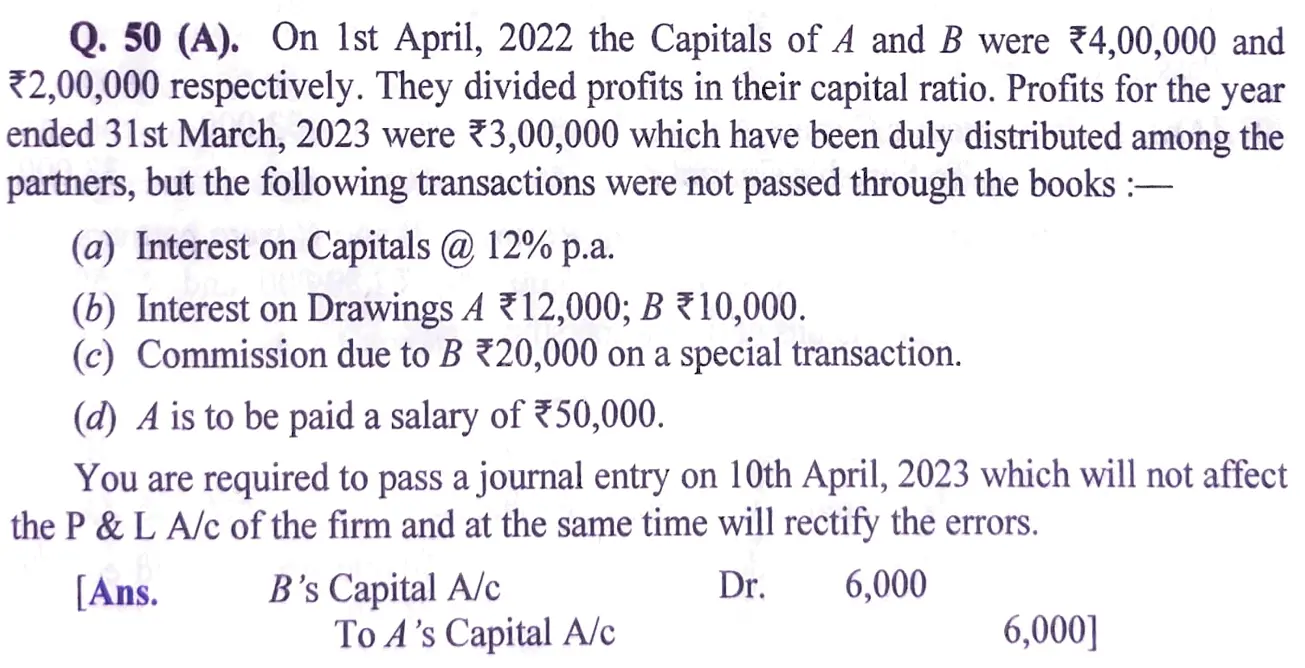

On 1st April, 2022 the Capitals of A and B were ₹ 4,00,000 and ₹ 2,00,000 respectively. They divided profits in their capital ratio, Profits for the year ended 31st March

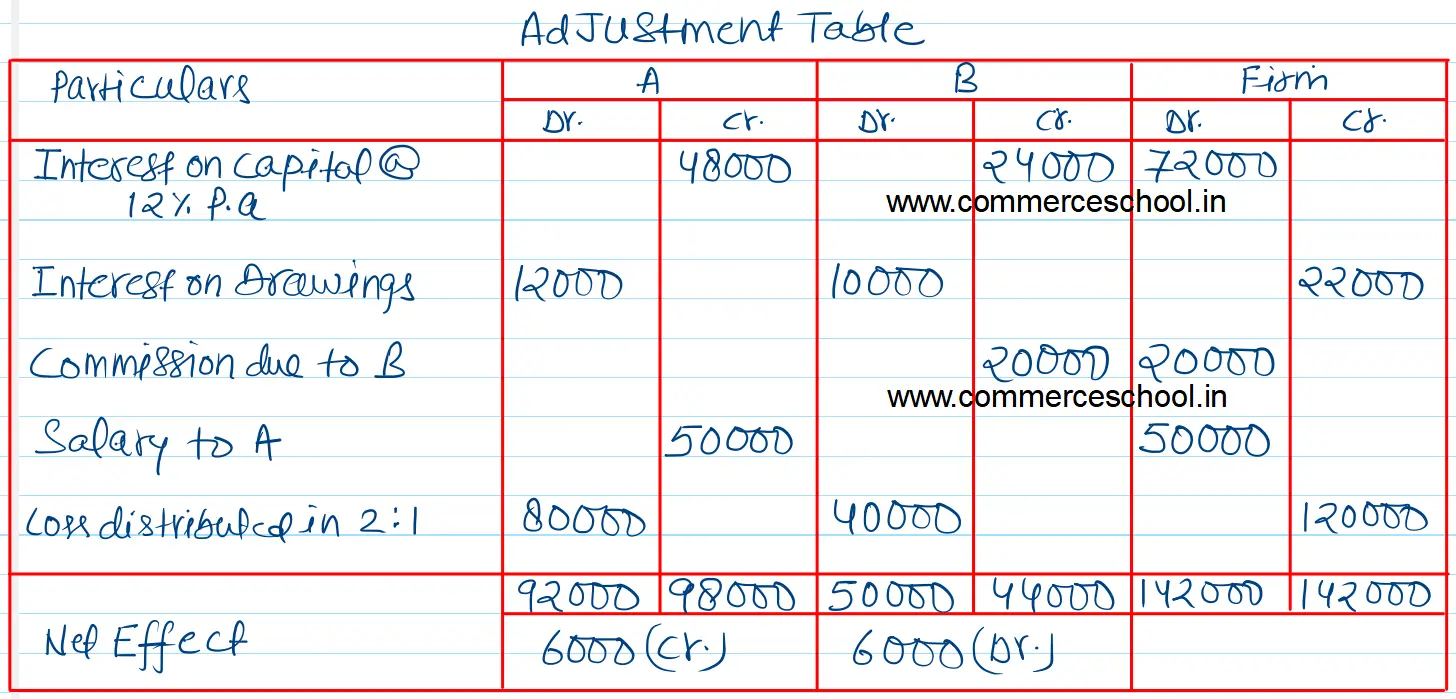

On 1st April, 2022 the Capitals of A and B were ₹ 4,00,000 and ₹ 2,00,000 respectively. They divided profits in their capital ratio, Profits for the year ended 31st March, 2023 were ₹ 3,00,000 which have been duly distributed among the partners, but the following transactions, were not passed through the books:-

(a) Interest on Capitals @ 12% p.a.

(b) Interest on Drawings A ₹ 12,000; B ₹ 10,000.

(c) Commission due to B ₹ 20,000 on a special transaction.

(d) A is to be paid a salary of ₹ 50,000.

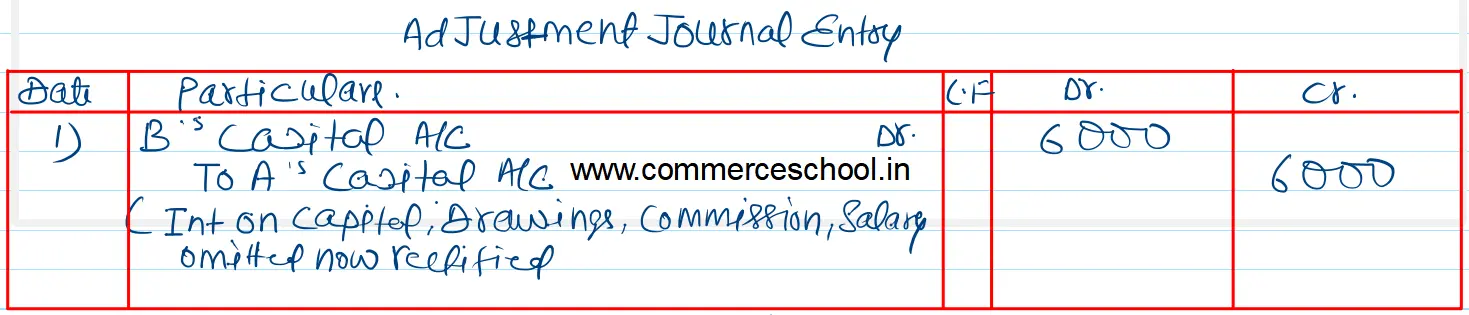

You are required to pass a journal entry on 10th April, 2023 which will not affect the P & L A/c of the firm and at the same time will rectify the errors.

Ans:

B’s Capital A/c Dr. 6,000

To A’s Capital A/c 6,000

Anurag Pathak Answered question