Om, Ram and Shanti were partners in a firm sharing profits in the ratio of 3 : 2 : 1. On 1st April, 2014 their Balance Sheet was as follows:

Om, Ram and Shanti were partners in a firm sharing profits in the ratio of 3 : 2 : 1. On 1st April, 2014 their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

|

Capital Accounts: Om Ram Shanti General Reserve Creditors Bills Payable |

3,58,000 3,00,000 2,62,000 48,000 1,60,000 90,000 |

Land and Building Plant and Machinery Furniture Bills Receivables Sundry Debtors Stock Bank |

3,64,000 2,95,000 2,33,000 38,000 90,000 1,11,000 87,000 |

| 12,18,000 | 12,18,000 |

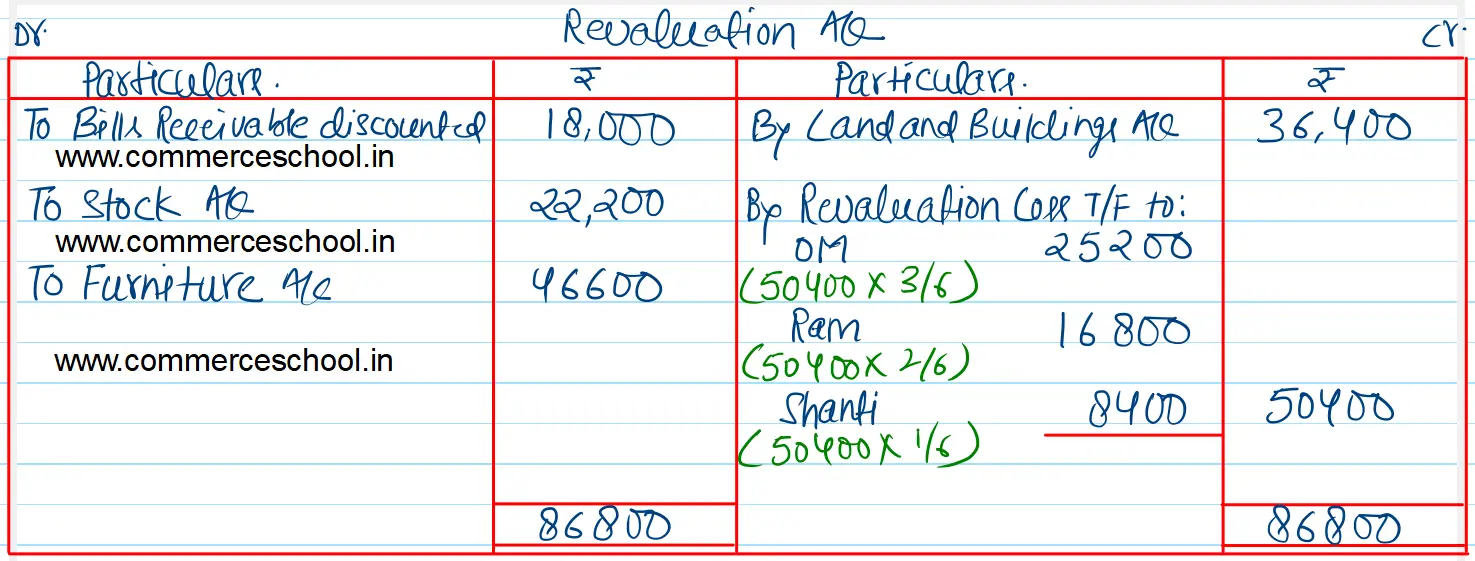

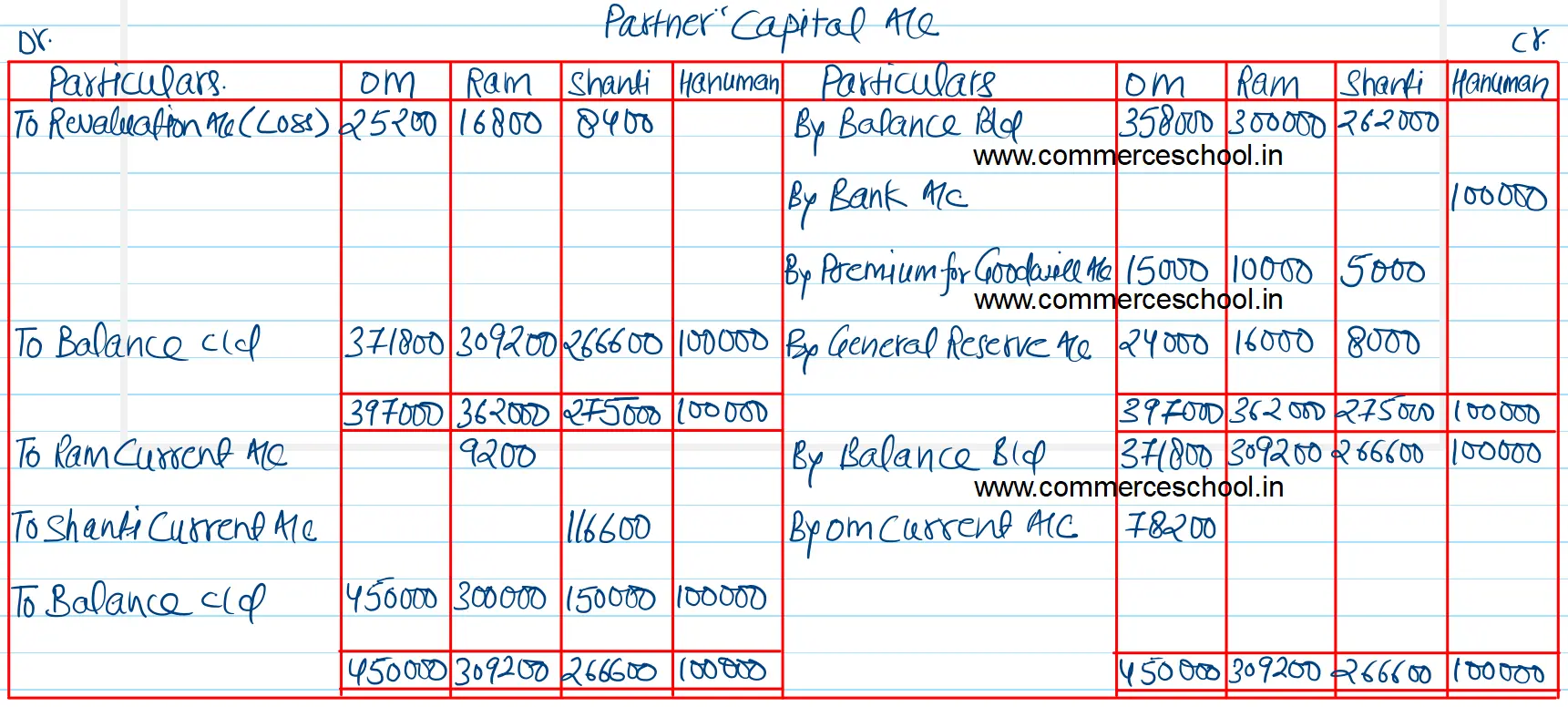

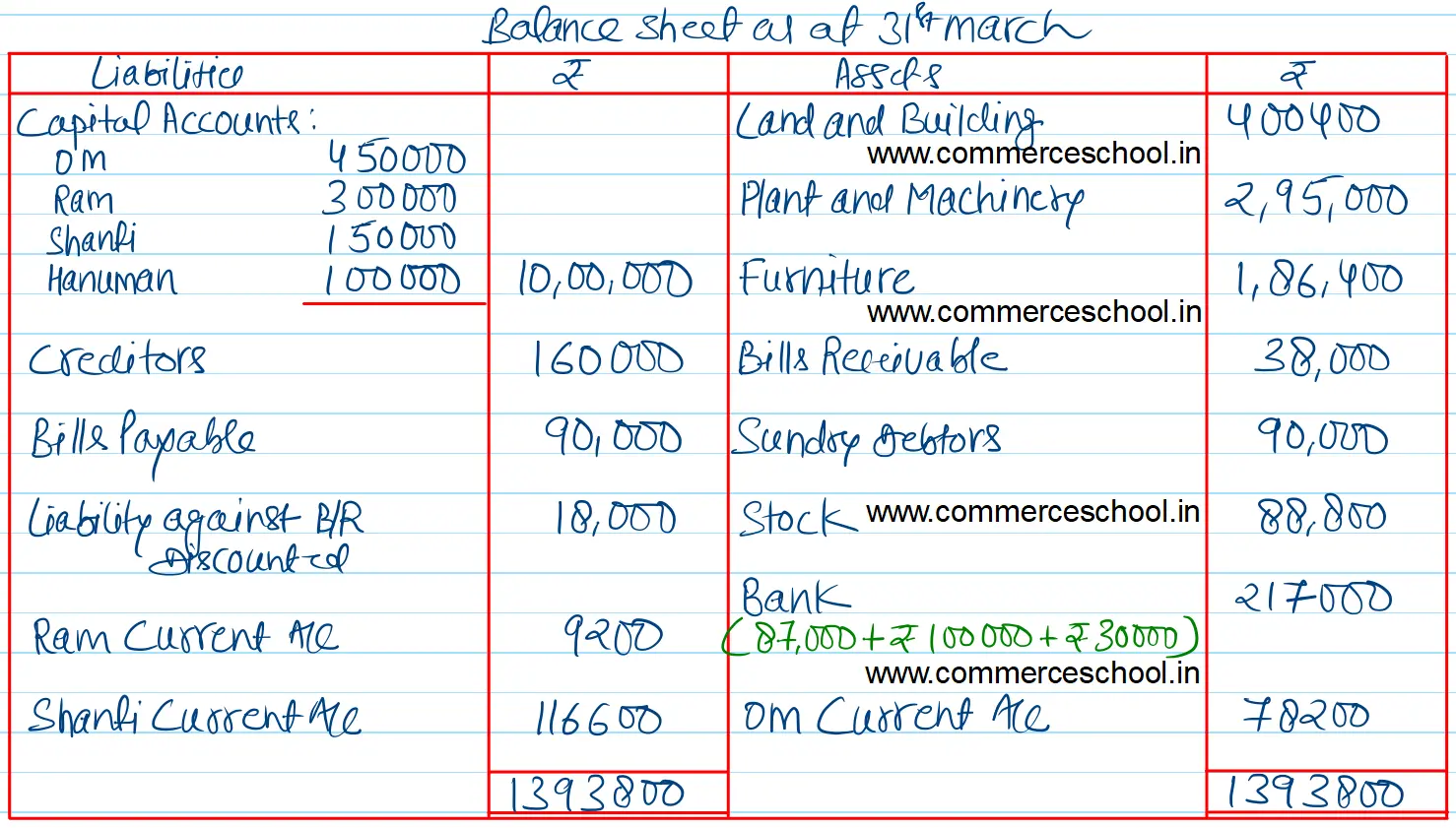

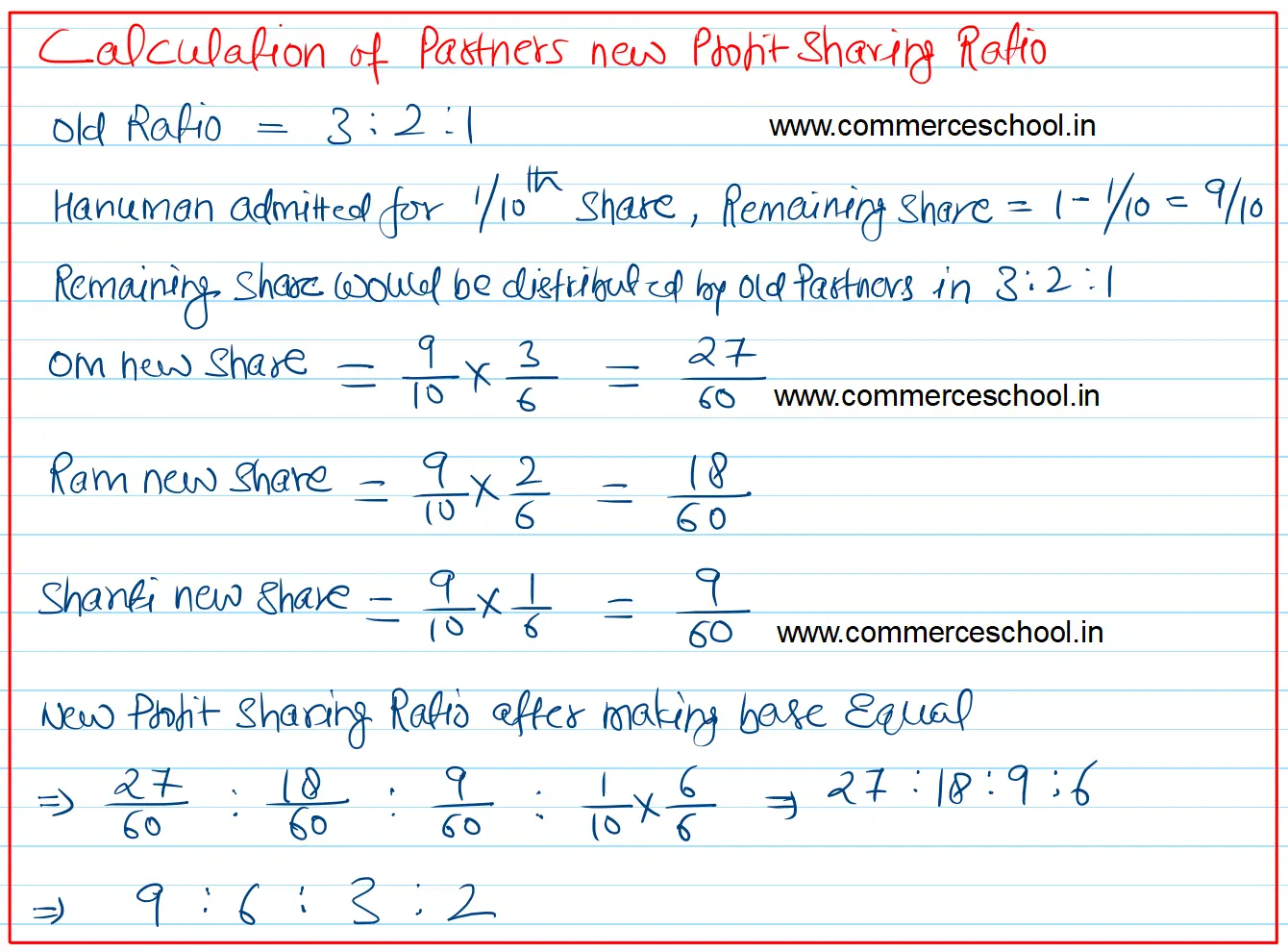

On the above date Hanuman was admitted on the following terms: (i) He will bring ₹ 1,00,000 for his capital and will get 1/10th share in the profits. (ii) He will bring necessary cash for his share of goodwill premium. The goodwill of the firm was valued at ₹ 3,00,000. (iii) A liability of ₹ 18,000 will be created against bills receivables discounted. (iv) The value of stock and furniture will be reduced by 20%. (v) The value of land and building will be increased by 10%. (vi) Capital accounts of the partners will be adjusted on the basis of Hanuman’s Capital in their profit sharing raito by opening current accounts. Prepare Revaluation Account and Partner’s Capital Accounts. [Ans: Loss on Revaluation ₹ 50,400; Capital Accounts Om ₹ 4,50,000; Ram ₹ 3,00,000; Shanti ₹ 1,50,000 and Hanuman ₹ 1,00,000; Om’s Current A/c ₹ 78,200 (Dr.) Ram’s Current A/c ₹ 9,200 (Cr.); Shanti’s Current A/c ₹ 1,16,600 (Cr.).]