On 1st April 2020, Banglore Silk Ltd. purchased a machinery for ₹ 20,00,000. It provides depreciation at 10% p.a. on the Written Down Value Method and closes its books on 31st March ever year

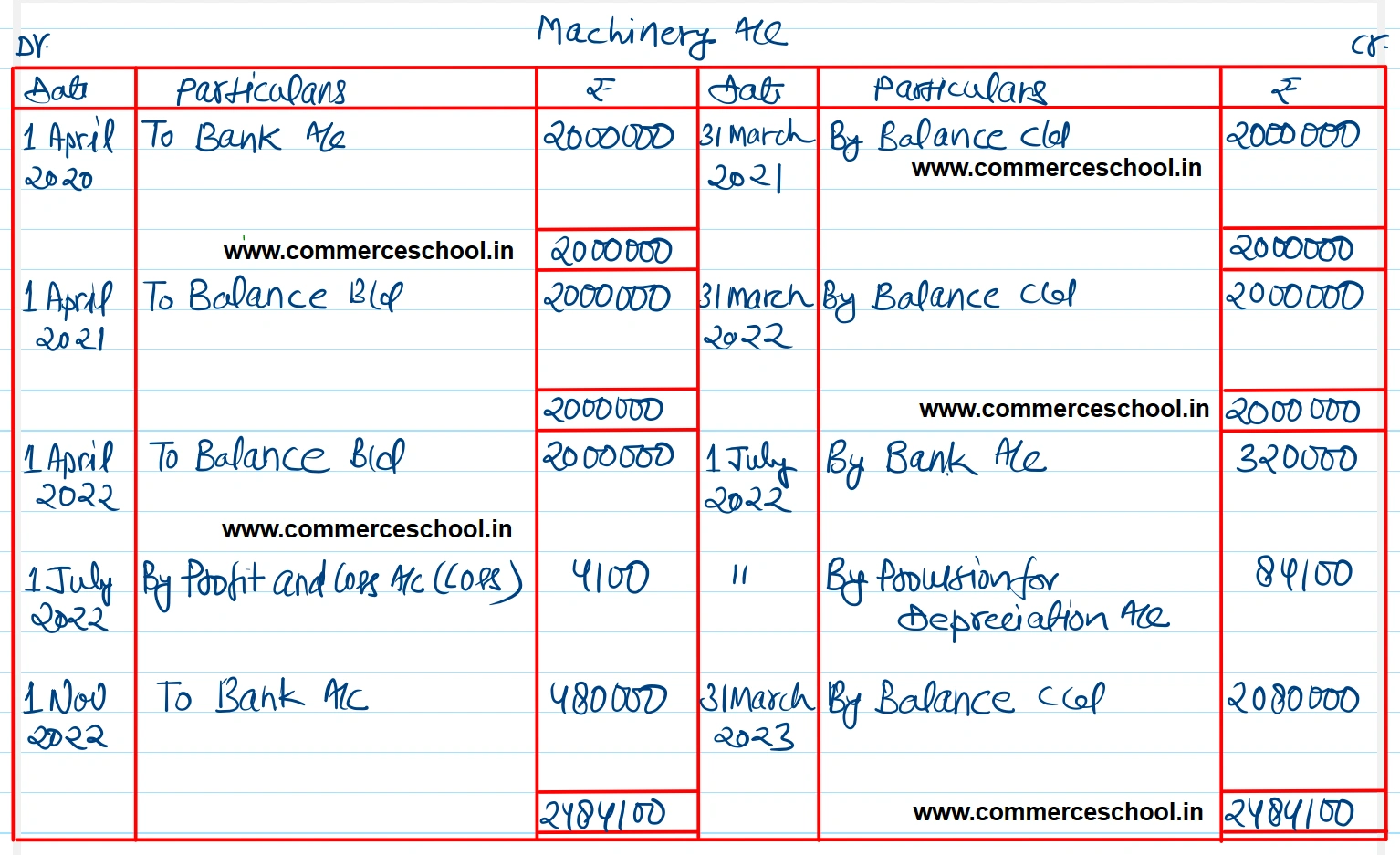

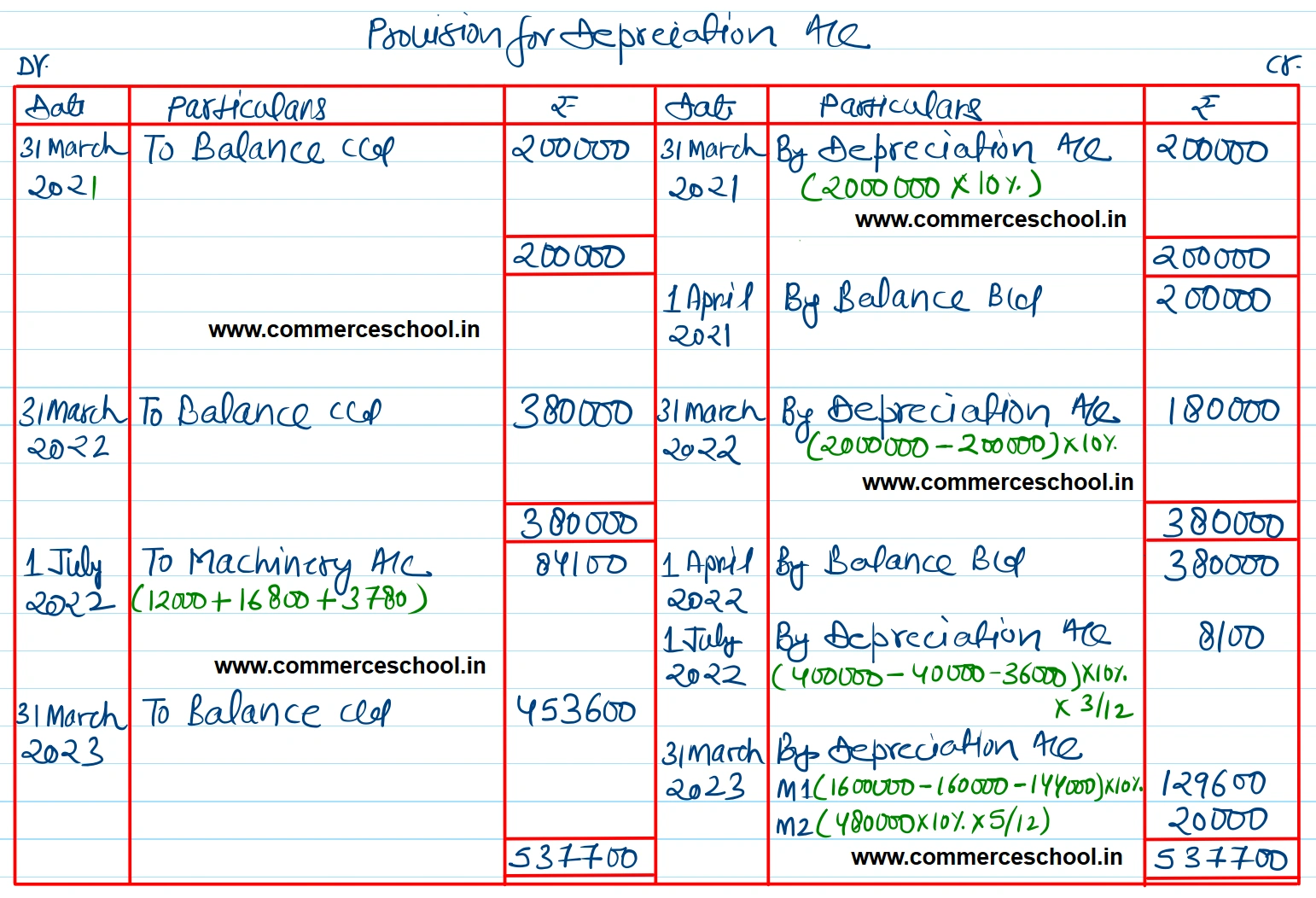

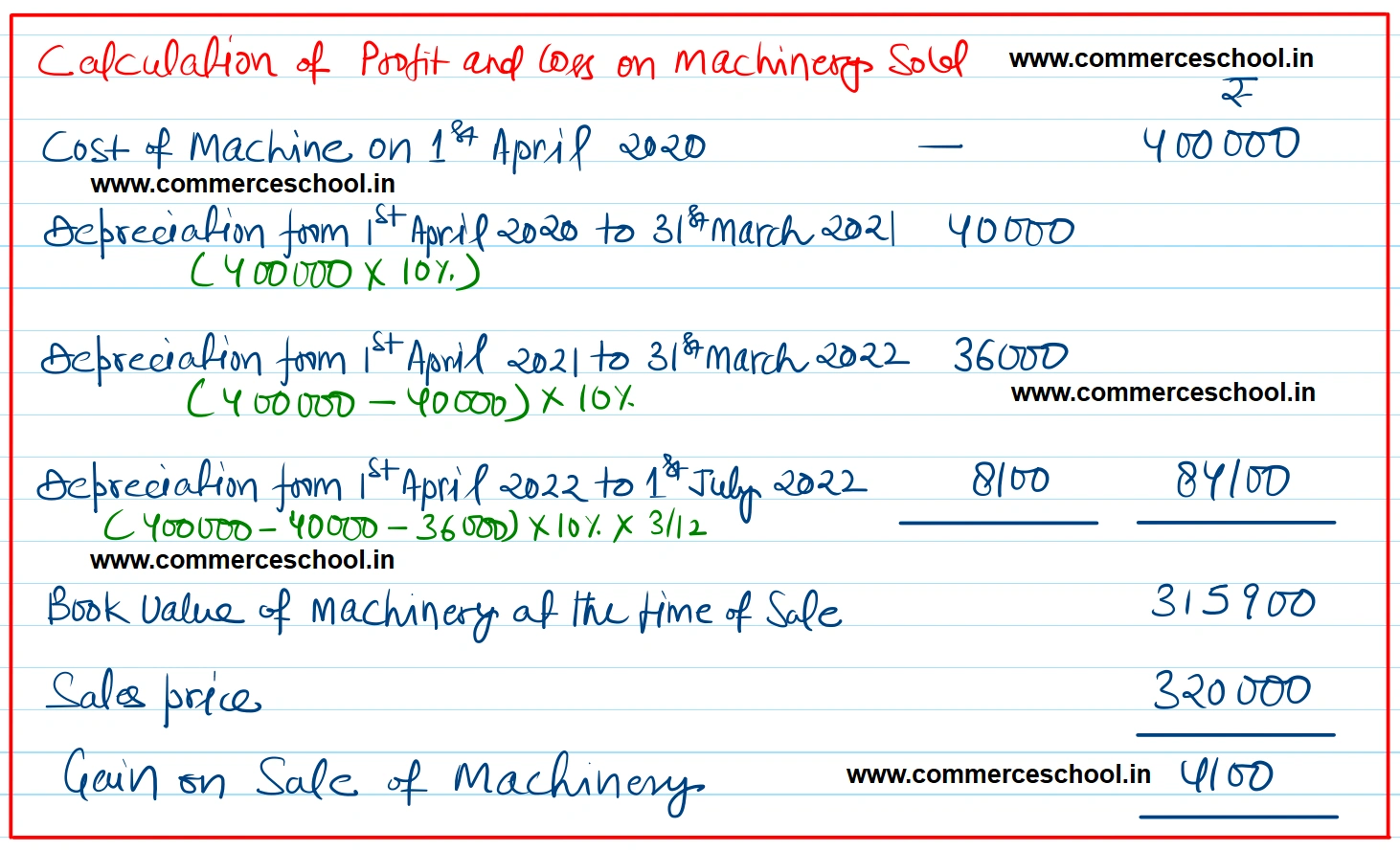

On 1st April 2020, Banglore Silk Ltd. purchased a machinery for ₹ 20,00,000. It provides depreciation at 10% p.a. on the Written Down Value Method and closes its books on 31st March ever year. On 1st July 2022, a part of the machinery purchased on 1st April 2020 for ₹ 4,00,000 was sold for ₹ 3,20,000. On 1st November 2022, a new machinery was purchased for ₹ 4,80,000. You are required to prepare Machinery Account, Depreciation Account and Provision for Depreciation Account for three years ending 31st March 2023.

[Ans. Balance of Machinery A/c on 31st March 2023 ₹ 20,80,000; Balance of Provision for Depreciation A/c on 31st March 2023 ₹ 4,53,600; Gain on sale of Machinery ₹ 4,100.]

Anurag Pathak Answered question