Nem and Khem sharing profits in the ratio of 3 : 2 admit Prem as a partner with 1/3 share in profits. He had to contribute proportionate capital. They had following financial position

Nem and Khem sharing profits in the ratio of 3 : 2 admit Prem as a partner with 1/3 share in profits. He had to contribute proportionate capital. They had following financial position:

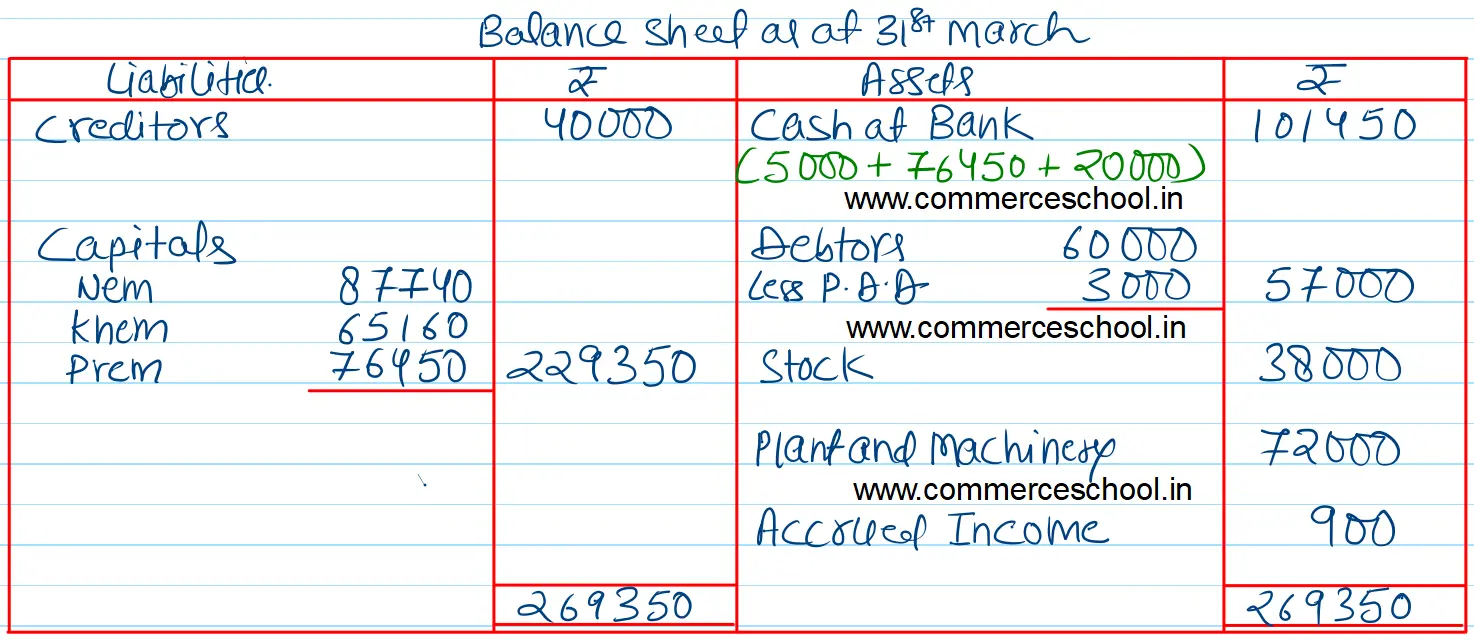

Balance Sheet as at 31st March

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 40,000 | Cash at Bank | 5,000 |

| Reserve Fund | 50,000 | Debtors | 60,000 |

| Capitals: Nem Khem |

50,000 40,000 |

Stock | 35,000 |

| Plant and Machinery | 80,000 | ||

| 1,80,000 | 1,80,000 |

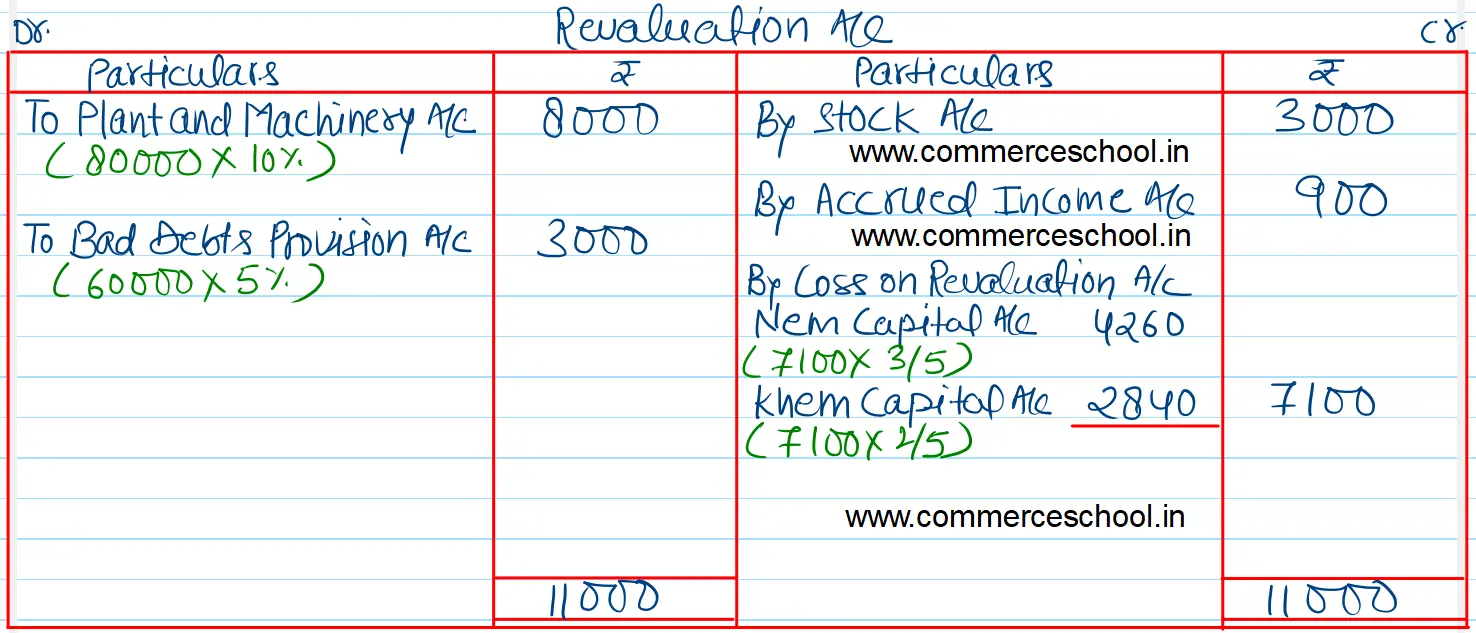

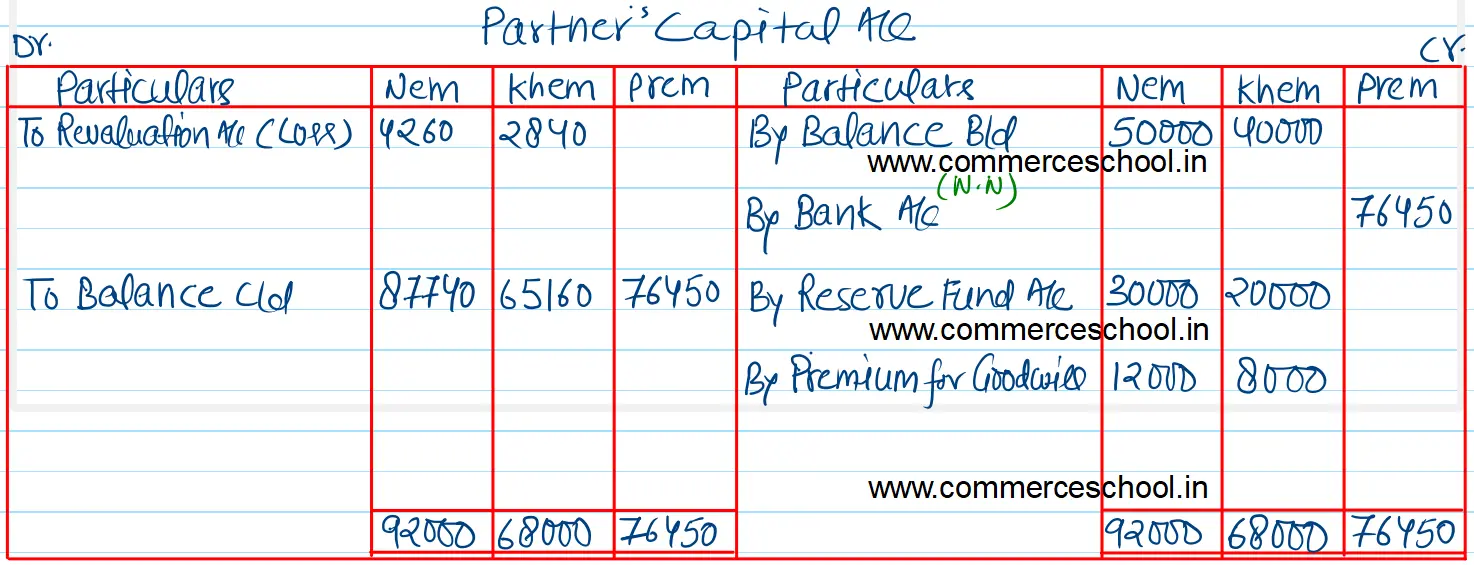

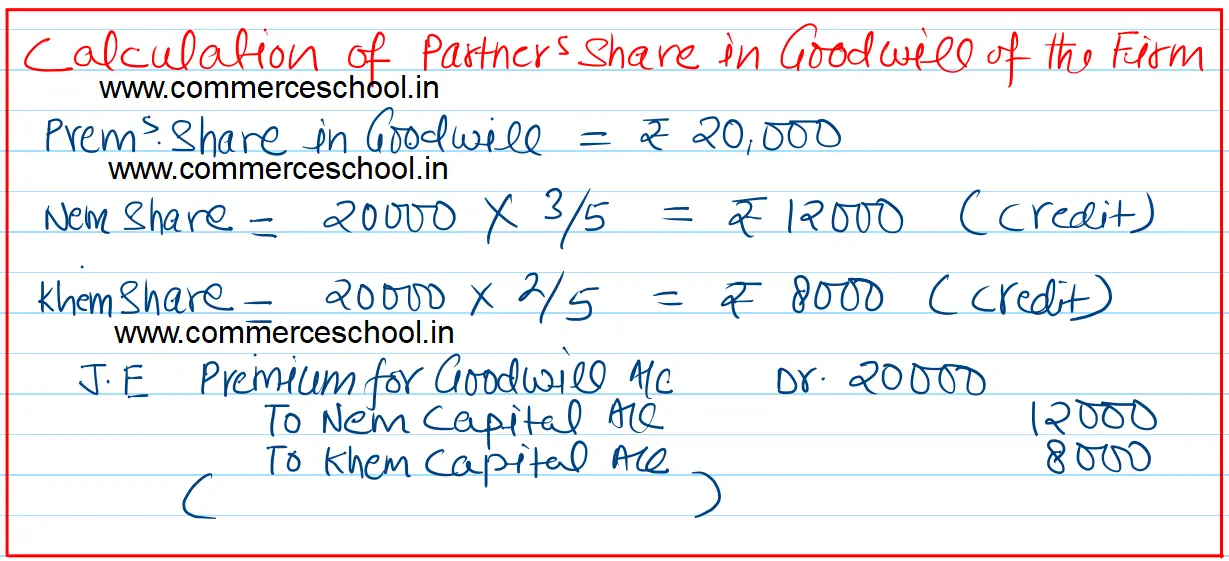

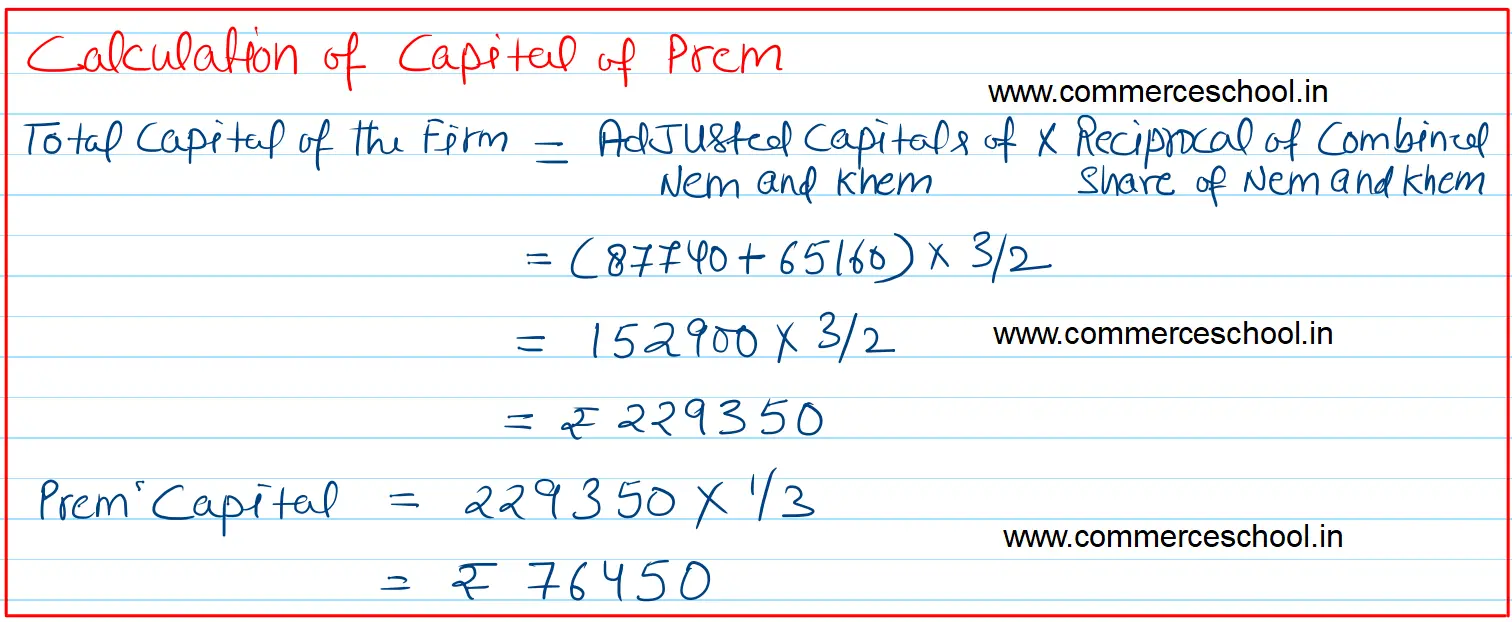

They agreed to admit Prem as a partner on the following terms: (i) Plant and Machinery to be reduced by 10%. (ii) Stock to be increased by ₹ 3,000. (iii) Bad debts provision was to be created at 5%. (iv) Accrued incomes not appearing in the books ₹ 900. (v) Prem was to introduce ₹ 20,000 as premium for goodwill for 1/3rd share of the future profits of the firm. Prepare Profit and Loss Adjustment Account, Capital Accounts and Balance Sheet of the new firm. Also calculate new profit sharing ratio. [Ans. Loss on Revaluation ₹ 7,100; Capital Accounts : Nem ₹ 87,740; Khem ₹ 65,160 and Prem ₹ 76,450; Bank Balance ₹ 1,01,450; and Balance Sheet Total ₹ 2,69,350. New Profit sharing ratio 6 : 4 : 5.]