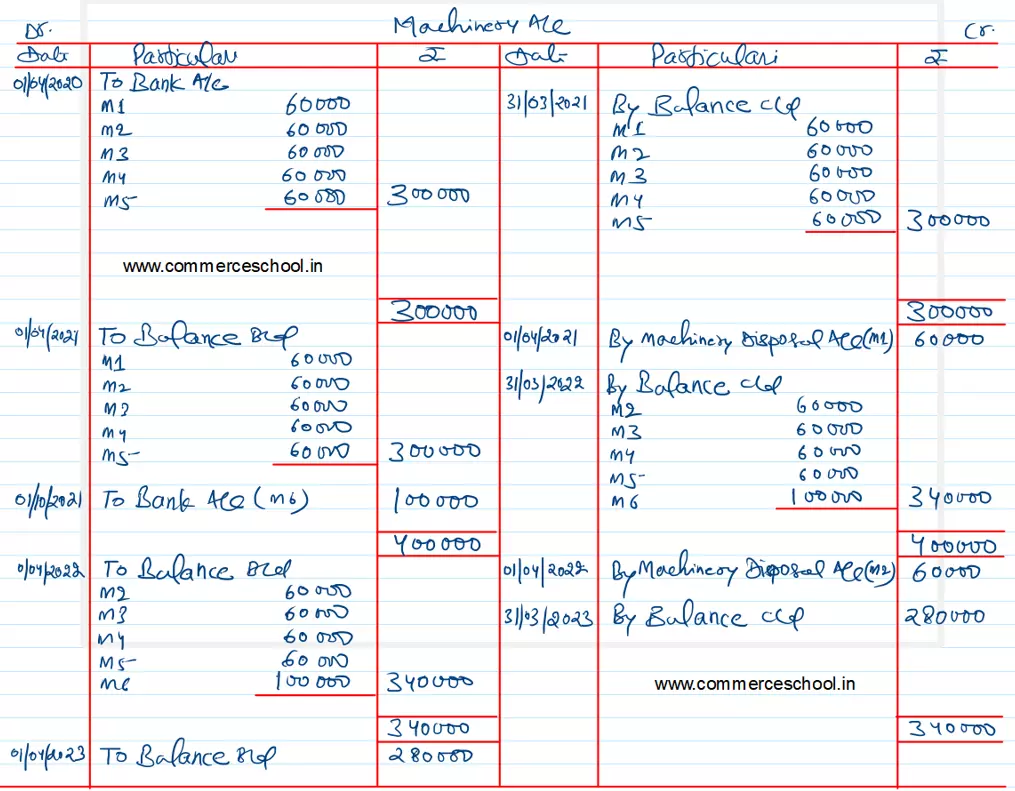

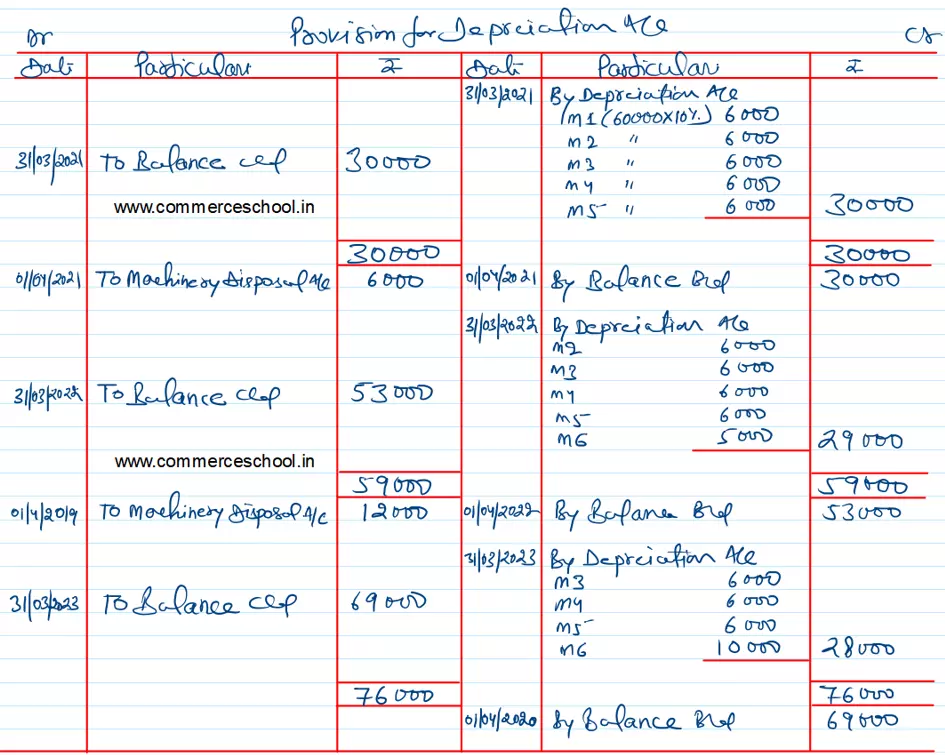

On 1st April, 2020, Amit Kumar purchased five machines for ₹ 60,000 each. Depreciation @ 10% p.a. on initial cost has been charged from the Profit & Loss Account and credited to Provision for Depreciation Account

On 1st April, 2020, Amit Kumar purchased five machines for ₹ 60,000 each. Depreciation @ 10% p.a. on initial cost has been charged from the Profit & Loss Account and credited to Provision for Depreciation Account.

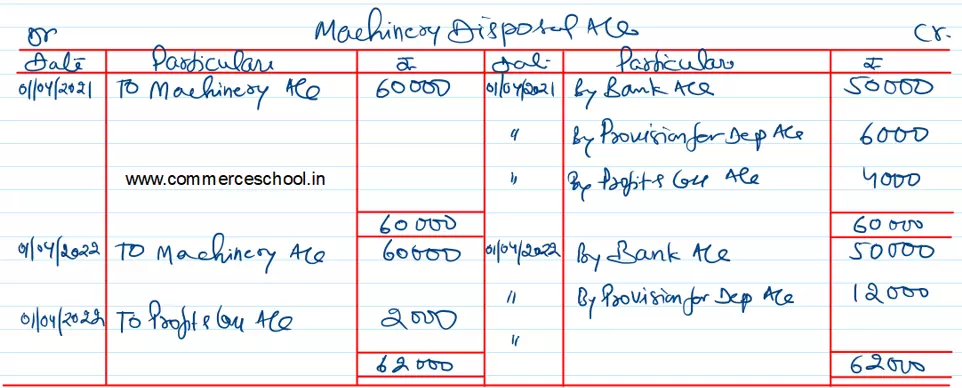

On 1st April, 2021, one machine was sold for ₹ 50,000 and on 1st April, 2022 another machine was sold for ₹ 50,000. An improved model costing ₹ 1,00,000 was purchased on 1st October, 2021. Amit Kumar closes his books on 31st March each year.

You are required to show: (i) Machinery Account; (ii) Machinery Disposal Account and (iii) Provision for Depreciation Account for the period of three accounting years ended 31st March, 2023.

Anurag Pathak Changed status to publish