On 1st April 2013, Jay and Vijay entered into a partnership for supplying laboratory equipments to government schools situated in remote and backward areas

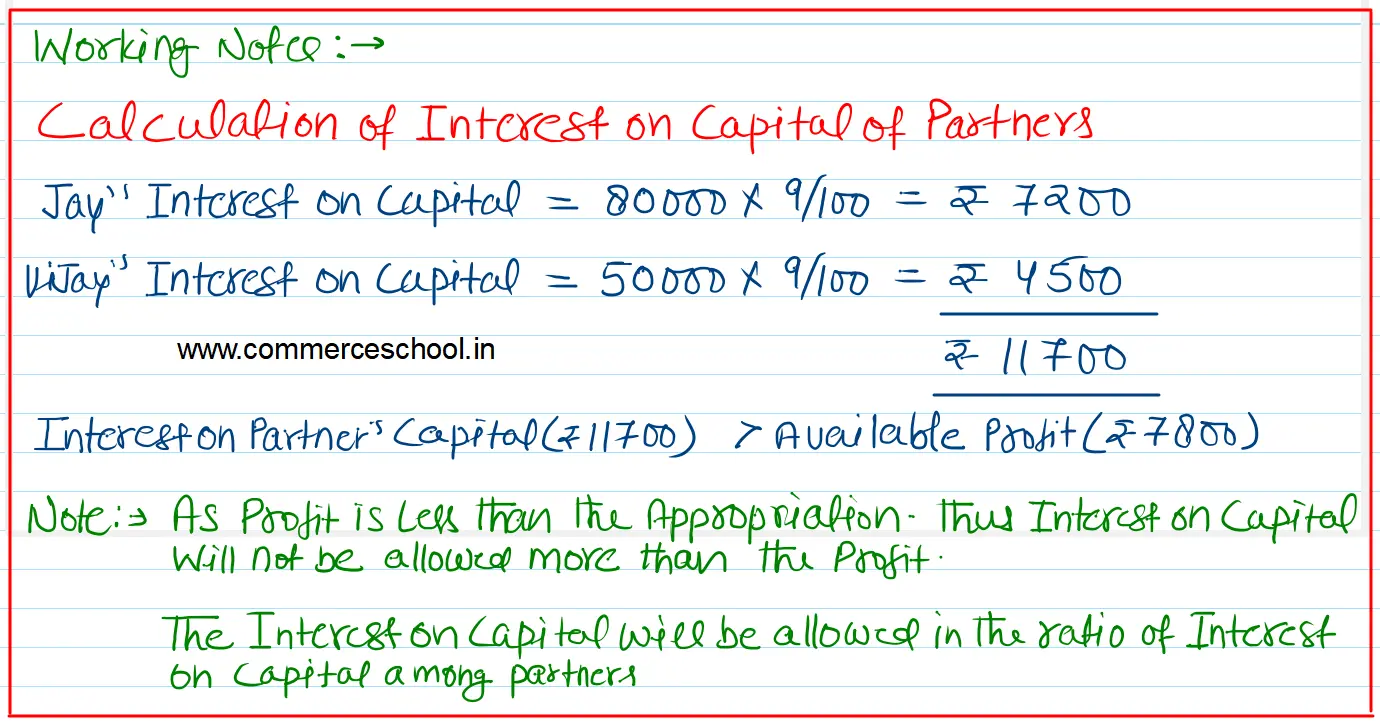

On 1st April 2013, Jay and Vijay entered into a partnership for supplying laboratory equipments to government schools situated in remote and backward areas. They contributed capitals of ₹ 80,000 and ₹ 50,000 respectively and agreed to share the profits in the ratio of 3 : 2. The Partnership Deed provided that interest on capital shall be allowed at 9% per annum. During the year the firm earned a profit of ₹ 7,800.

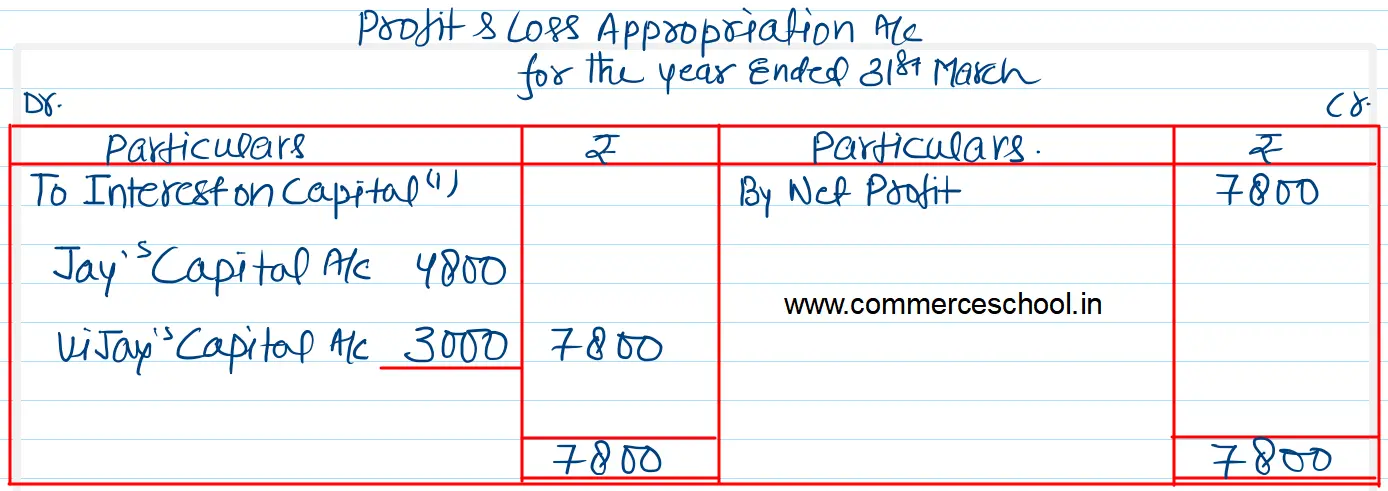

Showing your calculations clearly, prepare the ‘Profit and Loss Appropriation Account’ of Jay and Vijay for the year ended 31st March, 2014.

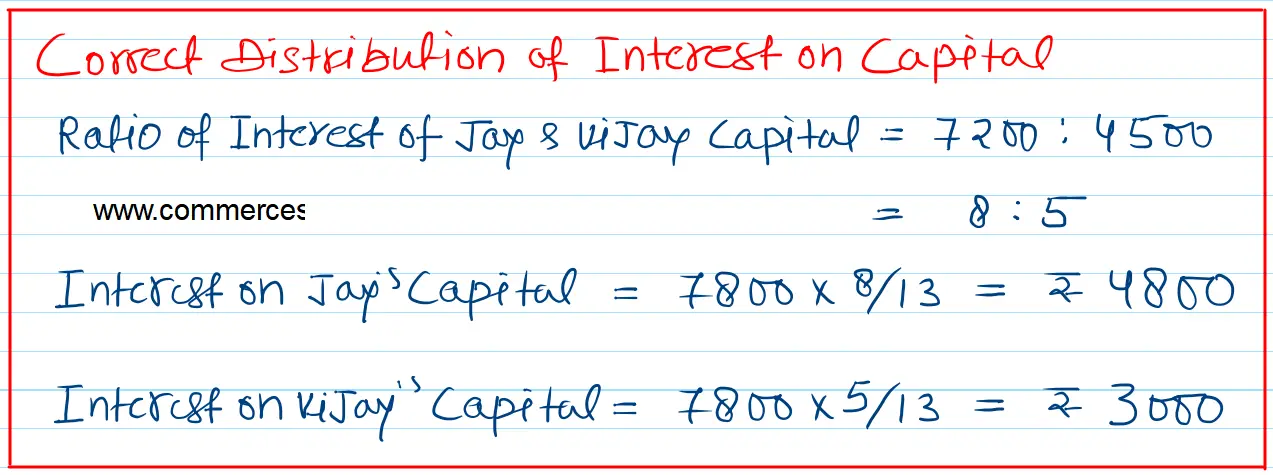

[Ans: Interest on Capital: Jay – ₹ 4,800; Vijay – ₹ 3,000]

[Hint: Since the amount of net profit is less than the total amount of interest on Capital, i.e., ₹ 7,200 (Jay) + ₹ 4,500 (Vijay) = ₹ 11,700, the net profit has been distributed in the ratio of interest claims of Jay and Vijay, i.e., ₹ 7,200 : ₹ 4,500 or 8 : 5.]