Neha and Tara are partners in a firm sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet on 31st March, 2012, stood as follows:

Neha and Tara are partners in a firm sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet on 31st March, 2012, stood as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/cs:

Neha Tara General Reserve Workmen Compensation Fund Creditors |

8,000 10,000 12,000 5,000 15,000 |

Plant and Machinery

Land and Building Debtors Stock Cash |

19,000 |

12,000 14,000 15,000 6,000 3,000 |

| 50,000 | 50,000 |

They agreed to admit Prachi into partnership for 1/5th share of profits on 1st April, 2012, on the following terms:

(a) All debtors to be considered as good and therefore the provision for doubtful debts to be written back.

(b) Value and Land and Building to be increased to ₹ 18,000.

(c) Value and Plant and Machinery to be reduced by ₹ 2,000.

(d) The liability against Workmen Compensation Fund is determined at ₹ 2,000 which is to be paid later in the year.

(e) Prachi to bring in her share of Goodwill of ₹ 10,000 in cash.

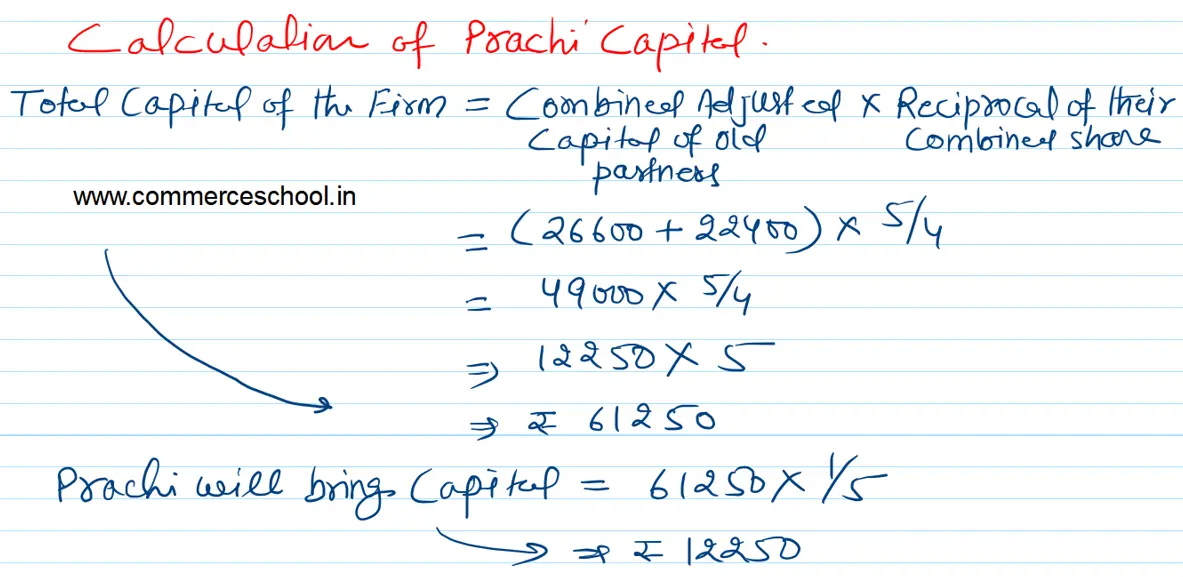

(f) She will further bring in cash so as to make her capital equal to 20% of the total capital of the new firm. (Show your workings clearly)

You are required to prepare:

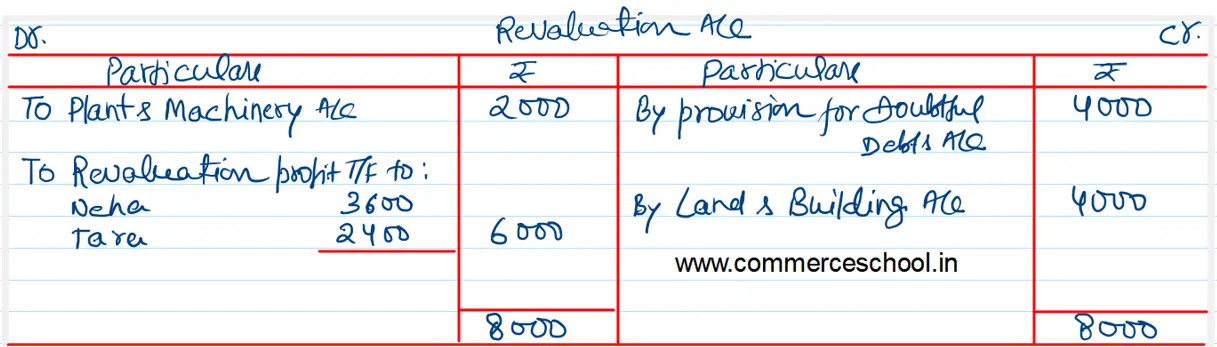

(i) Revaluation Account,

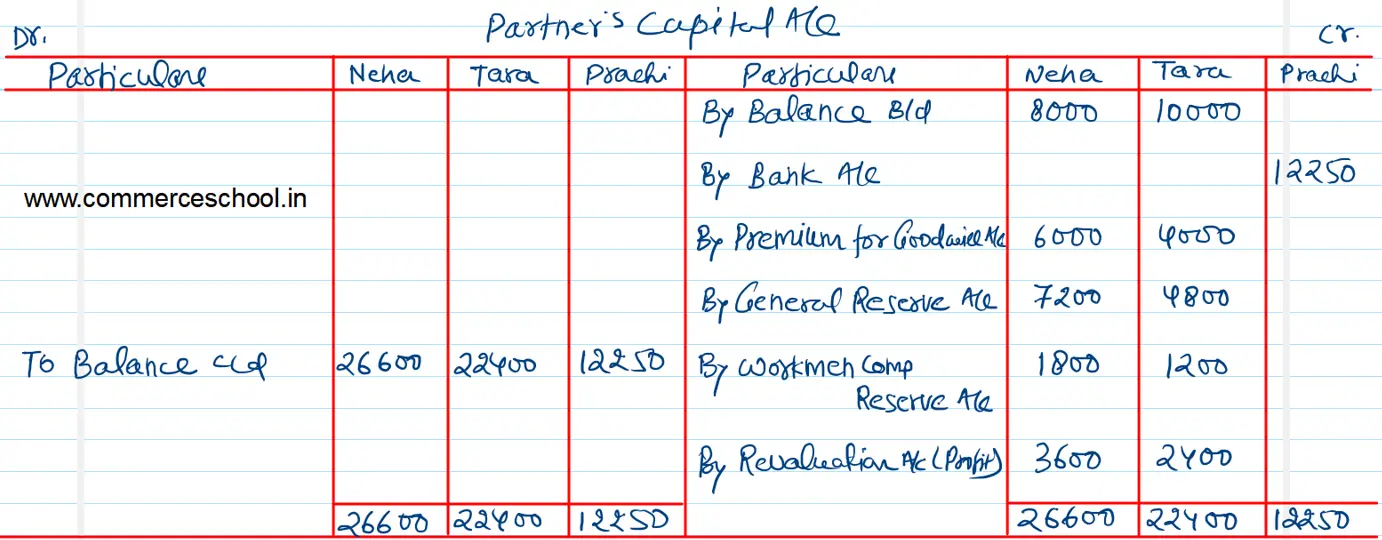

(ii) Partner’s Capital Accounts and

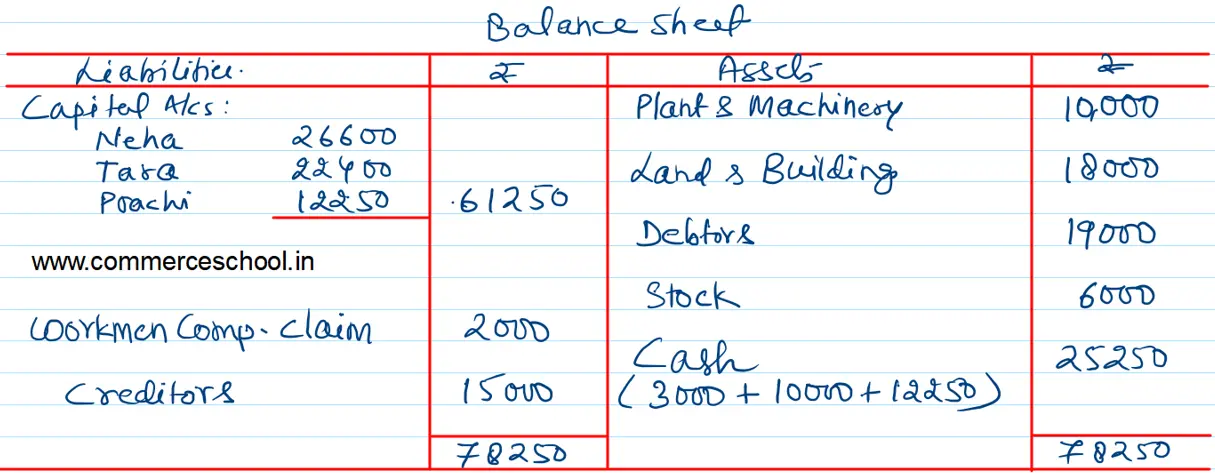

(iii) Balance Sheet of the Reconstituted firm.