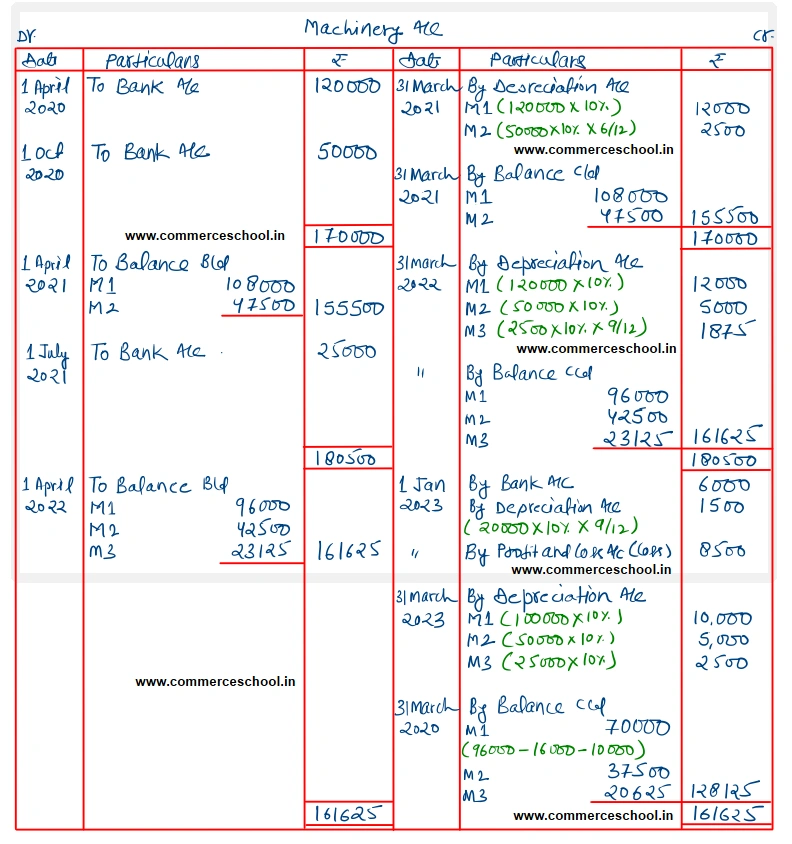

On 1st April, 2020, Plant and Machinery was purchased for ₹ 1,20,000. New machinery was purchased on 1st Oct., 2020, for ₹ 50,000 and on 1st July, 2021, for ₹ 25,000

On 1st April, 2020, Plant and Machinery was purchased for ₹ 1,20,000. New machinery was purchased on 1st Oct., 2020, for ₹ 50,000 and on 1st July, 2021, for ₹ 25,000. Expenses on Repairs and Renewals incurred on 1st April, 2022 were ₹ 5,000.

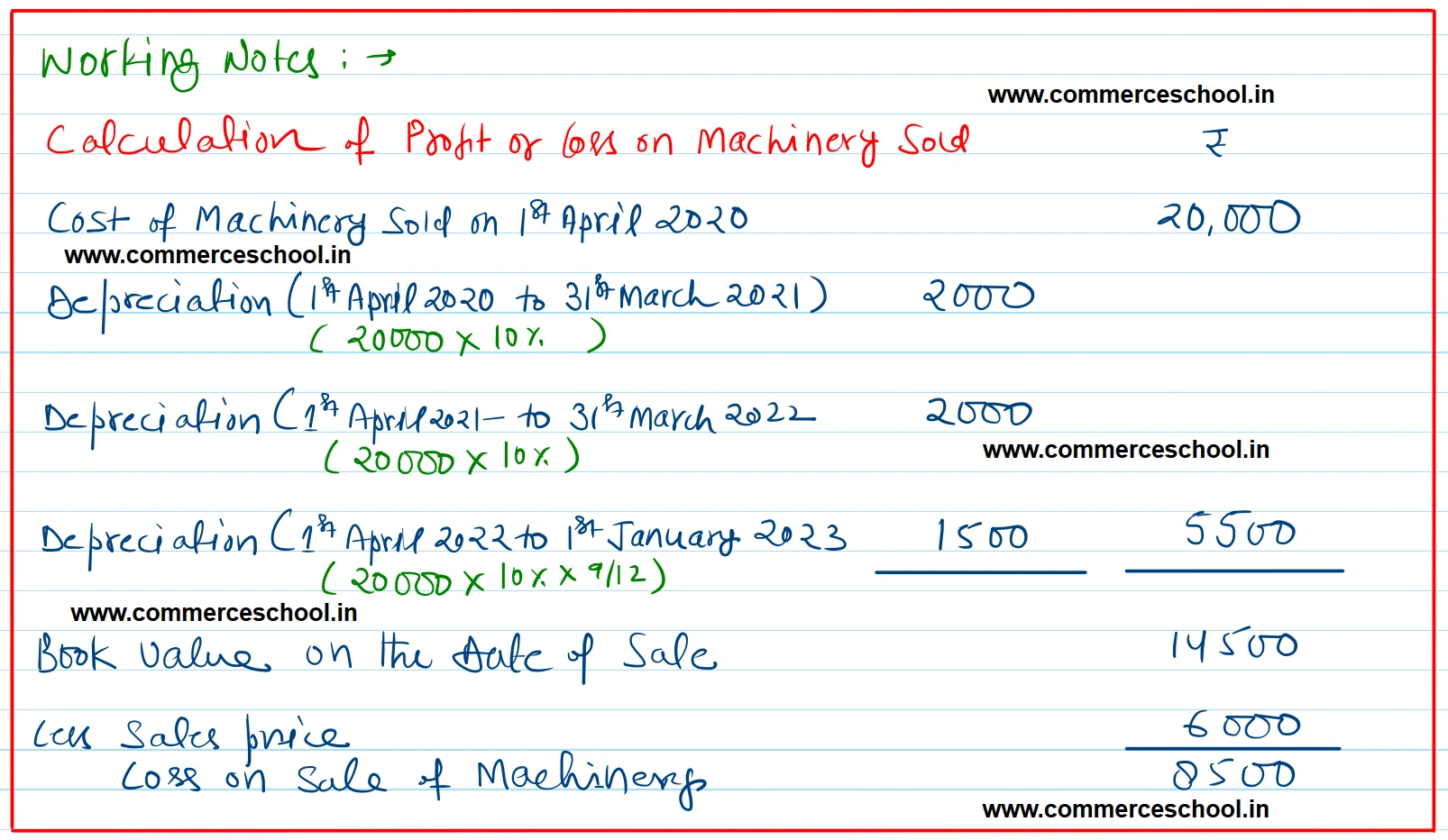

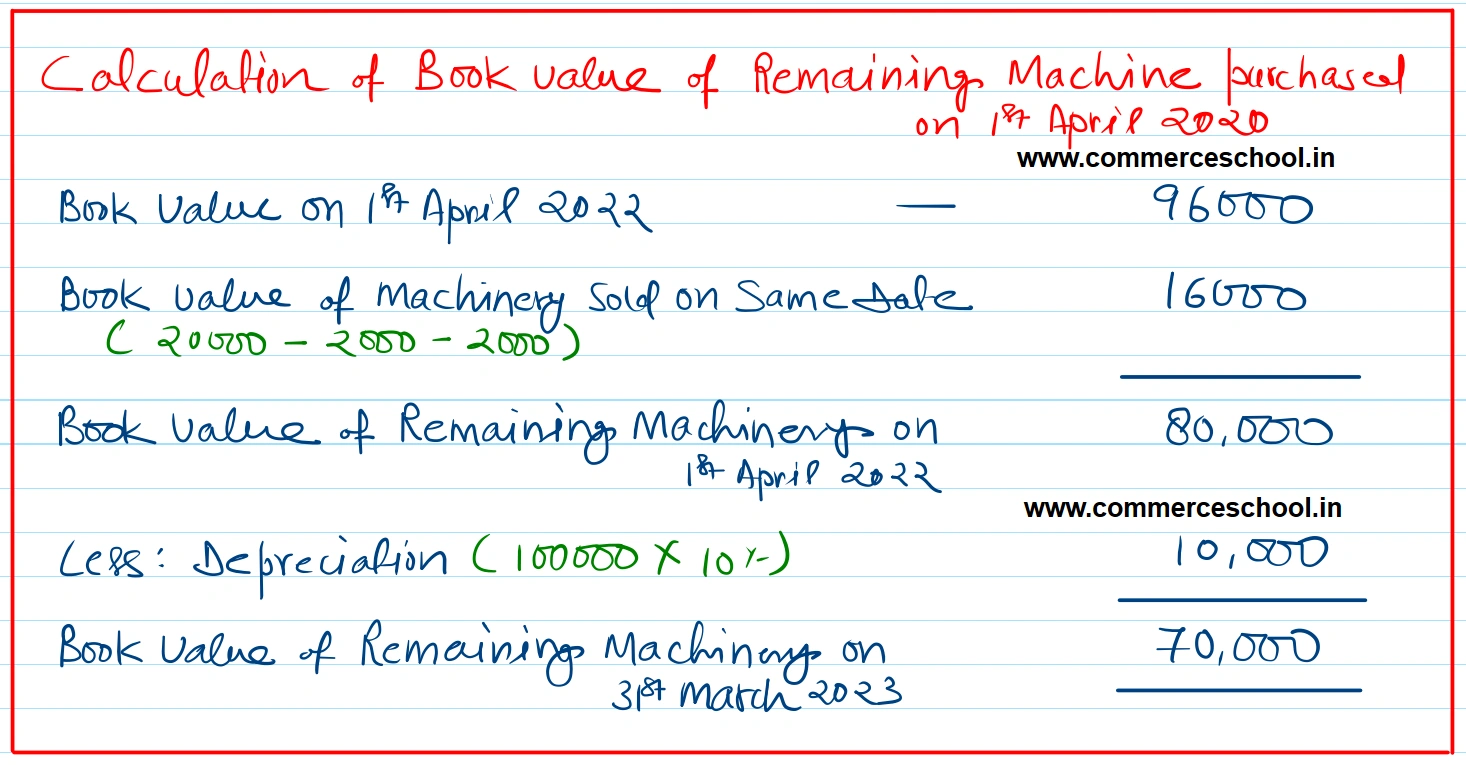

On 1st January, 2023, a machinery of the original value of ₹ 20,000 which was included in the machinery purchased on 1st April, 2020, was sold for ₹ 6,000. Prepare Plant & Machinery A/c for three years after providing depreciation at 10% p.a. on Straight Line Method. Accounts are closed on 31st March every year.

[Ans. Loss on sale of machinery ₹ 8,500; Balance of Machinery A/c on 31st March, 2023, ₹ 1,28,125.]

Anurag Pathak Answered question