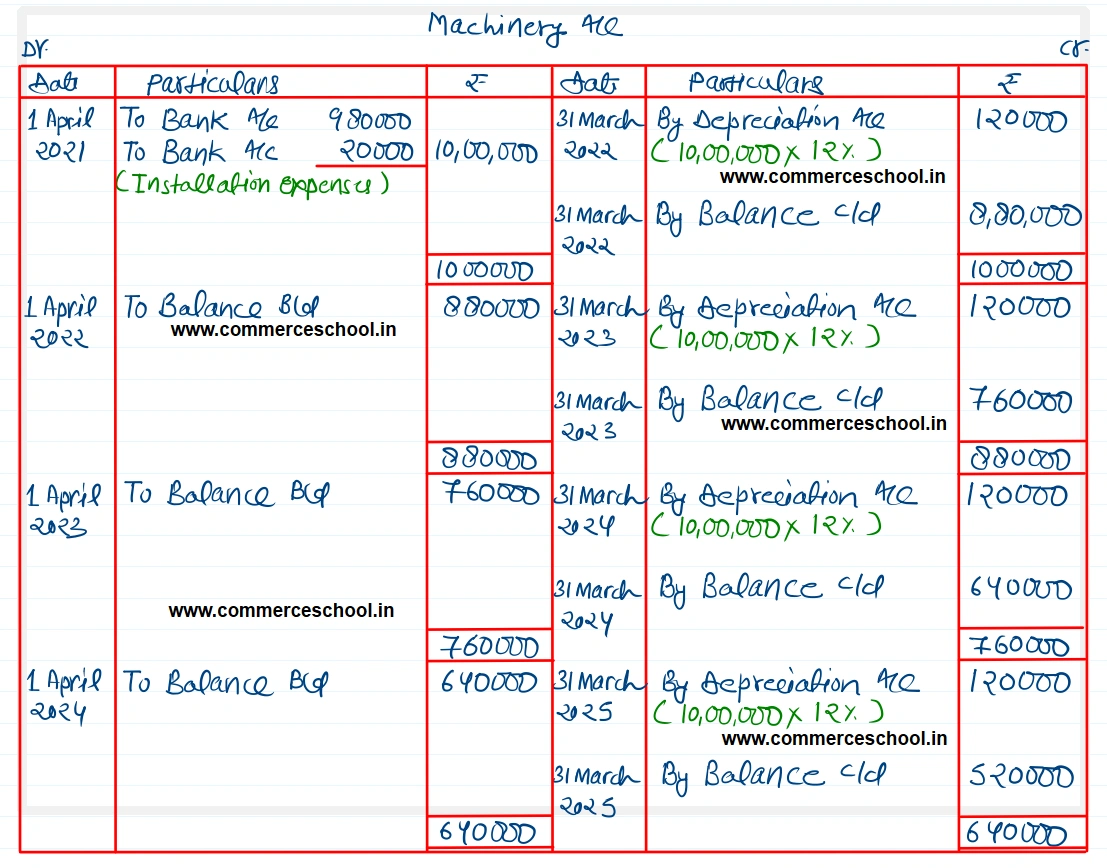

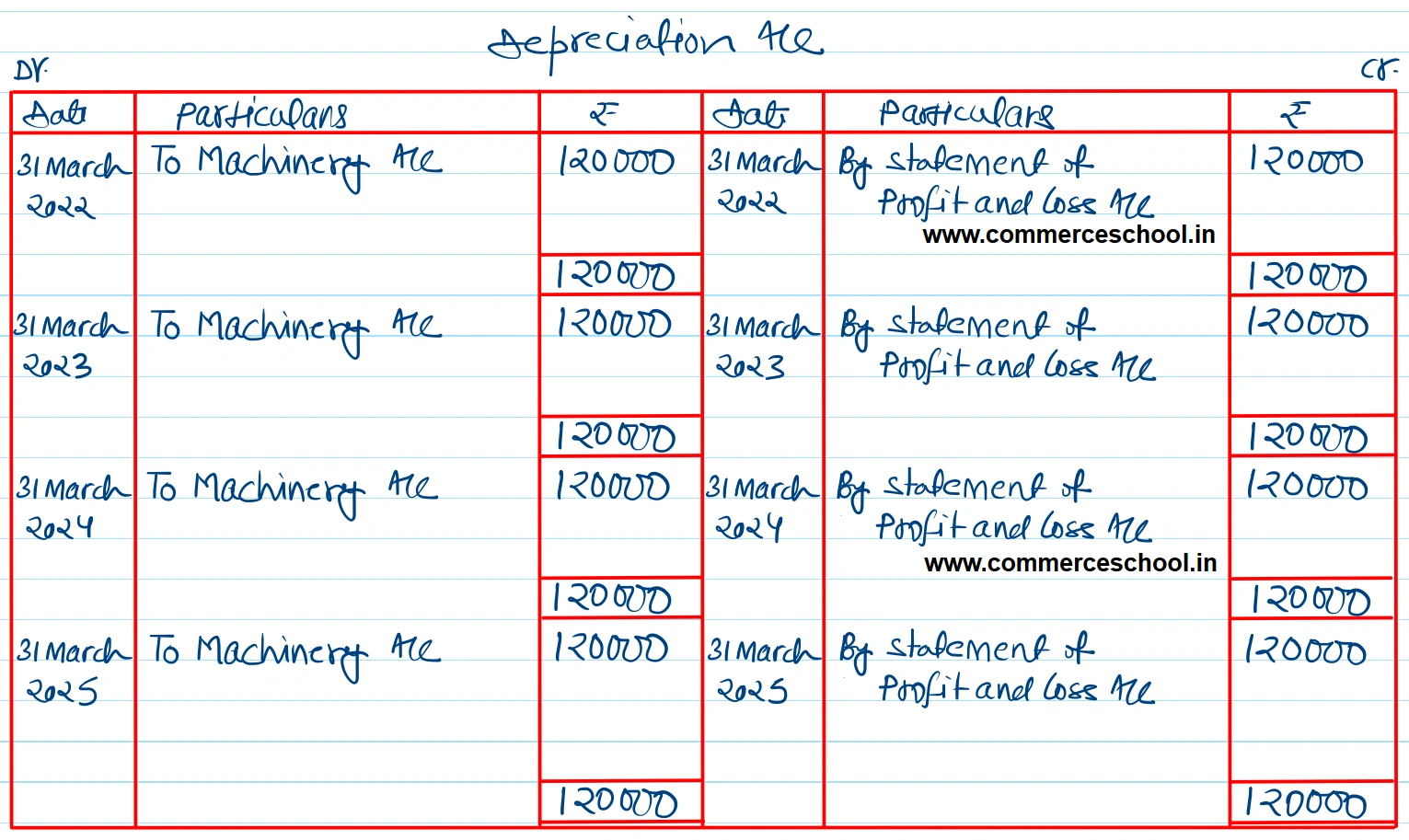

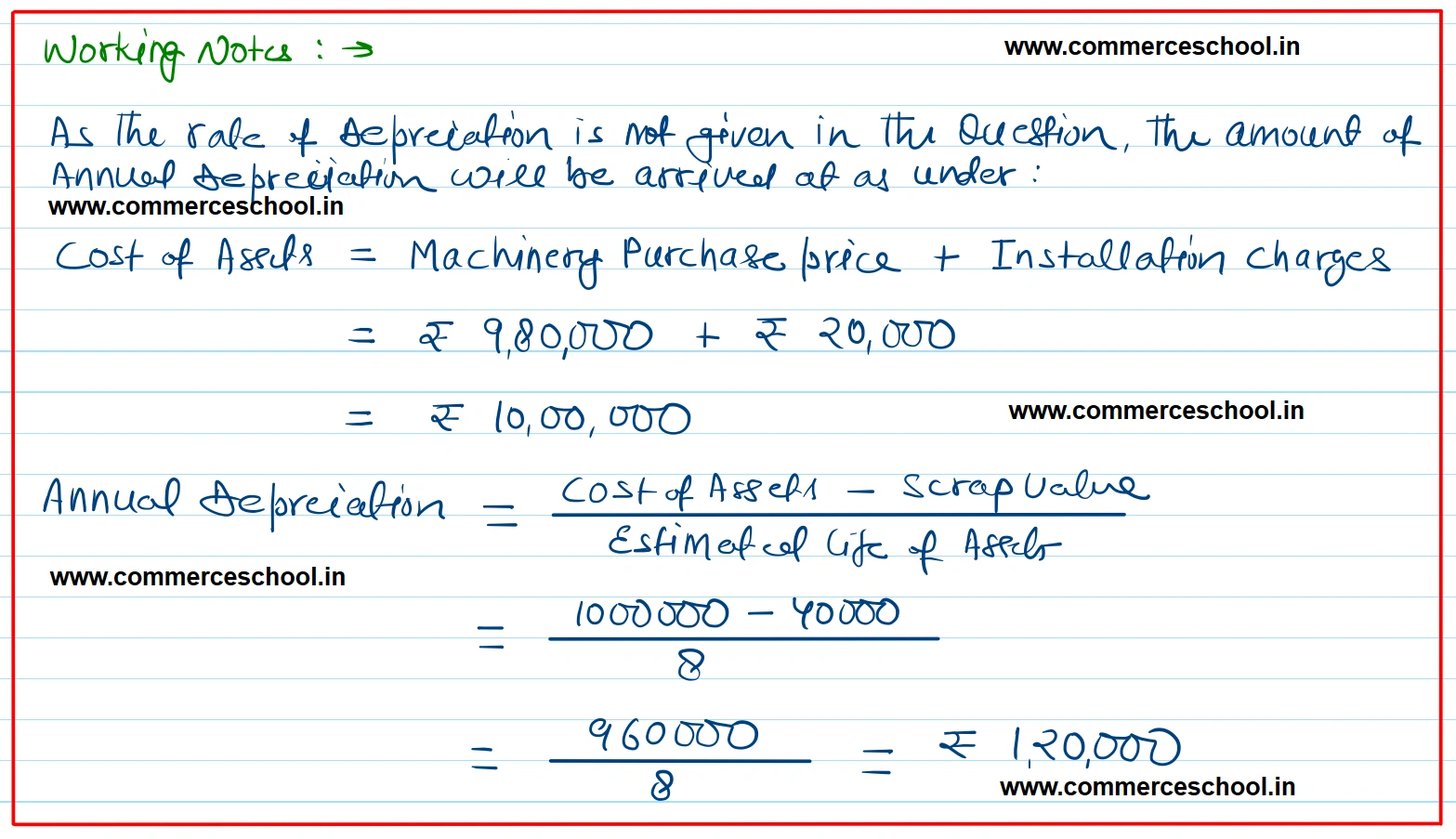

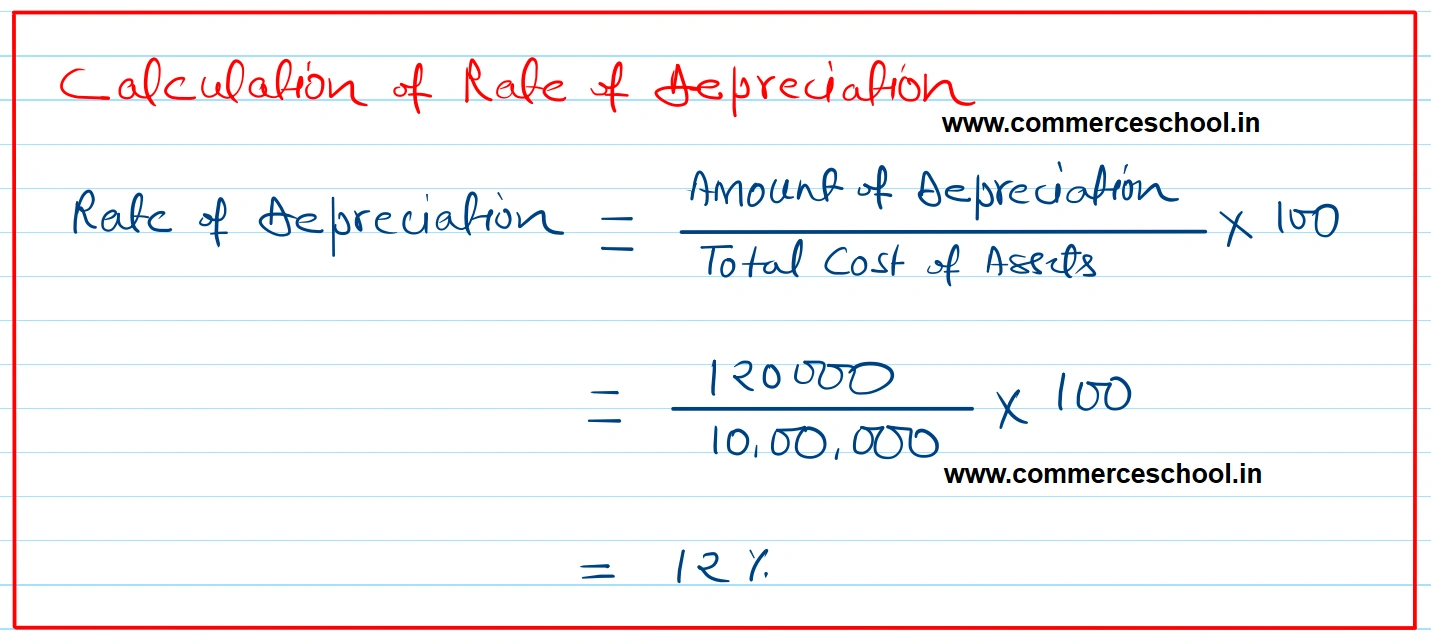

On 1st April, 2021, a limited company purchased a Machine for ₹ 9,80,000 and spent ₹ 20,000 on its installation. At the date of purchase, it was estimated that the scrap value of the machine would be ₹ 40,000 at the end of the eighth year.

On 1st April, 2021, a limited company purchased a Machine for ₹ 9,80,000 and spent ₹ 20,000 on its installation. At the date of purchase, it was estimated that the scrap value of the machine would be ₹ 40,000 at the end of the eighth year.

Give Machine Account and Depreciation A/c in the books of the Company for 4 years after providing depreciation by Fixed Instalment Method. The books are closed on 31st March every year.

[Ans. Balance of Machinery A/c on 31st March, 2025, ₹ 5,20,000; Rate of Depreciation 12% p.a.]

Anurag Pathak Answered question