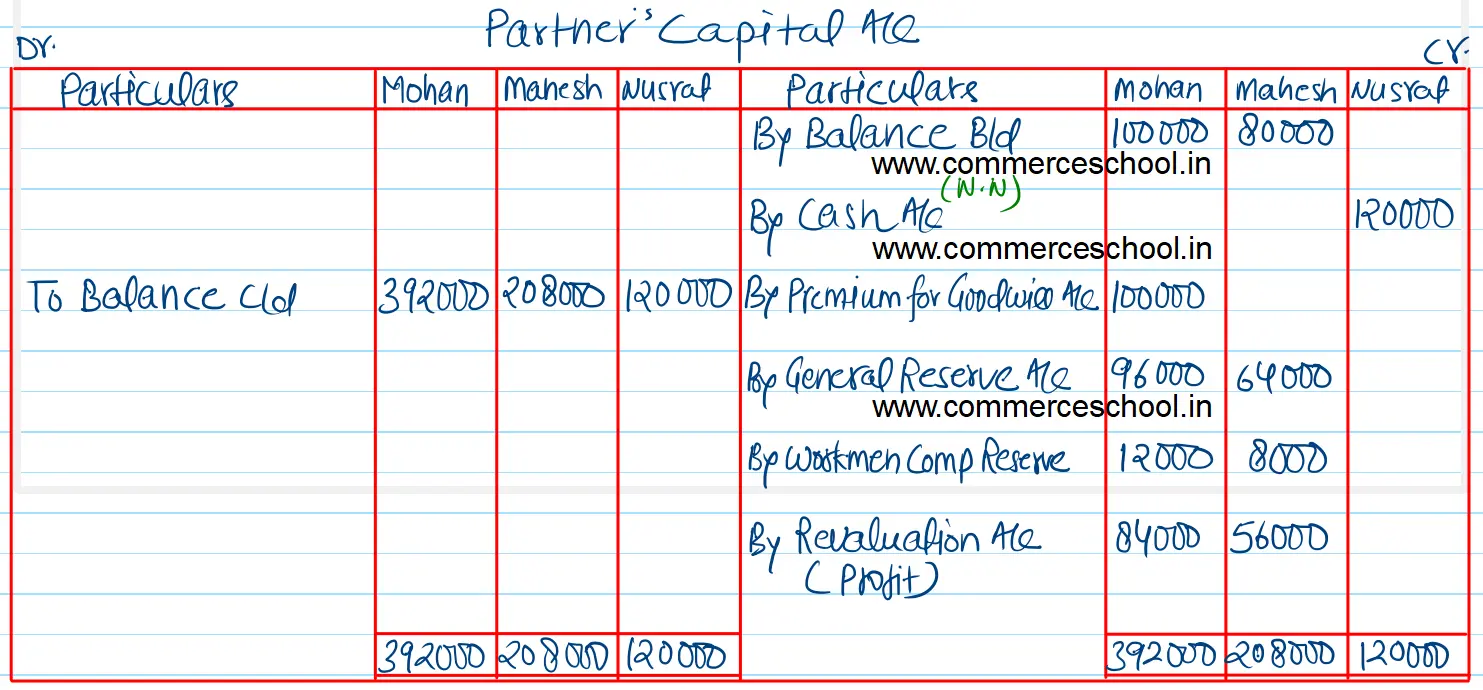

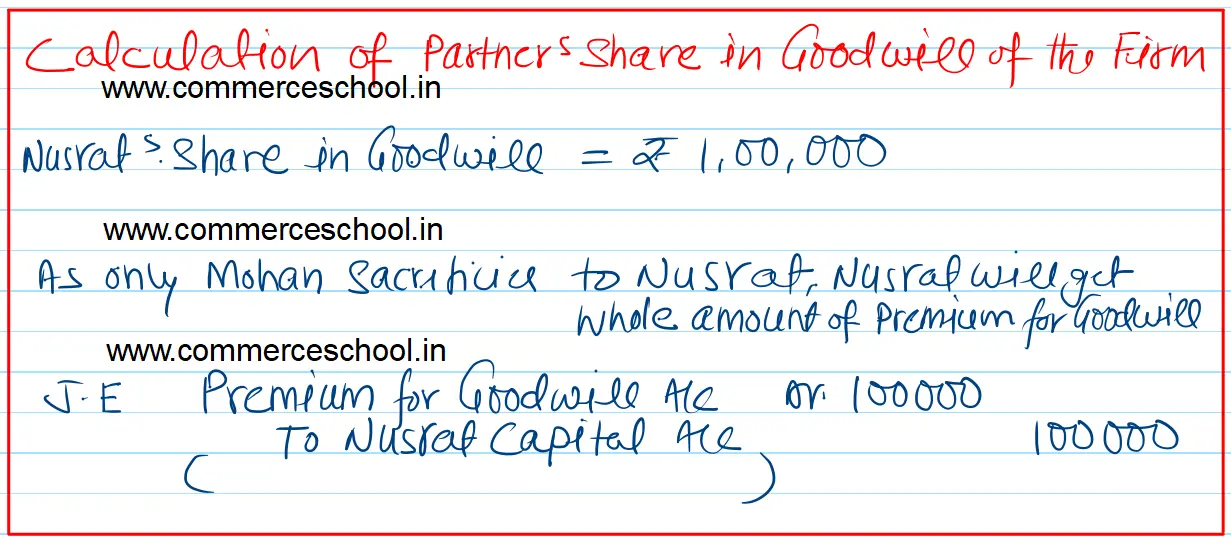

(iv) Nusrat brought in her share of goodwill ₹ 1,00,000 in cash.

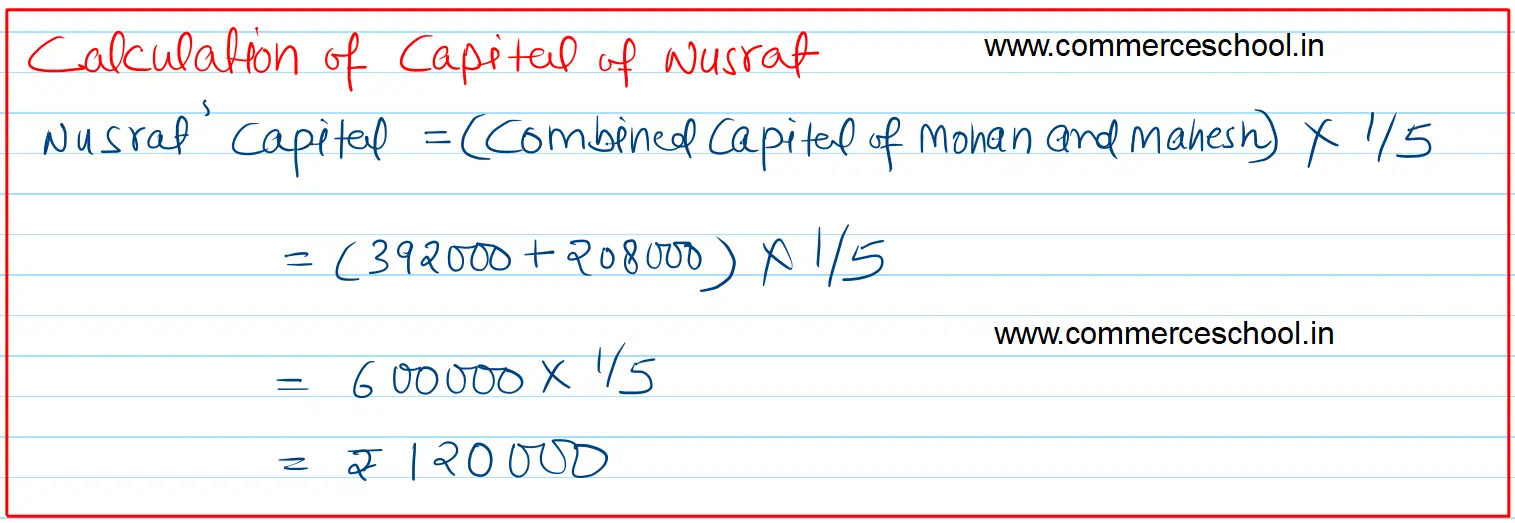

(v) Nusrat was to bring further cash as would make her capital equal to 20% of the combined capital of Mohan and Mahesh after above revaluation and adjustments are carried out.

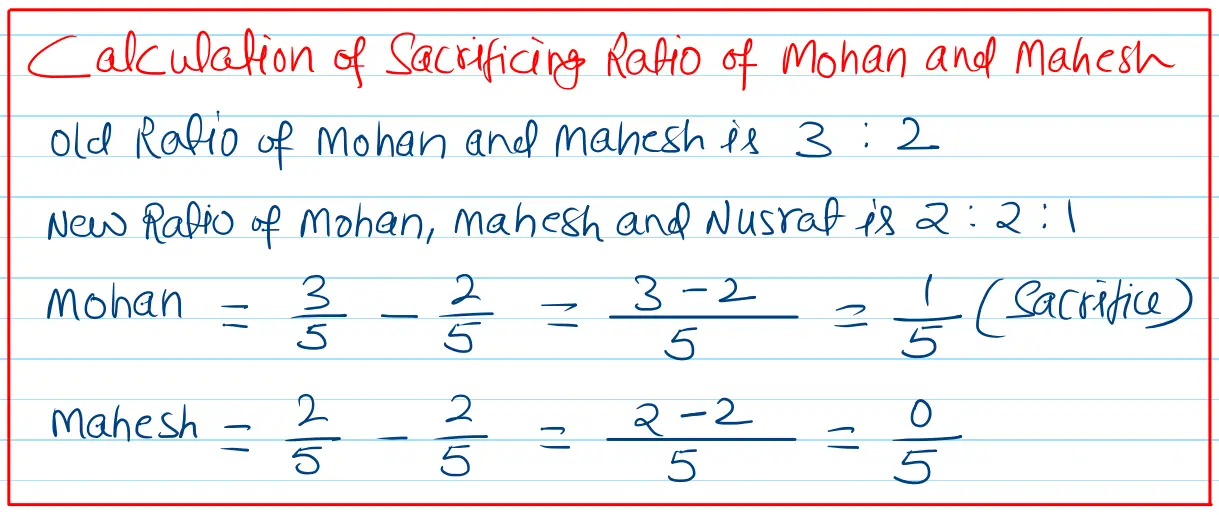

(vi) The future profit sharing ratio will be Mohan 2/5th, Mahesh 2/5th, Nusrat 1/5th.

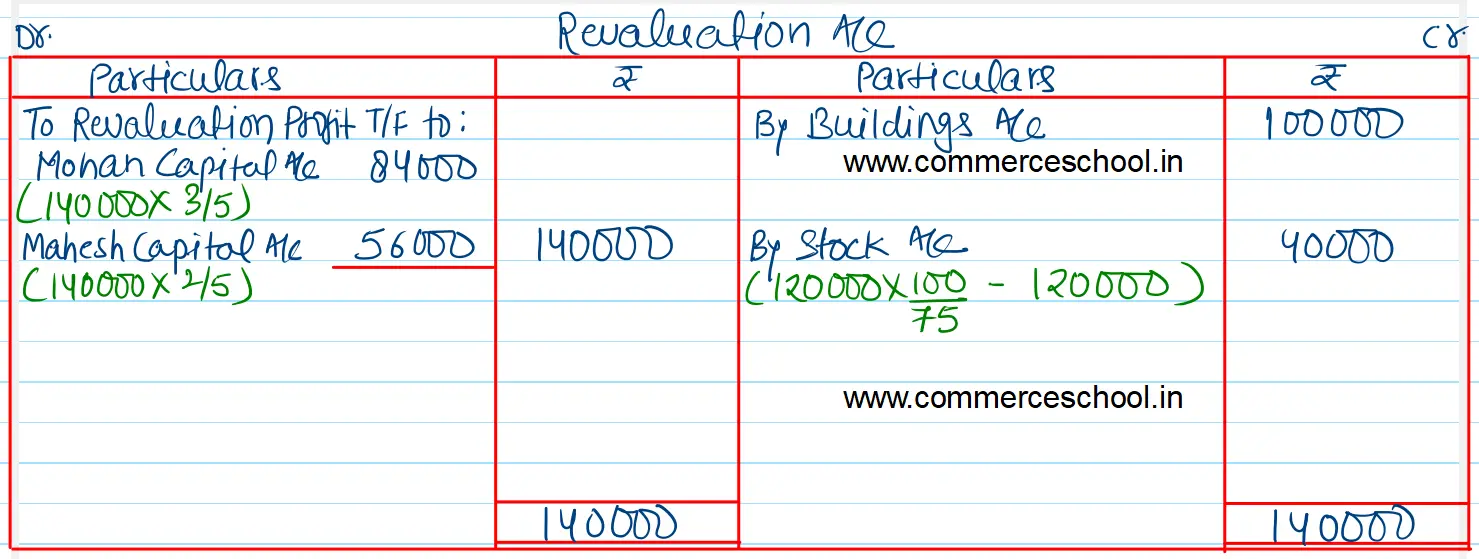

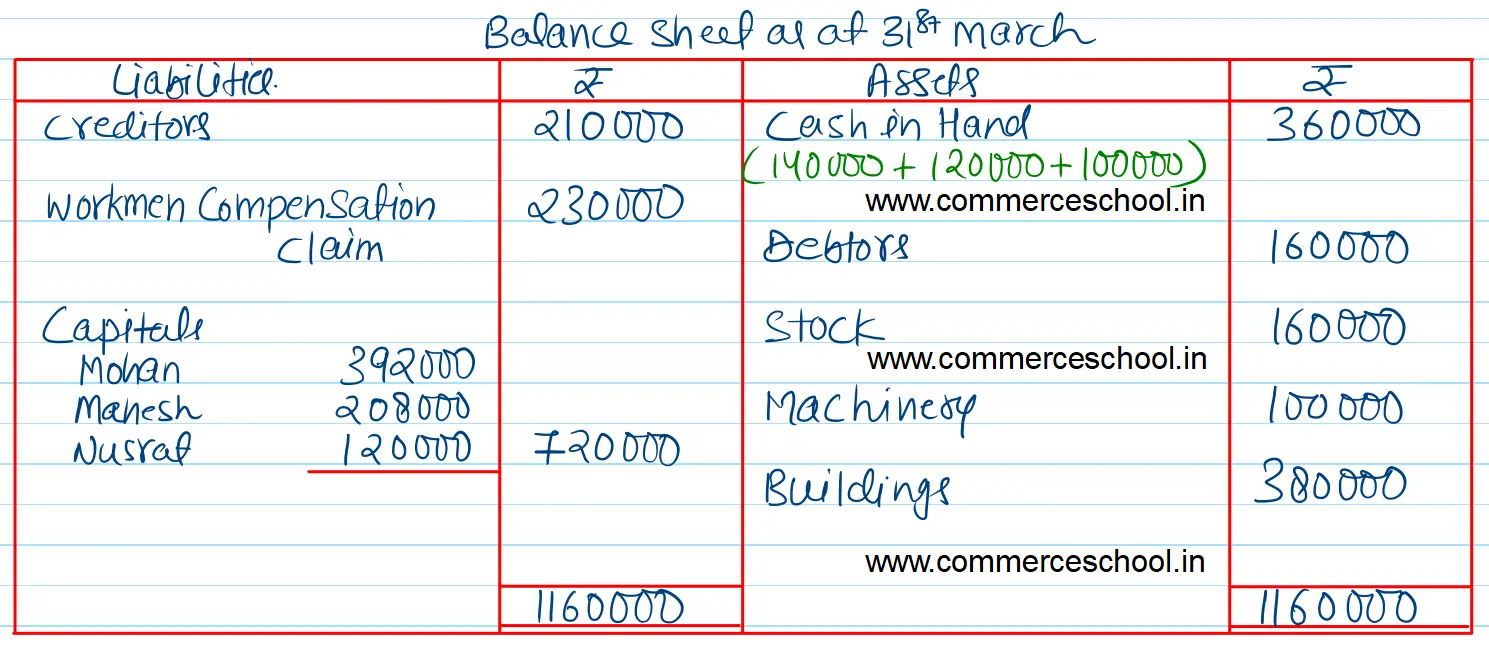

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm. Also show clearly the calculation of capital brought by Nusrat.

[Ans. Gain on Revaluation ₹ 1,40,000; Capital Accounts: Mohan ₹ 3,92,000; Mahesh ₹ 2,08,000; Nusrat ₹ 1,20,000. B/S Total ₹ 11,60,000.]

Balance Sheet of Mohan and Mahesh as at 1st April

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 2,10,000 | Cash in Hand | 1,40,000 |

| Workmen’s Compensation Fund | 2,50,000 | Debtors | 1,60,000 |

| General Reserve | 1,60,000 | Stock | 1,20,000 |

| Capitals: Mohan Mahesh | 1,00,000 80,000 | Machinery | 1,00,000 |

| Building | 2,80,000 | ||

| 8,00,000 | 8,00,000 |

Anurag Pathak Answered question