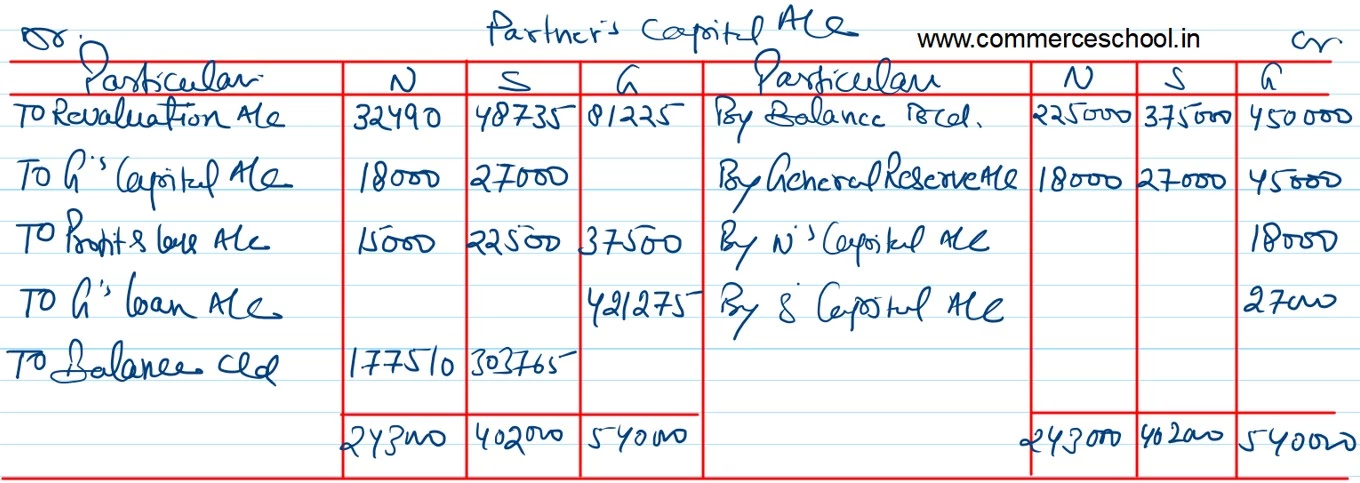

N, S and G were partners in a firm sharing profits and losses in the ratio of 2 : 3 : 5. on 31st March, 2016 their Balance sheet was as under:

N, S and G were partners in a firm sharing profits and losses in the ratio of 2 : 3 : 5. on 31st March, 2016 their Balance sheet was as under:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

General Reserve Capitals: N S G |

1,65,000

90,000 2,25,000 3,75,000 4,50,000 |

Cash

Debtors Stock Machinery Patents Building Profit & Loss Account |

1,35,000

|

1,20,000

1,20,000 1,50,000 4,50,000 90,000 3,00,000 75,000 |

| 13,05,000 | 13,05,000 |

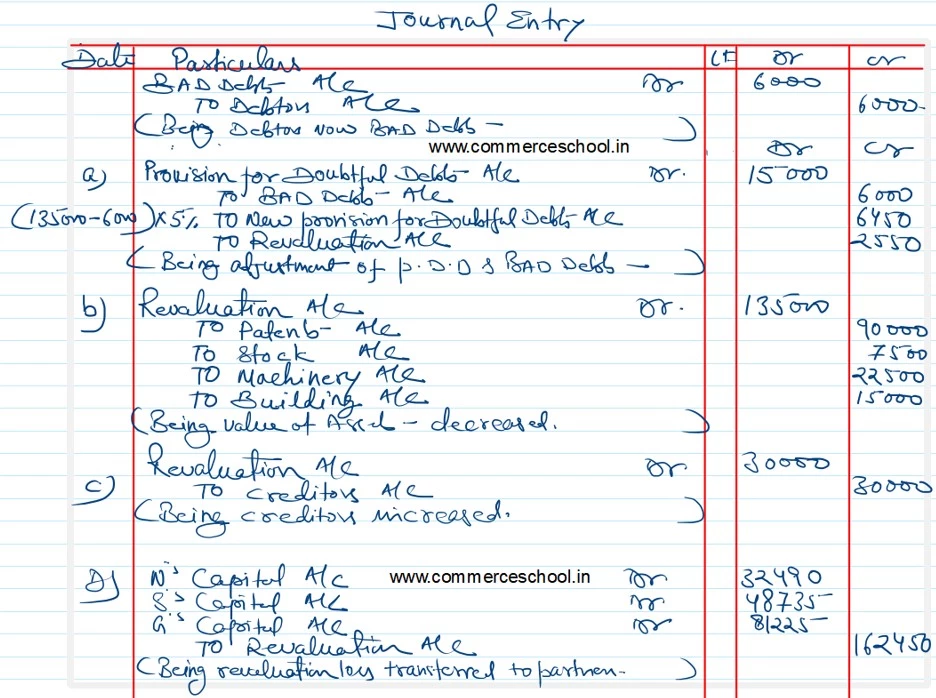

G retired on the above date and it was agreed that:

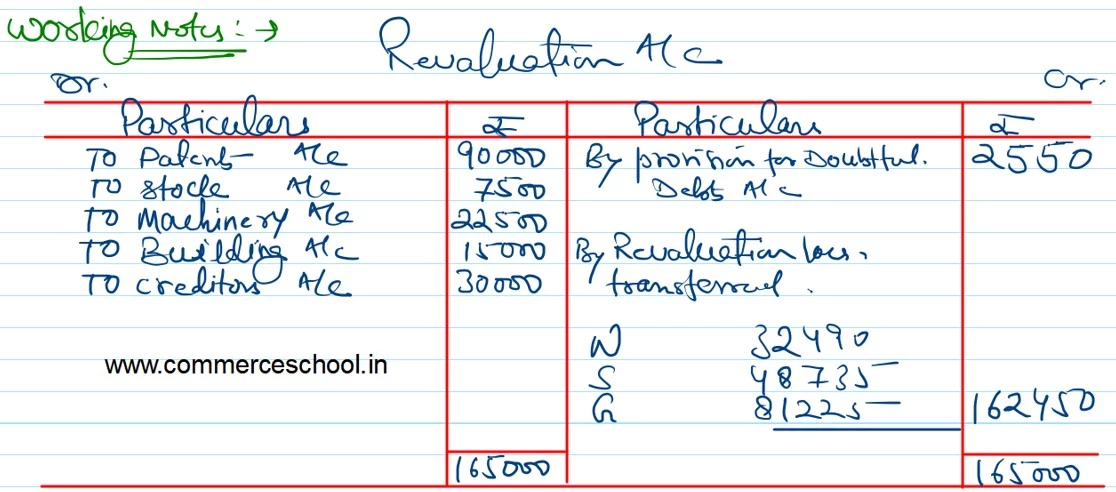

a) Debtors of ₹ 6,000 will be written off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

b) Patents will be completely written off and stock, machinery and building will be depreciated by 5%.

c) An unrecorded creditor of ₹ 30,000 will be taken into account.

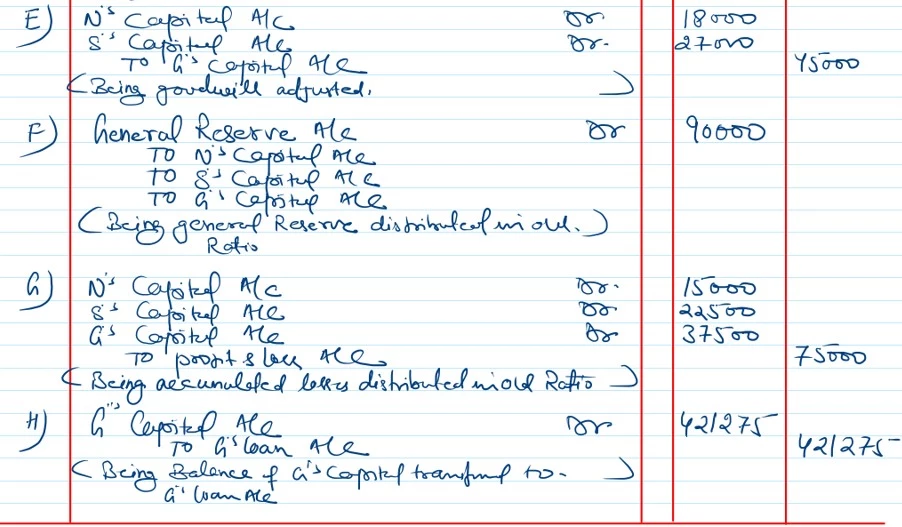

d) N and S will share the future profits in 2 : 3 ratio.

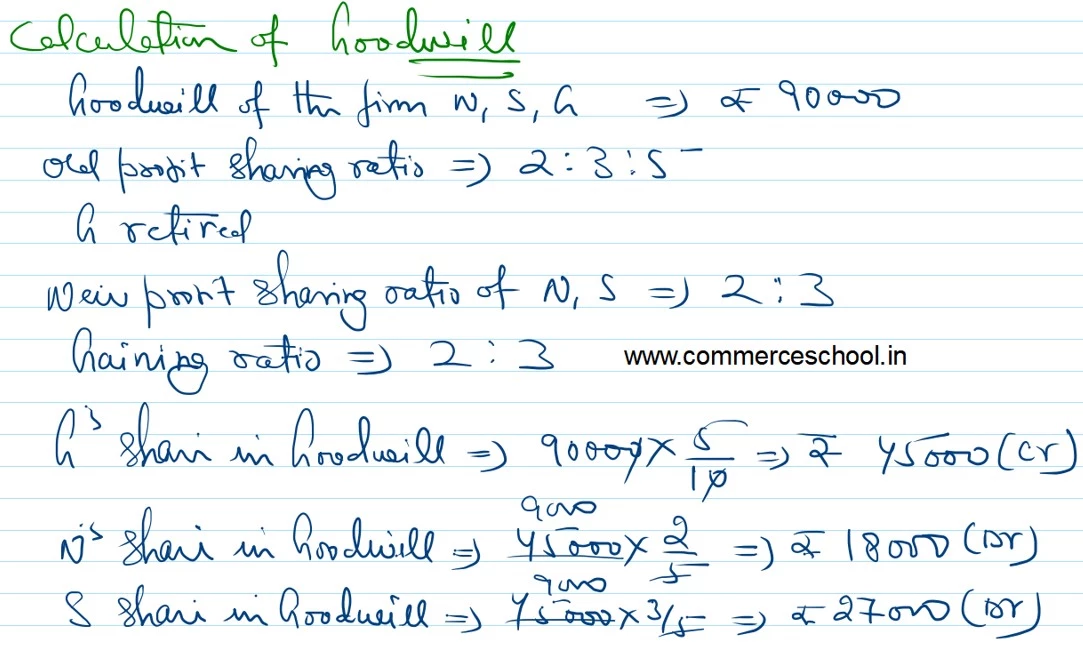

e) Goodwill of the firm on G’s retirement was valued at ₹ 90,000.

Pass necessary Journal entries for the abvoe transactions in the books of the firm on G’s retirement.