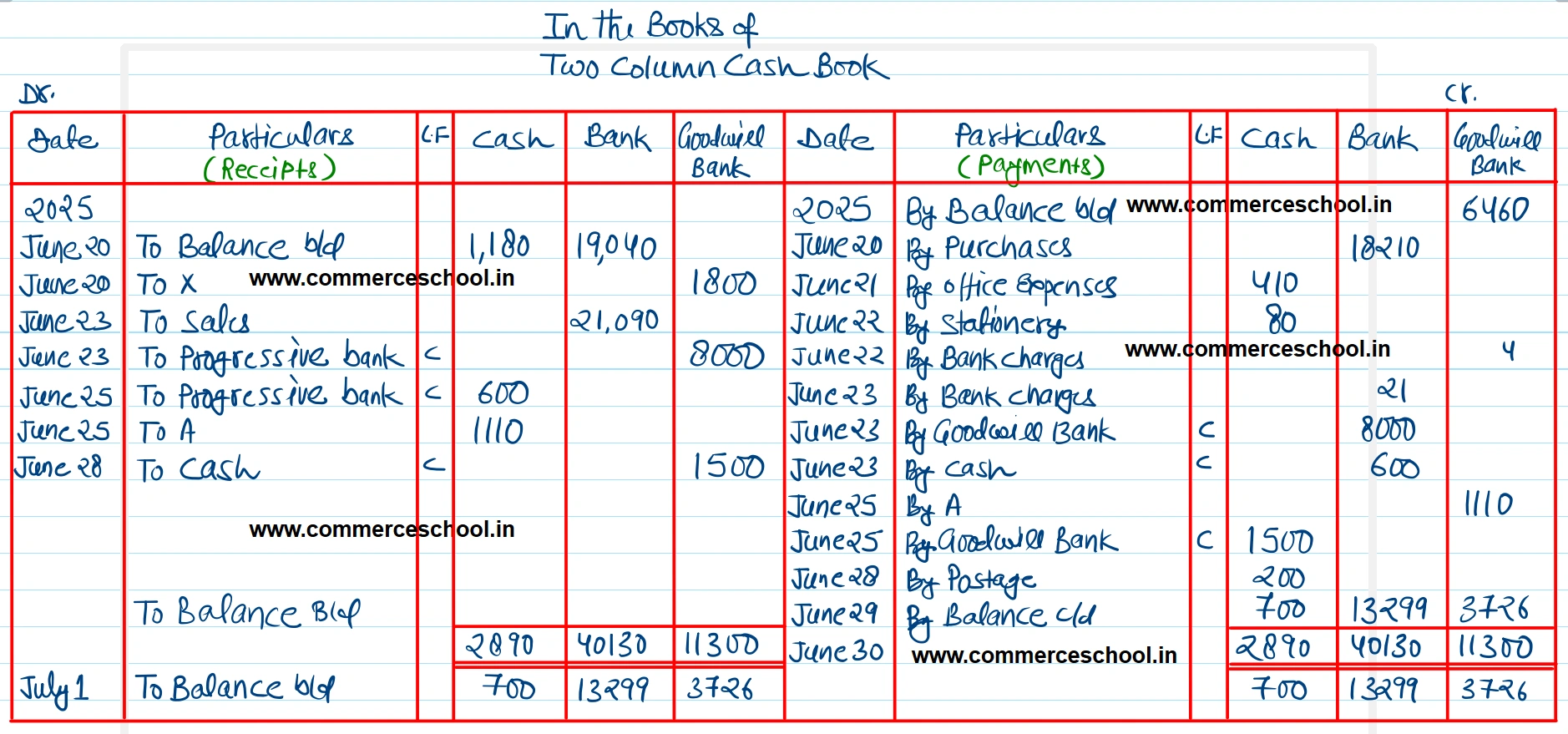

Mr. Lal operates two bank accounts both of which are maintained in the columnar cash book itself. You are required to prepare a proforma of the cahs book, record the following transactions therein and draw the closing balances as on 30th June, 2025

Mr. Lal operates two bank accounts both of which are maintained in the columnar cash book itself. You are required to prepare a proforma of the cahs book, record the following transactions therein and draw the closing balances as on 30th June, 2025:

| 2025 | ₹ |

| June 20 | Opening Balance of Cash – ₹ 1,180 Progressive Bank – ₹ 19,040 Goodwill Bank (Overdraft) – ₹ 6,460 |

| 20 | Received cheque for ₹ 1,800 from a debtor Mr. X and depsited in Goodwill Bank. The Bank credited the amount on 23rd June and debited ₹ 4 as its collection charges. |

| 21 | Purchased goods for ₹ 18,210 and a cheque issued on Progressive Bank. |

| 22 | Paid office expenses ₹ 410 and ₹ 80 for stationery in cash. |

| 23 | Deposited a cheque for ₹ 21,090 being sale proceeds of goods in Progressive Bank. The Bank credited the amount ont he same day and debited ₹ 21 as cheque discounting charges. |

| 23 | A cheque for ₹ 8,000 drawn by Mr. Lal himself on Progressive Bank was desposited in his account with Goodwill Bank. |

| 25 | Cash drawn from the account with Progressive Bank ₹ 600 for office use. |

| 25 | A cheque for ₹ 1,100 received from Mr. A and earlier deposited in Goodwill Bank (on 14th June) was returned unpaid and Bank debited ₹ 10 towards its charges. Mr. Lal received the amount of returned cheque and Bank charges in cash from Mr. A. |

| 28 | Deposited cash ₹ 1,500 in the account with Goodwill Bank. |

| 29 | Purchased postal stamps for ₹ 200 and paid in cash. |

[Ans.Cash in Hand ₹ 700; Balance at Progressive Bank ₹ 13,299; and at Goodwill Bank ₹ 3,726.

Anurag Pathak Changed status to publish